VV Shots/iStock Editorial via Getty Images

Welcome to the July edition of the graphite miners news.

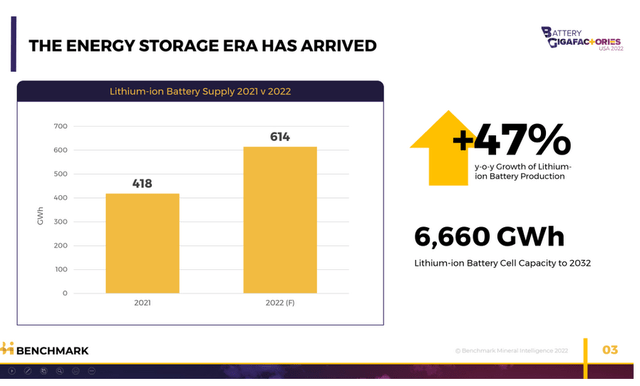

July saw more news on the huge demand wave ahead for lithium ion batteries (CAGR of 47% to 2032) and further moves by governments and companies to secure their supply chain of critical metals. The big news was Ford/SK On entering an MOU with Syrah Resources to evaluate sourcing active anode material supply from Syrah’s Vidalia AAM facility in USA.

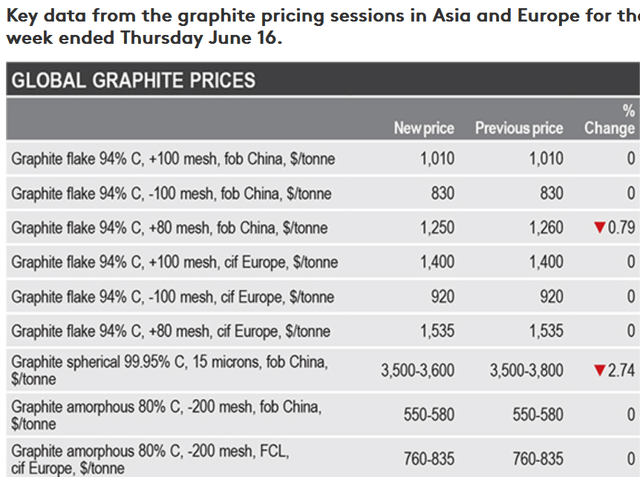

Graphite price news

During the past 30 days the China graphite flake-194 EXW spot price was not updated (up 0.23% the past 60 days) and is up 15.18% over the past 360 days. Note that 94-97% is considered best suited for use in batteries; it is then upgraded to 99.9% purity to make “spherical” graphite used in Li-ion batteries. The spherical graphite 99.95% min EXW China price was down 1.66% the past 30 days.

Fastmarkets (see below, not updated this month) shows China graphite flake 94% C (-100 mesh) prices at US$830/t and Europe graphite flake 94% C (-100 mesh) prices at US$920/t.

Fastmarkets graphite prices the week ending June 16, 2022 (no update available for July 2022)

Source: Fastmarkets

Note: You can read about the different types of graphite and their uses here.

A reminder of a 2016 Elon Musk quote:

Our cells should be called Nickel-Graphite, because primarily the cathode is nickel and the anode side is graphite with silicon oxide.

Graphite demand and supply forecast charts

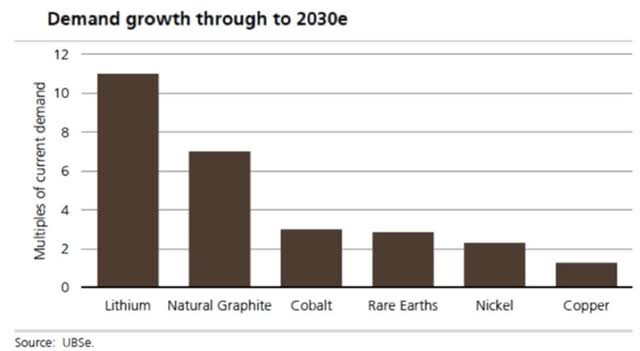

UBS’s EV metals demand forecast (from Nov. 2020)

Source: Mining.com courtesy UBS

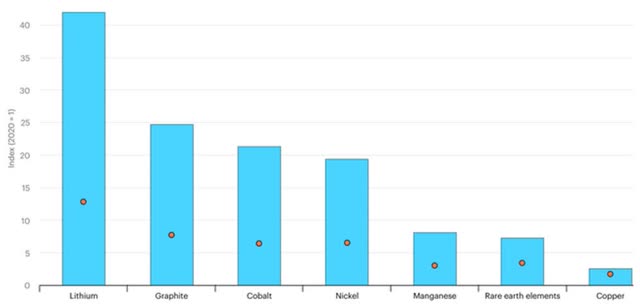

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

Source: International Energy Agency 2021 report

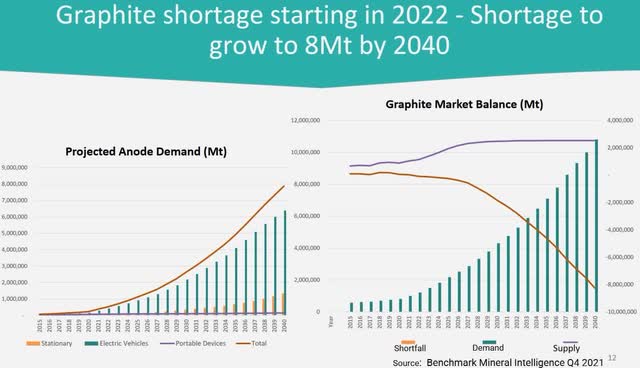

BMI forecasts graphite deficits to begin from 2022 as demand for graphite grows strongly

Source: Lomiko Metals company presentation courtesy Benchmark Mineral Intelligence

Graphite market news

On June 23 Benchmark Mineral Intelligence reported:

The energy storage revolution has arrived… but who will have dominion over the megatrend of our times?… In 2022, lithium ion battery demand is growing at its fastest ever rate and is on course for 50% year-on-year growth… The raw materials fueling these gigafactories have also witnessed a coming of age moment.

Lithium supply has increased nearly three-and-a-half times and will be over a 600,000 tonne industry in 2022 – the first time it has topped the half a million tonne mark.

Cobalt demand from the battery industry will reach over 70% of total global volume in 2022, the highest proportion of demand of any of the battery minerals, followed closely by lithium.

Nickel sulphate supply, the battery chemical needed by the lithium ion battery industry, will approach 500,000 tonnes in 2022, more than a 3.5x increase over a 5 year period.

Graphite remains the highest intensity mineral in the lithium ion battery by weight with over 570,000 tonnes of natural flake to be consumed in 2022.

Yet, consumer demand for electric vehicles surpasses our ability to supply them. Waiting times for EVs are lengthening, a lithium ion battery shortage is hitting many automakers, and, most crucially, key raw material prices are at all time highs.

Source: Benchmark Mineral Intelligence

On July 8 Benchmark Mineral Intelligence reported:

Posco expands lithium ion empire with silicon anode acquisition. South Korea’s Posco acquired a silicon anode startup for 47.8 billion won ($36.8 million), as it looks to invest along the battery supply chain. The Korean steelmaker purchased 100% of Daejeon-based Tera Technos from its parent company Tera Science on July 1. Posco intends to invest $20 billion into the lithium ion supply chain between now and 2030, as it looks to reduce South Korea’s dependence on China for key battery materials such as cathodes and anodes.

On July 13 Bloomberg reported:

US says it will back miners to stop China’s weaponization of battery metals… “Our concern is that critical minerals could be vulnerable to manipulation, as we’ve seen in other areas, or weaponization,” Granholm said Wednesday in a meeting in Sydney with companies including BHP Group, Rio Tinto Group and Lynas Corp. “We are very serious about establishing strong relationships with Australia, and with you and with your potential customers for offtake”… Producers in nations including Australia can also access support through agencies including the Department of Energy’s loan programs office, Granholm said at the Wednesday meeting… Syrah Resources Ltd., a Melbourne-based graphite producer with facilities in Mozambique and Louisiana, in April won a $107 million commitment from the loan programs office. Rare earths producer Lynas Rare Earths Ltd. in June signed a contract with the U.S. Department of Defense to establish a plant in Texas.

On July 25 Yahoo (and GlobeNewswire) reported:

Graphite Market – Growth, Trends, COVID-19 Impact, and Forecasts (2022 – 2027). The graphite market accounted for around 2,700 kilo metric ton in 2021, and it is expected to register a CAGR of more than 5% during the forecast period, 2022-2027… Over the short term, the major factors driving the growth of the market studied include the augmenting demand from the burgeoning lithium-ion (Li-ion) battery industry and the rise in steel production in Asia and the Middle East. The growing usage of graphite in green technologies and the popularity of graphene are projected to offer opportunities for the manufacturers over the forecast period.

Graphite miners news

Graphite producers

I have not covered the following graphite producers as they are not typically accessible to most Western investors. They include – Aoyu Graphite Group, BTR New Energy Materials, Qingdao Black Dragon, National de Grafite, Shanshan Technology, and LuiMao Graphite.

Note: AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF) is also a “diversified producer”, producing graphite, vanadium, and lithium. SGL Carbon (OTCPK:SGLFF) (ETR:SGL) is a synthetic graphite producer and Novonix [ASX:NVX] (OTCQX:NVNXF) is commercializing their synthetic graphite product. Graphex Group Limited [HK:6128] (OTCQX:GRFXY) makes spherical graphite.

Syrah Resources Limited [ASX:SYR][GR:3S7]( OTCPK:SYAAF)(OTC:SRHYY)

Syrah Resources Limited owns the Balama graphite mine in Mozambique. Syrah is also working to become a vertically integrated producer of natural graphite Active Anode Material (“AAM”) at their Vidalia facility, Louisiana, USA.

On July 21, Syrah Resources Limited announced: “Quarterly activities report – period ended 30 June 2022.” Highlights include:

- “…Demand growth for Balama natural graphite end uses, with global electric vehicle (“EV”) sales up 51% in June 2022 quarter, versus the June 2021 quarter, to approximately 2.2 million units and Chinese anode production increasing to above 100kt per month in the June 2022 quarter.

- Balama produced 44kt natural graphite at 79% recovery with 44kt sold and shipped during quarter.

- Balama C1 cash costs (FOB Nacala/Pemba) of US$543 per tonne.

- Weighted average sales price increased to US$662 per tonne (CIF).

- Two ~10kt spot breakbulk shipments from Pemba port completed in the June 2022 quarter.

- Significant forward sales order book of nearly 90kt natural graphite, demonstrating robust underlying demand conditions.

- Detailed engineering on the initial expansion of Vidalia AAM facility to 11.25ktpa AAM production capacity (“Vidalia Initial Expansion”) more than 76% completed.

- Construction of Vidalia Initial Expansion project advancing within the planned schedule and budget.

- 11.25ktpa AAM Vidalia facility targeted to start production in the September 2023 quarter.

- Definitive Feasibility Study (“DFS”) on the expansion of Vidalia’s production capacity to at least 45ktpa AAM, inclusive of 11.25ktpa AAM, well underway and to be completed in 2022.

- Entered into memorandum of understanding with Mitsubishi Chemicals Company to develop to new AAM products and localised production facilities in US and Europe.

- Exploring expansion of downstream business into Europe and commenced process for development of a large-scale AAM facility in the European Union potentially through partnership.

- Conditional Commitment 3 offered by the US Department of Energy (“DOE”) for an Advanced Technology Vehicles Manufacturing loan to support the financing of the Vidalia Initial Expansion project4. Syrah and DOE targeting signing of a binding loan in the September 2022 quarter.

- Quarter end cash balance of US$168 million.”

On July 22, Syrah Resources Limited announced: “Syrah enters into memorandum of understanding with Ford and SK On.” Highlights include:

- “Syrah enters into a non-binding memorandum of understanding with Ford and SK On.

- Ford and SK On will jointly supply lithium-ion batteries for Ford’s electric vehicle programs with large-scale battery manufacturing facilities planned in Tennessee and Kentucky.

- Syrah, Ford and SK On will evaluate a strategic arrangement, including natural graphite active anode material (“AAM”) supply, relating to the Vidalia AAM facility in USA.”

You can view the latest investor presentation here.

Catalysts:

- September 2023 quarter – First Stage 11.25ktpa AAM Vidalia facility targeted to start production.

Ceylon Graphite [TSXV:CYL] [GR:CCY] (OTC:CYLYF)

Ceylon Graphite has ‘Vein graphite’ production out of one mine in Sri Lanka with 121 square kilometers of tenements.

No significant news for the month.

Mineral Commodities Ltd. (“MRC”) [ASX:MRC]

Skaland Graphite is 90% owned by MRC. Skaland is the highest grade flake graphite operation in the world and largest producing mine in Europe; with immediate European graphite production of up to 10,000 tonnes per annum with regulatory approval to increase to 16,000. MRC plans to demerge its Norwegian graphite assets into a newly incorporated Norway company branded as Ascent Graphite.

No news for the month.

Tirupati Graphite [LSE:TGR]

On July 21, Tirupati Graphite announced:

Update on Madagascar Operations. Addressing operational challenges and moving closer to our target of Net-Zero Emissions… The Company is on track to increase its primary flake graphite production capacity in Madagascar to 30ktpa by September 2022 which will make it one of the few significant producers of the critical mineral outside China.

Northern Graphite [TSXV:NGC][GR:ONG] (OTCQX:NGPHF)

Northern Graphite has agreed to purchase from Imerys the Lac des Iles producing graphite mine in Quebec and the Okanjande graphite deposit/Okorusu processing plant in Namibia. They also own the Bissett Creek graphite project located 100km east of North Bay, Ontario, Canada and close to major roads and infrastructure. The Company has completed an NI 43-101 Bankable final Feasibility Study and received its major environmental permit.

On June 29, Northern Graphite announced:

Northern Graphite commences high resolution VTEMTM Plus Airborne Survey on South Okak Ni-Cu-Co Project…

On July 6, Northern Graphite announced:

Northern Graphite announces price increase due to inflationary pressures. Northern Graphite Corporation… is informing the market that it will increase prices on production from its Lac des Iles, Quebec graphite mine by 6% in order to cover rising costs due to global inflationary pressures on energy, freight and operational expenses.

On July 11, Northern Graphite announced:

Northern Graphite completes Preliminary Economic Assessment on restart of Namibian operations. Okanjande/Okorusu on Track for Production by Mid 2023.

You can view the latest investor presentation here and the latest Trend Investing article on Northern Graphite here or the very recent and excellent Trend Investing CEO interview here.

Graphite developers

Talga Group [ASX:TLG] [GR:TGX] (OTCPK:TLGRF)

Talga Group is a technology minerals company enabling stronger, lighter, and more functional materials for the multi-billion dollar global coatings, battery, construction and carbon composites markets using graphene and graphite. Talga 100% owned graphite deposits are in Sweden, proprietary process test facility is in Germany.

On July 6, Talga Group announced: “New drill results reveal Niska Link graphite.” Highlights include:

- “First drilling of 2km long ‘Niska Link’ target intersects wide and high grade graphite zones at Talga’s 100% owned Vittangi graphite project in northern Sweden.

- Significant downhole intercepts include: 84m @ 20.2% Cg (from 15m)…

- Remaining results expected in August with an update of Vittangi graphite resource to follow.

- Exploration push on Tier-1 graphite asset driven by strong demand for Talga’s European source of anode for Li-ion batteries.”

On July 21, Talga Group announced:

Swedish ECA finance support for anode project. Battery materials company Talga Group Ltd (“Talga” or “the Company”)(TLG:ASX) is pleased to advise that it has received a Letter of Interest from the Government-owned Swedish Export Credit Corporation (“SEK”) to support construction financing of Talga’s Vittangi Anode Project in Sweden…

You can view the latest investor presentation here.

South Star Battery Metals [TSXV:STS] (OTCQB:STSBF)

South Star Battery Metals owns the Santa Cruz Graphite Project in Brazil with a Phase 1 commercial production target for Q4 2022. Plus the right to earn-in to up to 75% for the Graphite Project in Coosa County, Alabama.

No news for the month.

Westwater Resources (NYSE:WWR)

Westwater Resources Inc. is developing an advanced battery graphite business in Alabama. The Coosa Graphite Plant (2023 production start) plans to source natural graphite initially from non-China suppliers and then from the USA from 2028.

No news for the month.

You can view the latest investor presentation here.

Gratomic Inc. [TSXV:GRAT] [GR:CB82] (OTCQX:CBULF)

Gratomic’s Aukam Graphite Project is located in Namibia, Africa. The Project is undergoing ‘operational readiness‘. Gratomic also 100% own the Capim Grosso Graphite Project in Brazil. Gratomic is also collaborating with Forge Nano to develop a second facility for graphite micronization and spheronization.

On June 23, Gratomic Inc. announced:

Gratomic provides drilling update on Capim Grosso Graphite Project. Gratomic Inc… announces that an additional 778.2 m of drilling (for a total of 3,162.8 m to date) of the 5,000-meter drilling campaign on its Capim Grosso graphite project has been completed…

On June 29, Gratomic Inc. announced:

Gratomic reports completion on first stage of diamond drilling at Aukam… Assay results are expected within 30 days enabling the geological modelling of the drilled mineralization to be completed and quantified. This will also enable new drill targets to be defined and pursued.

Black Rock Mining [ASX:BKT]

On July 25, Black Rock Mining announced: “Black Rock commences resettlement activities at Mahenge Graphite Project.” Highlights include:

- “Commencement of compensation process pursuant to the Mahenge Graphite Project Resettlement Action Plan…

- Provides access on ground for potential start of early works program ahead of planned commencement of mine construction.”

NextSource Materials Inc. [TSX:NEXT] [GR:1JW] (OTCQB:NSRCF)

NextSource Materials Inc. is a mine development company based in Toronto, Canada, that’s developing its 100%-owned, Feasibility-Stage Molo Graphite Project in Madagascar. The Company also has the Green Giant Vanadium Project on the same property. The Molo mine is fully-funded and scheduled to commission in March, 2022.

No news for the month.

Investors can view the latest company presentation here or the latest Trend Investing article here.

Nouveau Monde Graphite [TSXV:NOU] (OTCQX:NMGRF) (NYSE:NMG) and Mason Graphite [TSXV:LLG] [GR:M01] ( OTCQX:MGPHF)

Nouveau Monde Graphite (“NMG”) own the Matawinie graphite project, located in the municipality of Saint-Michel-des-Saints, approximately 150 km north of Montreal, Canada. NMG (51%) and Mason Graphite (49%) have agreed to JV (subject to approvals) on the Lac Guéret Project.

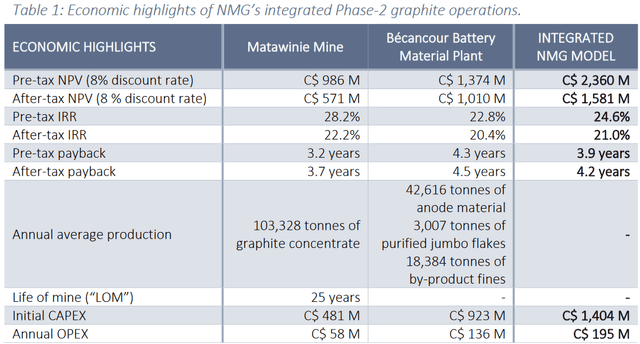

On July 6, Nouveau Monde Graphite announced: “NMG issues results of feasibility study for its integrated ore-to anode-material model projected to be North America’s largest natural graphite operation with attractive economics.” Highlights include:

- “NMG is developing a turnkey natural graphite operation with competitive advantages due to its privileged location, vertical integration, cost structure, ESG credentials and experienced team.

- The Company’s Phase-2 Matawinie Mine and Bécancour Battery Material Plant projects, located within a 150-km radius of Montréal, Québec, show attractive economics and robust operational parameters underpinned by a large mineral property, NMG’s proprietary technologies, and clean hydroelectricity powering its operations.

- The Feasibility Study of NMG’s integrated operation indicates a 21% after-tax IRR and NPV of C$ 1,581 million based on current projections of pricing prepared by a third-party expert for high-purity flakes and advanced graphite materials.

- NMG’s integrated production flowsheet provides the flexibility to distribute graphite concentrate per flake size and market demand in order to cater to the most profitable segments.

- NMG’s phased approach has helped de-risk NMG’s projects while accelerating the engineering of Phase-2 operations, generating process and cost optimization, and supporting commercialization with potential customers.

- NMG is designing a mine of the future, targeted to be all-electric, complemented by clean advanced beneficiation facilities in order to provide battery and EV manufacturers with responsibly extracted, environmentally transformed, and locally sourced green anode material.”

Source: NMG

On July 18, Nouveau Monde Graphite announced: “Life cycle assessment of NMG’s graphite advanced materials confirm minimal environmental footprint.”

On July 20, Nouveau Monde Graphite announced:

NMG announces the successful initial closing of the previously announced investment agreement with Mason Graphite. Pursuant to the Investment Agreement, NMG has entered into an option and joint venture agreement (the “Option and JV Agreement”) with Mason Graphite, pursuant to which the parties will collaborate to advance the Property, with a view to form a joint venture (the “Joint Venture”), and pursuant to which Mason Graphite will grant an option to NMG to acquire a 51% interest in the Property and other related assets (the “Option”) to be exercisable by NMG, the whole subject to the conditions set forth in the Option and JV Agreement…

You can view the latest investor presentation here.

Greenwing Resources Limited [ASX:GW1] (OTCPK:BSSMF) (formerly Bass Metals [ASX:BSM]

On July 11, Greenwing Resources Limited announced: “San Jorge lithium project update…”

On July 12, Greenwing Resources Limited announced: “Mineral resource update: 212% increase in graphite resource at Graphmda Mining Complex.” Highlights include:

- “Greenwing has expanded the Graphmada Mineral Resource, nearly tripling the Mineral Resource to 61.9Mt at 4.5% Fixed Carbon (FC), with total contained graphite now greater than 2.7 million tonnes (refer Table 1).

- Given the quantum of the new mineralization discovered, the Company is reviewing its project development strategy, as part of ongoing feasibility studies.

- These ongoing feasibility studies being conducted focus on expanded production levels at Graphmada, and a concept study will be completed during the quarter to determine the potential of Graphmada to supply both advanced material and lithium battery anode markets.

- Greenwing is planning a geophysics program at Graphmada to determine further diamond drill targets, aiming to significantly increase the Mineral Resource once again.”

You can view the latest company presentation here.

Triton Minerals [ASX:TON][GR:1TG]

Triton Minerals Ltd. engages in the acquisition, exploration and development of areas that are highly prospective for gold, graphite, and other minerals. The company was founded on March 28, 2006 and is headquartered in West Perth, Australia. Triton has two large graphite projects in Mozambique, not far from Syrah Resources Balama project.

No news for the month.

You can view the latest investor presentation here and the latest article on Trend Investing here.

Magnis Energy Technologies Ltd [ASX:MNS] (OTCQX:MNSEF)

Magnis is an Australian based company that has rapidly moved into battery technology and is planning to become one of the world’s largest manufacturers of lithium-ion battery cells. Magnis has a world class graphite deposit in Tanzania known as the Nachu Graphite Project.

On June 22, Magnis Energy Technologies Ltd. announced: “New York lithium-ion battery plant update.” Highlights include:

- “New York battery plant status at the end of June – 84% complete.

- Initial production of several thousand cells expected in August which will ramp up to 10,000 cells/day as production scales up.

- Safety – Zero incidents in June.”

On July 25, Magnis Energy Technologies Ltd. announced: “Magnis US shares begin real-time electronic trading.”

Eagle Graphite [TSXV:EGA] (OTCPK:APMFF)

The Black Crystal Project is located in the Slocan Valley area of British Columbia, Canada, 35km West of the city of Nelson, and 70km North of the border to the USA. The quarry and plant areas are the project’s two main centers of activity.

No news for the month.

SRG Mining Inc. [TSXV:SRG] [GR:18Y] [Formerly SRG Graphite Inc.]

SRG is focused on developing the Lola graphite deposit, which is located in the Republic of Guinea, West Africa. The Lola Graphite occurrence has a prospective surface outline of 3.22 km2 of continuous graphitic gneiss, one of the largest graphitic surface areas in the world. SRG owns 100% of the Lola Graphite Project.

No news for the month.

You can view the latest investor presentation here.

Leading Edge Materials [TSXV:LEM] (OTCQB:LEMIF)

Leading Edge Materials Corp. is a Canadian company focused on becoming a sustainable supplier of a range of critical materials. Leading Edge Materials’ flagship asset is the Woxna Graphite Project and processing plant in central Sweden. The company also owns the Norra Karr REE project, and the 51% of the Bihor Sud Nickel-Cobalt exploration stage project in Romania.

On July 14, Leading Edge Materials Corp. announced: “Leading Edge Materials receives approval for first-year exploration program in Romania.” Highlights include:

- “Exploration to focus on surface mapping and re-opening historical galleries.

- Rock grab samples from mine dumps report grades up to 6.8% Cobalt and 28% Nickel.”

Investors can view the latest company presentation here.

Renascor Resources [ASX:RNU](OTC:RSNUF)

Renascor Resources Ltd. is an Australian exploration company, which focuses on the discovery and development of economically viable deposits containing uranium, gold, copper, and associated minerals. Its projects include graphite, copper, precious metals, and uranium.

On July 6, Renascor Resources announced: “Latest Siviour drill assays amongst thickest and highest-grade graphite to date. Results support anticipated expansion in Siviour Resource and improved mining schedule in updated Battery Anode Material Study.” Highlights include:

- “New drill assays from recent drilling at Renascor’s Siviour Graphite Deposit in South Australia have confirmed intersections within the project area that are amongst the thickest and highest grade to date, with results including: 45 metres at 9.4% Total Graphitic Carbon (TGC) from 23 metres and 10 metres at 6.6% TGC from 8 metres (SIVRC264), 25 metres at 13.7% TGC from 17 metres (SIVRC266), 20 metres at 7.5% TGC from 7 metres (SIVRC267), and 17 metres at 7.6% TGC from 48 metres (SIVRC273)…

- Siviour is currently the second largest reported Proven Graphite Reserve in the world and the largest Graphite Reserve outside Africa1, supporting a 40 year mine life with production of Graphite Concentrates of up to 150,000 tonne per annum.

- The drill results will be incorporated into a revised pit design and mining schedule as part of Renascor’s optimised Battery Anode Material Study3 (BAM Study), with the potential to reduce mining costs and increase the volume of graphitic ore mined.

- The results will also permit the calculation of revised Mineral Resource Estimate, expected to be completed in the current quarter.”

On July 12, Renascor Resources announced:

Renascor extends Siviour Project Area. Drilling expected to start this quarter to further expand Siviour Mineral Resource and support potential future production capacity increases.

You can view the latest investor presentation here.

EcoGraf Limited [ASX:EGR] [FSE:FMK] (ECGFF)

No significant news for the month.

You can view the latest investor presentation here.

Lomiko Metals Inc. [TSXV:LMR] (OTCQB:LMRMF)

Lomiko has two projects in Canada – La Loutre graphite Project (flagship) (100% interest) and the Bourier lithium Project (70% earn in interest).

On July 21, Lomiko Metals Inc. announced:

Lomiko announces closing of flow-through private placement and update on regional graphite exploration and Bourier Lithium Project… At La Loutre we continue to advance our diamond drill program in the EV Zone, environmental baseline studies and metallurgical studies continue… Lomiko has initiated helicopter-borne geophysical surveys on its six regional graphite properties…

Metals Australia [ASX:MLS]

On July 27 Metals Australia reported:

Metals Australia completes very successful Phase 2 metallurgical testwork on Lac Rainy high-grade Graphite Project. Bulk graphite concentrate Despatched for spherical graphite and battery testwork… the final stage of the Phase 2 metallurgical testwork on the Company’s high grade Lac Rainy Graphite Project in Quebec, Canada has produced a pilot scale bulk sample of graphite concentrate that has met the required specifications for downstream lithium-ion battery testwork. This bulk concentrate sample has now been despatched to specialist graphite testing group, ProGraphite in Germany to carry out critical spheronisation (spherical graphite), purification and battery testwork to determine lithium-ion battery anode charging qualities and durability.

Sovereign Metals [ASX:SVM] [GR:SVM][LSE:SVML]

Sovereign Metals Ltd. is an exploration company, which engages in the explorations of graphite, copper, and gold resources. It operates through the Queensland, Australia and Malawi geographical segments. Sovereign Metals has world’s biggest graphite saprolith resource of 65m tonnes at 7.1% TGC at their Maligunde Project in Malawi.

No graphite related news for the month.

You can view the latest investor presentation here.

BlackEarth Minerals [ASX:BEM]

On July 26 BlackEarth Minerals announced:

Massive Mineral Resource upgrade achieved at Razafy.

• The Mineral Resource upgrade represents a 63% increase in the Company’s previously reported overall Mineral Resource tonnes

• Recent diamond drill program has delivered an upgraded JORC (2012) reportable Indicated and Inferred Mineral Resource for Razafy of 25.7Mt @ 6.2% TGC at the Maniry Project – Total Resources now stand at 37.6Mt @ 6.4% TGC…

Zentek Ltd. [TSXV:ZEN] (ZTEK)(OTCPK:ZENYF) (formerly ZEN Graphene Solutions Ltd.)

On July 18, Zentek Ltd. announced: “Zentek files a provisional patent on the use of ZenGUARD™ as an Anti-Inflammatory Agent…”

Other graphite juniors

Armadale Capital [AIM:ACP], BlackEarth Minerals [ASX:BEM], DNI Metals [CSE:DNI] (OTC:DMNKF), Eagle Graphite [TSXV:EGA] [GR:NJGP] (OTC:APMFF), Electric Royalties [TSXV:ELEC], Focus Graphite [TSXV:FMS][GR:FKC] (OTCQB:FCSMF), Graphite One Resources Inc. [TSXV:GPH] [GR:2JC] (OTCQX:GPHOF), Green Battery Minerals Inc. [TSXV:GEM] (OTCQB:GBMIF), International Graphite [ASX:IG6], Metals Australia [ASX:MLS], New Energy Metals Corp. [ASX:NXE], Volt Resources [ASX:VRC] [GR:R8L], Walkabout Resources Ltd [ASX:WKT].

Synthetic Graphite companies

- SGL Carbon (ETR:SGL)

- Novonix Ltd [ASX:NVX]

Graphene companies

- Archer Materials [ASX:AXE]

- Elcora Advanced Materials Corp. [TSXV:ERA](OTCPK:ECORF)

- First Graphene [ASX:FGR] (OTCQB:FGPHF)

- Graphene Manufacturing Group Ltd [TSXV:GMG]

- NanoXplore Inc. [TSXV:GRA] (OTCQX:NNXPF)

- Strategic Elements Ltd [ASX:SOR]

- Zentek Ltd. [TSXV:ZEN]

Conclusion

July saw generally flat flake and spherical graphite prices.

Highlights for the month were:

- BMI: The energy storage revolution has arrived. Li-ion battery production to grow at a CAGR of 47% to 2032.

- POSCO expands lithium ion empire with silicon anode acquisition.

- US says it will back miners to stop China’s weaponization of battery metals.

- Syrah Resources commenced process for development of a large-scale AAM facility in the European Union potentially through partnership. Enters into MOU with Ford and SK On.

- Northern Graphite completes PEA on restart of Namibian operations, Okanjande/Okorusu on track for production by mid-2023.

- Talga Group receives Swedish ECA finance support for anode project.

- Nouveau Monde Graphite integrated operation FS results in an after-tax NPV8% of C$1,581m and after-tax IRR of 21%, initial CapEx of C$1,404m.

-

Greenwing Resources 212% Resource increase at Graphmda Mining Complex.

-

Magnis Energy Technologies consortium’s New York battery plant is now 84% complete.

- Renascor Resources drills 45 metres at 9.4% Total Graphitic Carbon (TGC) from 23 metres.

- Metals Australia completes very successful Phase 2 metallurgical testwork on Lac Rainy high-grade Graphite Project.

- BlackEarth Minerals announces massive Mineral Resource upgrade achieved at Razafy.

As usual all comments are welcome.

Be the first to comment