Chris Hondros/Getty Images News

Introduction

As a dividend growth investor, I am constantly looking for new opportunities that will increase my annual dividend income. Sometimes I analyze shares I already own and consider adding to, while other times my focus is on new positions that can strengthen my dividend growth portfolio. In this article, I will analyze a new candidate for my portfolio.

In my dividend growth portfolio, I lack exposure to the financial sector. In this sector, I own shares in banks like Bank of America (BAC), insurance companies like Prudential (PRU), and money managers such as T. Rowe (TROW). In this article, I will analyze a leading investment bank in the United States, Goldman Sachs (NYSE:GS) to which I have zero exposure to.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier for me to compare analyzed stocks. I will look into the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

According to Seeking Alpha’s company overview, The Goldman Sachs Group, a financial institution, provides a range of financial services for corporations, financial institutions, governments, and individuals worldwide. It operates through four segments: Investment Banking, Global Markets, Asset Management, and Consumer & Wealth Management. The company was founded in 1869 and is headquartered in New York, New York.

Fundamentals

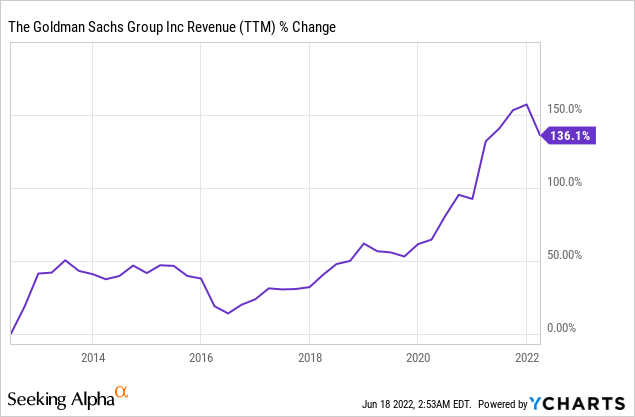

The revenues of Goldman Sachs have more than doubled over the last decade. Revenues increased as the market performed well, and it allowed Goldman to charge more and manage more assets as it has increased the value of assets under supervision (AUS). Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Goldman Sachs to suffer from a decline in revenues in 2022, followed by solid low single digits increase in the following years as the market stabilizes following the increase in interest rates.

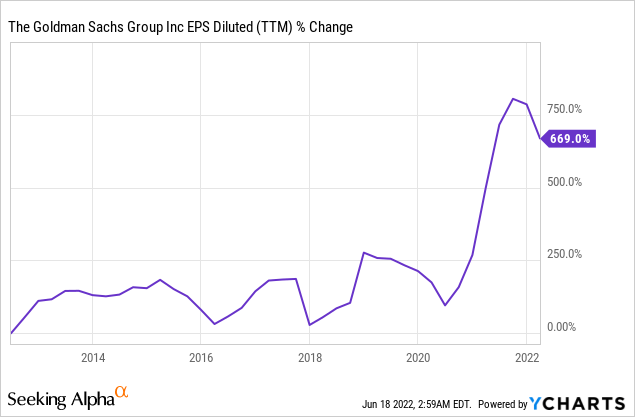

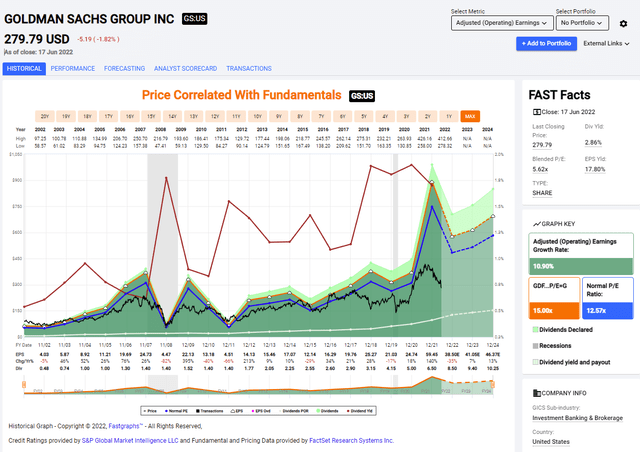

The EPS (earnings per share) has increased at a much faster pace. The reason for that is that in addition to the higher sales, the company also enjoyed improved margins as it maintained high efficiency. Moreover, significant share buyback following the 2008-09 financial crisis has also supported higher EPS growth. Going forward, the consensus of analysts, as seen on Seeking Alpha, expects Goldman’s EPS to decline in 2022 as we enter the bear market, followed by a high-single digits annual growth in the 3 years to follow.

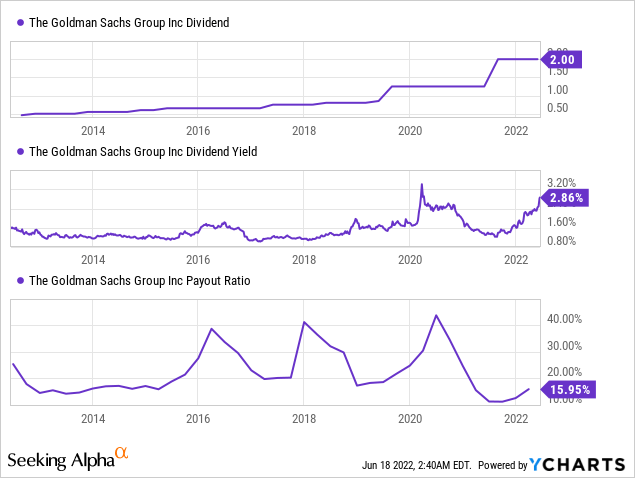

Goldman Sachs has increased its dividend for the past 10 years. The company has reduced the dividend payment slightly during the 2008-9 financial crisis, but the current dividend of $2 quarterly is more than four times higher than the 2009 dividend. The dividend is extremely safe with a payout ratio of 16%, and even with a decrease in earnings, this almost 3% yield seems safe for dividend growth investors.

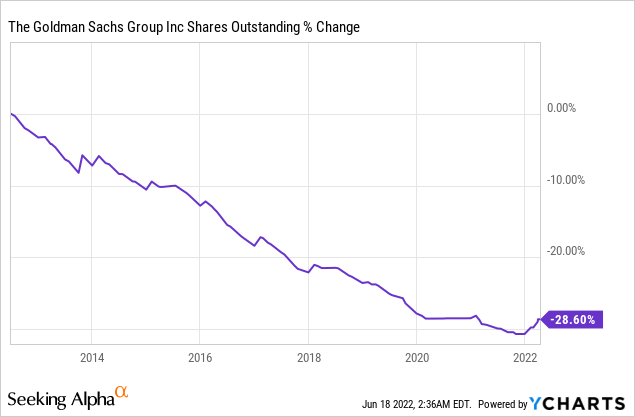

The number of shares outstanding has decreased significantly over the last decade. Goldman Sachs has bought back 28.6% of its shares, which means more than 1 in 4 shares have been retired. Buybacks when used by a growing business are beneficial to EPS growth and are a great way to return capital to shareholders in addition to dividends. Goldman may increase buybacks if it passes the 2022 stress test.

Valuation

Shares of Goldman Sachs are trading for an attractive P/E (price to earnings) ratio. The company is trading for 7.5 times the 2022 estimated EPS according to the consensus of analysts as seen on Seeking Alpha. The graph below from FAST Graphs emphasizes how attractively valued Goldman Sachs is as it trades significantly below its average P/E ratio of 12.5. While the current expected growth rate is lower than the historical average the shares still seem attractively valued.

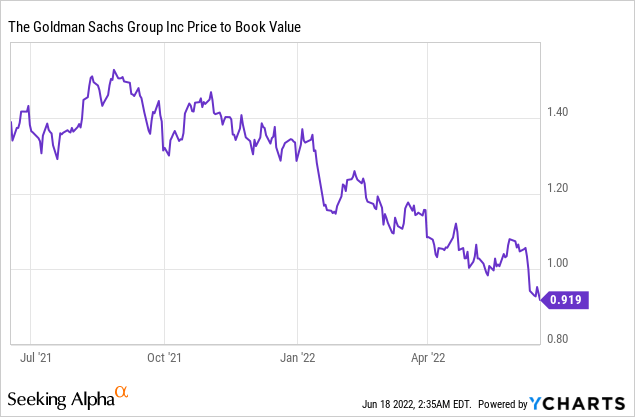

Moreover, when we look at the P/B (price to book value) ratio, which is a very prominent metric for a bank’s valuation, we see that Goldman Sachs is trading right now below its book value. Just several months ago, the company traded for a significant premium to its book value. When a bank trades for less than its book value it implies that the shares are attractively valued.

To conclude, Goldman Sachs is a blue-chip investment bank. It has performed well over the last decade and enjoyed increasing revenues and EPS which led to higher dividends and buybacks. This solid package comes at an attractive valuation when the P/E ratio and the P/B ratio are signaling that the current price may be an interesting entry point.

Opportunities

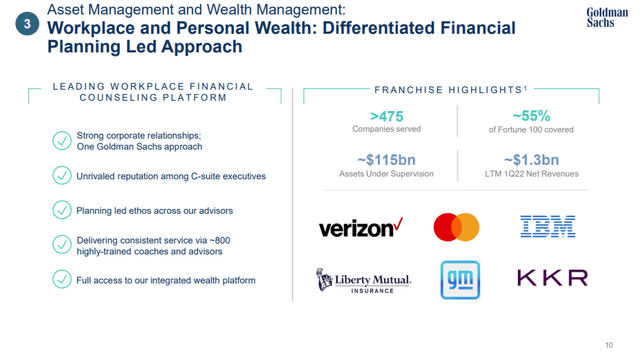

The first growth opportunity is the wealth management segment. During Q1 2022 this segment has shown record revenues. This segment accounts for roughly 18% of the revenues, and when the market volatility is high as it is today, Goldman Sachs can shine. The firm is trusted and well-known and has a track record to show long-term success. When the risks are higher, investors prefer trusted and well-known brands and Goldman Sachs is one of them, thus many leading companies choose Goldman for their employees.

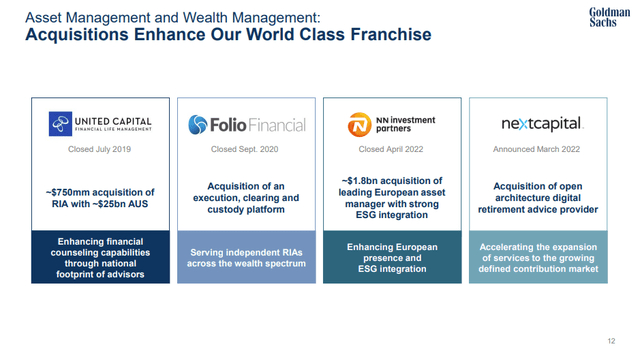

The company’s leading position will also allow Goldman Sachs to extend its value proposition. As we see shares in the fintech realm declining sometimes by more than 80%, Goldman Sachs can take advantage of its strong position to acquire some of them and become an even more prominent player. The company has already done so in the past several years, and the current environment will be a great M&A environment for industry leaders.

In addition, Goldman Sachs as a leading financial institution is constantly under the tight supervision of the regulators. While this is many times a disadvantage, when the economy suffers from higher uncertainty, it is a plus as investors know that the bank is stable and safe. At the end of the month, the stress test results for 2022 will be published, and Goldman Sachs is expected to once again pass them thus increasing confidence, and probably increasing dividends and buybacks.

Risks

A recession is the most prominent risk for Goldman Sachs. A recession will most likely keep the price of equity low and thus the company’s AUS will be low. This, in turn, will trigger downward revisions for the company’s EPS and revenues and the current estimates may turn out to be higher than anticipated. Therefore, a recession may hinder the company’s growth in the medium term.

Investment banks are more sensitive to recessions because of that. They tend to outperform during bull markets and underperform during recessions as the AUS declines, and some clients even withdrew money from the funds. In the financial crisis of 2008-09, Goldman declined more than the broader market, and its revenues declined more than the average S&P 500 company.

In addition, there is also the risk of competition. Goldman Sachs is competing with other leading investment banks such as Morgan Stanley (MS) and JPMorgan (JPM). The company is also competing with cheaper alternatives like ETFs and startups that claim to be better wealth managers using technology and better analysis.

Conclusions

Goldman Sachs is a great blue-chip company. The company has proved great execution with a long-term improvement in the fundamentals. Higher sales led to higher EPS which allowed the company to pay dividends and buy back more of its own shares. In addition, the company has several growth prospects both organically and inorganically with M&A as the valuation of many companies is significantly lower.

While there are some risks, they are mostly for the short to medium term, as the fears of a recession are increasing. While I do not dismiss these risks, the current valuation takes most of them into account. The P/E is much lower than average, and the shares are trading below book value. Therefore, I believe that Goldman Sachs is a BUY for long-term dividend growth investors.

Be the first to comment