PonyWang/E+ via Getty Images

Videogames have been a focus as a pandemic era beneficiary. However, it seems some major trends are reversing, especially in mobile gaming, hitting companies like Gravity (NASDAQ:GRVY) hard. While the multiple is pretty low on the stock, and they are pushing launches in new markets to strengthen revenue, private server controversies give us some concerns about the reputation of its key titles. Moreover, with a skew towards casual gaming, which is simply a less attractive market, we’d rather pass on the stock.

Some Words on Q1

Gravity is quite influential in the gaming world due to its Ragnarok titles that have held their own for years. While the game is tuned differently for PC and mobile releases, where generally the PC releases will have more complexity, the following for most of these games are pretty substantial across Asia, with Ragnarok Online being one of their most longstanding titles with a respectable and consistent active user base upon which to generate revenue from in-game item purchases. These games have a powerful social component with relatively low incremental costs creating margin and a recurring revenue stream, so the economics are fundamentally quite nice.

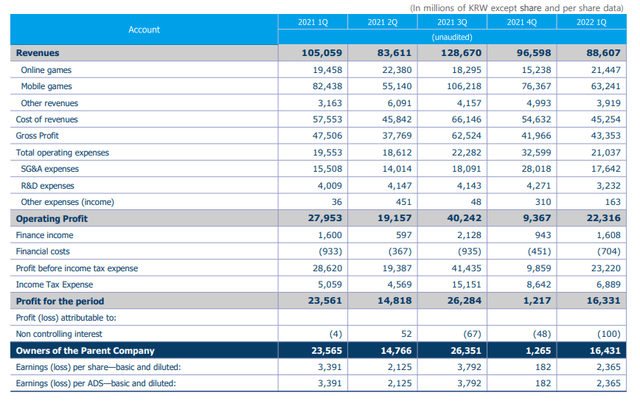

The concern we have is that mobile gaming revenues are really falling as they are more causal, and attracted players whose threshold to game is higher. 75% of their revenue are from mobile titles that attract casual players who have put the game down now that the pandemic is easing. This skew towards mobile is causing the revenues to fall, despite strength in the online segment after successful new launches of Ragnarok titles in Taiwan and HK.

With the loss of scale on moderately higher SG&A costs, margins fell and the direct loss of volumes caused double digit declines in operating profit.

Our Concerns

Since the Q1, videogames have broadly continued to fall, with revenues coming from mobile gaming being the most hit, but also losing ground on more traditional platforms with a dearth of new releases, besides Elden Ring. The pandemic is subsiding with increases in mobility extremely apparent. We worry about the direction of Gravity’s underlying markets as we move further into the year with a very active summer season looming. Moreover, the skew towards mobile gaming exacerbates the issue for the company as opposed to others which may have titles that generate a bit more loyalty and appeal to a more dedicated demographic.

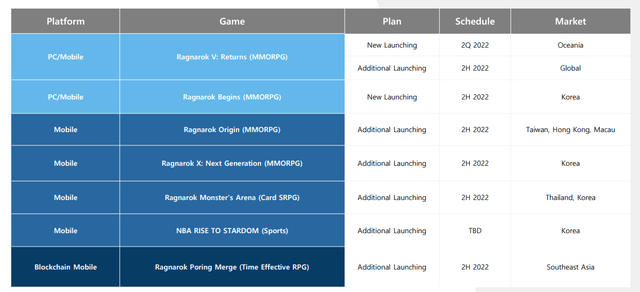

A further issue is that while there is some traction in the online platform thanks to new releases, bad-will is being generated by the company as they clamp down on beloved private servers, not too dissimilar to the Nostalrius issue that Activision Blizzard (ATVI) had on their hands when players were not satisfied with the state of the game. While the financial impacts might not be so tangible, especially since the point of the clamp down is to deal with servers where Gravity makes little profit, the bigger concern is the complaints of bots being used to populate the game and buff monthly active user figures. With games like these already having their quality a little questioned given the model and platforms, these accusations don’t help, and it does spell some failure in development strategy much like what cost ATVI its reputation over the years mostly starting with the Diablo mobile release. With Tencent (OTCPK:TCEHY) and a lot of other competent competition in the Asian markets with releases like Genshin Impact, even the online segment could see some more pressure than what would be ideal. Nonetheless, major releases in the H2 should still bolster that segment and produce some growth, but probably not enough to offset the much more important mobile segment.

Upcoming Launches (Q1 2022 Pres)

Final Words

The valuation has become quite compelling. The stock only trades at an 8x PE, but the issue is that the net income is falling rather precipitously, by 30% YoY as of Q1. This is not a growth story anymore, and not a turnaround story either given the dominance of the mobile segment in the mix. Overall, the direction is negative, and with markets punishing beta and any uncertainty more harshly as rates rise, we think the stock is a clear pass.

If you thought our angle on this company was interesting, you may want to check out our service, The Value Lab. We focus on long-only value strategies, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our group of buy-side and sell-side experienced analysts will have lots to talk about. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment