General Motors Announces It’s Building A New Electric Vehicle Battery Plant In Lansing, Michigan Bill Pugliano/Getty Images News

Credit General Motors Co. (NYSE:GM) for indomitable confidence as reflected by its aggressive all-BEV strategy and bullish financial projections – in the face of rising mineral costs for batteries and unpredictable consumer response that have increased the uncertainty and timing for potential BEV profitability.

GM’s board of directors and senior management surely grasp the inherent risk of committing so much of the corporation’s resources to a comprehensive conversion from internal combustion engines to BEVs over the next decade. The decision to push forward reflects GM’s belief that consumers and businesses will flock to new BEV models like the Chevrolet Equinox and BrightDrop’s commercial electric delivery vans in large enough numbers to justify GM’s investment through 2035.

FedEx has committed to buy GM BEVs (GM)

Major commitment

GM has earmarked an investment of $35 billion toward BEVs through 2035, at which point it intends to be an all-electric company. This sum, for the sake of perspective, represents nearly two-thirds of the company’s current market capitalization of roughly $56 billion and is based on the assumption that the U.S. – GM’s most important market – will be rapidly transitioning from ICE to BEVs over the next decade.

As GM phases in key BEV products like the Chevy Silverado electric pickup and battery-powered versions of Chevy Blazer, Chevy Equinox, and new models like the Cadillac Lyriq, the automaker will de-emphasize its gasoline models. All of which assumes that customers will respond positively to the new BEV models – as opposed to, for example, hanging on longer to aging gasoline vehicles or, to suggest another example, selecting non-GM models that are gas-electric hybrids or use pure ICE technology.

A key business issue for GM is whether it can sell its BEVs in large enough volumes and at high enough prices to generate a return to investors. Hence, the assertion of CEO Mary Barra at GM’s mid-November investor day that GM will be selling BEVs at the rate of a million annually by 2025 and that the new class of vehicles will be as profitable as GM’s ICE models.

Crosstown rivals

GM and Ford Motor Co. (F) are embroiled in a Detroit-centric intramural competition to see which of the two largest U.S. automakers will be first to be successfully all-BEV. An announcement from GM describing how all-encompassing and quickly its new BEV models will come to market (and how quickly its new U.S.-based battery plants will open) is customarily followed by a similar announcement from Ford – and vice versa.

GM and Ford are disproportionately dependent, from a profitability perspective, on full-size, gasoline-powered pickup trucks, whose architectures also support large and profitable SUVs. Both have developed battery versions – the recently introduced Ford F150 Lightning and GM’s soon-to-be introduced Chevy Silverado EV. Whether the models will sell in great enough numbers and at high enough prices to match the profitability of the current models is an open question, and likely the critical assumption on which both automakers’ BEV strategy rests.

But these pickups give the incumbents an advantage over startups, which don’t have the cash flow from existing models, to smooth the transition to electric.

CEO Mary Barra at GM Investor Day (GM)

On Nov. 17, GM executives told investors “that the combination of government incentives for U.S. battery-making facilities and revisions made to the EV tax credit for buyers (under the Inflation Reduction Act) would help boost its margins in the coming years.” GM is assuming that it can drive down the cost of the battery and that it can reduce the cost of distributing BEVs by using regional centers – instead of dealers – to hold inventory. GM says retail customers can more easily – and cost-effectively – shop and arrange delivery for BEVs online using the automaker’s digital portal.

GM told The Wall Street Journal “it expects operating-profit margins in North America-the region that generates the bulk of its profit today-would remain in the 8%-to-10% range over the next several years, even as it increases capital investment to pave the way for a broader lineup of EVs.”

Alternate views

Other global automakers, notably Toyota Motor Corp. (TM), aren’t so sure the consumer uptake of BEVs in the U.S. will be as swift as GM assumes, nor will battery and other costs result in a profitable business in the short term. Toyota is pursuing an incremental approach to battery electrification, having introduced one BEV, the bZ4X, with plans for an SUV. The Japanese automaker, which argues that its gas-electric hybrid models play a major role in reducing CO2, says it plans to be “carbon-neutral” as a corporation by 2050.

Likewise, Hyundai Motor Co. (OTCPK:HYMLF) is hedging its transition to BEVs with a strategy that emphasizes models employing gas-electric hybrid powertrains. The Hyundai group, which includes Kia and Genesis brands, is the No. 2 seller of BEVs behind Tesla (TSLA).

Jose Munoz, CEO of Hyundai and Genesis in North America, said at the Los Angeles Auto Show earlier in November “based on the information we get from our customers, not all are ready to transition to an EV in just one shot.” By moving from ICE models to hybrids, Munoz said, customers are getting closer to buying a battery-powered vehicle.

Munoz said that Hyundai was disappointed by the Inflation Reduction Act, which contains a welter of restrictions and qualifying rules about the local content of minerals for batteries that served to exclude Hyundai from a $7,500 federal incentive for BEV buyers. The automaker had pledged to invest $10 billion for battery-related projects through 2025, presumably on the assumption that its BEVs would qualify.

Government counts

The point here is that federal and state rules governing the sale of vehicles – not to mention the fickleness of consumers – are critical to the business case for any technological transition, including when introducing BEVs to a public that seems pretty satisfied with fossil fuel-powered vehicles. That’s one reason why Toyota is exercising caution, choosing to keep its powder reasonably dry until consumer demand or new legislation forces the company to accelerate its BEV output.

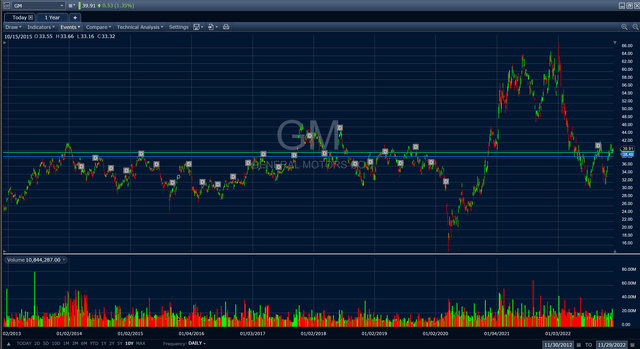

Price chart for GM shares since 2012 (Fidelity Active Trader Pro)

GM is pursuing a somewhat riskier strategy than Toyota with regard to BEV production in the U.S., the world’s most profitable vehicle market. Other than a COVID-era run-up in share price and return to form, including the resumption of a small cash dividend, GM shares have done little since its 2010 post-bankruptcy initial public offering.

Accordingly, I remain cautious on GM shares until the company’s assumptions about profitability and the sale of 1 million BEVs in 2025 come to fruition.

Be the first to comment