Chris Hondros

Banks have been hammered since last November, and much of what has happened to them for the past eight months has to do with a perfect storm of negative events. First, banks as a whole seemed overpriced in the view of many market observers a year ago, and by the standards of the past decade they may have been. Second, high inflation looked like a much more negative thing than the mild inflation and higher rates that come with a strong economy. Last but not least, the markets started to worry about the risk of a serious recession stemming from the Federal Reserve’s rate increases undertaken to reduce inflation. The latter two events were accompanied by tougher stress tests as the Fed tried to make sure that banks were sufficiently capitalized to weather a major storm.

Banks fell more than 30% as a sector with only minor differences. Here are the four most important banks with price declines from their 2021 top, current price earnings (P/E) ratios, and market caps:

- Goldman Sachs (NYSE:GS) down 31%, 8.6 P/E, $106B market cap

- Morgan Stanley (MS) down 33%, 10.6 P/E, $134 B market cap

- JPMorgan (JPM) down 32.5%, 11.3 P/E, $335B market cap

- Bank of America (BAC) down 36%, 9.8 P/E, $256B market cap

You will notice that the four banks are not ranked in order of their percentage declines. They are ranked in inverse order of their level of diversification. Diversification in this case essentially means the importance of ordinary consumer banking in their revenue and income streams. One might have expected that more diversification of revenue and earnings streams is a good thing, and it usually is when it comes to the ordinary ups and downs of a business cycle. When it comes to stress tests run by the Fed, however, the risks that come with consumer banking make diversified banks more likely to suffer losses which have systemic effects with the potential to damage the entire financial system. Here’s the way the Fed described the things taken into account for the stress tests:

2022’s hypothetical scenario included a severe global recession with substantial stress in commercial real estate and corporate debt markets. The unemployment rate rises by 5-3/4 percentage points to a peak of 10% and GDP declines commensurately. Asset prices decline sharply, with a nearly 40% decline in commercial real estate prices and a 55% decline in stock prices.”

Here’s how the recent Fed stress tests rated the Tier 1 ratios of the four major banks:

| Bank | Q4 21 Actual | Test Result | Minimum |

| Bank of America | 10.6 | 7.8 | 7.6 |

| JPMorgan | 13.1 | 10.6 | 9.8 |

| Morgan Stanley | 16 | 14.7 | 11.4 |

| Goldman Sachs | 14.2 | 12.2 | 8.4 |

To understand why Investment Banks like Goldman and Morgan Stanley do well on stress tests refer to the elements of risk considered important by the Federal Reserve in assessing whether a bank presents systemic risk. None of them come up in an important way in the businesses of Investment Banking. Poor revenues and earnings from underwriting and investment banking, asset management, and trading may be a bad thing for an individual bank but poor performance and losses in those areas do not ripple through the financial system and the economy in the same way defaults of individual and business loans do.

BAC, the bank with the highest percentage of its revenues in interest income from loans, clearly passed by a tiny margin. JPM did a little better, and MS did much better. Goldman, however, was the big winner. Doing poorly on the stress tests harms the immediate prospects of a bank in several ways, placing limitations on stock buybacks and dividend increases while compelling management to focus on things other than maximizing revenues and profits. Doing well conversely provides a bank with more options. Following the posting of the stress test outcomes JPMorgan kept its dividend at the previous level, Bank of America increased its dividend 5%, Morgan Stanley increased its dividend 11% and authorized a $20 billion share repurchase, and Goldman Sachs, the biggest winner, increased its dividend 25%.

It’s All About The Business Model

A bank is a bank, and all banks are included in the Seeking Alpha financial sector. Among major banks, however, there is major difference in business model. Goldman Sachs and Morgan Stanley are Investment Banks while Bank of America and JPMorgan are Diversified Banks. This does not mean that BAC and JPM have no Investment Banking units; they are in fact number one and number 3 among global giants in investment banking. What it means is that they also have enormous consumer banking units. There are in fact two separate industry classifications used by Seeking Alpha. Investment Banks tend to get most of their revenues and earnings from trading, asset management, and investment banking. Diversified Banks contain those elements along with consumer banking. The table below shows the proportions of each part for three of the majors, although they do not report in a precisely parallel manner. BAC does not break out its non-interest income in the same detail as the three included in the table:

| JPM | MS | GS | |

| Net Interest Income | $53.3B | $9.3B | $6.8B |

| Trust Income | $21.4B | – | – |

| Brokerage Commissions | – | 5.7B | 3.6B |

| Trading | $14.9B | $12.7B | $23.1B |

| Asset Management | – | $20.7B | $8.3B |

| Underwriting and Investment Banking | – | $10.0B | $12.7B |

| Other | $28.6B | $.8 | – |

It’s worth reiterating that the all four banks are among the largest investment banks in the world. They are in fact the current top four, ranked in this order: JPM, GS, BAC, MS. To get a better sense of the size and scale of their businesses, check the revenue numbers against the market caps in the earlier section. Although having large businesses in global investment banking, JPMorgan and Bank of America are so much larger than Goldman Sachs and Morgan Stanley that their investment banking businesses are less important in relative terms.

BAC and JPM both have Asset Management and Underwriting/Investment Banking but do not break them out in detail as reported under Financials at SA. For BAC, interest revenues and non-interest revenues are close to 50/50. For JPM non-interest income exceeds investment income by about $13 billion after adding a couple of smaller categories such as Mortgage Banking.

Goldman Sachs, Its History, And Its Competitors

Goldman Sachs was founded in 1869 and existed as a partnership until going public in 1999. It’s leading figures have gone back and forth between Goldman and the US government starting in the 1930s and 40s when CEO Sidney Weinberg served as FDR’s liaison with business leaders. During the financial crisis of 2007-2009 former CEO Henry Paulson served as Secretary of the Treasury and was a major participant in important decisions such as creating the TARP program. His decisions were sometimes criticized as reflecting a conflict of interest because of his previous position at Goldman Sachs.

There was some apprehension that Goldman itself might cease to be viable because of its deep involvement in securitization of sub-prime mortgage but $10 billion in TARP funds and a $5 billion loan from Berkshire Hathaway (BRK.A)(BRK.B) carrying a 10% interest rate helped restore confidence. The Berkshire loan was negotiated by Vice Chairman for Investment Banking Byron Trott who had advised Warren Buffett on deals including the financing of the Mars-Wrigley merger and the Berkshire acquisition of Marmon. As a result of the crisis both Goldman and Morgan Stanley chose to become traditional “bank holding companies” in 2008 enabling them to participate in doing consumer banking.

It was not until 2018 that GS launched a consumer division with the stated intention of diversifying its income streams, but so far it has made little progress. An SA News item on June 28 reported that Goldman had forecast a $1.2 billion loss in consumer banking for 2022. A $1 billion loss in 2021 had previously been described as the low point. It’s no surprise that Goldman has so far failed to prosper in a business so different from the other things it does. What is a surprise is that Goldman was unable to see that this was going to be the case. The redeeming fact is that Goldman’s commitment to Consumer Banking is so small that even complete disaster wouldn’t make much of a difference in its overall performance.

A question raised at the earnings call in January seemed to be asking between the lines whether Goldman could count on continuing outstanding Trading revenues in a changing environment. The answer was, of course, yes, but it is important to keep in mind that some of the worst events in Goldman history had to do with Trading and Investment Banking blow-ups which came with little warning at times of unexpected market stress. Goldman did well on the stress tests but is by no means immune to a severe economic event. Trading accounts for about half of Goldman’s revenues and Underwriting/Investment Banking takes the number close to 75%. That’s probably about what a classic investment bank should look like. Morgan Stanley just turns the ratio of Trading and Asset Management upside down, making MS somewhat more conservative. Its business mix helps Goldman have the highest return on capital at 15%.

In the upcoming earnings call investors interested in Goldman should listen carefully to anything having to do with trading and the environment for underwriting and other investment banking.

Analyst Ratings, Quant Ranking, Factor Grades, And Price History

Neither Seeking Alpha writers nor Wall Street Analysts have a sell recommendation for Goldman Sachs. Not one. Writers on SA give Goldman 1 Strong Buy, 6 Buys, and 1 Hold. Wall Street Analysts give it 9 Strong Buys, 8 Buys, and 10 Holds. It makes you wonder about who the people were that were selling as it fell more than 30%. The only negative view come with Seeking Alpha Quant Ranking And Factor Grades.

Factor Grades are about as bad it gets:

Those F grades for Growth and Profitability should stop optimists in their tracks, and Momentum and Revisions aren’t encouraging for the shorter term. The valuation grade of B- is pretty interesting for a stock selling at 8.6 times earnings. What would it take for Goldman to get an A?

Quant Ranking tells another interesting story. Of all stocks covered Goldman ranks 2013 out of 4628 which is a little above average by some quick math. Among stocks in the Financial Sector it ranks 428 out of 649, not good at all, although I must say that the Sector is full of ticker symbols I don’t recognize. Among its fellow investment banks GS does a bit better, number 7 out of 25. Scanning the Investment Banking Industry I noticed, however, that Morgan Stanley ranks higher at number 3 and that all of its Factor Ratings are higher than the Factor Rating for GS.

In the case of Goldman I am actually not too concerned about its ranking in various Factors because the issues measured are not necessarily the important ones. Many are short term or involve things which may or may not happen to the economy in the immediate future. Barring an unexpected mishap they should not damage Goldman’s potential as a long term investment. Perhaps SA Writers and Wall Street Analysts are looking over the valley.

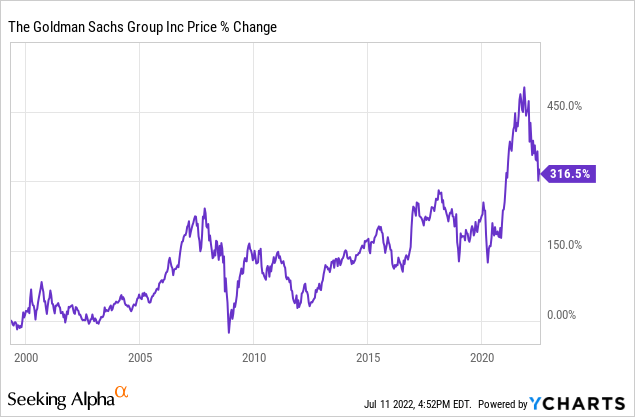

The price chart all the way back to 2000 tells an interesting story. It shows a lot of susceptibility to crises and sensitivity to periods when interest rates went up abruptly. Notice that it performed worse as the Fed raised rates in 2018 than it did in the pandemic mini-crash.

Conclusion: Should A Long Term Investor Buy Goldman Now?

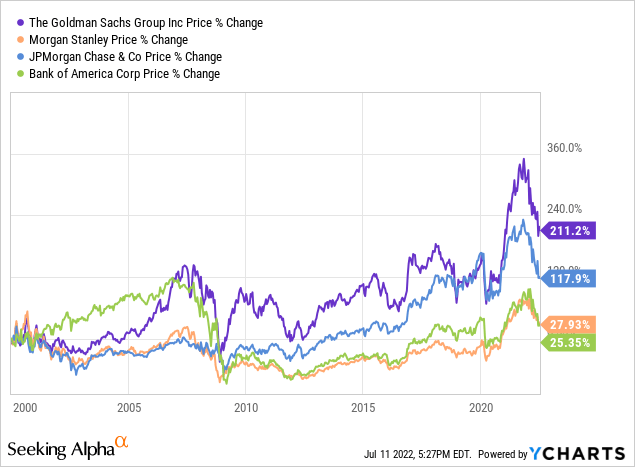

If you are ever going to buy Goldman Sachs, this might be the moment. It could well be knocked down another 30% if every possible bad thing mentioned in the stress tests comes to pass, but that is unlikely. When it becomes clear that a recovery is on the way Goldman could gain back that amount in a few weeks. It’s a wonderfully volatile stock, as the above chart shows, but despite all the ups and downs it has outperformed both its peer Morgan Stanley and the two Diversified Banks, BAC and JPM, since January 1, 2000. Here’s the chart to prove it:

Of course you can read that chart a few ways. BAC was the leader until the 2007-2009 crash almost destroyed it. JPM was the plodder which did very well with a much smoother ride. Morgan Stanley was another smooth plodder which ended up doing no better than Bank of America. For consistency you might want JPMorgan. If you don’t mind a bumpy ride you might choose Goldman. That assumes of course that the same factors are at work now that produced the results over the last 20 years. Goldman’s history has many examples of getting into difficulty but landing on its feet.

Banks are all dirt cheap. Goldman is by a significant margin the cheapest. Its P/E ratio is 8.6. Its price is about equal to its book value and only 8% above its tangible book value. In five years you may look back and say, Gee, could I really have bought Goldman Sachs at those prices? I have to call it a Buy. I don’t own it but might in the near future if the market continues to improve the opportunity.

Be the first to comment