JayLazarin/iStock Unreleased via Getty Images

Background and History

Goldman Sachs (GS) is one of the most successful investment banks to ever exist. Founded in 1869 by Marcus Goldman, this bank has transformed the financial services industry. Goldman is a dynamic player that is constantly evolving with the state of the market. I believe Goldman is now entering a stage of self-fulfilling earnings growth that they will leverage with their technological and financial advantage. Goldman will remain a safe pick as well as a strong growth play. This coming year will be major for Goldman as a multitude of tailwinds will propel the business to new heights.

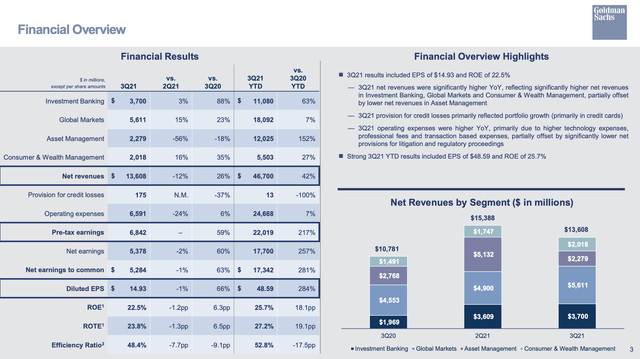

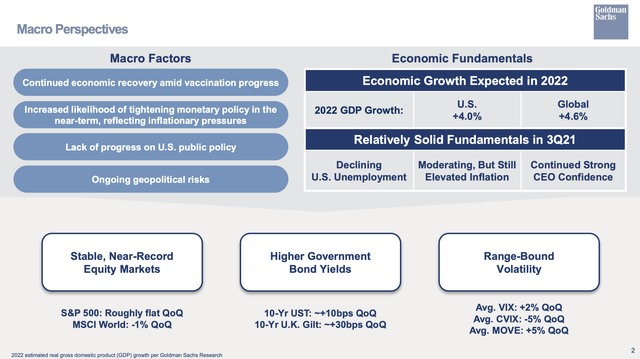

Source: (Goldman Sachs Q3 2021 Earnings Presentation)

The macro objectives are very clear for Goldman in 2022. Reinvest back into Marcus and expand the consumer bank. Goldman can take advantage of interest rate hikes through more than just large institutions. Small and medium-sized businesses (SMBs) and everyday consumers are increasingly looking for appealing financing options like Marcus provides.

Revenue has been Growing with the Bank’s Innovative Initiatives

There are many long-term tailwinds that will meaningfully expand valuations. Growth is coming from the technological changes the company has been going through for the past decade. Goldman’s computer engineers make up 25% of the company’s workforce. As the world becomes more digitized, banks are going to need to keep up. Moving forward, I believe Goldman is the best-equipped bank from an innovation perspective to keep up with growing fin-tech banks that are disrupting age-old financial infrastructure.

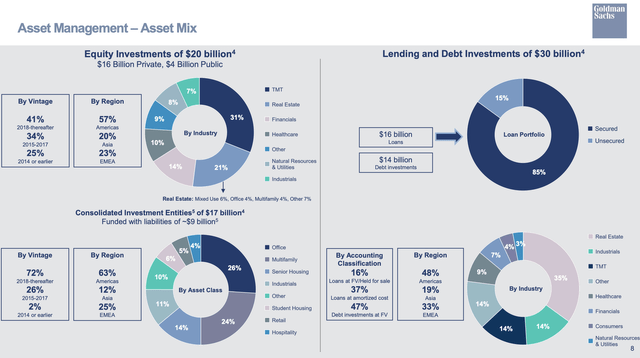

Source: (Goldman Sachs Q3 2021 Earnings Presentation)

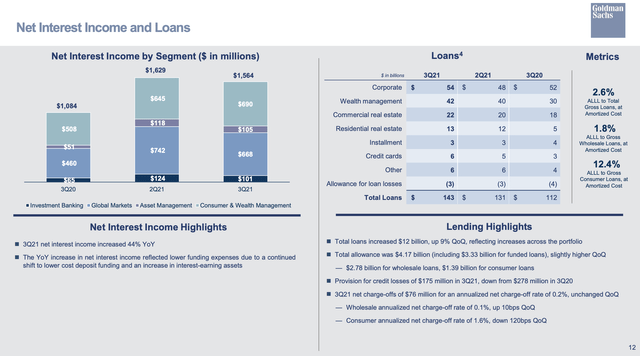

Source: (Goldman Sachs Q3 2021 Earnings Presentation)

The financial highlights give a brief overview of the growth Goldman has undergone in the past year. As more money flows out of mutual funds and into ETFs, the wealth management business has done very well. Comparatively, Goldman performed much better in Q2 than in Q3 due to the large influx of revenue generated by both the wealth management and investment banking businesses. The recent flurry of SPACs, DPOs, and IPOs has pumped an incredible amount of liquidity into the market. Goldman has been the primary underwriter for many of these deals, and they continue to charge exuberant fees along with their sky-high listing of some of these companies. These moves have given Goldman an incredible ROE, and I believe the investment case will only continue to strengthen in future quarters.

Source: (Goldman Sachs Q3 2021 Earnings Presentation)

Source: (Goldman Sachs Q3 2021 Earnings Presentation)

The financial advisory business has been a strong driver of revenue growth. Many companies need advice on whether or not to take out debt, make an acquisition, or go public, and Goldman has one of the most historic advisory businesses in the world. completing many high-profile IPOs throughout the ’80s, ’90s, ‘2000s, and even today. The pickup in interest rates should shift more of the companies’ revenues toward debt underwriting and equity underwriting as companies will be looking for ways to ramp up cash in the face of potentially higher rates.

Source: (Goldman Sachs Q3 2021 Earnings Presentation)

Source: (Goldman Sachs Q3 2021 Earnings Presentation)

Asset management has historically been a very strong business unit for Goldman. The company has clearly been focusing on regional growth and attracting money from new markets. I believe this will be a profitable endeavor because of the low-interest rates across the world and the inherent increase in asset prices across the world. The diverse exposure to multiple industries lowers the overall risk, which can be especially prevalent when investing in developing countries and economies.

Strong Cash Flow has been a Major Strength in Operations

The operational strength of Goldman is well known across the street. Goldman has historically had very strong cash flow and earnings statements. One of the reasons for the recent rise in the stock price is how undervalued Goldman is from a fundamental perspective. Even today, I believe Goldman has a massive runway ahead of it as people begin to put a value on the technology that the company has invested in over the past couple of years.

Source: (Goldman Sachs Q3 2021 Earnings Presentation)

Source: (Goldman Sachs Q3 2021 Earnings Presentation)

Expenses have been kept in check by management. Strong margins are a large reason why cash flow in recent quarters has been so large. As the company continues to leverage its technology into its products, from investment banking to asset management, the valuation should reflect the changing attitude within the company.

Source: (Goldman Sachs Q3 2021 Earnings Presentation)

Source: (Goldman Sachs Q3 2021 Earnings Presentation)

Lending will be a growing business unit for Goldman moving forward. As investment banks increase lending due to rate hikes, I believe Goldman will gain material earnings from selling and underwriting debt. Not to mention the considerable cash flow from equity underwriting to boot. Overall, I like Goldman due to the variety and strength of its business units.

Long term Risks will not Materialize without a Few Triggering Events

I don’t believe that the long-term thesis is at serious risk. However, there are a few incidents that may put pressure on future earnings. First of all, inflation needs to slow down and rates need to pick up to discourage consumers from rampant spending. Goldman will be able to survive if the economy weakens, but its valuation may fall. There is a strong basis for Goldman above 320 due to the relatively low P/E ratio. I don’t believe Goldman is as exposed to these macro risks as other large banks and asset managers. The variety Goldman has and the operational flexibility it can provide can’t be beaten by many competitors on the street. I have faith that Jerome Powell will lead the country out of the pandemic even if inflation persists for some years to come. The disaster scenario was avoided in 2020, and I believe central banks need to tighten policy so there are safeguards in place to prevent the financial system from falling off the brink due to rampant inflation.

Valuation is strong and investors should take advantage

Goldman is in a much better position than many of its peers. The variety of successful businesses gives the company options on which unit they want to emphasize at one time. Also, many other banks don’t have in-house technological leadership like Goldman. At today’s prices, Goldman should be re-rated as a technologically advanced bank that is bringing consistent cash flow and earnings growth.

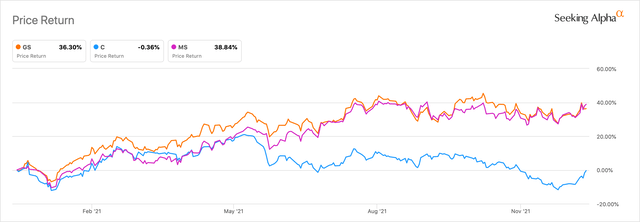

Source: (Goldman Sachs Price Return Seeking Alpha Peer Comparison)

Banks have overall performed very well throughout 2021. Goldman sported a 36% return while Citibank only posted a -.5% return. This is due to rapidly deteriorating revenue growth from operational problems. However, Citi is a similarly sized bank to Goldman and deserves to be compared as such. While Goldman has grown considerably over the past 12 months, another competitor has done just as well. Morgan Stanley’s (MS) strong asset management business has been driving consistent earnings beats for multiple quarters now. It only makes sense that the company returned 38% in 2021. However, there is a severe disconnect when it comes to the valuation of these three.

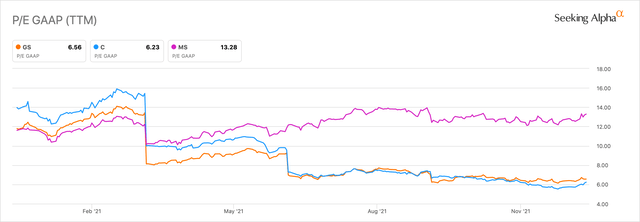

Source: (Goldman Sachs P/E Seeking Alpha Peer Comparison)

Source: (Goldman Sachs P/E Seeking Alpha Peer Comparison)

Since the beginning of the year, Goldman’s valuation has massively contracted. Earnings beat after earnings beat has left this high-growing conglomerate at a trailing P/E of 6. For a growing bank, this is almost unbelievable. Morgan Stanley, which experienced similar price appreciation this year, actually remained steady in their P/E. This simply means that the fundamentals of Goldman were much stronger than Morgan Stanley’s, and Goldman didn’t get the return they deserved. In 2022, Goldman has a unique opportunity to change financial services yet again.

Conclusion and Rating

Goldman Sachs is one of my top picks for 2022. I believe the company will achieve long-term growth through its in-house technology investments. I rate Goldman very bullish and look forward to what future earnings results will bring the company.

Be the first to comment