Chris Hondros/Getty Images News

Goldman Sachs BDC, Inc. (NYSE:GSBD) is an excellent business development company for investors seeking recurring dividend income.

Following the recent market downturn, Goldman Sachs BDC is trading at a much lower book value multiple, and the company has a very safe investment portfolio comprised of high-quality debt investments.

Goldman Sachs BDC has a consistent yield, which is covered by the company’s net investment income, due to its focus on first and second lien debt investments.

Safety-First Portfolio With Focus On First And Second Liens

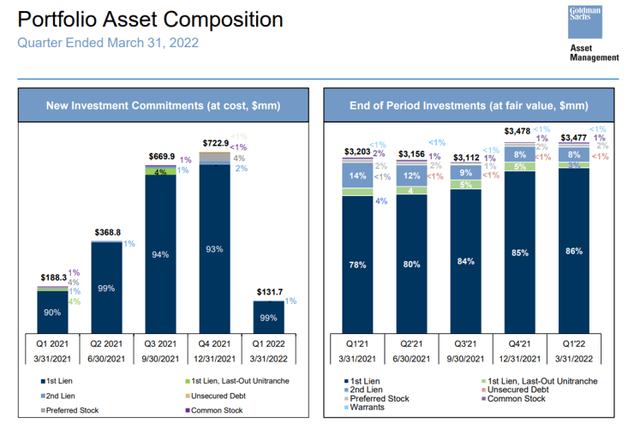

Goldman Sachs BDC is the BDC investment arm of global investment powerhouse Goldman Sachs. The company has primarily focused on first and second liens, which are highly secured, collateralized loans that provide the BDC with recurring net interest income over the loan’s life. The business development company has a high concentration of first-lien investments (86%) and a much lower concentration of second-lien investments (8%).

Goldman Sachs BDC’s portfolio is stable because 94% of all investments are in first and second liens. Warrants, preferred stock, and other investments make up the remaining 6% of the portfolio. With market volatility on the rise and investors increasingly concerned about the possibility of a recession/stagflation, BDCs with a safety-first philosophy could outperform the market.

In terms of new investment commitments, 99% of new funds went into first lien investment whereas 1% went to second liens.

Portfolio Composition (Goldman Sachs BDC)

Diversified, Floating Rate Exposure

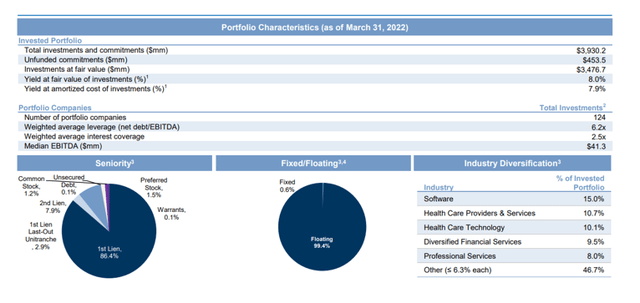

Goldman Sachs BDC is a diversified business development firm focused on cash flow stable industries such as software, healthcare, diversified financial services, and professional services.

The BDC’s total portfolio was valued at $3.9 billion, including future investment commitments. As of March 31, 2022, the trust’s portfolio included 124 portfolio companies with an average EBITDA of $41.3 million.

What stands out about Goldman Sachs BDC’s portfolio characteristics is that 99.4% of the trust’s investments were in floating rate debt. This means that as interest rates rise, the business development company’s net interest income rises. Higher interest rates are a positive for Goldman Sachs BDC because the central bank is becoming more aggressive in combating inflation in 2022.

Portfolio Characteristics (Goldman Sachs BDC)

Dividend Is Covered By Net Investment Income

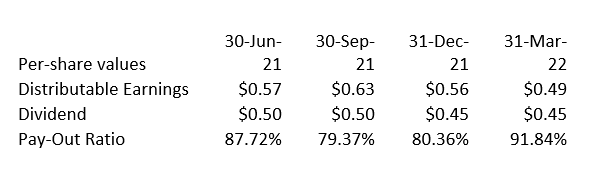

Goldman Sachs consistently covers its dividend payments with net investment income, implying that the stock yield is sustainable.

In the previous year, the pay-out ratio, arguably one of the most important metrics for business development firms, was 84%. Goldman Sachs BDC paid special quarterly dividends of $0.05 per share last year but has now returned to paying only the regular quarterly dividend of $0.45 per share. The stock has a 10.8% yield based on a $1.80 per share dividend payout.

Dividend And Pay-Out Ratio (Author Created Table Using BDC Information)

Why Goldman Sachs BDC Could See A Lower Stock Price

The market is very concerned about inflation sending the U.S. economy into a slump. A recession is a significant risk factor for Goldman Sachs BDC because it may cause some borrowers to struggle with their debt obligations, lowering the BDC’s net investment income. An increase in loan losses could result in a declining book value, which could lead to a lower book value multiple for Goldman Sachs BDC.

P/B Multiple

Because the Fed raised interest rates in June, business development companies and mortgage trusts took significant valuation hits. Goldman Sachs BDC’s stock has historically traded at a premium to book value because it is a higher quality BDC (first and second lien focus). Higher quality BDCs frequently trade at premium multiples, indicating that investors value the distribution’s safety as well as the portfolio’s stability.

Goldman Sachs BDC is currently trading at a 6% premium to book value, which is lower than the long-term average.

My Conclusion

Goldman Sachs BDC pays a consistent $0.45 per share dividend, resulting in a (covered) 10.8% dividend yield.

Goldman Sachs BDC’s net investment income covers the stock yield, and the portfolio is constructed in such a way that it can withstand a major recession due to the company’s emphasis on first and second lien investments.

Furthermore, Goldman Sachs BDC has a diverse investment portfolio, and the stock began trading at a minor premium to book value in June.

Be the first to comment