Sean Gallup

Thesis

Pre-Q3 I wrote an article about Google where I asked the question if the search giant’s September quarter will be as bad as analysts are pricing. Well, it was (unexpectedly) worse. Google missed analyst consensus estimates with regards to both revenue and EPS, which caused Google stock to lose as much as 7% in after-hours trading.

I do not think that Google’s Q3 results are a disaster, and the stock should be punished with a 7% sell-off. However, following a worse than expected Q3, I agree that it is reasonable to be more cautious on the search giant’s near- to mid-term outlook.

I continue to believe that the valuation has accounted sufficiently for any fundamental headwinds. And the long-term picture for Google remains bright. I downgrade to ‘Buy’ from ‘Strong Buy’ previously.

Google’s Q3

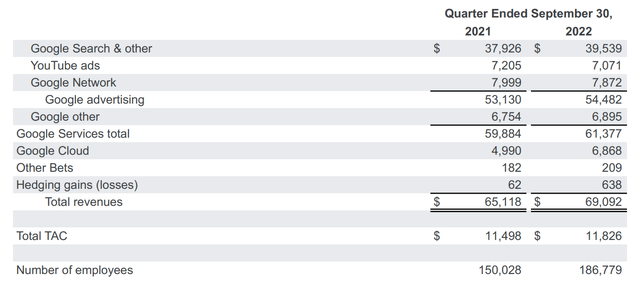

Google’s growth and profitability slowed down sharply in Q3. During the September quarter, Google generated revenues of ‘only’ $69.09 billion, versus analyst consensus estimates of $70.7 billion. Google’s Q3 revenue expansion slowed down to 6% year over year growth, after achieving 41% year over year growth one year prior. However, investors should consider that without the currency headwind (strong dollar), year over year revenue growth would have been closer to 11%.

Profitability wasn’t much better either: Operating income decreased 19% versus Q3 2021, down to $17.14 billion. The Alphabet conglomerate reported EPS equal to $1.06, as compared to $1.40 in Q3 2021. As with revenue, earnings fell short of analyst consensus estimates, which had expected $1.25.

Advertising Slowed Sharply, Cloud Solid

Following a disastrous Q3 quarter from Snap Inc (SNAP), Google’s advertising business confirmed that demand digital ad spending slowed sharply in the September quarter. Although Google Search was up about 4.2% year over year, the result of $39.54 billion missed estimates by almost one billion. At the same time, YouTube advertising decreased 2%, down to $7.1 billion and Google network also decreased by almost 2%, down to $7.9 billion

In the earnings call, Google executive said that Q3 was a ‘tough time in the ad market’, and the company is seeing ‘pullback from advertiser spend in some areas’.

Google’s Cloud business was relatively strong – growing 38% year over year to $6.9 billion of revenues. But the segment failed to prop up Google’s results, recording a widening net loss of $699 million, as compared with a loss of $644 million one year earlier.

Time To Be More Cautious

Although Google did not give any formal guidance for Q4 early 2023 in terms of absolute numbers, the company said that the December quarter will likely fail to convince against the ‘tough comparison’ Q4 2021. Moreover, ‘pull-backs’ from advertisers will likely continue to pressure revenues.

Reflecting on the disappointing quarter, Google’s CEO Sundar Pichai commented:

… Our reported results reflect the effect of foreign exchange. The growth in our advertising revenues was also impacted by lapping last year’s elevated growth levels and the challenging macro climate.

Responding to such challenges, he added:

We are sharpening our focus on a clear set of product and business priorities. The product announcements we have made in just the past month alone have shown that very clearly, including significant improvements to Search powered by AI, new ways to monetize YouTube Shorts, which will support the creator ecosystem, the strong series of hardware launches and a new partnership and product announcements at Cloud Next. These will all drive value for users, partners and our business.

We have also started our work to drive efficiency by realigning resources to invest in our biggest growth opportunities.

But personally, I am disappointed to learn that Google has not implemented those ‘efficiency gains’ already. Google added about 51,000 new employees since the start of the year, and 12,765 employees in Q3 alone – despite the slowing environment. It is hard to justify a greater than 30% year-over-year increase in headcount while recording revenue growth of only 6% respectively. This is a huge disappointment for me. And when asked about a justification from Morgan Stanley (MS) analyst Brian Novak, Mr. Pichai clearly stumbled to give a reason:

Brian… I think — look, I think we gave some — we’ve been clear that we are going to moderate our pace of hiring going into Q4 as well as 2023. I think we are seeing a lot of opportunities across a whole set of areas. And every time, talent is the most precious resource, so we are constantly working to make sure everyone we’ve brought in is working on the most important things as a company and particularly so. And that’s a lot of what sharpening our focus has been about.

We are reviewing projects at all scales pretty granularly to make sure we have the right plans there, and based on that, the right resourcing and making course corrections. And this will be an ongoing thing. It is something we’ll continue doing going into ’23 as well.

As long as Google fails to once again deliver strong revenue growth, or show some discipline in operating expenditures (in my opinion it is as bad as Meta Platforms (META), but without the ambitious vision and clear focus on dedicated R&D), I believe it is reasonable to be a bit more cautious towards Google stock.

Valuation Still Attractive

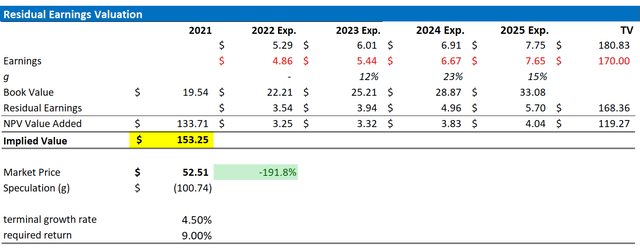

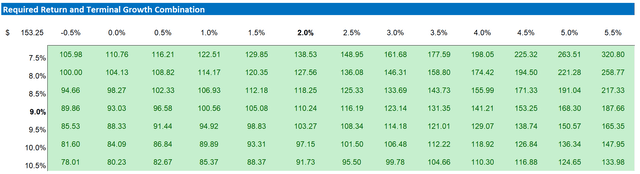

Following a disappointing Q3, I upgrade my residual earnings model for Google to account for preliminary consensus EPS downgrades. However, I continue to anchor on an 9% cost of equity and a 4%, terminal growth rate (one percentage point higher than estimated nominal global GDP growth).

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price of $153.25, versus $156.24 prior.

Analyst EPS Estimates; Author’s Calculations

Below is also the updated sensitivity table.

Analyst EPS Estimates; Author’s Calculations

Conclusion

I am still very positive on Google’s long-term outlook. But reflecting on a worse-than expected Q3, I believe it is reasonable to downgrade Google stock from ‘Strong Buy’ to ‘Buy’. Although my updated residual earnings model does not indicate a material change in fair implied value – $153.25 now, versus $156.24 – traders and speculators might cause the fair implied valuation to materially differ from my target price. Following the Q3 results, price momentum is likely to favor downside.

Be the first to comment