Marko Geber

For the most part this year, the tech sector’s harrowing losses have been driven primarily by sentiment and not by fundamentals. There have been plenty of companies that have been performing quite admirably (as if a pending recession was not at all on the horizon) that have seen their share prices sliced in half or worse, simply because the market believes that growth is out of vogue and that only cold, hard earnings matter today.

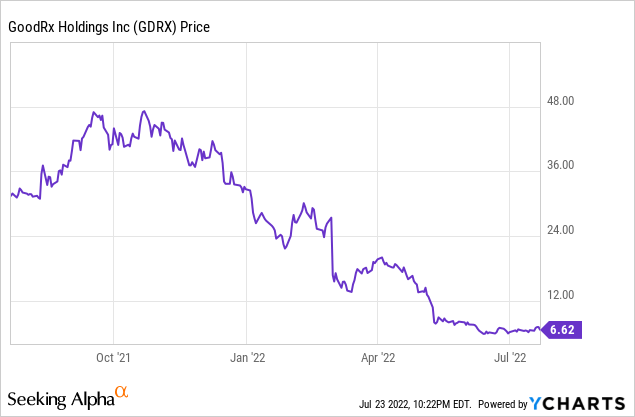

For GoodRx (NASDAQ:GDRX), however, loss of confidence has been driven both by weakened sentiment as well as actually worrying fundamental news. This discount-drug website has been among the biggest decliners of the internet sector this year, shedding roughly 80% of its value.

Now, as a value-oriented investor, I tend to be a “buy the dip” believer. I believe that valuations have upswings and downswings, and that investors can seize tremendous upside by doubling down on growth when the market is in fear mode. But in the case of GoodRx, I am downgrading my recommendation on the stock to neutral.

The justification is simple here: new risks have emerged (which we’ll discuss in the next section) that the company itself has said will not have a near-term resolution. At the same time, there are plenty of other tech alternatives in the market that have been hammered nearly as badly as GoodRx, yet don’t have a significant dent on their fundamentals. I’d prefer deploying capital on these names – some top picks currently include Asana (ASAN), Smartsheet (SMAR), Airbnb (ABNB), Palantir (PLTR), and Coupa (COUP). With GoodRx, however, I’d prefer cutting losses and moving to the sidelines, as I don’t think there are any near-term catalysts here to ease investors’ worries and spark a rebound.

The grocer issue

Let’s get into the meat of the issue. Alongside GoodRx’s Q1 results, the company issued Q2 guidance that included a cryptic warning that a certain large grocer is no longer accepting GoodRx discounts at its stores. Though GoodRx did not name the grocer, it is widely believed in reports to be Kroger, one of the largest chains in the U.S.

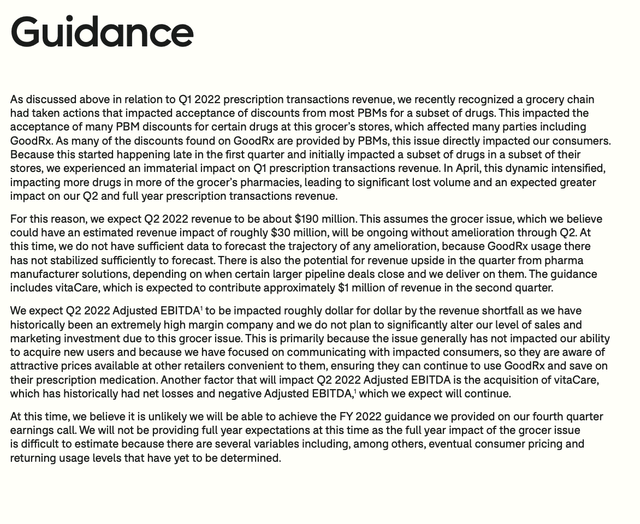

There will be an immediate revenue impact of this dispute in Q2. Revenue is expected to take a $30 million hit in Q2, which is roughly one-fifth of GoodRx’s quarterly prescription transactions revenue.

GoodRx guidance (GoodRx Q1 shareholder letter)

Given there is no near-term resolution here, this revenue headwind could persist a long time. The bigger concern beyond the revenue hit, however, is the fact that this non-acceptance of GoodRx discounts at Kroger could upend the validity of GoodRx’s entire business model.

Here’s some helpful commentary from co-CEO Trevor Bezdek explaining more background on the issue, made during his prepared remarks on the Q1 earnings call:

I wanted to spend a moment discussing an unexpected headwind note that impacted us lately first quarter and is impacting our current and expected performance. Recently, we recognized a grocery chain sustained actions that impacted acceptance of discounts from most PBMs for a subset of drugs. This impacted the acceptance of many PBM discounts for certain drugs at the grocery stores, which affected many parties, including GoodRx. As many of the discounts found on GoodRx are provided by PBMs, this issue directly impacted our consumers. Because this started happening late in the first quarter and initially impacted a subset of drugs in a subset of their stores, we experienced an immaterial impact on Q1 prescription transactions revenue that we estimate was roughly $1 million to $2 million based on our subsequent quantification.

In April, this dynamic intensified, impacting more drugs and more of the groceries and pharmacies, leading to significant lost volumes and an expected greater impact on our Q2 and full year prescription transactions revenue. We are still doing significant discount volume with this grocer, but it is currently substantially decreased from typical levels. It’s unfortunate that this issue impacts our consumers and financial performance, since PBMs, not GoodRx negotiate economics and pharmacies. We are not aware of similar PBM partner issues at this time and believe that the scale of the situation is unique. This is the unique situation, because one in the past, the pharmacy has negotiated and changed pricing with one or two PBMs at a time. In this case, these growth are negotiated with almost all PBMs at the same time. This effectively meant that all discount pricing became unavailable to consumers at the same time.

The swift action we took in response to this issue, including removing discount prices from our platform for this grocer, while PBMs work with this growth run resolution, protected our new user growth from being impacted.

Today, two-thirds of GoodRx’s revenue comes from prescription transactions. And while the company has been diligently hard at work to diversify its revenue streams, this is exactly the core of GoodRx’s business and the reason Wall Street flocked to GoodRx in the first place: the cut GoodRx receives from prescription transactions are both incredibly high margin (the company has gross margins in the 90s) while also having a recurring-revenue element, as consumers tend to purchase prescription drugs regularly (and presumably always use the same discounts as well).

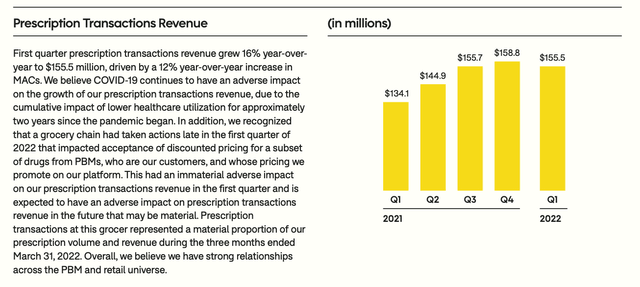

This headwind comes at an unfortunate time, as GoodRx’s revenue is already decelerating quickly due to ongoing COVID headwinds (people have continued to put off seeing their doctors, which has led to a backlog of undiagnosed conditions and a reduction in prescription drug transactions). In Q1, prescription transaction revenue growth slowed to 16% y/y, decelerating sharply from 21% y/y growth in Q4 and 25% y/y growth in Q3. In Q2, if the full $30 million impact from the grocer dispute materializes, GoodRx’s comps will swing negative for the first time.

GoodRx prescription transactions revenue (GoodRx Q1 shareholder letter)

Diversification efforts

Now, to GoodRx’s credit, the company has been doggedly increasing its routes to monetization over the past several years, which was one key component of my former bullish thesis on this stock.

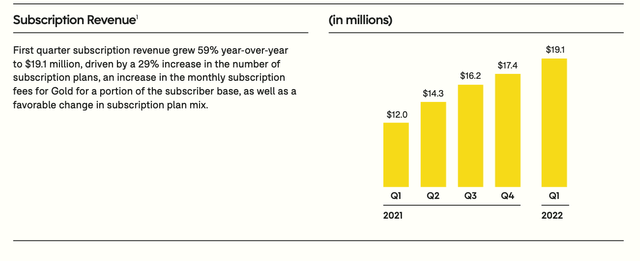

Subscription revenue, in particular, is still seeing strong growth: up 59% y/y to $19.1 million in the quarter. This is driven by GoodRx’s premium savings program, “Gold”, which has seen more and more traction with consumers.

GoodRx subscription revenue (GoodRx Q1 shareholder letter)

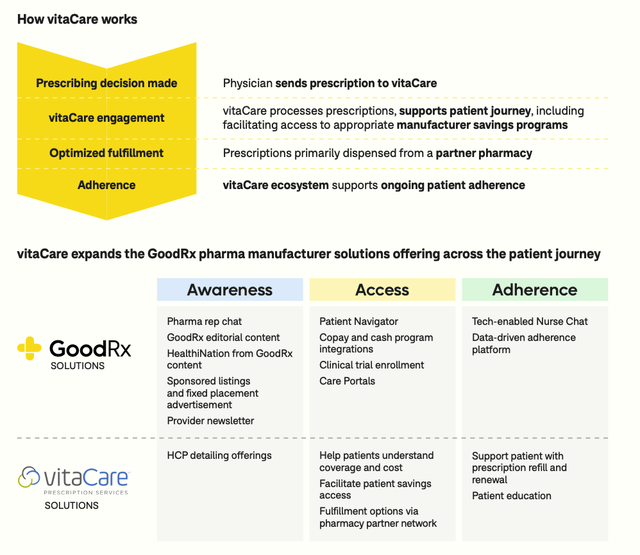

On top of organic growth, the company is leveraging its balance sheet to acquire growth as well. GoodRx recently spent $150 million in cash to acquire vitaCare, a pharmacy services platform that provides an end-to-end experience for patients, from receiving a physician’s prescription to purchasing it at a partner pharmacy. vitaCare also helps patients understand their insurance plan’s drug coverage and discover what discounts and savings may be available.

GoodRx Vitacare (GoodRx Q1 shareholder letter)

At the end of the day, however, these diversification efforts will not be sizable enough to “save” GoodRx should the prescription transaction business go south. Subscriptions only represent less than 10% of revenue today, and if GoodRx savings are accepted at fewer retail locations, the entire premise of GoodRx Gold is also threatened in the first place.

Key takeaways

Is GoodRx cheap? Certainly – at current share prices near $7, the company has a market cap of just $2.63 billion and an enterprise value of $2.44 billion, netting off the $845.4 million of cash and $661.9 million of debt on the company’s most recent balance sheet. This puts GoodRx at a 10.0x EV/TTM adjusted EBITDA multiple, based on trailing twelve-month EBITDA of $243.3 million.

That cheapness, however, is a reflection of the market’s lack of confidence in GoodRx’s ability to maintain its “golden goose” of prescription transaction revenue. GoodRx has basically become a gamble stock on whether or not it can resolve this issue and prevent it from spreading to its other retail partners. Right now, with many growth stocks on sale without carrying similar risks, I’m content to move to the sidelines here.

Be the first to comment