Drew Angerer/Getty Images News

2022 hasn’t been a friendly year for the Pelosis. According to CongressTrading.com, House Speaker Nancy Pelosi’s husband Paul Pelosi recently took heavy losses totaling almost $1 million from call options on Micron (MU), Nvidia (NVDA) and Disney (DIS).

For a quick review of the semiconductor space, corporate earnings have been awful and estimates have been cut at the quickest pace since 2008. Micron is seeing supply outpacing demand in a deteriorating environment with “extremely aggressive pricing” (analysis here). Nvidia has seen its Gaming revenue fallen off a cliff due to softening demand as GPU mining is virtually dead (here). AMD’s (AMD) Q3 revenue will come in ~$1 billion below expectations due to weak PC sales (here).

Nevertheless, the Pelosis sticked to their bet on Google (NASDAQ:GOOG) by exercising 200 call options at a strike price of $100, for a total of $2 million. The deep-in-the-money calls were purchased on 12/17/2021 when Google’s stock was trading at roughly ~$140 a share. While Google is not immune to an economic recession (100% probability in 2023 per Bloomberg), the search giant should serve the Pelosis well when all the macro headwinds are said and done.

Worsening macro environment

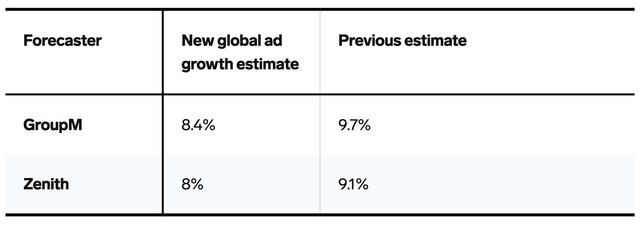

Of course, staying invested in Google takes patience as the current economic conditions point to a rather difficult environment for the advertising market. Recently, WPP’s GroupM and Zenith have adjusted their 2022 growth forecasts for the US ad market from +9.7%/+9.1% to +8.4%/+8%.

While consumer spending remained somewhat resilient as Bank of America (BAC) reported a 1% growth in consumer deposits and 13% growth in credit card spending in 3Q22, the sentiment around higher interest rates and inflation is clearly negative for the overall ad market. Already, many companies, especially in the tech space, have announced layoffs and hiring freezes to tighten the belt.

The September job report was strong with unemployment rate at 3.5%, but this number is likely to go up as the Fed continues tightening until inflation cools down. The simple logic here is that higher rates impact the demand side of the economy, which subsequently impacts household incomes, and that is never good for advertising.

According to Insider Intelligence, a recent survey of 43 multinational firms by the Word Federation of Advertisers (WFA) shows that almost 30% of major advertisers are cutting their ad budgets in 2023, with 74% admitting the economic slowdown is affecting their budgeting.

Another survey of 150 marketers conducted by William Blair also indicates that 92% of marketers said ad budgets would be cut in a recession. Additionally, the firm thinks the ad market could fall by 2%-8% in 2023 with a 10% drop being the worst case scenario. For a second opinion, here’s my worst case scenario of Google in 2023.

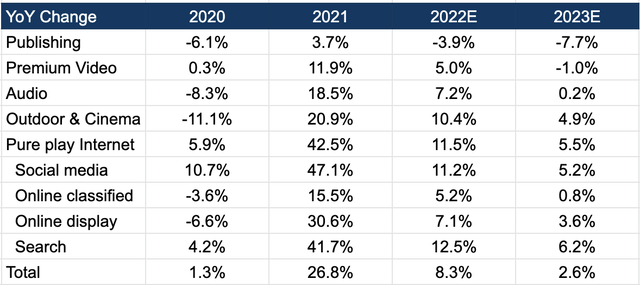

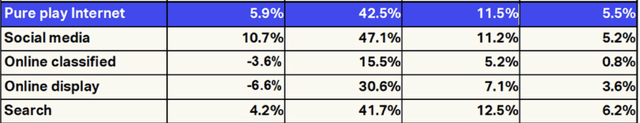

Lastly, a recent report by WARC (World Advertising Research Center) says that while global ad spend will increase by 8.3% to $881 billion in 2022, growth will decelerate to just 2.6% in 2023. Per the table below, digital advertising (pure play Internet) will not be immune to a slowdown.

Recession or not, the macro outlook doesn’t look great, and advertisers are bracing for impact.

But Google is well positioned

A potential 2023 recession will affect every digital advertising company differently given the differences in end markets and business models. From a top-down perspective, top-of-the-funnel marketing budgets are most likely to be cut in an economic downturn as ads primarily focus on impressions rather than conversions.

These include display and social media advertising that mainly try to reach as many potential customers as possible with no guarantee that viewers will “convert” by clicking on a link or directly make a purchase. I therefore expect companies like Meta (META), Snap (SNAP), and Roku (ROKU) to be in a tougher spot should advertisers scale back their budgets in a recession.

There are also industry-specific issues surrounding the iOS privacy policy which has created problems around measurement and targeting for social media apps. Meta has guided $10 billion in lost revenue from Apple’s (AAPL) IDFA in 2022. Although Roku competes in the CTV space with minimal impact from Apple’s privacy updates, the company has seen worse-than-expected revenue headwinds due to a weak scatter market where advertisers are just one click away from turning off their campaigns.

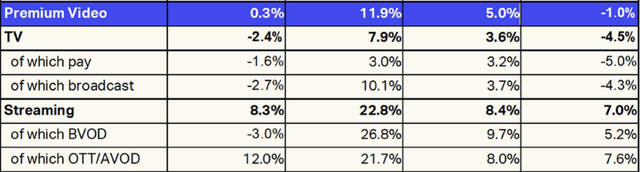

Of course, Google’s YouTube will still be exposed to budget cuts as AVOD (advertising-based video on demand) or online video ads still belong to the top end of the marketing funnel. However, the downside risk to AVOD could be somewhat limited by budgets shifting from TV to streaming. Per WARC, both pay and broadcast TV spend are expected to shrink by 5% and 4.3% in 2023, while OTT/AVOD is expected to maintain roughly the same growth rate as 2021 (8%).

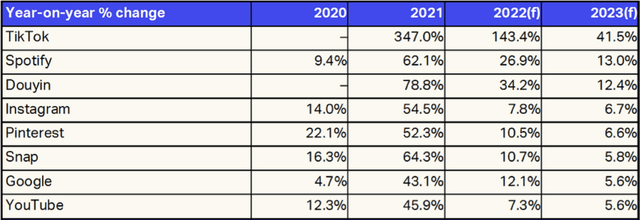

Speaking of YouTube, TikTok remains a sentiment overhang as the short-form video app has taken the advertising landscape by storm in 2022. As both YouTube and Instagram have moved aggressively into the short-form video space, TikTok has actually expanded the maximum length of its videos to 10 minutes.

In my view, this exposes the limitations of short videos as the ROI may be in question when users are casually scrolling through 30-to-45-second videos vs. longer ones where YouTube is the clear winner. While TikTok is definitely a fast grower with an estimated 143% top-line growth in 2022 and 43% in 2023, I believe it would not be easy for the Chinese app to compete successfully in Google’s home turf of long-from videos. Further, TikTok is also exposed to regulatory risks in the US.

As scary as a downturn may sound, not all advertisers will cut back on ad spend as some may shift budgets to more effective mediums. This is where Google’s search business (also Amazon Advertising (AMZN)) gets a favorable treatment as advertisers embrace a shorter-term, performance-oriented mindset. Compared to display and social media, search advertising has clearer audience intent as consumers are already looking for something when searching on Google as well as Amazon. This is potentially why WARC is expecting search to hold up relatively well in 2023.

Key takeaway

The Pelosis are likely taking the long view on Google by converting their call options into 20,000 shares. I see this as quite a sensible bet given Google’s competitive position, fortress balance and the ability to generate shareholder returns by buying back shares at historically attractive multiples. Given the current macro narrative and minimal quantitative guidance from management, the Street is currently expecting just 6% revenue growth in 2H22, which has likely de-risked any potentially underwhelming results going forward. As a friendly reminder, Google will report 3Q22 results on 10/25.

While muted revenue growth will likely stretch into 2023, CEO Sundar Pichai has indicated that he intends to make the company 20% more efficient. It’s unclear whether this will directly translate into a 20% decrease in corporate spending, but if history is a guide, Google managed its OPEX extremely well in the 2008 recession. From a margin perspective, sources of upside may also come from cutting off unproductive investments in “Other Bets”.

In short, Google remains my top value pick in digital advertising. Although the next few quarters will likely see worrying economic data, disappointing earnings results, and choppy price actions, I continue to find shares attractive at 17x 2023 earnings which represents just a small premium to the S&P 500. With a multi-year horizon, I believe investors (incl. the Pelosis) will be well rewarded as soon as the current down cycle finds a bottom.

Be the first to comment