400tmax

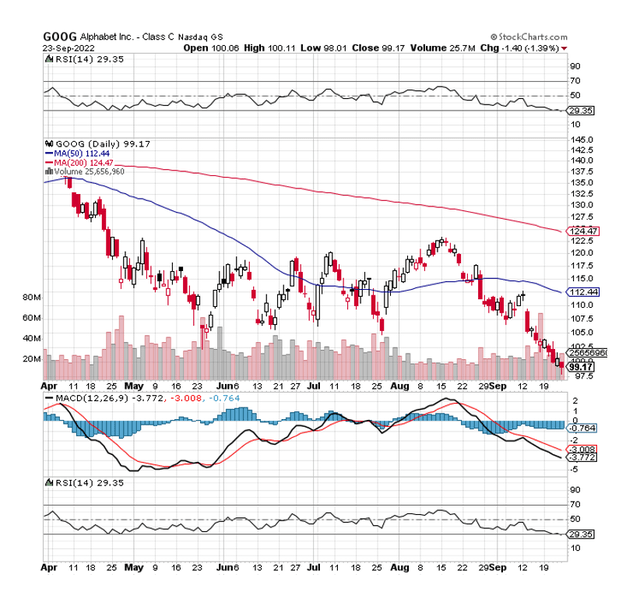

Despite a strong 2Q-22 earnings report from Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), the stock has struggled to gain traction in recent weeks. In fact, the stock has lost all of its post-second-quarter earnings gains and fell to a new 52-week low on Friday, when the DOW fell another 500 points following yet another 75-basis-point interest rate hike.

Despite the fact that Google’s business is in good shape overall, short-term stock price weakness creates a new opportunity to invest in Google stock at a compelling earnings multiple.

Google’s search segment is too important to dismiss, and I believe the market underestimates Google’s worth. Because Google stock is also oversold according to RSI, I believe we are dealing with an all-in opportunity here.

Google’s Post-Earnings Gains Have Been Lost

Google stock has lost all of its gains since the company reported earnings for 2Q-22 on July 26, 2022. The stock initially gained some ground, raising hopes that it would finally break out of its trading range, but these expectations have not been met.

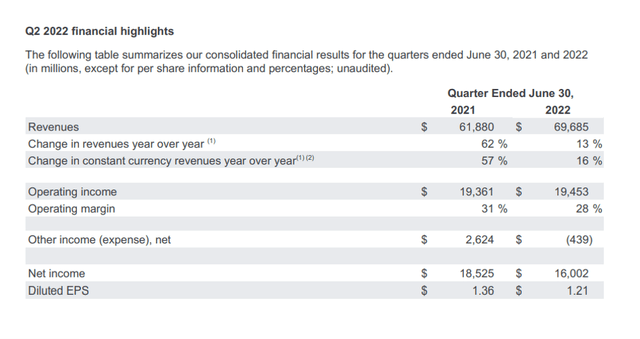

Despite the obvious headwinds thrown at the company by the digital ad market, Google had a pretty good second quarter in terms of revenue growth. Given the circumstances, Google’s 2Q-22 revenue increased 13% YoY to $69.7 billion. Earnings per share were $1.21, slightly below consensus, but Google demonstrated to the market that it is still capable of increasing sales.

Q2-22 Financial Highlights (Alphabet Inc.)

The advertising network is critical to Google’s success, and I believe it will continue to perform well for the search giant, recession or no recession.

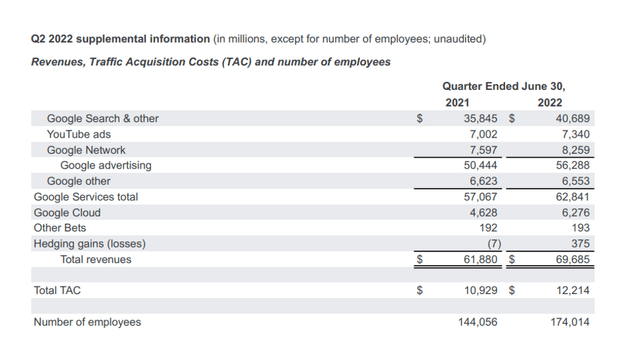

In 2Q-22, Google generated $56.3 billion in revenue solely from its various advertising platforms and networks, with the majority of revenue coming from Google’s core search business. In 2Q-22, Google search related advertising sales increased 13.5% YoY, slightly outpacing Google’s total sales growth of 12.6%. In the second quarter, search advertising sales accounted for 58% of total sales and 72% of total advertising sales.

Because Google’s search engine is the most-visited search platform in the world, with a market share of approximately 84%, it will continue to be Google’s cash cow for at least a few more years.

Q2-22 Supplemental Information (Alphabet Inc.)

Google Stock Just Dipped Into Oversold Territory

Technically, Google stock became oversold on Friday based on the Relative Strength Index, which is frequently used to capture sentiment among a stock’s buyers and sellers.

If the Relative Strength Index falls below 30, it is a sign that investors have become overly bearish on the stock in general, which may be interpreted as a contrarian indicator. A value above 70, on the other hand, indicates extreme bullishness and, as a result, that the stock is overbought. The Relative Strength Index indicates sentiment neutrality between 30 and 70.

The RSI for Google stock is currently 29. The RSI value for Google stock fell below 30 on Friday, indicating that GOOG is now officially oversold.

The implication for investors is that the stock may suffer from exaggerated negative sentiment in the short run, indicating that the stock should be purchased from a contrarian standpoint.

Low P/E-Ratio + Favorable Technical Setup (Oversold) = Strong Buy Opportunity

Google stock is undervalued based on earnings, and this is the primary reason I believe GOOG should be purchased.

The market expects Google to earn $5.91 per share in 2023, based on the assumption that the company’s sales will increase by about 12% YoY (according to Yahoo Finance estimates).

Google is currently trading at a P/E ratio of 16.7x based on earnings of$5.91 per share.

Given the company’s quasi-monopoly position in its core search business and the fact that the stock has recently become oversold, I believe Google stock is close to being irresistible at this earnings multiple.

Earnings Estimate (Alphabet Inc.)

Why Google Might See A Lower Valuation

Obviously, the market is experiencing major issues right now, such as rising inflation and higher interest rates. Both of these factors pose growing risks to the economy and may drive Google’s stock price even lower.

However, Google should be able to weather those storms, especially because the company’s search business is recession-proof and marketers will continue to use the company’s advertising tools.

A decline in Google’s market value, I believe, will be driven more by sentiment than by a deterioration in Google’s business.

My Conclusion

Google stock officially became oversold on Friday (RSI fell below 30), so I see the current setup (low P/E-valuation + low RSI) as an opportunity to increase my position in the technology company.

I believe the market overstates Google’s advertising issues, and the stock has simply become too cheap.

With a P/E ratio of 16.7x, Google is very attractively valued, and it is only a matter of time before sentiment shifts again, in my opinion.

All things considered, Google stock represents an all-in opportunity with a very high margin of safety.

Be the first to comment