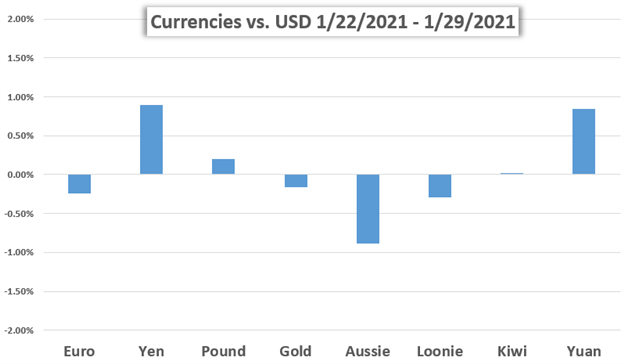

Markets gyrated wildly this past week as traders reacted to a barrage of headlines ranging from central bank commentary and high-impact economic data releases to big tech earnings and GameStop stock price volatility. Global PMI data was fairly mixed with economic activity in the US shining most bright and lockdown-burdened UK posting a deeper contraction. GBP/USD eked out a modest 0.12% gain week-on-week nonetheless.

The US Dollar strengthened more broadly, however, as USD/JPY spiked 0.94% higher and EUR/USD stumbled -0.31% lower. ECB official Klaas Knot jawboned the Euro lower by flirting with the idea of another interest rate cut and Fed Chair Jerome Powell reiterated how the FOMC intends on keeping monetary policy highly accommodative.

Recommended by Rich Dvorak

Get Your Free Top Trading Opportunities Forecast

Major equity indices like the Nasdaq faced selling pressure despite better-than-expected earnings from Apple and Microsoft. Investors seemingly turned skittish and laid off risk after brokerages and clearinghouses intervened to curb collateral impact from GameStop mania.

The VIX ‘fear-gauge’ spiked above the 30-handle as S&P 500 Index sank -3.31% on the week. Bitcoin advanced 3.80% and snapped the crypto’s two-week stretch of weakness. Across the commodity complex, silver prices surged 5.31% while gold and crude oil lacked direction.

Looking to the week ahead, markets could be in store for more volatility. Scheduled event risk on the DailyFX Economic Calendar highlights upcoming interest rate decisions from the Reserve Bank of Australia and Bank of England, the release of Eurozone GDP data, as well as employment reports out of New Zealand, Canada, and the United States.

Recommended by Rich Dvorak

Trading Forex News: The Strategy

Furthermore, traders will likely keep an eye out for stimulus headlines with democrat-controlled congress set to take up President Biden’s $1.9-trillion fiscal aid package. Earnings reports from Pfizer, Google-parent Alphabet, and Amazon are also on tap to cross market wires next week. That all said, with month-end flows in the rearview mirror, liquidity conditions and trader sentiment stand out as two key drivers of where markets might head next. What else are our analysts expecting in the week ahead?

FUNDAMENTAL FORECASTS

Euro Forecast: EUR/USD to Shrug Off Any Hints of an ECB Interest Rate Cut

Nobody is seriously expecting the ECB to cut Eurozone interest rates any time soon. It appears keen to persuade the markets that a reduction is possible but there’s little chance EUR/USD will react.

Stock Market Forecast for the Week Ahead: Will the Mania Continue?

US indices were thrown into disarray last week as an army of retail traders poured into stocks with heavy short interest like GameStop. What makes for an intriguing story is also immensely risky for the investors involved and will likely end in tears.

US Dollar Forecast: Where to After GameStop Short-Squeeze Rattled Markets?

The US Dollar may remain in a consolidative state as fundamental risks, such as fiscal stimulus bets, non-farm payrolls and “short-squeezing”, threaten broader stock market sentiment.

British Pound Outlook: Bank of England and Covid-19 will Drive GBP Price Action

The latest Bank of England (BoE) monetary policy decision will be the main focus for Sterling traders, but covid-19 stats and the EU/UK vaccination dust-up will also move GBP next week.

Crude Oil Forecast: Backwardation Hints at Gains with OPEC JMMC on Tap

Crude oil prices may continue to push higher ahead of OPEC’s JMMC meeting, on the back of futures curve backwardation, vaccination progress and a notable decline in global cases of Covid-19.

Gold Price Forecast: Is Gold at Risk From a US Dollar Turning Point?

Gold prices consolidating, however, US Dollar may present a risk.

AUD/USD Rate Outlook Hinges on February 2021 RBA Rate Decision

The Reserve Bank of Australia (RBA) interest rate decision may fuel the recent rebound in AUD/USD if the central bank retains the current course for monetary policy.

TECHNICAL FORECASTS

US Dollar Technical Forecast: DXY, EUR/USD, GBP/USD, AUD/USD

The broader US Dollar Index rebounded 0.71% last month amid rising volatility and fading EUR/USD strength. GBP/USD looks primed for a break and AUD/USD is contending with support.

Dow Jones Forecast: Will There be Another 10 Percent Price Drop?

The Dow Jones entered a technical correction after breaking the “Ascending Channel” formed since early November. MACD divergence points to bearish momentum that may lead to a deeper pullback.

Pound Technical Outlook: GBP/USD, Short & Medium-term Charts to Watch

GBP/USD has been trending higher in choppy fashion; channel and wedge formations to keep an eye on for further cues.

Mexican Peso Forecast: Bears Lose Control as USD/MXN Threatens to Break Above Key Resistance

USD/MXN is attempting to break above a descending trendline as buyers gain momentum.

AUD/USD, AUD/CAD Key Chart Patterns. Are Breakdowns Looming?

The Australian Dollar has formed bearish technical setups against its US and Canadian counterparts, with prices potentially setting up for significant breakdowns.

Gold, Silver Price Forecast: Silver Bid, Gold/Silver Ratio Breaks Down

Gold has continued to digest for much of the past six months, but this week saw Silver bulls show up in a very pronounced manner.

US DOLLAR WEEKLY PERFORMANCE AGAINST CURRENCIES & GOLD

Recommended by Rich Dvorak

Download your free guide on the basics of forex trading!

Be the first to comment