Gold Price Talking Points

The price of gold pulls back from a fresh yearly high ($1704) as global equity indices stage a rebound, but the ongoing threat posed by COVID-19 may keep the precious metal afloat as the outbreak continues to drag on the global supply chain.

Gold Price Pullback Fizzles Amid Bets for More Fed Rate Cuts

The recent pullback in the price of gold my prove to be short lived as the coronavirus shows no signs of slowing down, and the weakening outlook for global growth may continue to heighten the appeal of bullion as market participants look for an alternative to fiat currencies.

The emergency rate cut by the Federal Reserve suggests the global community of central banks will respond to the outbreak by implementing lower interest rates, and Chairman Jerome Powell and Co. may show a major shift in the forward guidance for monetary policy as the “Committee judged that the risks to the U.S. outlook have changed materially.”

As a result, the Summary of Economic Projections (SEP) are likely to reflect a lower trajectory for the benchmark interest rate as the Federal Open Market Committee (FOMC) pledges to “act as appropriate to support the economy,” and the central bank may ultimately implement a zero interest rate policy (ZIRP) in 2020 as President Donald Trump tweets that Chairman Powell and Co. “should get our Fed Rate down to the levels of our competitor nations.”

In turn, Fed Fund futures show 100% probability for another Fed rate cut on March 18, with market participants pricing a greater than 60% chance for a 75bp rate cut as the central bank alters the course for monetary policy.

With that said, the price of gold may continue to benefit from the low interest environment as market participants look for an alternative to fiat-currencies, and the broader outlook for bullion remains constructive as the reaction to the former-resistance zone around $1447 (38.2% expansion) to $1457 (100% expansion) helped to rule out the threat of a Head-and-Shoulders formation.

Recommended by David Song

Download the 1Q 2020 Forecast for Gold

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

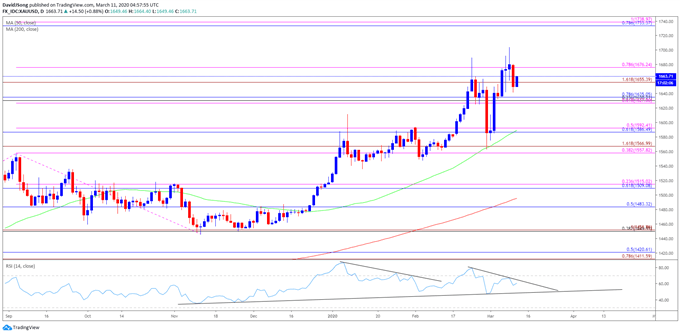

Gold Price Daily Chart

Source: Trading View

- The opening range for 2020 instilled a constructive outlook for the price of gold as the precious metal cleared the 2019 high ($1557), with the Relative Strength Index (RSI) pushing into overbought territory during the same period.

- A similar scenario materialized in February, with the price of gold marking the monthly low ($1548) during the first full week, while the RSI broke out of the bearish formation from earlier this year to push back into overbought territory.

- In turn, the monthly opening range for March may highlight a similar dynamic as gold climbs to a fresh yearly high ($1704), and the recent pullback may prove to be short lived as the price of bullion struggles to extend the recent series of lower highs and lows.

- Lack of momentum to break/close below the Fibonacci overlap around $1627 (61.8% expansion) to $1635 (78.6% retracement) may push the price of gold back above the $1676 (78.6% expansion) region, with the next area of interest coming in around $1733 (78/6% retracement) to $1739 (100% expansion).

- Will keep a close eye on the RSI as it appears to be in a similar scenario to earlier this year, with a break of the bearish formation likely to trigger another overbought signal.

Recommended by David Song

Traits of Successful Traders

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment