Gold, XAU/USD, Crude Oil, OPEC Report, Biden Stimulus Package – Talking Points:

- Gold and crude oil prices cautiously weakened as the US Dollar climbed

- XAU/USD at risk to reports Joe Biden eying USD 2 trillion stimulus relief

- WTI eyeing OPEC monthly report after some concern about oversupply

Recommended by Daniel Dubrovsky

Check out our fresh outlook for gold in the first quarter!

Anti-fiat gold prices slightly weakened over the past 24 hours as the US Dollar climbed. Falling longer-dated Treasury yields helped keep losses in the anti-fiat yellow metal from deepening following a 30-year government bond auction. Growth-linked crude oil prices pulled back cautiously. This followed commentary from OPEC Secretary General Mohammad Sanusi Barkindo, who said that oil stocks are ‘stubbornly high’.

During Thursday’s Asia Pacific trading session, XAU/USD extended losses after reports crossed the wires from CNN that Joe Biden’s advisors told allies in Congress that another relief package could be about USD 2 trillion. This is much higher than what Senate Minority Leader Chuck Schumer is hoping for, who pushed for more than 1.3 trillion during Wednesday’s Wall Street trading session.

In response, Treasury yields on the longer-dated end soared as the US Dollar received a bid. This weighed on gold prices, and may continue doing so in the near-term amid larger-than-expected stimulus prospects. The package would of course have to pass in the Senate, where Democrats would only have a very narrow majority due to the 50-50 split with Vice President-elect Kamala Harris acting as the tie-breaking vote.

This may also bode well for crude oil prices over the remaining 24 hours. However, do keep an eye out for OPEC’s monthly outlook report, especially after the ominous warning from Barkindo noted earlier. Concerns about oversupply, also in the context of Saudi Arabia unexpectedly planning to decrease output, may work against energy prices. This is as the world’s largest economy remains in battle with elevated Covid cases.

Recommended by Daniel Dubrovsky

What are the top trading opportunities this year?

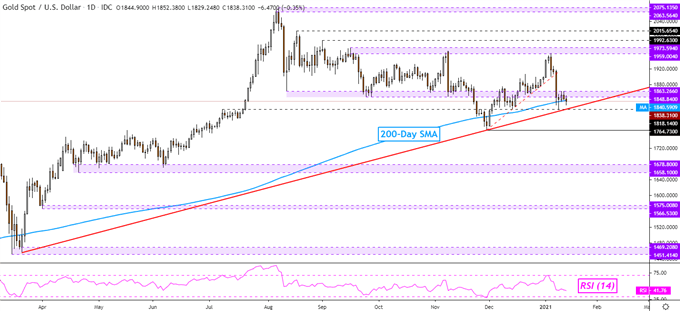

Gold Technical Analysis

Gold prices are coming up on a key zone of support following recent losses. These are a combination of the 200-day Simple Moving Average (SMA), the rising trendline from March and the 1818 inflection point from June. This trifecta could be a critical point for XAU/USD, as a break under exposes the November low for a chance to resume last year’s top – see chart below.

XAU/USD Daily Chart

Chart Created Using TradingView

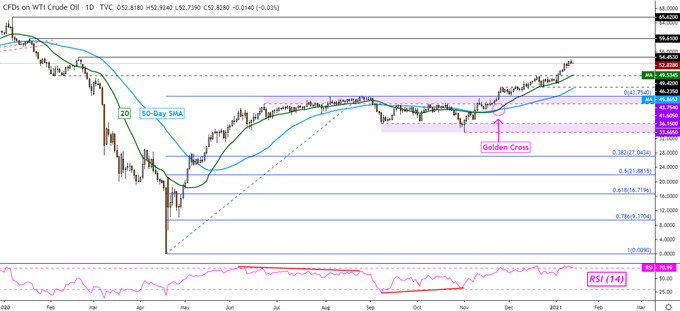

Crude Oil Technical Analysis

WTI crude oil prices sit just shy off February 2020 highs after pushing above 49.42, as expected. I highlighted the latter as a key inflection point earlier. A bullish ‘Golden Cross’ is also underpinning the case to the upside after the 20-day SMA crossed above the 50-day one back in November. Climbing above 54.45 exposes the January 20, 2020 high.

Recommended by Daniel Dubrovsky

Where might crude oil prices go in the first quarter!

WTI Crude Oil Daily Chart

Chart Created Using TradingView

— Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter

Be the first to comment