Trygve Finkelsen/iStock Editorial via Getty Images

The hype for SPAC mergers has undoubtedly faded in recent months as compared to a year ago. In addition to mounting macroeconomic headwinds over the valuation prospects of growth businesses that typically dominate SPAC mergers, the IPO method has also been met with increasing scrutiny by regulators following a slew of federal investigations on the viability of “bullish SPAC forecasts” disclosed.

However, the upcoming business combination between Gores Guggenheim (NASDAQ:GGPI) and European electric vehicle (“EV”) upstart Polestar will likely defy the looming challenges and mark one of the most looked forward to de-SPAC transactions of the year. Unlike its SPAC peers that have gone public over the past two years, Polestar has already begun productions on its flagship fully electric “Polestar 2” sedan, with 29,000 units delivered in 2021. The EV maker also has a widespread and growing global presence across more than 19 markets at the moment, with strong backing from parent companies Volvo (OTCPK:VOLAF, OTCPK:VLVLY, OTCPK:VOLVY) and Geely (OTCPK:GELYF, OTCPK:GELYY). The company’s 2021 delivery volumes have also met its global sales target for the year, a rare sighting amid other EV SPACs that have been faced with production delays and production ramp up challenges due to heightening supply chain constraints over the past year.

Polestar was also in the spotlight this week after Hertz (HTZ) announced plans to purchase 65,000 EVs from the brand under a five-year deal. GGPI’s stock surged more than 12% immediately after the news broke earlier this week, imitating a similar rally in Tesla’s stock (TSLA) following Hertz’s announcement of a similar purchase order to expand its electric rental fleet last year.

With the planned SPAC merger fast-approaching completion, Polestar could quickly catch up to become another market darling ahead of the increasingly competitive EV arms race. GGPI is currently trading at a discount to other EV pureplays, which is further amplified considering Polestar’s operational advantage in terms of global expansion, production ramp up and delivery volumes achieved to date. This makes GGPI an attractive investment opportunity ahead of its planned merger with Polestar, which is expected to close in the first half of the year.

About the GGPI-Polestar Merger

GGPI and Polestar announced their planned business combination last September, which would give the latter an implied valuation of about $20 billion. The transaction is expected to add about $1 billion in cash proceeds to Polestar’s balance sheet as a result of $800 million in “SPAC cash” held in trust and $250 million from PIPE investors, less related transaction fees.

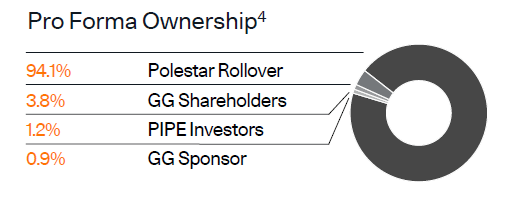

The EV maker intends to allocate the transaction proceeds towards continued expansion of its product roadmap and operational footprint to “create a leading company in the rapidly growing global premium EV market”, making it one of the rapidly rising contenders against industry leader Tesla and other EV pureplays. The company currently counts global auto manufacturers Volvo and Geely as its core shareholders. Following the completion of the transaction, Polestar’s ownership structure is estimated as follows:

- Polestar Rollover: Existing Polestar shareholders, which includes famed Hollywood actor Leonardo DiCaprio in addition to Volvo and Geely, are expected to control 94.1% of the company post-merger. Last month, Volvo disclosed its position as Polestar’s current largest shareholder through a 49.5% equity interest, and has entered into a “Declaration of Intent to subscribe to a potential future equity or equity linked securities issued by Polestar” related to its upcoming business combination with GGPI. Geely, Polestar’s second largest shareholder, alongside DiCaprio, have yet to disclose the size of their respective equity interests in Polestar, but are known to have entered into a similar declaration of intent as Volvo.

- GGPI Shareholders: Current shareholders of GGPI pre-merger are expected to account for 3.8% equity interest in Polestar post-merger.

- PIPE Investors: Top-tier institutional investors that have contributed $250 million to the transaction through PIPE is estimated to represent 1.2% equity interest in Polestar post-merger

- GGPI Sponsor: Current GGPI sponsors, including Gores Group and Guggenheim Capital, is expected to retain 0.9% equity stake in Polestar post-merger.

Polestar Post-Merger Ownership Structure (Polestar March 2022 Investor Presentation)

The Force Behind Polestar’s “Asset Light” Business Strategy

Polestar’s “asset light” business strategy makes one of its core competitive advantages against other EV pureplays in the industry. Different from industry peer Fisker (FSR), which also operates an asset light business model, Polestar does not necessarily fully “outsource” its manufacturing process, but rather leverages the volume production expertise of its parent companies Volvo and Geely. This has allowed Polestar to rapidly scale its productions, despite protracted supply chain constraints that have caused some of its industry peers to slash projections, upending the broader automotive industry in the first quarter of the year. The effectiveness and efficiency of Polestar’s asset light strategy is also corroborated by its recent achievement in growing production volumes by 185% to 29,000 vehicles in 2021, satisfying its growth target for the year. Polestar’s ability to deliver 29,000 vehicles in 2021 also beats the 2022 – first full year production – guidance reported by peers Lucid (LCID) and Rivian (RIVN), which targets 12,000 to 14,000 units and 25,000 units, respectively, underscoring the Volvo- and Geely-backed EV upstart’s asset light advantage.

The asset light business strategy is also known to reduce capital intensity and enable Polestar to deploy greater investments toward expanding its product and technology road map and global footprint. To date, Polestar has already lined up production capacity to meet anticipated demand for its growing product pipeline and global market presence out to mid-decade, while also bolstering its prospects for continued margin expansion through platform sharing with its parent companies:

- Polestar 1: The brand’s first hybrid model, Polestar 1, was previously produced at the EV maker’s fully owned and operated facility in Chengdu, China. However, productions of Polestar 1 have been discontinued, as the EV maker redirects its focus toward fully electric models going forward. It is currently uncertain which future model the Chengdu facility’s annual production capacity of 750 vehicles will be allocated to. The facility was originally tooled for production of vehicles based on the “Scalable Product Architecture 1” (“SPA 1”) platform. SPA 2, the successor to SPA 1, which supports the upcoming Polestar 3 SUV model with expected start of productions (“SOP”) later this year and the future Polestar 5 premium 4-door GT with expected SOP in 2024, will likely be able to leverage Polestar’s fully owned and operated Chengdu facility in the future.

- Polestar 2: The brand’s first fully electric sedan, Polestar 2, is currently produced in Volvo’s owned and operated Taizhou facility. The Taizhou facility currently has annual production capacity of up to 180,000 vehicles based on the “Compact Modular Architecture” (“CMA”) platform that was jointly developed by Volvo and Geely. Polestar 2, which leverages Volvo’s total annual production capacity of 180,000 vehicles in Taizhou, also shares the CMA platform that supports the Volvo XC40 and the fully electric Volvo XC40 Recharge, underscoring the benefits of its asset light business model at work. Platform sharing with Volvo is expected to further margin expansion on the Polestar 2 thanks to rapid economies of scale. Polestar is currently planning to expand Polestar 2 productions to Europe within the near future. The plans are consistent with Polestar’s guided annual sales target of more than 104,000 units of the fully electric premium sedan by mid-decade.

- Polestar 3: As mentioned in earlier sections, the Polestar 3 will be the brand’s first electric SUV built on the SPA 2 platform. SOP will begin later this year at Volvo’s owned and operated facilities in China (Chengdu) and the U.S. (Charleston). Both facilities have annual production capacity of 150,000 vehicles each, which will be ample for supporting Polestar’s annual sales target of 24,000 units beginning next year and up to 77,000 units by 2025.

- Polestar 4: The Polestar 4 electric premium SUV, which does not begin SOP until next year, will leverage the production expertise of Geely’s owned and operating facility in Hangzhou Bay, China. The facility currently has annual production capacity of 240,000 vehicles, and will facilitate production of the Polestar 4 based on the “Pure Electric Modular Architecture” (“PMA”) platform jointly designed by Geely and Volvo. Similar to the Polestar 2, the upcoming Polestar 4 will be another classic example of how Polestar stands to capitalize on opportunities for rapidly achieving economies of scale through platform sharing with Geely.

- Polestar 5: The Polestar 5 electric premium 4-door GT, which is scheduled for SOP in 2024, will share the SPA 2 platform that drives the upcoming Polestar 3 SUV. The Polestar 5 is designed based on Polestar’s “Precept” concept car unveiled in 2020, and will be built at the Geely-owned but Polestar-operated Chongqing facility. The facility, which has planned annual production capacity of 30,000 vehicles fully dedicated to Polestar, is expected to be carbon-neutral, which aligns with the brand’s aspirations to produce a climate-neutral car that combines sustainability and innovation by the end of the decade.

Benefits of a Diverse Vehicle Model Portfolio and Pricing Strategy

More than 30 brand new EV models are scheduled for launch this year in the U.S. alone. And by mid-decade, the U.S. is expected to have more than 130 EV models, while Europe will have more than 300. Recognizing the need to stay competitive, Polestar has ambitious plans to have four fully electric models across all major vehicle segments by 2024 in order to maximize its global market penetration ahead of accelerating EV adoption. As mentioned in the previous section, Polestar will be launching two SUVs, as well as another premium four-door GT to better compete against other premium EV pureplays like Tesla and Lucid, as well as ICE-turned-electric legacy automakers like Porsche. The new models will be equipped with advanced autonomous driving and connectivity technologies powered by industry-leading hardware and software from Luminar (LAZR), Nvidia (NVDA) and Zenseact, placing Polestar’s technological competencies at a competitive level against peers, while also potentially opening the door to new recurring revenue streams from the sale of self-driving services.

The Polestar 3 and Polestar 4 SUVs, which have been compared to the Porsche Cayenne and Porsche Macan, respectively, will add to Polestar’s strength in better capitalizing on demand from the most popular SUV vehicle segment – SUVs currently command more than 50% of annual new car registrations in the U.S. and close to 46% in Europe. With targeted range per charge of more than 370 miles (> 600 km) on its upcoming SUVs, capable of charging to 80% in under 20 minutes, Polestar seeks to remain competitive against currently available premium electric options in the segment, including the BMW iX (OTCPK:BMWYY), Rivian R1S, and upcoming Xpeng G9 (XPEV).

However, the extended range battery packs that are expected to power Polestar’s new models from now to 2024 still trails by wide margins compared to some of the best-in-class offerings by other premium EV pureplay peers, including Lucid, Tesla and NIO (NYSE: NIO). Yet, Polestar’s diverse pricing strategy for its premium electric line-up is expected to compensate for some of the shortfall. With prices ranging from $50,000 to $60,000 on the affordable Polestar 2 premium electric sedan, all the way to $200,000+ on future Polestar 4 and Polestar 5 premium electric performance SUV and 4-door GT, there is a Polestar vehicle suited for every consumer preference. Paired with various financial incentives, such as tax credits and government subsidies across different markets, Polestar’s diverse pricing options make it an attractive choice as the global switch from ICE vehicles to EVs pick up in pace, bolstering its market share, and inadvertently, financial prospects over the longer-term.

Polestar is also one of the few automakers to offer bi-directional, vehicle-to-grid charging compatibility beginning with its upcoming Polestar 3 SUV, which also helps to compensate for its range capability shortfall compared to some of the other premium EV pureplays. According to the BNEF, “drivers with a bi-directional charger in the U.K. can benefit by about $370 annually” in cost-savings. With rising prices at the pump and more frequent than expected weather-induced blackouts across major economies in recent years, equipping vehicles with bi-directional charging capability can be another enticing offering by Polestar to capture the likes of prospective customers.

Fast-Expanding Global Market Presence

Similar to most EV upstarts in the market today, Polestar also adopts a digital-focused, direct go-to-market strategy. The entire shopping experience, from scheduling a test drive to configuring a Polestar order and booking service appointments post-sales, can be easily accessed in the palm of consumers’ hands through the Polestar app. The strategy has become increasingly popular amongst EV pureplays in recent years, thanks to its “easy to scale” nature. It also complements the cohort’s respective direct-to-sales showrooms, as opposed to dealerships that have historically been a favourite to legacy automakers, by enhancing focus on customer experience while also reducing the need for large capital investments into building inventory.

Polestar’s digital-focused direct sales strategy is a companion to the 100+ physical showrooms it currently operates across more than 19 markets in Europe, Asia Pacific and the U.S. The EV maker plans to have at least 150 retail locations in operation by the end of the year, and seeks to expand its global presence to more than 30 markets by 2023. Polestar will be “adding Spain, Portugal and Ireland to its European market footprint” in the first half of the year, followed by an entry to the Middle East with new showrooms across the UAE, Kuwait and Israel.

The EV maker’s dedication to bolstering its presence in Europe comes at an opportune time, as stringent emissions standards set by the European Commission are expected to further accelerate mass-market EV adoption across the broader European markets in coming years. While new car registrations across Europe have dwindled in recent months due to raw material supply shortages, EV sales have remained resilient. More than 2.3 million EVs were sold in Europe last year, accounting for a fifth of the region’s new car registrations. EV adoption has clearly hit an inflection point in the European market, as the EU continues to press towards plans of having all new vehicle sales be emissions-free by 2035 with favourable policy support. Current leaders in plug-in vehicle sales in Europe include Mercedes Benz (OTCPK:DDAIF, OTCPK:DMLRY), Tesla and BMW in the top five, indicating robust demand for luxury premium EVs like those offered by Polestar across the region. And with the Middle East’s EV market expected to grow at a CAGR of 15% over the next five years, Polestar is slated to benefit from a well-timed entry into the market later this year.

Polestar has also been eager in bolstering its brand awareness in the growing American EV market. As opposed to its more established presence in Europe, few in North America have even heard about Polestar before its merger with GGPI was announced last year. But traction has picked up since, following the debut of its “first-ever Super Bowl ad” earlier this year, which included bold jabs at industry-leading rivals like Volkswagen (OTCPK:VWAGY, OTCPK:VLKAF) and Tesla during the 30-second slot. Hertz’s recent decision to add 65,000 Polestar EVs to its rental fleet over the next five years in an estimated $3 billion deal will also serve as a key marketing tool for the new EV maker, allowing potential customers to take its vehicles for a spin and determine whether they would like one for themselves down the road.

Polestar has also expanded its retail presence in the U.S. in recent years. With 25 showrooms spread across the country, Polestar is well-positioned to capitalize on growth opportunities within the American EV market. The Biden Administration’s recent pledge to reduce greenhouse gas pollution by at least 50% to 52% from 2005 levels by 2030 has played a significant role in the introduction of favourable follow-up policies for the broader EV sector. Multiple infrastructure bills have either been passed or are undergoing review to include additional funding for building out the U.S. EV economy to encourage accelerated adoption. For instance, the $550 billion infrastructure bill allocates $7.5 billion towards building out the U.S.’ public charging network. The apportioned funding will be transformational given the current deficit of public EV chargers required to support state- and federal-level emissions reduction goals, and the need to further enhance EV adoption. President Biden has also recently made it a national goal to have half of new car sales be emissions-free by 2030, and has accordingly proposed a tax credit program in the $1.75 trillion tax and spending bill. If passed, consumers for all EV purchases will be eligible for a $7,500 tax credit, making strong long-term tailwinds for Polestar. The continued rollout of favourable policy support from the government is expected to further stimulate the American EV economy, underpinning growth at a CAGR of 30% towards 14 million EVs on American roads by 2030.

Financial Prospects

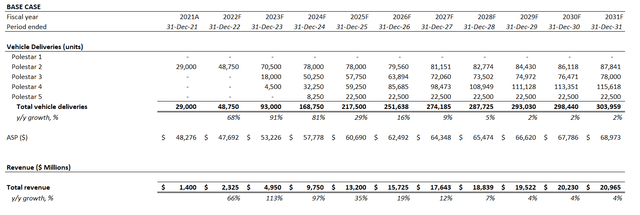

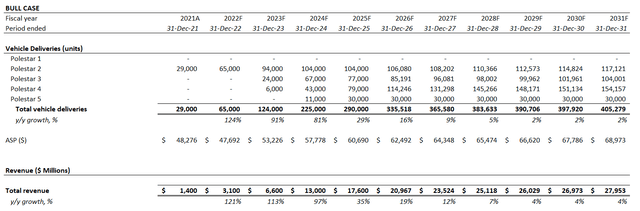

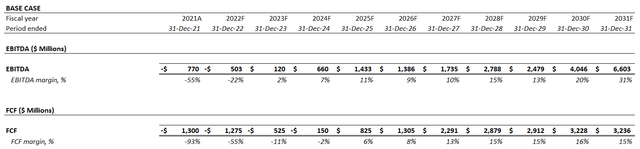

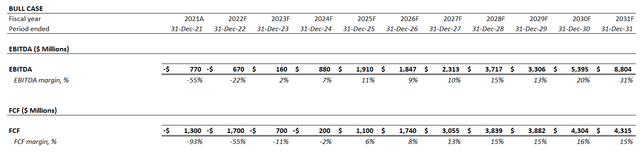

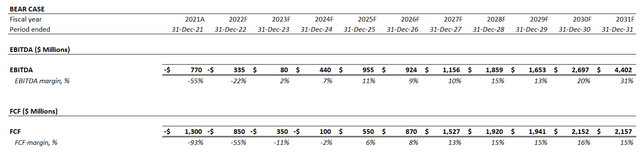

Based on Polestar’s March 2022 Investor Presentation, the EV maker aspires to increase EV sales volumes from 29,000 units in 2021 to 290,000 units by mid-decade. The forecast is expected to boost revenues from $1.4 billion in the previous year to $17.6 billion by 2025, representing topline expansion at a compounded annual growth rate (“CAGR”) of 88% over the next four years. The company’s guided cost structure is also showing expectations for competitive EBITDA and free cash flow margin expansion of -55% to 11%, and -93% to 6%, respectively, between 2021 and 2025, thanks to operational efficiencies enabled by its asset light business model.

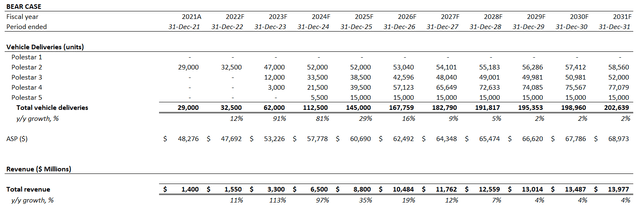

However, considering the consistent trend of estimate misses by EV peers in recent years due to protracted supply chain and production ramp up challenges that have been a repeated warning by Tesla CEO Elon Musk, we have discounted management’s guidance by 25% in our base case scenario. The adjustment is consistent with those observed across EV pureplays such as NIO, Lucid and Rivian in the past year as a result of protracted supply chain woes stemming from pandemic disruptions, which have been further exacerbated by the recent outbreak of conflict between Russia and Ukraine. The 25% adjustment to management’s guidance also considers parent company Volvo’s potential failure to meet its current year production forecast due to ongoing chip supply shortages that have forced its factories to a temporary “standstill”. Tepid demand in the near-term as consumers adjust to rising price pressures and a potential economic slowdown ahead of tightening central bank policies could also add challenge to Polestar’s sales prospects within the foreseeable future.

As a result, our base case forecast projects Polestar vehicle sales to grow from 29,000 units in 2021 to 217,500 units by mid-decade. For valuation purposes, we have also extended the forecast to 2031 by applying a modest volume growth CAGR of 4%, consistent with blended GDP expansion rates, in the five-year period following 2026. This is expected to drive revenue growth from $1.4 billion in 2021 (29,000 vehicles sold) to $13.2 billion by 2025 (estimated 217,500 vehicles sold), and $21.0 billion by 2031 (estimated ~304,000 vehicles sold).

Polestar Base Case Sales Projections (Author)

Polestar Bull Case Sales Projections (Polestar March 2022 Investor Presentation)

Polestar Bear Case Sales Projections (Author)

Applying the same margin projections guided by management from 2021 to 2025, and considering industry peer margin estimates from 2026 to 2031, our base case forecast expects EBITDA to expand from -$770 million to $6.6 billion, and free cash flow to expand from -$1.3 billion to $3.2 billion in the forecast period between 2021 and 2031.

Polestar Base Case EBITDA and FCF Projections (Author)

Polestar Bull Case EBITDA and FCF Projections (Polestar March 2022 Investor Presentation)

Polestar Bear Case EBITDA and FCF Projections (Author)

Polestar_-_Forecasted_Financial_Information.pdf

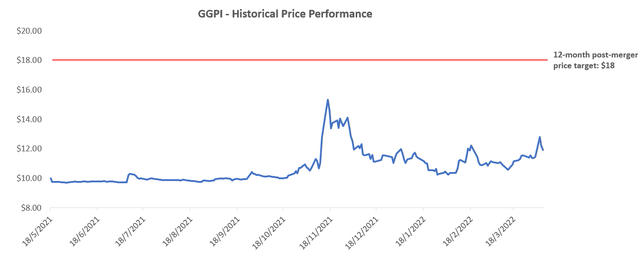

Valuation Analysis

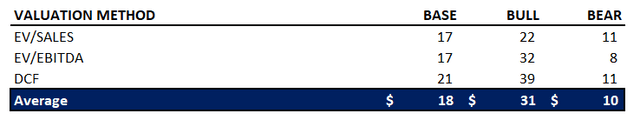

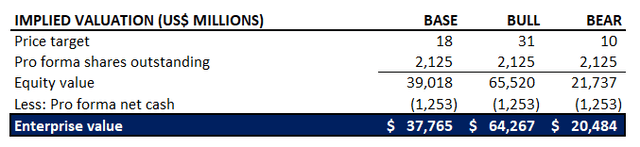

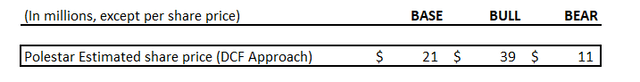

By equally weighing an EV/sales-based, EV/EBITDA-based and discounted cash flows (“DCF”) valuation approach, we have determined a base case post-merger 12-month price target of $18 (implied valuation $37 billion) for the GGPI stock. This represents upside potential of more than 50% based on the stock’s last traded share price of $11.89 at the time of writing (April 6th).

GGPI 12-Month Price Target (Author)

Polestar Valuation Analysis (Author)

Polestar Valuation Analysis (Author)

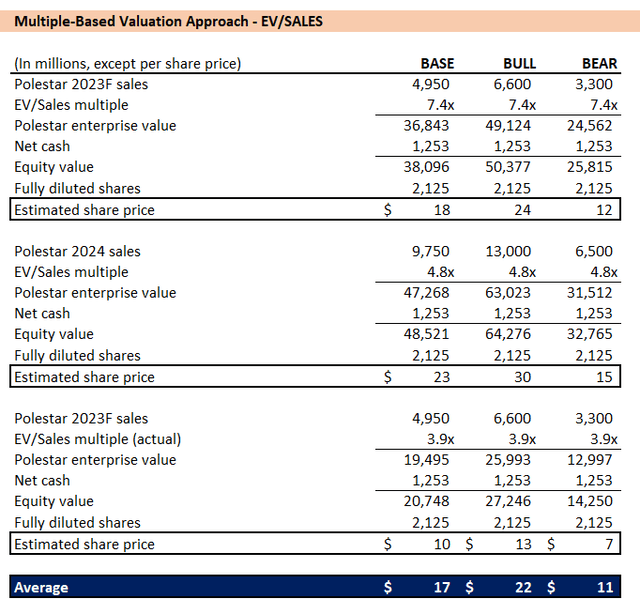

1. EV/Sales Valuation Approach:

For the EV/sales-based approach, we have averaged the PT derived by applying 7.4x, 4.8x and 3.9x to base (i.e. 75% of management guidance), bull (i.e. management guidance from March 2022 Investor Presentation) and bear case (i.e. 50% of management guidance) 2023 and 2024 revenue projections, respectively.

Polestar EV/Sales-Based Valuation Approach (Author)

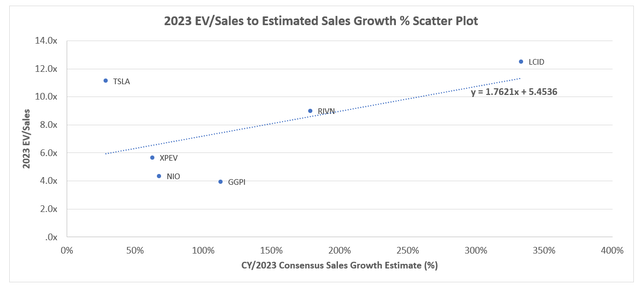

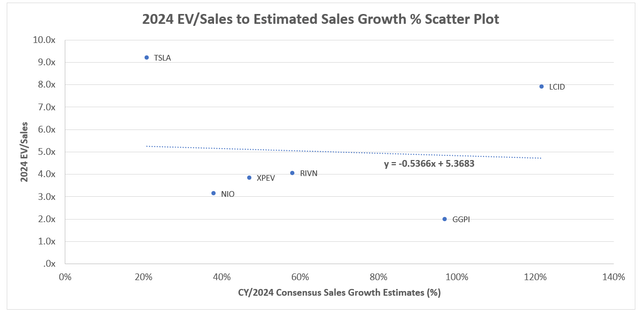

The EV/sales multiple applied is determined in consistency with the growth assumptions considered in our fundamental forecast and is derived in accordance with corresponding valuation trends observed across growing EV peers:

Polestar Peer Comp (Author)

Polestar Peer Comp (Author)

Based on GGPI’s current forward EV/sales multiple of about 3.9x, it is trading at a discount to the 7.4x 2023 EV/sales and 4.8x 2024 EV/sales it deserves based on the EV/sales to sales growth correlation currently observed across EV pureplays.

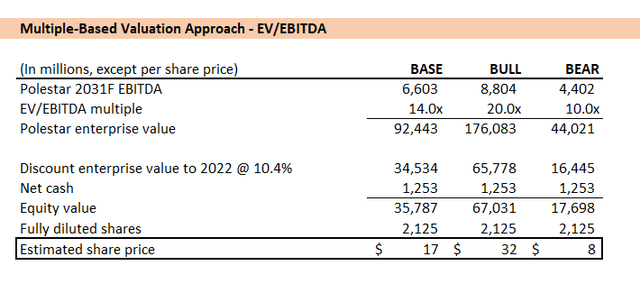

2. EV/EBITDA Valuation Approach:

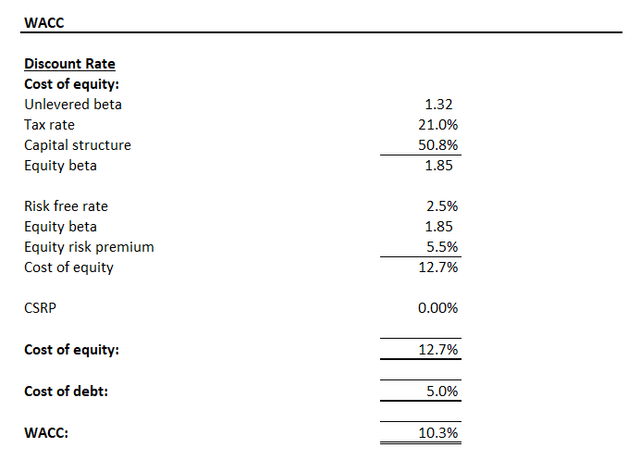

For the EV/EBITDA-based approach, we have derived the PT by applying 14x, 20x and 10x to the base, bull and bear case 2031 EBITDA forecast, respectively, discounted back to 2022 at 10.3%. The valuation assumptions applied are consistent with those observed across recent EV upstarts like Rivian and Lucid, and is consistent with expectations for Polestar sales and EBITDA to still be expanding rapidly between 2026 to 2031.

Polestar EV/EBITDA-Based Valuation Approach (Author)

Polestar Discount Rate (Author)

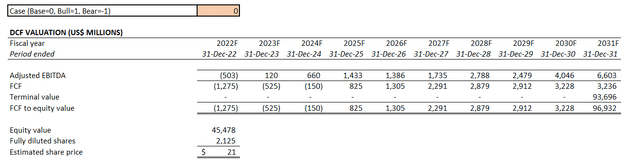

3. DCF Valuation Approach:

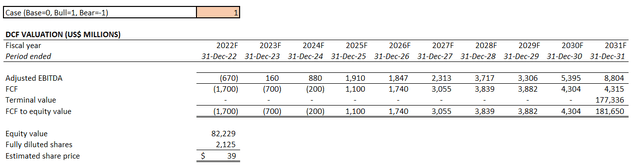

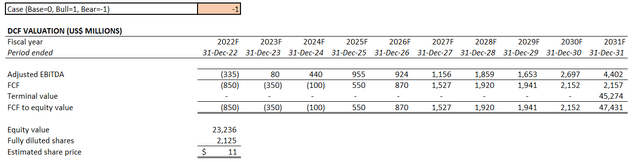

For the DCF approach, we have drawn the projected cash flow streams from the base, bull and bear case fundamental forecast discussed in earlier sections, and applied an exit multiple of 14x, 20x and 10x, respectively, and WACC of 10.3%. The valuation assumptions are consistent with Polestar’s continued global market share growth expectations ahead of accelerating EV adoption worldwide, as well as its anticipated capital structure and continued ability in delivering favourable margin expansion as a result of its asset light business strategy.

Polestar Base Case DCF Valuation Analysis (Author)

Polestar Bull Case DCF Valuation Analysis (Author)

Polestar Bear Case DCF Valuation Analysis (Author)

Polestar DCF Valuation Summary (Author)

Conclusion

Although Polestar does not have a technology moat like best-in-class range capabilities or a comprehensive, vertically integrated business model from in-house manufacturing to exclusive charging services boasted by some of its premium EV peers, it has proven to be an upstart capable of running an operationally efficient business from day one thanks to unwavering support by its parent companies. Strong backing from Volvo and Geely on a financial and operational standpoint, paired with autonomy for Polestar to grow as a standalone brand and business, is a strong confidence booster for its valuation prospects.

And Polestar’s upcoming merger with GGPI will only further its market share by enabling greater investments into continued expansion of its product and technology roadmap and international footprint to capitalize on growing EV opportunities ahead. We see unrealized upside potential still in GGPI’s stock as a result of the upcoming valuation re-rate post-completion of the SPAC merger, which makes it an attractive buying opportunity at current price levels.

Author’s Note: Thank you for reading my analysis. Please note that I am in the process of planning a subscription service with Seeking Alpha’s Marketplace. The service will allow you to follow my model portfolio, interact with me directly, and participate in chat rooms with other subscribers. I’ll be launching in the near future with a legacy discount for early subscribers and I’ll be sharing more details as we ramp up to launch in the coming months.

Be the first to comment