Paula Bronstein/Getty Images News

I believe the investment thesis to be quite simple for Gravity (NASDAQ:GRVY), buy the company if you trust that it will be able to return more than 1 LTM EBIT (discounted to today) in the future. Any additional upsides you get for free.

Although I don’t consider pay-to-win games particularly appealing or quality material, the downside risk is truly limited by the cash and low current valuation. At the same time, several occurrences can make the stock explode in price, either buying back shares, special dividends, good acquisitions, or more. This case appears to be an asymmetrical risk/reward situation flying under the radar.

The Business

Gravity is a mostly online gaming producer company born in early 2000, primarily known for owning and profiting from the Ragnarok franchise since the first release of the MMORPG, Ragnarok Online, worldwide. Besides developing and servicing its games, the company successfully developed a global publishing business which allowed them to grow exponentially the business more recently.

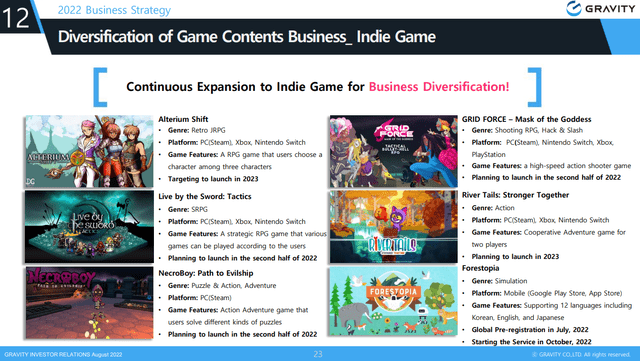

While the Ragnarok franchise and mobile platform are the most common areas, there seems to be a focus on diversifying the product mix into different areas and platforms. NBA game launch in Korea is still pending a release date, it might be interesting to see how they can perform away from their “cash cow” Ragnarok games.

New Products (2022 2Q Results)

Worth highlighting that the Japanese company, GungHo, owns a dominant position of almost 60% of Gravity and that they have a global footprint, but mainly with an Asian focus.

Past and Current Situation

Safe to say that the COVID-19 pandemic was a big contributor to growth in the last years, but I believe that it’s really difficult to quantify how much. Recent numbers, although slightly lower, show resilience in the business with still very interesting margins and overall performance. The company has shown that it can manage well the releases of the fast-changing environment present in the gaming industry, especially in the mobile platform, to produce consistent results.

While most gaming firms have been suffering heavily lately, I think that there is still a lot of potential in the industry. The gaming industry, more specifically the mobile one, is still projected to grow significantly over the next few years.

Looking at the past chart of the stock price, there are two major spikes after good news. I believe this could still happen a third time with the right catalyst.

Present Opportunity

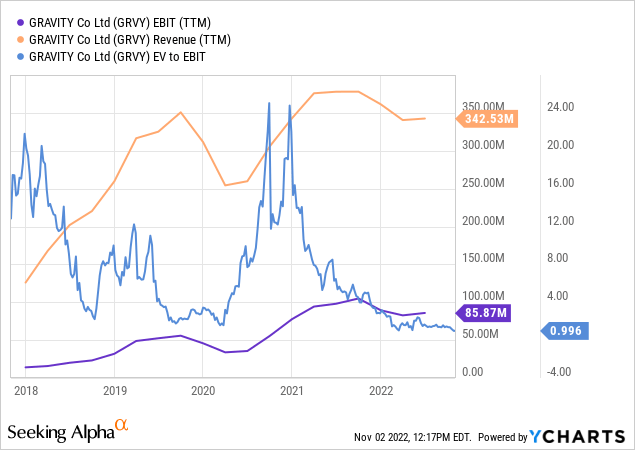

Usually, I spend some time estimating an accurate DCF to have at least a price target, but for this case, that is just not necessary. Gravity is now trading below 1x EV/EBIT (TTM) with no debt. This is a screaming bargain if one believes in the continuation of the (profitable) activity for at least some years and that the cash will, eventually, be deployed in a way that benefits the shareholders.

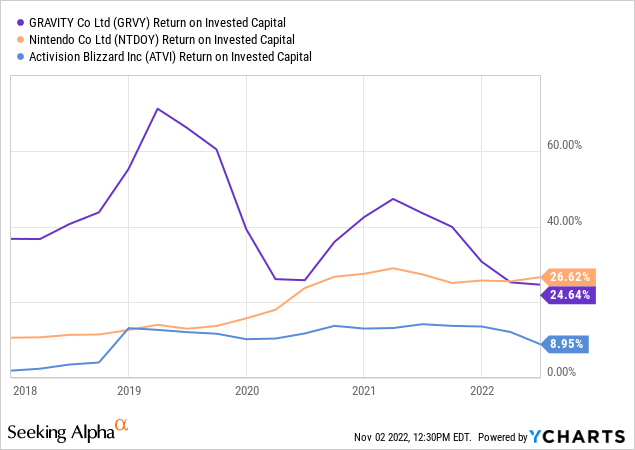

The potential upside present today, at current prices, is huge. This is a very asset-light business model which delivers very interesting returns on capital, even with a large cash “drag”, with similar levels as Nintendo (OTCPK:NTDOY) and better than Activision (ATVI).

On the opposite side, it’s hard to qualify the games produced as quality. The reviews are not great, leaving the idea that the profits aren’t sustainable enough and that spamming new questionable quality games each quarter will eventually saturate and ruin the franchise. Is this a problem at current price levels? I don’t think so.

What Can Go Wrong?

There is always risk in any investment and this one is no exception. These are the risks that I see for Gravity going forward:

- Accounting fraud – I feel that this should only be a small risk, nonetheless, it’s for me a red flag keeping an increasing cash position without any sort of capital allocation for this long. If we can’t count on the excess liquidity, then the valuation changes significantly.

- GungHo dominant position – The fact that there’s a majority shareholder reduces value from the remaining stakes. The rest of the shareholders possess little power to influence a decision, including the capital allocation problem.

- Small Cap – Considering the market cap, this is a small company and that brings additional risks to the fold. Less scrutiny from analysts, debt holders, and news outlets.

- Country Risk – While a developed country, South Korea and Asia, in general, might require an extra risk premium to consider.

- Delisting possibility – Together with the dominant position risk, there might exist the possibility of GungHo delisting Gravity at a price different than our perception of value. The low multiple price could justify that move.

- Lack of product diversity – Mostly sole reliance on the Ragnarok name is a weakness and makes them dependent on a single brand.

Bottom line

While there are some doubts regarding sustainability, quality of content, and even capital allocation, I believe that is more than priced in at current levels.

It’s incredible to see how low has this stock reached. Considering a market cap of $300M, no debt, and the last cash position of $219M (last June, now it should be more), it costs roughly $80M to get a business that has produced between $20M and $62M of free cash flow since 2017. This makes no sense to me unless it’s pricing in any fraud or if the business is expected to go bankrupt in the next few years.

As suggested in the title, I see a small downside due to the liquidity but a huge upside potential if any catalyst presents itself.

Be the first to comment