Alena Kravchenko

Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) (more specifically, Google) has been written about on a regular basis. The fundamentals are a screaming buy, the recent price decline is an opportunity, and it is only of the lasting monopolies, but in the spirit of bringing a different perspective to the discussion, I have attempted to speak about two topics that I believe are yet to have been spoken about in depth.

1. Earnings May Not Be What They Seem

Google’s Delta to the US Dollar

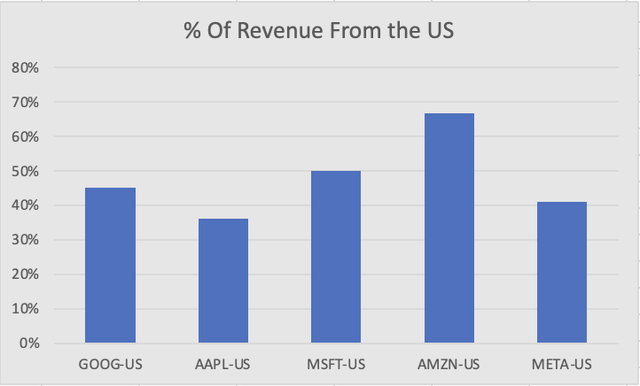

Companies such as Microsoft (MSFT) have already begun to warn of EPS downgrades on the back of the strength of the U.S. dollar, which has risen 11% YTD. As evident below, Alphabet has a larger exposure to the delta of the U.S. dollar than MSFT and therefore we can expect EPS to be downgraded this quarter.

Company Filings – Author’s Work

The extent of the downgrade and the effect on EPS is anyone’s guess, but the data below is an indication of what one may expect. It is evident in the empirical data that MSFT has been the most effective in hedging currency exposure compared to Google and Amazon (AMZN). I would like to bring the reader’s attention to 2014 in the table below, which was a year in which the U.S. dollar strengthened 24%. This had a substantial effect on Alphabet’s result, and should not be discounted away from the recent earnings.

|

GOOG |

2021 |

2020 |

2019 |

2014 |

|

|

Free Cash Flow |

67,012.00 |

42,843.00 |

30,972.00 |

11,417.00 |

|

|

Exchange Rate Effect |

-287.00 |

24.00 |

-23.00 |

-433.00 |

AVERAGE |

|

FX Effect on Free Cash Flow |

-0.43% |

0.06% |

-0.07% |

-3.79% |

-0.64% |

|

MSFT |

|||||

|

Free Cash Flow |

56,118.00 |

45,234.00 |

38,260.00 |

26,746.00 |

|

|

Exchange Rate Effect |

-29.00 |

-201.00 |

-115.00 |

-139.00 |

AVERAGE |

|

FX Effect on Free Cash Flow |

-0.05% |

-0.44% |

-0.30% |

-0.52% |

-0.15% |

|

AMZN |

|||||

|

Free Cash Flow |

-14,726.00 |

25,924.00 |

21,653.00 |

1,949.00 |

|

|

Exchange Rate Effect |

-364.00 |

618.00 |

70.00 |

-310.00 |

AVERAGE |

|

FX Effect on Free Cash Flow |

2.47% |

2.38% |

0.32% |

-15.91% |

-1.87% |

Source: Company filings and Author’s work

Economic Slowdown

There have been headlines written on the recent slowdown in hiring, specifically within mega tech giants, there is much to be said about the change of tone from Alphabet over the last quarter (emphasis added):

“What I tried to make clear is we do continue to plan to invest aggressively this year. I made that point in opening comments with respect to both ongoing hiring at a rapid clip as well as ongoing investment in technical infrastructure

Source: April 26, 2022 Q2 Earnings Call

This is to be juxtaposed with the recent 8-K released stating (emphasis added):

The uncertain global economic outlook has been top of mind. Like all companies, we’re not immune to economic headwinds… we’ll be slowing the pace of hiring for the rest of the year, while still supporting our most important opportunities.

Source: 8-K Released July 12, 2022

To combat principal-agency conflicts, information asymmetry must be minimized.

Information asymmetry is defined as:

When one party (in our example: management) to an economic transaction (in our example: acquisition of the stock) possesses greater material knowledge than the other party (in our example: us).

Signaling confidence by management is done through many techniques, such as stock repurchases or increasing dividends, but the tone of management is used less frequently, rightfully so (due to its arbitrary nature), compared to other methods. Though it should rank higher on the information chain when the message is clear from management. This has been the case with the messaging of management throughout this quarter.

2. Now, The Bigger Picture – Recession? Who Cares

The clear and concise bear case surrounding Google is the nature of its business – advertising and the economic backdrop. Advertising has imperially proven to be where companies cut costs in times of crisis. Is that always the case?

Information presented below indicates that during the Great Financial Crisis, Google’s Ad business was still generating growth in revenues, albeit at a more modest pace. This currently juxtaposes the much too pessimistic nature that surrounds its prospects in the event of a recession. While this economic slowdown is starkly different to the GFC, the conclusion is the same. Companies cut costs in waste; they will continue to pay for what allows them to generate revenue in a crisis. Given the leaps and bounds that Google has taken with regards to the value their Ad business generates for businesses, it is likely that spending on advertising as a sector to slow down but remain marginally stronger at Google.

|

Google Total Ad Revenues ($ in Billions) |

2008 |

2009 |

2010 |

|

Worldwide |

7 |

9.1 |

11.2 |

|

Change (%) |

30.00% |

23.08% |

|

|

Google Display Ad Revenues ($ in Billions) |

2008 |

2009 |

2010 |

|

Worldwide |

0.4 |

0.7 |

1.6 |

|

Change (%) |

75.00% |

128.57% |

|

|

Google Search Ad Revenues ($ in Billions) |

2008 |

2009 |

2010 |

|

Worldwide |

6.6 |

8.4 |

9.6 |

|

Change (%) |

27.27% |

14.29% |

|

Source: Company filings and Author’s work

Risks and Conclusion

The risks that the next decade can and will be starkly different from the last decade do not allude me. A deep recession, dare I say – Stagflation, and a tight labor market are all fair bear cases when looking at Google. That is why there is such a discount in the market. Please note that I believe that Google will always be facing regulatory challenges, especially from Europe, but Google is growing out of its dependency on its monopoly and slowly into other businesses.

Given the current economic backdrop and the reasons presented above, if there is an earnings miss this week, I will be adding to my long position. I am realistic in the short term, but optimistic for the long run.

Be the first to comment