Alena Kravchenko

Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) announced its 2Q-22 earnings report two days ago, and while the stock rose as a result, the valuation is so low in comparison to Google’s long-term potential that I have doubled my investment.

The post-earnings bounce also signals that the stock has bottomed and that market sentiment toward mega-cap corporations may alter in the future.

Google’s cloud division is benefiting from strong demand and serves as a counterweight to the search/advertising division.

Even though Google’s search platform is not growing as quickly as some may have hoped, the company is well capitalized and will weather the storm.

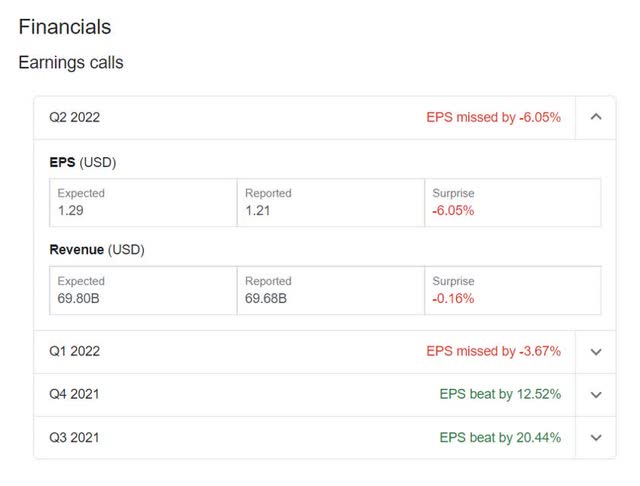

Google’s 2Q-22 Earnings And Sales Double-Missed

Google released its 2Q-22 earnings and sales figures two days ago and, sadly, failed to achieve the slightly higher earnings-per-share and sales projections.

Earnings per share fell by 6% in the second quarter, although revenues fell by a smaller margin. It was Google’s second earnings shortfall in a row, despite fundamentally strong cloud performance.

Earnings Calls (Alphabet Inc)

While Google’s advertising sales growth slowed (+12% YoY in 2Q-22), the results for the second quarter were still quite impressive.

Sales for the second quarter totaled $69.7 billion, representing a 13% YoY increase in a slow market. Currency fluctuations reduced Google’s sales growth rate by 3.7 percentage points in the second quarter.

Google’s 1Q-21 comparisons were extremely unfavorable. Google’s advertising businesses benefited from increased advertiser expenditure in the prior quarter across all of Google’s ad delivery services, including Google Search & other, YouTube, and Google Network. There were also widespread Covid-19 limitations in force at the time, limiting consumers’ shopping alternatives.

For the time being, the majority of Google’s sales are generated by Google search sites, YouTube properties, and the Google Network, which includes AdSense and Google Ad Manager.

Approximately 81% of Google’s 2Q-22 sales come from its various advertising services, implying that a broad-scale decline in advertising spending will have a significant impact on Google. Cloud computing is one approach for Google to mitigate this risk.

Sales in Google’s largest business, search, surged 14% YoY, but no business grew as steadily as cloud. Cloud revenues increased by 36% YoY, indicating that investors should place a greater emphasis on this section for future sales growth rather than Google’s extremely profitable search business.

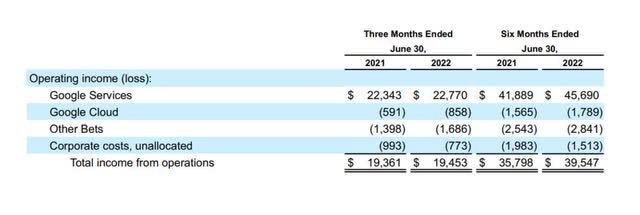

Cloud has the potential to become a true behemoth and cash cow for Google, with a growth rate roughly three times that of search. In the second quarter, sales were $6.3 billion, but the division is still not profitable for Google. This is expected to change once Google approaches critical mass and segment economics improve. Google Services generated a $22.3 billion operational profit for Google, and the business has been profitable for the corporation on a constant basis.

Operating Income (Alphabet Inc)

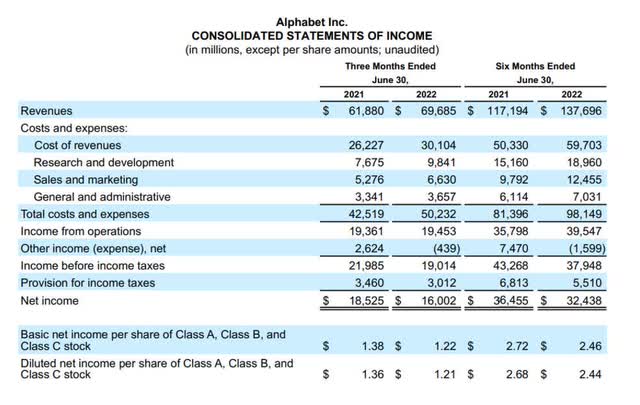

Google’s profits for the fiscal quarter ended June 30, 2022 were $16.0 billion, or $1.22 per share, a 12% decrease YoY. Even if profits fell $2.5 billion YoY due to slower growth and increased expenses, I find it difficult to blame Google given that $16.0 billion in profits is a pretty figure. The majority of this money will also be allocated to shareholders.

Consolidated Statements Of Income (Alphabet Inc)

Going Toe-To-Toe With Amazon

Google is launching a new battleground with Amazon, the unchallenged leader in the eCommerce space. Google-owned YouTube is teaming up with Shopify to take on Amazon in the eCommerce industry while also tapping into the massive creator community that uses YouTube as a primary marketing tool.

Why not take a share of creators’ revenues directly through the YouTube platform instead of merely running paid ads on YouTube? The concept is brilliant, and I covered the collaboration in my earlier piece, ‘Google Stock Is a Steal‘.

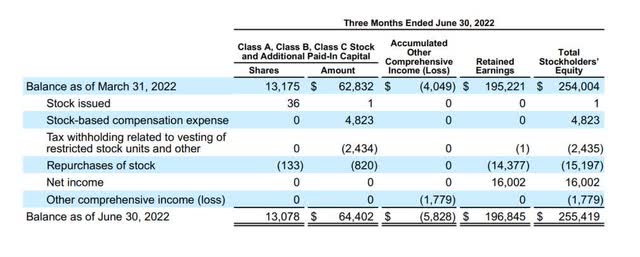

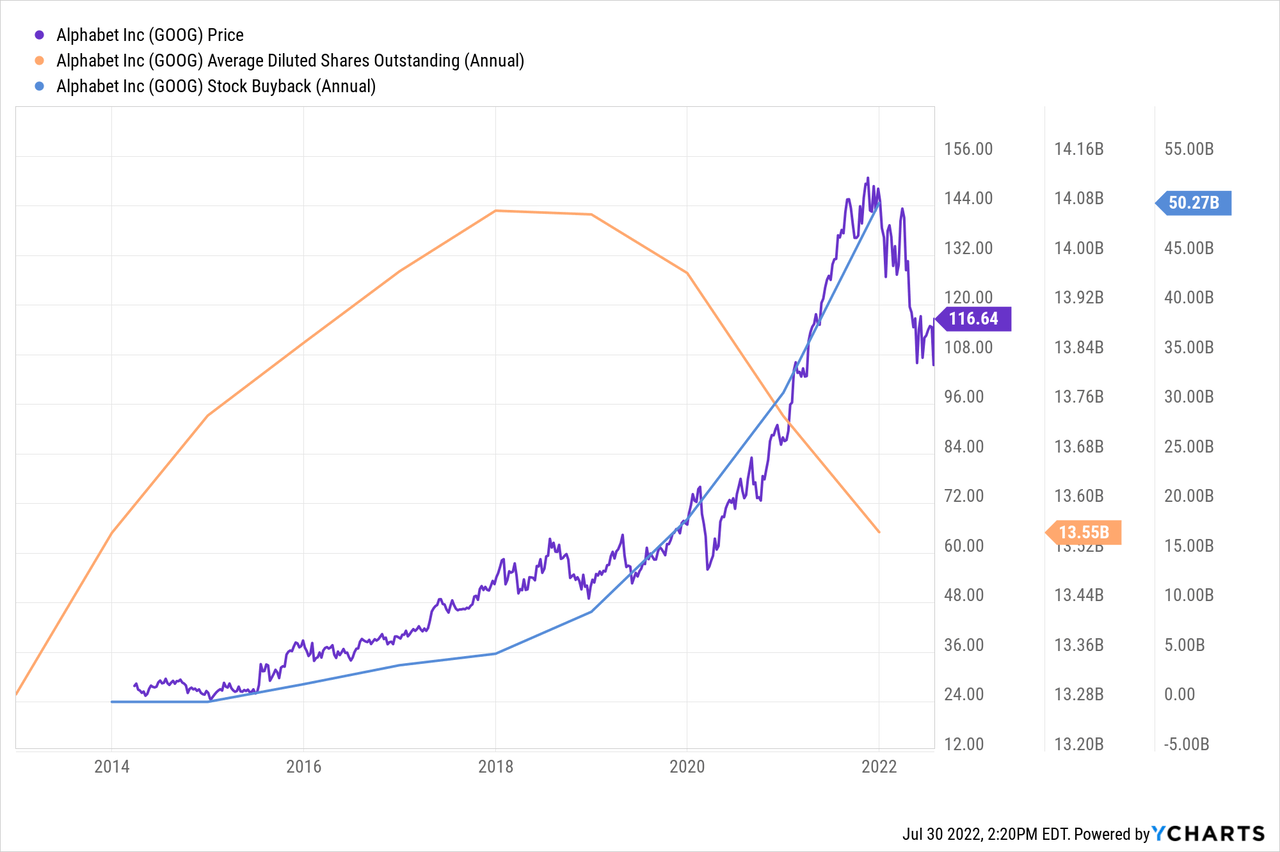

Why Stock Buybacks Are So Crucial For Alphabet

I’m increasing my stake in Google because I expect management to increase stock buybacks. Google may divide its huge wealth by buying back stock in the market and then retiring it.

Alphabet’s board of directors authorized a $70 billion buyback of Class A and Class C shares in April. At the end of the second quarter, $58.9 billion remained available for share repurchases. Google could repurchase 513 million shares at the current price of $114.81, representing approximately 4% of outstanding shares. Alphabet had approximately 13.0 billion shares outstanding at the end of 2Q-22, after adjusting for the 20-for-one stock split.

Alphabet repurchased 132.8 million Class A and Class C shares for a total of $15.2 billion in 1Q-21. In 2022, the repurchases are expected to total 231.1 million shares and $28.5 billion.

Stock Buybacks (Alphabet Inc)

Google has historically been very shareholder friendly, which was a key criterion for me to double down on Google following the post-earnings rally.

Knowing that management is monitoring my investment and repurchasing shares allows me to sleep soundly at night. Given its track record of stock repurchases, the company expects to repurchase a significant amount of stock each quarter.

A Recession Is Here

If you haven’t heard, the United States appears to be in a recession. The U.S. economy shrank by 0.9% in the second quarter, marking the second consecutive quarter of negative economic growth.

What better company to own than one whose management has demonstrated that it buys back stock in the market on a regular basis, especially when the price is low?

The Bottom Is In

I believe Google stock has reached its bottom, and $105 is a strong support level for GOOG, and the stock has bounced off it several times. Though the Relative Strength Index and the MACD do not indicate that GOOG is oversold, I believe the setup here is promising.

Despite a double-miss, 2Q’22 results were well-received in the market and jolted higher on strong cloud execution. If GOOG can break through the $120 resistance level, we could see a quick return to $145-150.

GOOG Share Price (Stockcharts)

Why Google Could See A Lower Valuation

Google is in the process of expanding into new business areas, such as the creator/eCommerce market. Google is diversifying its business in the process, making it less reliant on the overarching advertising segment, which is cyclical and unpredictable even for a company with Alphabet’s clout.

A recession is likely to have a significant impact on the advertising market, posing a risk to Google’s core businesses. Right now, I see a recession and a corresponding drop in advertising sales as the defining risk in the Google trade.

My Conclusion

I doubled my investment in Google after the company released its 2Q-22 earnings report because the company’s push into the creator community and aggressive use of cash for stock buybacks show that management is a good steward of investor capital.

In a recession, Google’s transition away from its dominant advertising business creates upside while limiting downside.

Last but not least, I believe GOOG has bottomed and that the market will begin to reward Alphabet for its cloud growth and generous stock buybacks.

Be the first to comment