Gold Price Analysis and News

- Gold Awaits US CPI

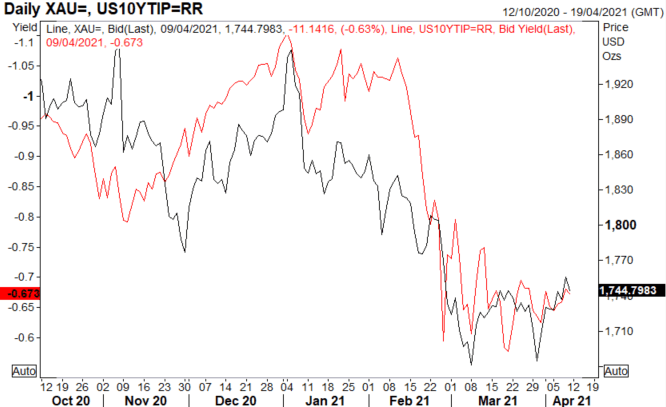

- US Real Yields Are Still the Best Guide for Gold Direction

- Gold Levels to Watch

Gold Awaits US CPI Data

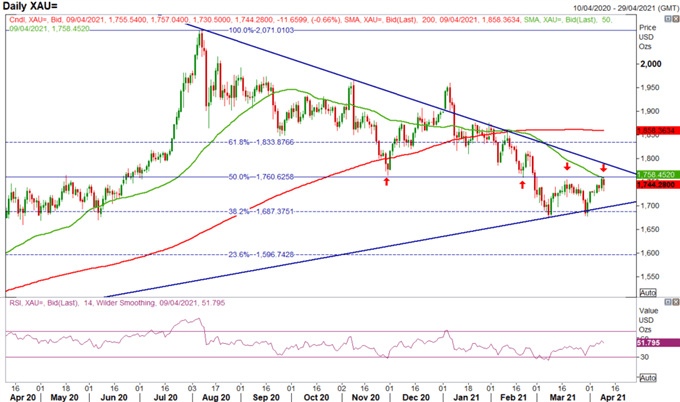

Despite edging lower towards the backend of the week, price action in gold had been somewhat encouraging with the precious metal attempting to form a double bottom. A culmination of a softer USD and US yields had in large part underpinned gold prices, however, the key area at $1760-65 has continued to cap rallies and thus keeps risks tilting lower.

As we look towards next week, the main focus will be on the US CPI reading, which will be a key factor as to whether gold prices managed to break resistance or head back towards $1700. Taking a look at last months reading, which saw the headline CPI rate in line with expectations, the core reading had been slightly softer however. In turn, the initial reaction in gold was higher, on the basis that US yields edged lower. Alongside this, given that the market remain fixated that a spike in inflation is coming, should we see a slight disappointment in the figure, this is likely to give good grounds for a breach of $1760-65, my thought behind this is that yields have been the largest determinant for the precious metal. The chart below highlights the relationship between gold and real yields (inverted).

Recommended by Justin McQueen

Download our fresh Q2 Gold Forecast

US Real Yields Are Still the Best Guide for Gold Direction

Source: Refinitiv

Gold Levels to Watch

The main area to focus on is $1760-65, in which a move lower in US yields would be needed to help gold break this resistance. Should this area be broken, this paves the way for a move to 1790-1800. While on the flip side, a close below $1670 would likely invalidate the potential recovery and open the doors to $1600.

Gold Chart: Daily Time Frame

Source: Refinitiv

| Change in | Longs | Shorts | OI |

| Daily | 3% | -16% | -2% |

| Weekly | 4% | 22% | 7% |

Be the first to comment