adventtr

In today’s article, I’d like to provide a long overdue update on Gold Resource Corp (NYSE:GORO). In particular, I’d like to review the operating performance and valuation metrics from the past few years, then discuss the company’s newest project and finally close with an examination of what is perceived to be the company’s biggest risk, viz. its reserves.

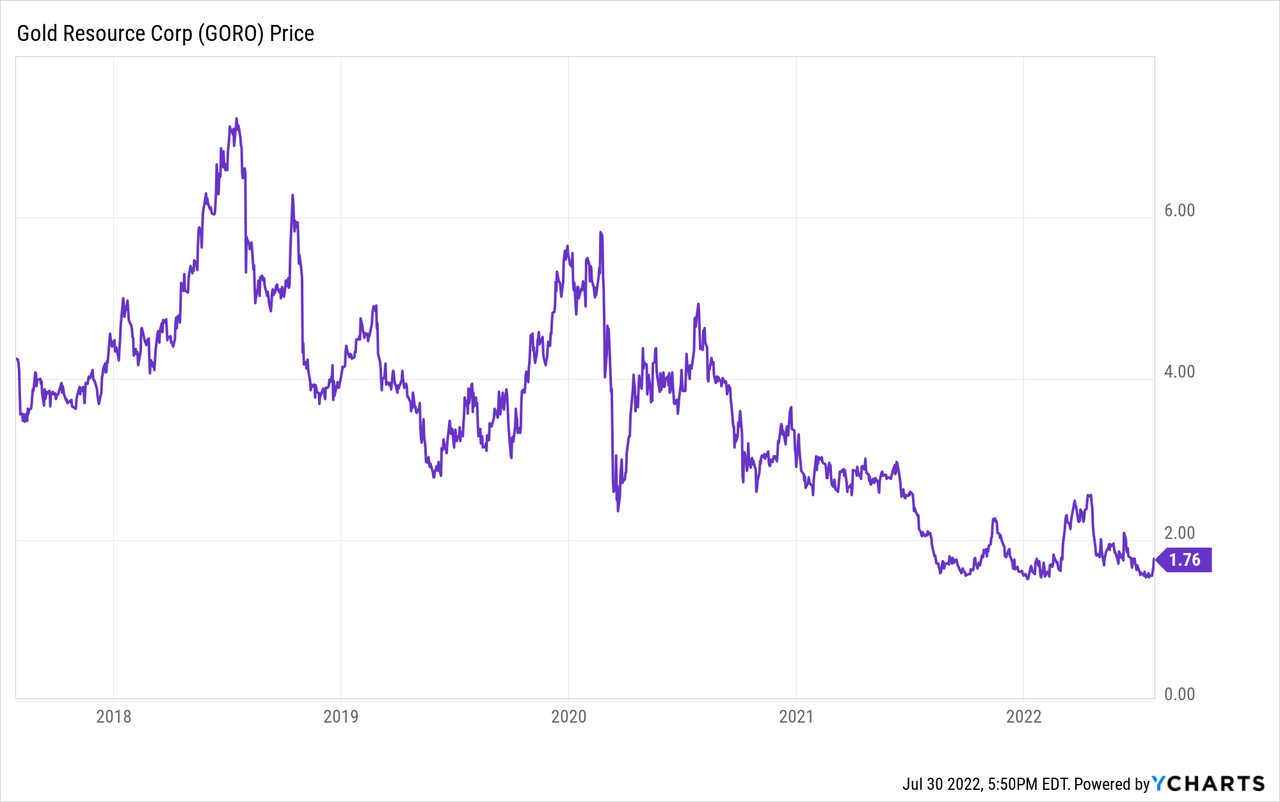

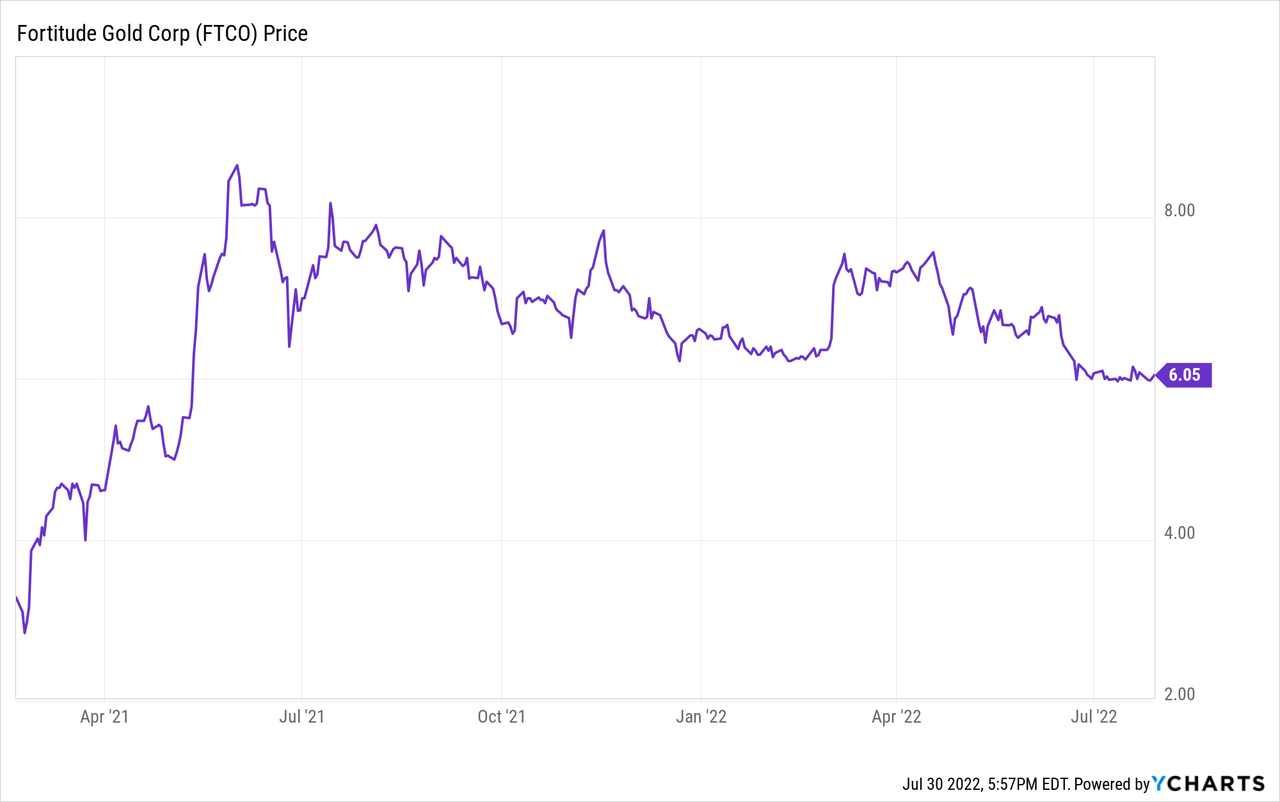

Stock Price

Let’s begin with the stock price performance. It’s a little complicated, because at the end of 2020 GORO spun off its Nevada assets under a new listed company, Fortitude Gold (OTCQB:FTCO), with GORO owners receiving one share of FTCO for every 3.5 shares of GORO that they held. But generally, if you divide the FTCO price by 3.5 and add it back to the GORO price, the full company value has held up quite well.

Dilution and Valuation Metrics

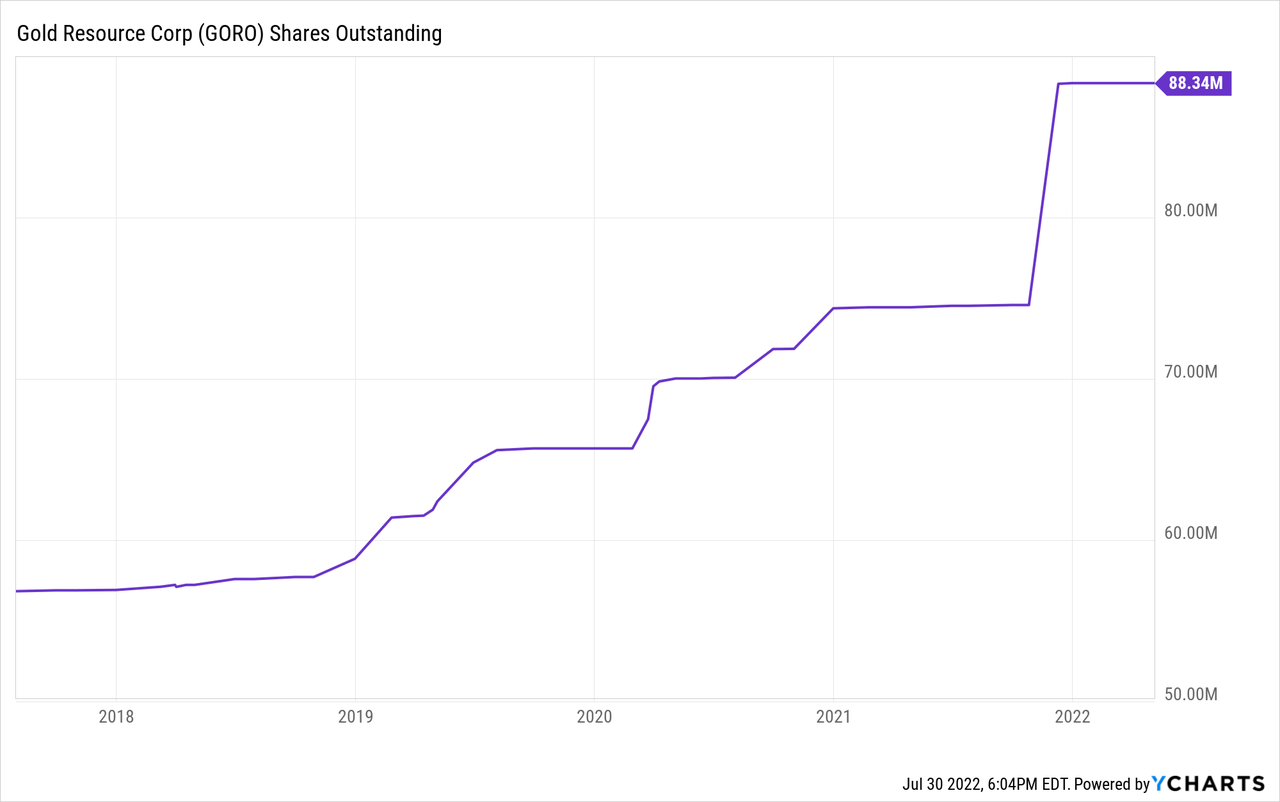

One of the most telling statistics for junior miners is the rate at which they’re willing to dilute existing shareholders. Believe or not, the chart below is actually better than typical for a junior miner, particularly since the company bought a new asset in Michigan (which I discuss below). But dilution is the first major risk to consider when evaluating an investment in GORO.

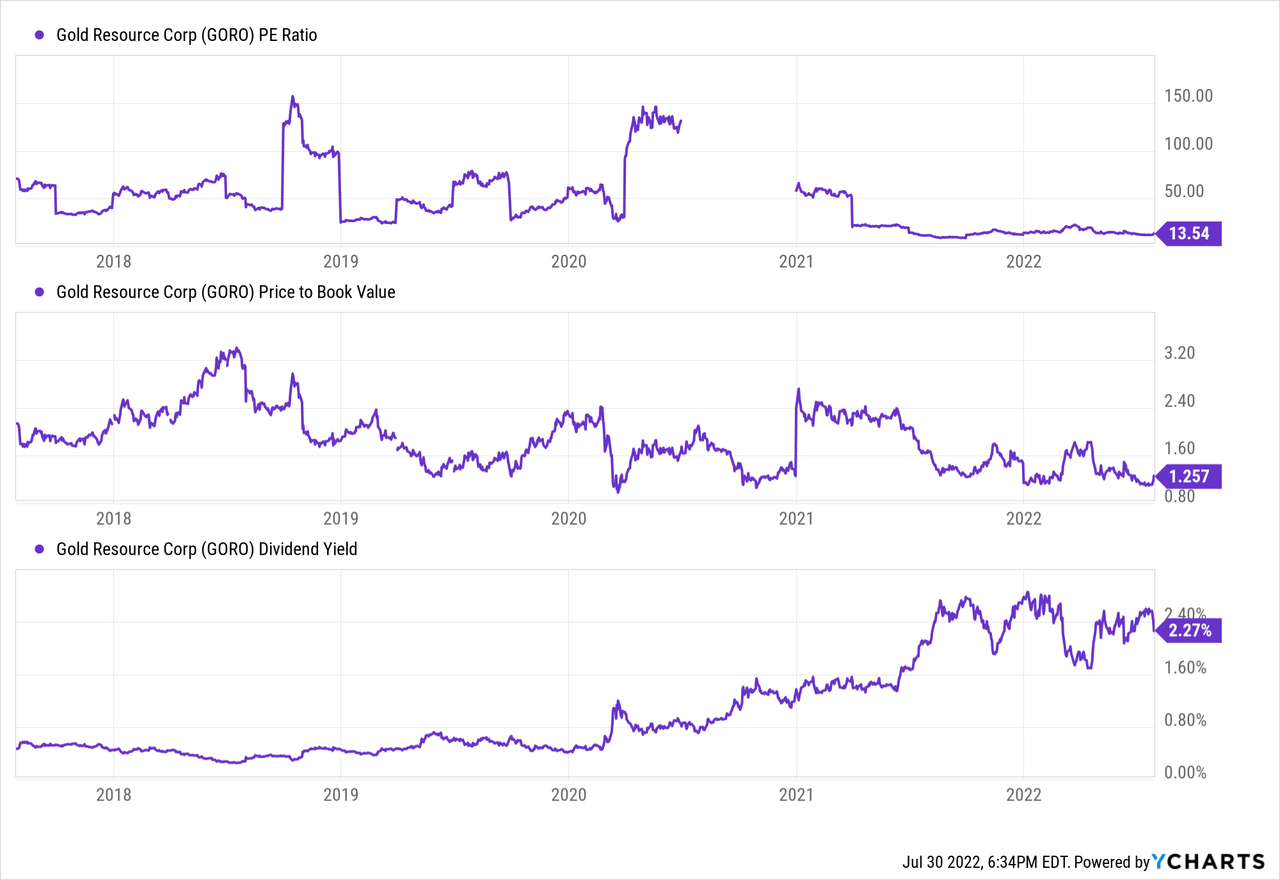

On the other hand, GORO has always sported relatively good valuation metrics, and that continues to be the case. See for instance the chart below showing historical P/E, P/B, and dividend yields.

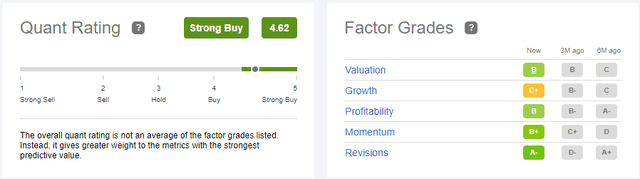

Additionally, Seeking Alpha has a very positive quant rating on the company as well as generally good factor grades.

Seeking Alpha

New Project – Back Forty (Michigan)

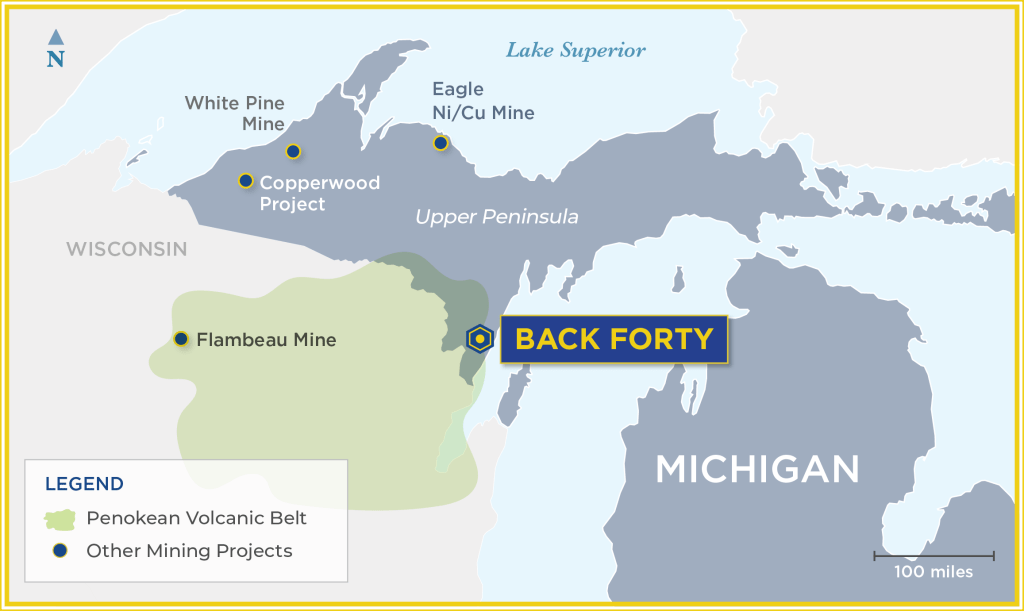

In 2021 GORO announced its plan (and rationale) to buy Aquila Resources whose sole asset is a prospective gold/zinc/copper/lead mining property located in northern Michigan.

GORO website

Here are some highlights from the NI 43-101 report detailing the property, with my emphasis. (For those new to precious metals investing, the Ni 43-101 report was spawned as an answer to the industry problems highlighted by the massive Bre-X fraud in the late 1990s. As such, when they are available, investors should always refer to these NI 43-101 reports rather than just reading press releases.)

Resource and Mining Method

Aquila’s Back Forty Deposit (“the Deposit”) is a volcanogenic massive sulphide (“VMS”) deposit located along the mineral‐rich Penokean Volcanic Belt (“PVB”) in Michigan’s Upper Peninsula. The Project contains approximately 1.1 million ounces of gold and 1.2 billion pounds of zinc in the Measured and Indicated Mineral Resource classifications, with additional upside potential.

[…]

A Feasibility Study on the Project was issued in September 2018 that studied open pit mining and on-site processing plants for treating oxide material to produce gold doré and sulphide material to produce zinc, copper, lead concentrates. The value proposition of the Project was based on mining the highest value material as soon as possible and treating this material through the process plants to maximize cash flow.

[…]

The subject of this Technical Report and Preliminary Economic Assessment relates to an expansion of the open pit mining case (Phase 1) by proposing the development of an underground mine (Phase 2) associated with the Project after the open pit phase is complete. Before the open pit has been mined out, the development of an underground mine will commence to extend the life of mine of the Project.

Note that part of what drove GORO to purchase the Back Forty property is that it envisions mining a smaller portion of the deposit at higher IRRs and lower initial costs. We’ll have to wait for new feasibility studies to get all of the details, but most likely GORO will be targeting less than the entire resource mentioned above.

Permitting and Development

The big risk with the Back Forty project is permitting. GORO management says it closely studied the situation and believes it can get through the permitting process by reducing the overall scope and impact of the project. This dovetails with the idea of only going after the highest IRR ore in the orebody. However, confidence is one thing, execution is another. We’ll just have to follow along to see how the permitting process unfolds.

Personally, I’d like the company to slow play this development, while it builds reserves at the Mexican properties. Interestingly, during the latest conference call, the company had this to say regarding development generally, which kind of gibes with my slow play hope:

The economic climate has changed dramatically in the past few months. While we are comfortable with the guidance for the year, it is making new projects challenging. Across the industry, we are seeing projects suffer from cost escalation, as well as increased cost of capital at a time when commodity prices are declining. It is unfortunately a perfect storm. The duration of which is unknown.

El Alguila / Don David Gold Mine

The company’s flagship property is the El Alguila Project, which hosts the Don David Gold mine (previously referred to as the Arista and Switchback mines).

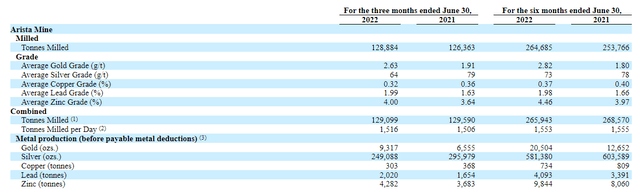

The mine is an underground vein type deposit. It has been in production since 2011. Over the past few years, the company has milled a little over 500K tonnes per year.

SEC filing

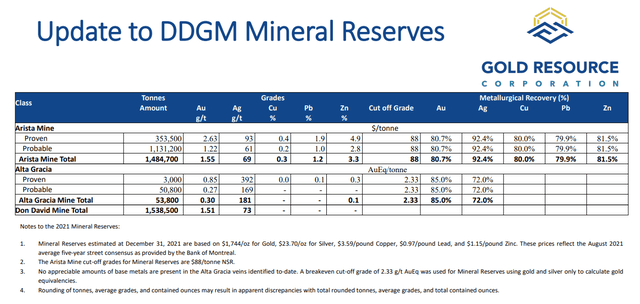

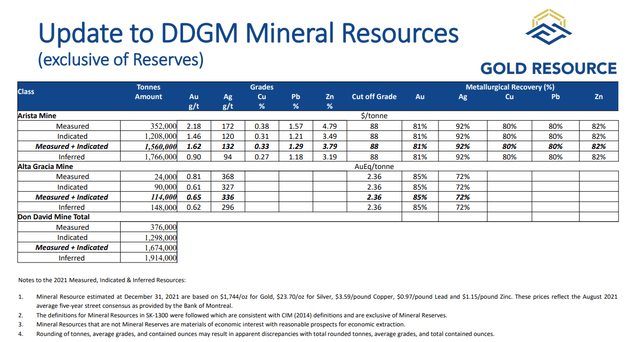

As of December 31, 2021 the company estimates that it has about 1,485,000 tonnes of proven and probable reserves and 1,560,000 tonnes of measured and indicated resources at the Arista mine.

Corporate Presentation

Corporate Presentation

Based on this, the company has three years of production ahead of it, and if the M&I resources are converted to proven and probable reserves, then it’s more like six years of production.

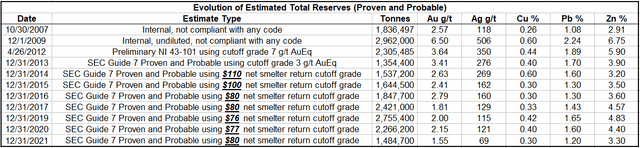

In order to appreciate how a deep orebody is exploited, in particular how reserves aren’t known initially but are discovered as new underground drill sites become available, I’ve tracked the company’s historical reserves over time. Note that on a yearly basis the comparison isn’t exactly apples-to-apples because reserves depend on the trailing three-year metal price averages and a net smelter return which depends on input prices. Nevertheless, one can see that despite mining about 500,000 tonnes per year, the company always has had 3-5 years of production ahead of it. Thus, worries about a very limited mine life to me are overblown.

Author’s Compilation of Company Historical Data

The bigger issue for me is that in the latest period, the reserve grades are lower than the historical data, suggesting that the company has preferentially mined high grade ore (which is totally logical) but hasn’t been able to find equivalent grade ore in its recent drilling programs. This is a concern as it could greatly affect profitability going forward.

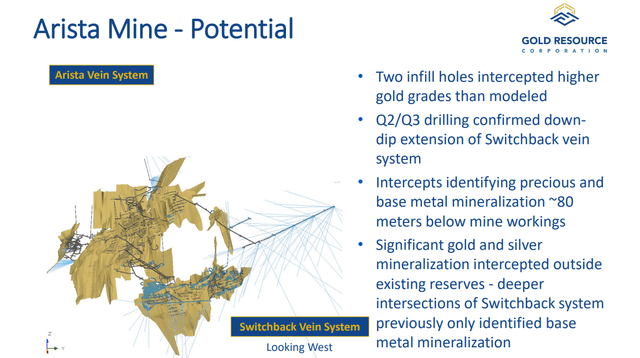

Note that in its most recent presentation, the company suggests that new drill results imply potentially higher grade veins and more precious metals at depth than previously expected, but until these results are incorporated into the orebody model, we have to conservatively use the grades listed above.

Corporate Presentation

Conclusion

Given its low valuation (P/E, P/B, etc.), the Seeking Alpha quant rating and today’s inflationary environment, I continue to hold my GORO shares and rate the stock a buy. I’m not giving it a strong buy however because I see two risks: grade degradation at the Arista mine and a possible long (and costly) development cycle at the Back Forty project.

If new — positive — drill results emerge from Arista, and/or permitting at Back Forty goes more smoothly than typical, then I will revisit my rating and issue a new update here at Seeking Alpha.

Be the first to comment