macgyverhh/iStock via Getty Images

In one of our previous coverage on Bitcoin (BTC-USD), we cautioned investors against investing in Bitcoin mining companies amid the expected Bitcoin crash dictated by its halving cycle. In such a scenario, Bitcoin mining companies take on more risk than simply holding the underlying asset Bitcoin. One of the main risks is insolvency. On average, Bitcoin mining companies have a total mining cost of $30,000 per BTC. This is with reference to Bitcoin mining companies including RIOT Blockchain (RIOT), HUT 8 (HUT) Core Scientific (CORZ), Stronghold Digital Mining (SDIG), Bitfarms (BITF), and others. If Bitcoin sustainably drops below the total mining cost, Bitcoin mining won’t remain a viable business.

We’ve analyzed Marathon Digital Holdings (NASDAQ:MARA), one of the largest enterprise Bitcoin self-mining companies in North America, several times in the past and have continued to find it uninvestable. MARA’s 2022Q1 earnings report and Bitcoin’s halving cycle have re-iterated our verdict that MARA remains uninvestable. Here’s why.

Outsized Management Compensation As Deterrence Against Prospective Ownership

Assume you’re a business owner, would you pay the top management of your company more than the total sales of your company? We would think not. However, this is the case for MARA.

For the 2021FY, MARA paid a total of $164mil to the management despite only making a total of $150.5mil in sales. Be it stock or cash compensation, this has adverse consequences for the future of the company.

In our recent coverage, we explained the technology behind one of the fast-growing semiconductor company’s (ON Semi (ON)) products which helped us understand the company’s prospects as it aligns with several megatrends of the 2020-2030 decade. Furthermore, it is supported by the shortages and excessive demand in the semiconductor market. Several comments we had from our readers are about their desire to see ON paying dividends. We expressed our concern that paying dividends will add to ON’s investment value proposition and is more likely to subtract from it.

We explained that paying dividends amid the semiconductor shortage is a negative signal. It signals to the market that the company is clueless about the capital at hand. Instead, the company should use the earnings to ramp up production to try to meet as much demand (gain market share) as possible. This will present its shareholders with the most value.

Similarly, the goal of a Bitcoin mining company is to mine as much Bitcoin as possible. The way to achieve this is to have more share in the Bitcoin network. A share in the Bitcoin network is the proposition of a Bitcoin mining company’s mining capacity (measured in Hash Rate) relative to other miners’ mining capacity.

As of the time of writing, the Bitcoin Network Hash Rate is 191 EH/s (Fig 1) and has been growing at 40% annually since 2020. In other words, the total mining capacity of every Bitcoin miner (including MARA) is 231 EH/s. As of the time of writing, MARA’s mining capacity is approximately 3.9 EH/s. This implies MARA occupies 1.6% of the Bitcoin Network.

There is a fixed number of minable Bitcoins annually. That number is 328,500 before the next halving event. Holding the current Bitcoin network and MARA’s hash rate constant, MARA is expected to mine 5256 Bitcoins annually.

For MARA to mine more Bitcoins, MARA needs to have more share in the Bitcoin network (more mining capacity relative to other miners). In other words, it is not enough for MARA to just increase its mining capacity, but has to increase its mining capacity faster than other miners combined.

Other than softening competition, the only other way to increase MARA’s mining capacity is by acquiring more up-to-date Bitcoin mining rigs. These Bitcoin mining rigs are expensive and this is why the Bitcoin mining business is very capital intensive.

Investors may wonder whether the majority of what has been paid to the management should’ve been used to buy more mining rigs instead. We’re not saying the management shouldn’t be rewarded. But to be rewarded an amount more than MARA’s total revenue is just simply absurd.

The table below illustrates just how much compensation to management accounts for MARA’s total mining cost since the beginning of 2020. Note that compensation to management does not include salaries.

On average, MARA spent $10mil in compensation to its management every quarter, with 2021Q3 and 2021Q1 being the outlier (for the time being). We find this cost structure isn’t sustainable and isn’t beneficial for the company’s future.

Table 1. The proportion of Compensation relative to MARA’s Overall Mining Cost

| Quarter | Mgnt Comp (mil) | Total Mining Cost (mil) | Proportion |

| 2022Q1 | $10.34 | $40 | 26% |

| 2021Q4 | $10.61 | $28.57 | 37% |

|

2021Q3 |

$97.2 | $109.263 | 89% |

| 2021Q2 | $4 | $13.545 | 30% |

| 2021Q1 | $54.4 | $57.544 | 95% |

Running A Deficit For Every Bitcoin Mined.

After excluding impairments and changes in asset fair value, MARA’s 2022Q1 total business cost stands at approximately $40mil. MARA mined 1,259 Bitcoins in 2022Q1 which implies a total mining cost of $31,700 per Bitcoin mined. As of the time of writing, Bitcoin has broken the “Institution” support line of $30,000 and fell below $21,000. Given MARA’s cost structure, MARA is losing $10,000 for every Bitcoin mined.

One might argue that MARA could cut back on certain non-productive expenses such as management compensation, but MARA’s track record begs to differ. in 2021Q3 and 2021Q1, Management compensation accounted for almost all of MARA’s expenditure.

MARA’s major expenditure is the cost of revenue, which consist of depreciation and electricity/hosting. These are essential expenditures that could not be cut back, as the name suggests, it is the cost of revenue.

Risk of Increasing Leverage and Depleting Bitcoin Reserves

When we combine the 2 observations made above, we can see that MARA is at risk of increasing its leverage and depleting its reserves.

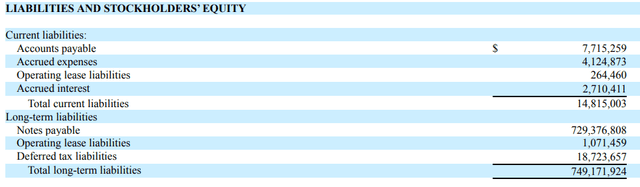

The majority of MARA’s liability is from MARA’s $745mil convertible note offerings in 2021Q4 (Fig 2).

Fig 2. MARA’s 2022Q1 Total Liability (Form 10-Q)

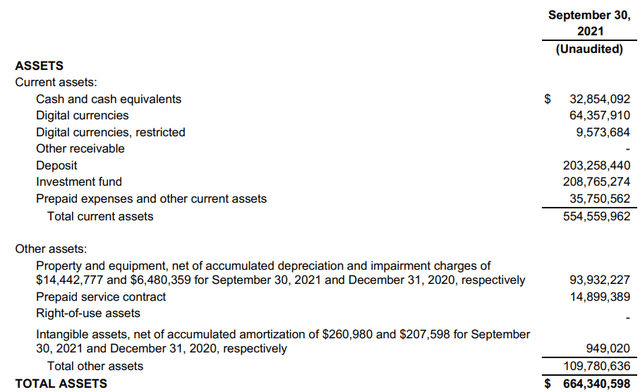

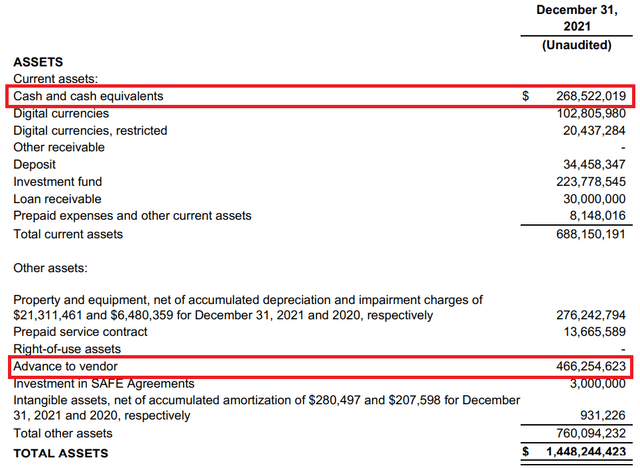

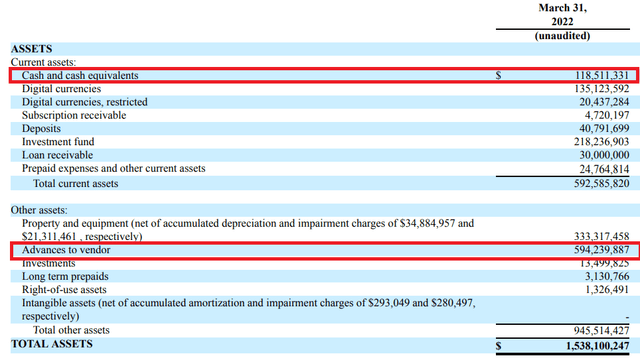

After the convertible note offerings, MARA’s 2022Q1 total liability stands at $749mil whereas its market cap is only $800mil. According to MARA’s 2021Q3 (Fig 3), 2021Q4 (Fig 4), and 2022Q1 (Fig 5) balance sheets, it is observable that more than 80% of the loan was used to pay vendors forward. Although paying vendors (buying mining rigs) is what MARA ought to do, it also makes MARA highly leveraged.

Fig 3. MARA’s 2021Q3 Total Asset (Form 10-Q)

Fig 4. MARA’s 2021Q4 Total Asset (Form 10-Q)

Fig 5. MARA’s 2022Q1 Total Asset (Form 10-Q)

As of 1st June 2022, MARA has 9,941 Bitcoin on its balance sheet. Assuming cash and cash equivalent remain constant, MARA’s total liquidity is $326.761mil ($118mil + 9,941 * $21,000), which is less than 50% of its total liability. According to the Bitcoin halving cycle, we could see Bitcoin hitting as low as $10,000. At $10,000 per Bitcoin, MARA’s total liquidity could fall below $217mil or 29% of the total liability.

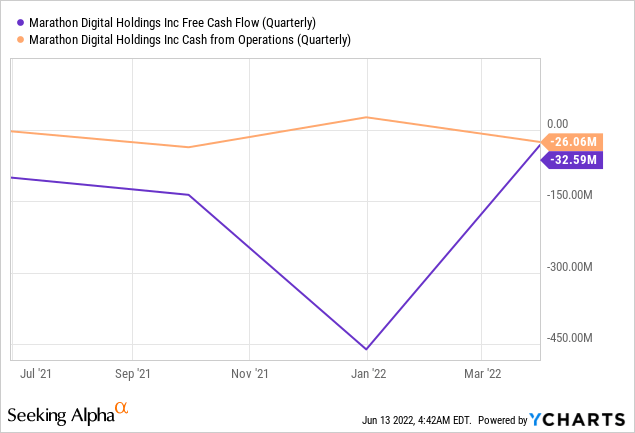

Based on the 2022Q1 cash flow and Bitcoin’s current price of $21,000, MARA’s cash will be depleted by end of 2022, and Bitcoin holdings will be depleted before the end of 2023. During the process, MARA’s leverage will continue to increase.

Fig 6. Cash Flow (YCharts)

Valuation

Our valuation model for Bitcoin mining company no longer works for MARA is now making losses for each Bitcoin mined. However, it shouldn’t take a model to tell us that MARA is currently not investable because it is mining Bitcoin at a loss.

In an interview, Kevin O’Leary revealed that he has invested in hydropower facilities to mine Bitcoin. Kevin O’Leary stated that it is not a feasible business to mine Bitcoin below $30,000 and he would convert the facilities to host data centers instead if such as scenario were to occur.

Unfortunately, that scenario is now here. There are 2 more years before the next halving. By then, the total minable Bitcoins per year will be cut in half. If the Bitcoin price does not double the current mining cost, Bitcoin miners will be devasted. One can only hope that the Bitcoin halving cycle will remain intact and MARA has enough liquidity to survive till then.

Conclusion

In summary, we find that MARA is not investable for the following reasons:

- MARA’s outsized compensation to its management to the point it can exceed its total revenue or contribute to more than 90% of MARA’s expenses should deter prospective investors unless we see material changes in this aspect.

- MARA’s current cost structure showed that the company is currently mining Bitcoin at a loss. Based on the latest quarterly report, MARA’s cash and Bitcoin holdings are at risk of being depleted by end of 2024.

- During the process of depletion, MARA will be increasingly leveraged.

The risk of shorting MARA is Bitcoin’s sudden rebound. We could still see MARA rebound alongside Bitcoin should Bitcoin rise above the $31,000 price level. Then, we’ll revisit MARA to suggest a price target and determine whether it is undervalued and investable. We discourage shorting MARA as we’re bullish on Bitcoin.

Be the first to comment