Sean Gallup

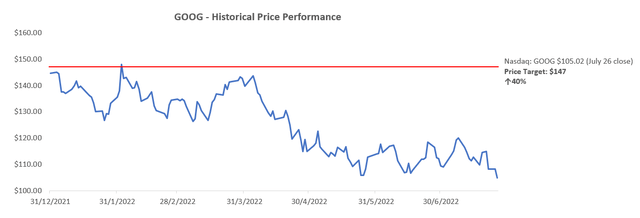

It has been a tough first six months for big tech, as it grapples with one of the largest market selloffs in history amid brewing macroeconomic uncertainties. The three months ended June 30th was a big quarter for Alphabet’s Google (GOOG / NASDAQ:GOOGL), as it preemptively prepares for an anticipated slowdown in ad spending – a core driver of its revenues – in the near-term, as well as other cost headwinds such as wage increases and FX challenges amid heightened macro challenges. The company also staged a 20-for-1 stock split earlier this month, which garnered a surge in retail interest, though its shares are still trading about 4% down since.

Google has lost more than a quarter of its market value this year, despite its limited exposure to raw material supply constraints, which accounts for the bulk of supply-driven inflationary pressures and bottom-line headwinds under today’s economy. Yet, wage inflation and broad-based economic uncertainties have turned the company cautious when it comes to hiring and cost efficiency management in recent weeks, raising investors’ concerns on its near-term growth and profitability outlook.

But despite not being “immune to economic headwinds” per CEO Sundar Pichai in his latest memo to employees regarding the company’s recent decision to slow hiring, Google’s Search and Other sales beat reported Tuesday evening underscores the business’ resilience still. Market response was also largely positive, despite a consolidated revenue and earnings miss. The company’s robust results in its core advertising business took the center stage on Tuesday evening’s earnings release, and assuaged investors’ concerns by defying the pronounced challenges felt by ad-reliant peers like Snap (SNAP) and Twitter (TWTR).

While a slowdown in ad spending is imminent due to the industry’s cyclical nature, Google’s recent Q2 results continue to support that its dominance in the online search market and broader digital moat remain competitive advantages that will help it weather the near-term market storm better than peers. Meanwhile, Google Cloud continues to gain market share slowly, but surely, thanks to a robust demand environment buoyed by secular trends that are defying risks of the looming economic downturn. While FX risks remain the lone piece that Google has no direct control / influence over, the company continues to diligently manage its operational efficiency to better align its near-term spending and investments with its longer-term growth goals.

Considering the continued resilience demonstrated through Google’s core Search ads business, and conservative commentary on 2H outlook that offers a realistic expectation of potential near-term macro headwinds, the company reinforces investors’ expectations on its ability in properly managing and overcoming uncertain times with strength.

Google’s shares currently trade at a forward EV/sales and price/earnings multiple of 4.4x and 19.1x, respectively. That is a discount of about 12% and 14% compared to the internet mean of 5x and 22.2x (ex-Twitter’s 66.6x forward P/E due to skew) on peers with a similar growth profile, respectively, and discount of ~20% compared to the broader market (Nasdaq 100 forward P/E ~25x). With Google’s long-term growth trajectory backed by a robust and diverse digital moat, strong balance sheet, and favourable secular tailwinds as demonstrated by its Q2 resilience against looming macro challenges, the stock remains an attractive long-term investment at current levels.

Zeroing-In on Ads

Investors’ Concern: Snap’s weaker-than-expected Q2 results literally snapped the market’s rally last week, wiping out more than $130 billion in market value across its peer group as fears spread that digital advertising may be headed for a steep downturn. Similar weakness reported by Twitter had only elevated investors’ angst over the performance of online advertising bellwethers Google and Meta Platforms (META) ahead of a second half economic outlook that is becoming increasingly uncertain.

Forecasts for total global advertising spending this year have also been on a rolling decline in response to the economy’s struggles with keeping inflation in check given extraordinary circumstances that include a protracted pandemic and Russia’s invasion of Ukraine. Leading media intelligence MAGNA Global has trimmed its prediction on global ad spending growth this year from 12% to 9% amid growing risks of a structural economic downturn later this year. This compares to global ad spending growth of +23% year-on-year in 2021 (U.S. +26% y/y), buoyed by a brief stint of post-pandemic economic recovery.

The above forecast on near-term softening in ad spending is further corroborated by observations of broad-based reductions in ad spending across small- and mid-sized business (“SMB”) ad agencies. The cohort of marketing, consulting and web design experts have already put 25% to 40% of their advertising projects on hold ahead of near-term economic uncertainties.

Google Results: Although the odds were stacked against Google, its Q2 Search and Other revenue beat proved otherwise. As advertisers regroup on marketing budgets amid economic uncertainties ahead, ad dollars will continue to be spent conservatively, while favouring distribution channels that can drive promising conversion rates. This is further corroborated by Google’s Q2 Search and Other revenue beat, underscoring the competitive advantage of the company’s leading market share of more than 90% in global online search. The segment reported revenues of $40.7 billion in the second quarter, representing y/y growth of 14% and sequential growth of 3%, beating average consensus estimates of $40.3 billion.

Looking ahead, management has cautioned a tough prior year compare and broad-based ad spending weakness amid near-term economic headwinds as a downside risk. While advertising is a cyclical sector that tends to contract amid an economic downturn, there has not been any structural downward shift observed in related spending across the advertising industry, especially in online ads. In other words, the near-term slowdown in ad spending will only be temporary in the digital sector, though more structurally pronounced in legacy outlets like linear TV.

The increasing use of technology has actually encouraged greater online ad spending in recent years. The global digital advertising market is expected to grow at a compounded annual growth rate (“CAGR”) of 21.6% over the next five years and drive an anticipated addressable market size of close to $1 trillion by mid-decade, making strong tailwinds for Google’s core advertising business. Specifically, video streaming platforms are now home to about 23% of total ad spend in the U.S., and the figure is expected to expand further as digital advertising’s more than 60% share of the broader advertising market today is projected to grow at an 11% CAGR through 2030.

This accordingly makes strong long-term growth trends for YouTube, which makes it one of the world’s most frequented websites after Google Search, and now accounts for close to 7% of total TV viewership (or 20% of video streaming viewership) in the U.S. Paired with Google’s dominant market share in online search (more than 90%), the company has become a preferred choice for digital ad placements as advertisers and merchants look to maximize conversion from their investment dollars spent amid near-term economic uncertainties.

Implications: Google’s advertising strength continues to demonstrate its ability to remain more resilient than social media peers like Snap, Twitter, and even Meta Platforms. With a portfolio of the world’s most-used digital platforms under its belt, logging more than 5 billion visits per day on its search engine alone, Google continues to lead the digital advertising industry with more than a third of related market share.

Google’s expansion of YouTube in recent years with subscription-based services like YouTube Premium and YouTube TV live streaming has also allowed it to better monetize on growing demand for ad distribution through video platforms as mentioned in earlier sections. Today, YouTube TV’s total subscription base (including non-paying trials) have exceeded five million, surpassing the reach of Disney’s equivalent Hulu + Live TV’s subscription base of four million. The recent launch of YouTube Shorts also captures additional viewership stemming from one of the fastest rising trends in video streaming – short-form videos. YouTube Shorts currently garner more than 30 billion views on a daily basis, underscoring the rapid transition to video-based interactions over text or photos.

In order to better monetize the prowess of Google’s various ad distribution channels built over the years, the company has recently introduced “Performance Max”, an automated marketing solution that helps advertisers and merchants extend reach across all of its Search, YouTube video / Shorts, Display, Gmail, and Maps platforms based on user preferences. Taking into consideration advertisers’ and/or merchants’ specified conversion targets, Performance Max will automatically deliver ads within their respective inventories (i.e. photos, texts, videos) across Google’s various distribution channels and maximize conversion rates.

The new Performance Max advertising feature screams “value for money”, which is an important trait within a constrained economic environment. It also appeals to the “trillions of offline [SMB] retail dollars moving online over the much longer-term” by making the online advertising process easier to use and highly scalable, driving additional value to merchants and advertisers for every ad dollar spent.

While it may seem that Google’s vast reliance on ad revenues exposes it to significant downside risks in the near-term as ad spending imminently pares back due to the cyclical nature of the sector, the company’s market-leading position in digital ads actually makes a competitive advantage instead. Google’s extensive reach through Search and YouTube has turned it into the preferred digital ad distribution channel to ensure maximized conversion rates. The company’s limited exposure to adverse impacts from Apple’s (AAPL) recent privacy policy changes compared to peers engaged in app-based targeted ads is another plus to bolster its market share wins on limited ad dollars amid ballooning macro uncertainties in the near-term.

Fundamental and Valuation Analysis Update

The Alphabet stock’s post-market performance immediately after the release of the company’s second quarter results was largely positive, which is consistent with its resilience against broad-based softening in ad demand observed across ad-reliant peers last week. Continued market share gains observed in Alphabet’s Google Cloud business is also a positive showing to support a favourable trajectory towards profitability over the longer-term.

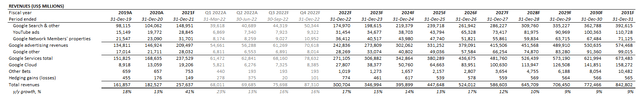

Adjusting our previous forecast for Google’s actual second quarter performance, as well as management’s commentary for the third quarter, we are projecting total revenues of $300.7 billion (+17% y/y) by year-end. The assumption takes into consideration recent developments regarding Google’s advertising business as discussed in the foregoing analysis, as well as continued expansion of its Google Cloud segment in terms of both product offerings and geographic footprint as discussed during the earnings call.

Alphabet Revenue Forecast (Author)

Specifically, advertising revenues are expected to remain resilient amid broad-based slowdown in the industry, reaching $242.8 billion by the end of the year (+16% y/y). We expect a back-end weighted year in ad spending buoyed by seasonality (i.e. back-to-school and holiday season, as well as elections this year), partially offset by ongoing economic uncertainties in the near-term as warned by management and as discussed in earlier sections. The projection also reflects Google Search’s continued market dominance and YouTube’s viewership growth momentum, which is set to help the company claw back on some of the near-term advertising industry headwinds.

Meanwhile, Google’s ongoing efforts in expanding the availability of its cloud services, alongside a commitment to innovation, such as the creation of industry-specific solutions (e.g. Manufacturing Data Engine and Manufacturing Connect), also reinforces its long-term market share gains and supports acceleration in coming years. Google Cloud’s continued growth trajectory is further corroborated by resilient demand despite broad-based macro challenges – building a digital fabric remains a critical mission for the commercial sector in order to ensure “improved productivity in the inflationary environment”, meaning IT spending on migrating workloads to the cloud and other digital transformation projects will remain strong. Based on the segment’s strong double-digit growth observed in the first half of the year, as well as favourable secular trends ahead, our base case forecasts projects Google Cloud sales to reach $27.8 billion by year-end (+45% y/y).

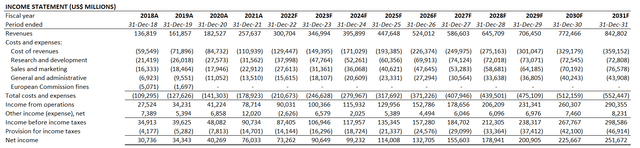

The projected cost structure for Google over the forecast period remains largely consistent with assumptions applied in our previous coverage as well. As a result, operating margins are expected to remain in the 30% range over the next five years to reflect ongoing cost pressures from Google Cloud investments, as well as near-term labour cost headwinds, then further expand over the longer-term as cloud opportunities continue to scale. Coupled with other nominal non-operating income and expenses, the company is forecast to generate consolidated net income of $73.3 billion in the current year (-4% y/y).

Alphabet Financial Forecast (Author)

Drawing on the above fundamental analysis, with additional consideration of the stock’s recent 20-for-1 split, our 12-month price target for the Google stock has been revised to $147. This represents upside potential of close to 35% based on the shares’ last traded price of $110 apiece in post-earnings late-trading July 26th.

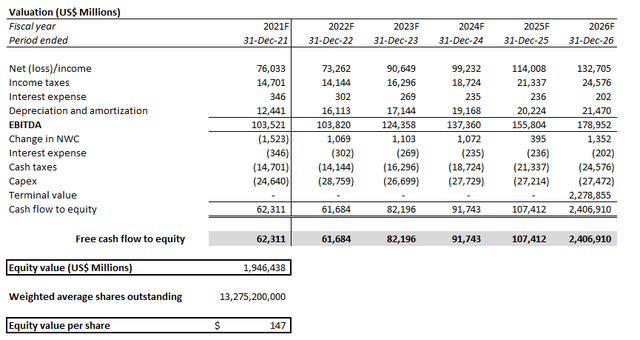

GOOG Valuation Analysis (Author)

The price target is derived from a discounted cash flow (“DCF”) analysis in conjunction with the financial projections over the five-year forecast period discussed in the earlier section. The analysis applies a WACC of 9.8% to discount Google’s projected free cash flows, which is consistent with its robust net cash position of $110 billion (including marketable securities) as of period end. Our valuation analysis also assumes an exit multiple of 12.7x, which in our view, better reflects Google’s industry-leading market share in digital ads, as well as its long-term growth trajectory compared to industry peers with a similar growth profile. The exit multiple applied is also consistent with a perpetual growth rate of about 3%, in line with longer-term GDP expansion across Google’s core markets.

GOOG Valuation Analysis (Author)

Google_-_Forecasted_Financial_Information.pdf

Is the Alphabet Stock a Buy After Q2 Earnings?

As mentioned in the beginning of the article, Google is currently trading at a discount to both its peer group, as well as the broader market, despite its best-in-class growth prospects and strong balance sheet. The company’s latest earnings has also proven its business’ resilience against near-term industry headwinds, which corroborates expectations for continued outperformance against peers.

We believe the ongoing market selloff that has been induced by mounting macro headwinds spanning runaway inflation, continued tightening of Federal Reserve policies, and rising recession risks has created an attractive entry opportunity in the stock. With Google playing a fundamental role in facilitating digital transformation in coming years, the company is well-positioned for sustained long-term growth, and inadvertently, promising returns for investors.

Be the first to comment