peterschreiber.media/iStock via Getty Images

Article Thesis

In this article, I’ll present a pair trade idea of going long Alibaba (NYSE:BABA) while shorting Amazon (NASDAQ:AMZN). I do believe that there is a high likelihood that Alibaba will outperform Amazon in the foreseeable future, due to a range of reasons. Alibaba is less impacted by inflation, benefits from a stronger consumer in China, trades at a way lower valuation, and Alibaba’s cash returns to shareholders are more meaningful as well.

The Inflation Impact On BABA And AMZN

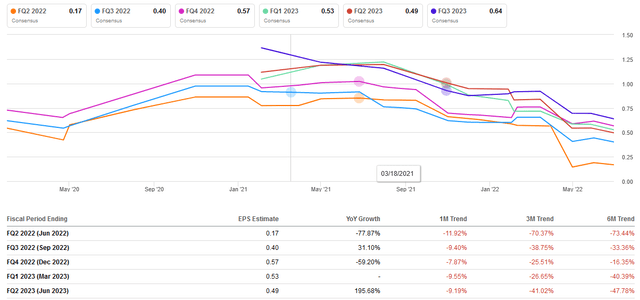

Earnings estimates for Amazon have dropped dramatically in recent months, as can be seen in the following chart from Seeking Alpha:

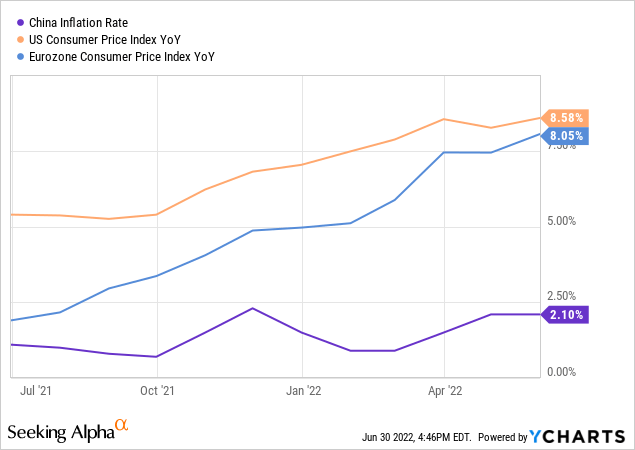

Earnings per share estimates for the current quarter have dropped more than 70% over the last three months, while EPS estimates for the following four quarters also dropped by 25% to 40%. A huge factor for that is the impact of inflation Amazon is currently dealing with. Since the company handles logistics itself, it is heavily impacted by higher fees for seaborne transportation and trucking. Higher wages due to employees demanding inflation compensation also lead to higher expenses at Amazon. This was already visible in the company’s Q1 results, with operating income dropping more than 50% year over year due to these cost pressures. Alibaba is way more insulated from inflation, due to two core reasons. First, it does not handle logistics itself and has fewer employees. Due to it being a platform provider, it does not have to pay more for shipping or storage and is not impacted by higher diesel prices, and so on. Second, inflation is much less of a problem in China versus the US and Europe, Amazon’s two biggest markets:

With inflation in China running at a steady 2% rate, whereas inflation in Europe and the US has exploded towards more than 8%, cost pressures naturally are way less pronounced for Alibaba. With the combination of lower inflationary pressures overall, and a more insulated, inflation-proof business model, Alibaba is poised to handle inflation way better than Amazon.

The Chinese Consumer Versus The American Consumer

Both companies do not operate in one market only, but both companies are highly dependent on one single market. In BABA’s case, that’s China, whereas Amazon is heavily exposed to the US market despite being active in many other countries on top of that. American consumers have, on average, more income and more spending power than Chinese consumers. But that is easily outweighed by the fact that there are many more Chinese consumers than US-based ones. And, importantly, the rate of change is highly in favor of the Chinese consumer market. China’s middle class has added several hundred million in recent years, and personal income and average wealth are growing rapidly in China.

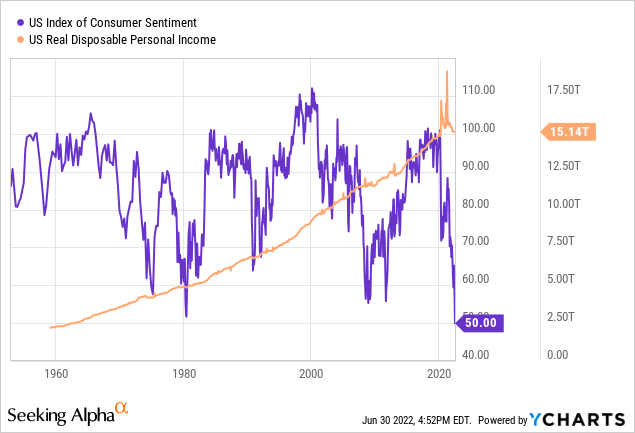

Due to high inflation rates, costly energy, and weak economic growth (Q1 GDP growth was negative, and Q2 GDP growth might also be negative according to GDPNow estimates), the US consumer is not in a good position right now. On top of that, a rapid rise in mortgage rates further pressures disposable income. The combination of these factors has led to a massive crash in US consumer sentiment, down below levels seen during the Great Recession and the pandemic:

In fact, US consumer sentiment is comparably weak to levels seen during the high-inflation environment in the early 1980s. Real disposable income has also waned in recent quarters, as fiscal stimulus has been pulled back and since inflation is taking a toll on Americans’ spending power. In that environment, a company that primarily sells discretionary consumer goods will not do too well, which is why Amazon is facing considerable demand headwinds this year.

With inflation being less of a problem in China, and with mortgage rates not rising as much there, the Chinese consumer is in a better position right now. Combined with the already higher GDP growth in China, this means that Alibaba is exposed to a stronger consumer story for now, which should be a tailwind for the company. During the most recent quarter, real revenue growth, i.e. adjusted for the rate of inflation in the two countries, was stronger for Alibaba, compared to Amazon. The same could hold true in the remainder of the year, especially with Alibaba likely benefitting from reopening tailwinds in China as lockdowns in Shanghai and other cities are being eased.

Alibaba’s And Amazon’s Valuation

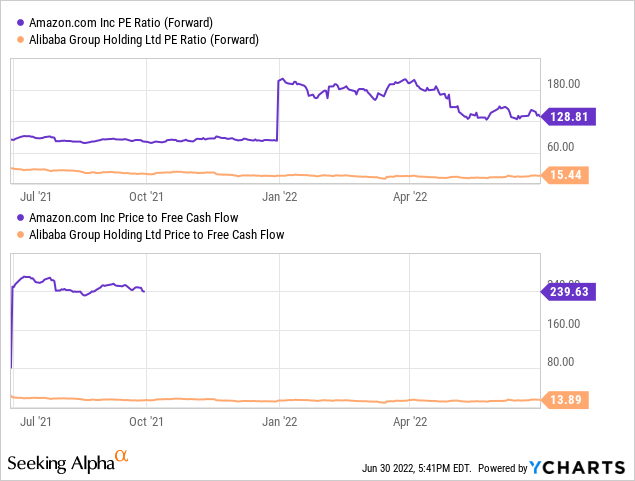

Everything has its price, and in Amazon’s case, that price is massively higher than what one has to pay for Alibaba.

Amazon is trading for 130x this year’s profit right now, while BABA is trading at around one-eighth of that, or 15x net profits. In other words, Amazon is trading with an earnings yield of less than 0.8%, while BABA’s owners get an earnings yield of around 6.5%. Amazon investors sometimes argue that the company’s depreciation charges mask underlying cash generation power, but when we look at the price to FCF ratio instead of the price to earnings ratio, the comparison is even worse. BABA trades with a 14x free cash flow multiple, while Amazon last traded with a free cash flow multiple of more than 200 when it was able to generate positive free cash flow at all. In recent quarters, that was not the case any longer, as Amazon reported a free cash outflow of $18 billion for the last four quarters.

There are reasons why BABA shouldn’t trade at an ultra-high valuation, such as its exposure to political and regulatory risks in China. But when Alibaba, which produces more than $22 billion in free cash a year is valued at just $310 billion, while Amazon, which burned $18 billion over the last year is valued at more than $1 trillion, that should give investors pause. From a valuation perspective, BABA has considerable upside potential, while Amazon could have considerable downside potential. A rise in BABA’s free cash flow multiple to 18, which wouldn’t be high, would allow for returns of around 30% from current levels, for example.

Alibaba’s Shareholder Returns Are More Attractive

Alibaba is generating way more cash than Amazon, which is actually burning it. This gives Alibaba the ability to return more cash to its owners relative to the size of the company. Alibaba currently is utilizing a share repurchase program worth $25 billion, which covers around 8% of the company’s market capitalization. With free cash flow standing at $22 billion over the last four quarters, Alibaba could use up this authorization rather quickly, which would result in a major decline in its share count.

Amazon is currently operating with a $10 billion share repurchase program. That’s less than 1% of the company’s market capitalization, thus even when fully utilized, it would only create a small dent in the company’s share count. On top of that, due to negative free cash flow, it seems doubtful whether Amazon will really push through this program, which would weaken its balance sheet further.

BABA’s buyback program should be way more accretive from an earnings per share and free cash flow per share perspective, as it will reduce the share count more meaningfully. On top of that, its stronger buyback pace could help put a floor under its share price going forward. Amazon, with its comparatively small buyback program, will likely not benefit from such a “floor effect”.

Risks To Consider

From a cost pressure, consumer strength, valuation, and shareholder return perspective, BABA seems poised to outperform AMZN going forward. That being said, politics is a risk to consider when going long Alibaba. I do not believe that it is in China’s best interest to hurt its tech players too much, but regulators could still employ rules that hurt Alibaba’s profitability. At the current valuation, that seems to be accounted for to some degree, but investors should keep an eye on this risk factor nevertheless.

For those investors that consider shorting Amazon, it is important to note that shorting always comes with risk. If Amazon were to roll out a new feature that is highly attractive or make a great acquisition, that could lead to a share price increase. If equity markets recover from their recent drop, Amazon would likely rise as well, thereby leading to losses for those that shorted it. If Amazon’s AWS were to experience accelerating growth, that could also lead to a rising share price. Since companies are likely not investing heavily in the current recession-prone environment, I do not believe that AWS growth will be overly strong in the coming quarters, however.

Amazon is not a widely-shorted stock, thus borrowing shares is rather easy. Short interest is around 1.2% according to Seeking Alpha, and according to my broker, the borrowing fee is less than 0.3% right now.

Takeaway

I do believe that there is a high likelihood for Alibaba to outperform Amazon in the foreseeable future. Its valuation is way more attractive, and inflation and a potential recession in the US and Europe are way more of a headwind for Amazon compared to Alibaba, which is pretty insulated from those macro risks. Combine this with Alibaba’s hefty buyback program that should support its shares, and I don’t see good reasons for Amazon performing as good as, or better than, Alibaba. That being said, every trade and investment comes with risks, and this trade surely isn’t fool-proof, so one’s personal risk tolerance and investment approach have to be accounted for.

Be the first to comment