Gold Price Forecast:

Gold Price Breakout on Hold as Yields Rise, GLD ETF Clocks Outflows

Gold’s price reversal was put on pause early this week as rising Treasury yields worked to undermine the recent breakout above resistance. Recent price action has established an encouraging technical backdrop for the precious metal after a double bottom formation gave way to a quick surge above resistance at $1,765. Now with resistance behind it, gold can take aim at the $1,800 mark with prior barriers offering potential support moving forward.

Gold Price Chart: Daily Time Frame (June 2020 – April 2021)

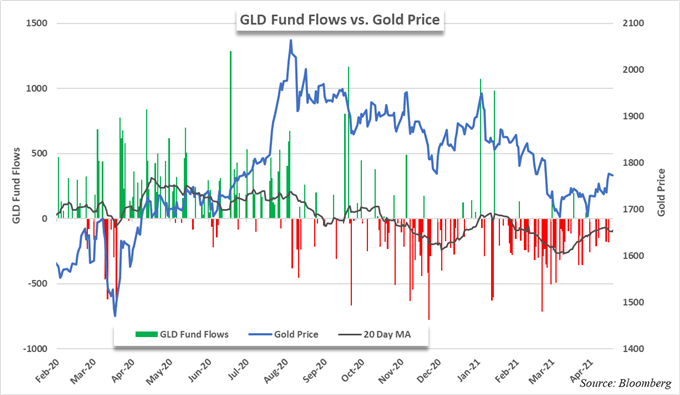

That said, a gold price rally is far from certain and risks remain. US Treasury yields remain the paramount concern for gold bulls as even a slight uptick in yields can work to undermine XAU/USD. Aside from the risk of rising Treasury yields, fund flow data reveals investors continue to reduce their exposure to the gold-tracking GLD exchange traded fund even as price has begun to turn higher.

Gold Price Chart & GLD ETF Flows

The GLD fund has seen persistent withdrawals since August when gold prices peaked and while recent gains have seen outflows slow, investors continue to yank capital from the fund. In the year-to-date alone, the GLD ETF has recorded net outflows of more than $8.4 billion. With that in mind, it could be argued many investors see recent price action as a brief respite for gold rather than a longer-term change in trend.

Recommended by Peter Hanks

Get Your Free Gold Forecast

Either way, the technical outlook for gold is the most encouraging it has been for months and shorter-term traders can look to explore range trading strategies in the precious metal as a result. With price on the precipice of a larger breakout, traders should look for prior resistance around $1,765 to successfully serve as support before further gains can be established. In the meantime, follow @PeterHanksFX on Twitter for updates and analysis.

–Written by Peter Hanks, Strategist for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Be the first to comment