Black_Kira/iStock via Getty Images

While the current general market weakness has brought many companies down this year, it brings opportunities to purchase companies whose stock prices has fallen but fundamentals have actually improved. One such company is Globant S.A. (NYSE:GLOB) as elaborated in my article below.

Investment thesis

The investment case for Globant is as follows:

- As a technology service provider based in Latin America, the company is in the center of the digital transformation story and is able to leverage on very strong tailwinds like spending on artificial intelligence, virtual reality, block chain and other emerging technologies as its customers look to reinvent and adapt their business models to the changing world.

- In addition, I think the growth strategy communicated by management is rather clear. Apart from landing new customers as well as expanding business with its existing client base, the company is focused on innovation in its offerings to be able to offer customers solutions and services to adapt their own business models to the newest technologies. As such, Globant’s focus on developing new innovative offerings as well as strategic acquisitions to complement its offerings is, in my view, the right strategy going forward.

- Globant has attracted a group of large customer base and grew strong relationships with these clients, as evident from the growing spend of the company’s top clients.

Overview

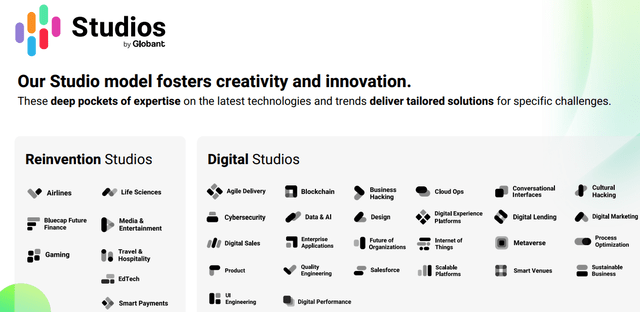

Globant was established in 2003, slightly less than 20 years ago and has since grown to become a global technology services provider. It has the engineering and technical capabilities of an IT services provider and also the design as well as innovation capabilities of a digital agency. The company helps bring digital business transformation to its customers by re-evaluating their business models to ensure future success by adapting to the changing times. The company delivers its services through its studio model, where it effectively organizes the company into individual smaller units to cater to the different and unique needs of different industries to provide more customized solutions for customers.

It has two studios. First, the reinvention studios comprise of individual units that provide some form of value add to industries to adapt their business models, technologies or operations to be more competitive. For example, it has a reinvention studio for airlines, which serves to use digital technologies and innovation to improve the customers experience. The portfolio of services that are include services to help airlines improve revenue management through machine learning (“ML”) or to ensure more connected airlines operations through use of artificial intelligence (“AI”) to have more seamless communications between the ground and crew staff.

Second, it has digital studios, which helps to bring the newest technologies and biggest trends to its customers to ensure that its customers are always ahead in their digital business transformation journey and hence, have robust business models to compete in the future. This includes things like its blockchain services that helps its customers to drive decentralized solutions, as well as conversational interface solutions which enables companies to offer a more human communication with their own customers to improve the customer experience. The image below shows some of the offerings within its reinvention and digital studios.

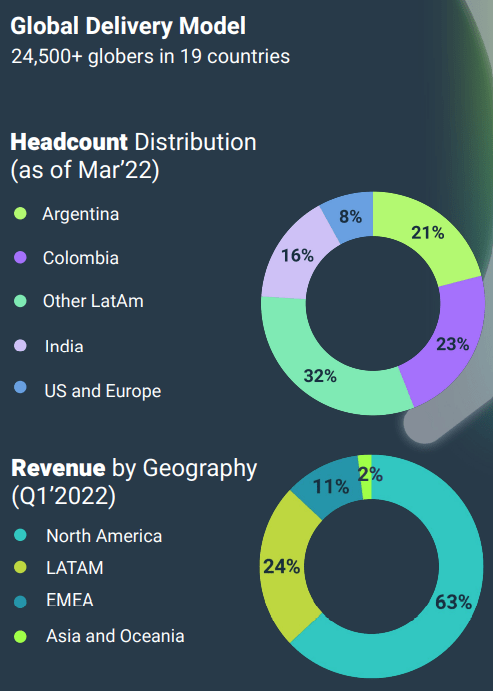

In terms of geographies, most of Globant’s workforce is located in Latin America, with almost 76% of its headcount in the region. That said, in terms of revenues, Latin America only makes up 24% of its revenues, while the bulk of its revenues come from the North America region. Together, these two regions makes up 87% of its total revenues.

Globant revenue and headcount mix (1Q22 slides)

Huge, growing market opportunity

I think one of the biggest themes favorable to Globant is the acceptance by organizations about the need for a digital transformation strategy. This was accelerated by the covid-19 pandemic.

According to IDC, about 85% of enterprises will:

“combine human expertise with artificial intelligence (“AI”), machine learning (“ML”), natural language processing and pattern recognition to augment foresight across the organization by 2026, making workers 25% more productive and effective.”

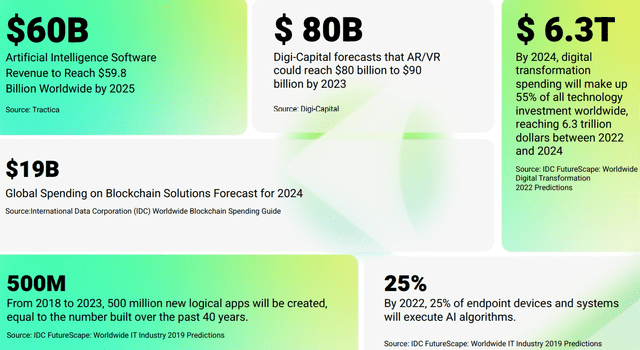

Also according to IDC, almost 55% of all global technology investment will be digital transformation spending by 2024.

Below are some of the relevant market sizes as well as drivers for Globant in the near future, which shows the huge opportunity the company has before it.

Future growth drivers (1Q22 slides)

The right strategy for the future

As mentioned earlier, Globant has a strong ability to not just grow its new customer base but also grow its current existing accounts. This is part of its main strategy to grow the revenues that comes from existing clients by cross-selling its studios while reaching further out to acquire new clients. Thus, Globant will focus on leveraging on current relationships to go deeper and introduce more services and functionalities to these current clients, while trying to showcase to new potential clients what the company’s offerings and technology has done for its current client base.

At the same time, it is important for Globant to be ahead of its competitors in terms of the technology offerings so that it can not just offer a comprehensive digital transformation, but also the most innovative and most technological one. Innovation in new features will open new markets and improve cross-selling abilities to capture more incremental revenues for the company and drive long term growth. This development of new innovative products and platforms is accelerated by Globant X, which is an incubator launched by the company to bring to market new technologies and platforms to generate revenues.

Apart from doing so organically, the company also can do so through strategic acquisitions. Globant has a decent track record in acquiring and integrating companies with innovative technologies that are complementary to the current product portfolio. As shown below, Globant has made several strategic acquisitions to supplement and complement its existing portfolio of products and services.

List of strategic acquisitions made (1Q22 slides)

All these innovation will ensure that Globant is able to maintain its competitive advantage in having very deep expertise in relevant emerging technologies. This is key because Globant’s competitive advantage in having these deep expertise that competitors do not have can then be applied to customers in a very quick manner to facilitate customers to adapt their business models rapidly.

Ability to attract and grow large customers

I think one of the competitive advantages Globant has is its ability to attract large clients, grow a long term relationship with them and eventually increase the size of these accounts.

These are some of the clients that Globant has attracted over the years, which includes companies like Coca-Cola (KO) and Unilever (UL). It is worth noting that Globant has had more than a decade of experience working with both Disney (DIS) and Electronic Arts (EA). I think that this huge client base that the company has amassed over time is one of its key competitive advantages as it has access to the budgets of these large, global companies and brings further opportunity to attract more within these industries as well when the solutions show results.

Globant customers (1Q22 slides)

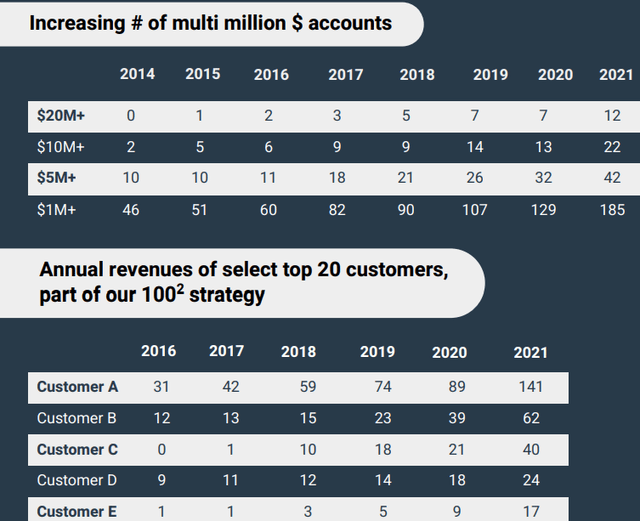

Next, I think this competitive advantage is further cemented by the company’s ability to grow these large accounts that it has landed. Globant has a 100-squared strategy, where it has a strategic focus on the accounts of 100 customers with the potential to reach $100 million in revenues. As we can see below, there is an increasing number of multi-million dollar accounts, as the number of accounts with more than $10 million in revenues grew from 2 in 2014 to 34 in 2021. Furthermore, it already has one client with more than $100 million in revenues, which shows that its 100-squared strategy is at the early stages of showing success.

Ability to grow and cross-sell (1Q22)

As disclosed, Walt Disney is Globant’s largest customer, accounting for 11% of revenues in 2021. In addition, almost 92% of the company’s total revenues for 2021 was from existing clients who have been with Globant in the prior year, which shows the relative stickiness of Globant’s offerings.

Valuation

Based on the track record of Globant as well as its solid results despite general market weakness, I think that the company deserves a higher multiple than its other pure play digital services peers. Also, I am of the view that Globant will continue to grow faster than the industry average for digital services companies and thus, there should be an acceptable premium applied to Globant in its multiples. As such, I assume a 2024F P/E of 40x, within the range of 30x to 45x forward P/E applied to comparable companies. Based on my 2024F EPS of $8.10 and assuming a discount rate of 13.1%, my target price for Globant is $287, implying a 55% upside from current levels.

Risks

Geopolitical risks

As Globant has significant operations in Latin America, the company is therefore subject to greater political, tax and economic risks than developed markets. Any such development may adversely affect the company and its prospects.

Talent risks

As the company requires professionals with deep technological expertise in AI and ML to provide these offerings to customers as well as to innovate, there is the risk that the company is unable to attract the best professional talent it needs or that the company is unable to retain these talent.

Key client risk

There is the risk that its top client, Walt Disney, which makes up 11% of revenues, may terminate Globant services and this may have a huge impact on the company given the significant revenue contribution of Walt Disney.

Competition

The market segment of technology and IT services is a competitive one and remains rather fragmented and the company also expects competition to be intense. According to management, this competition will come from “large global consulting and outsourcing firms, digital agencies and design firms, traditional technology outsourcing providers, and the in-house product development departments of Globant’s clients and potential clients.”

M&A integration risk

As strategic acquisitions are one of the company’s ways to grow, there is a risk of lack of proper integration after the M&A, leading to inefficiencies or synergies that are not reaped.

Conclusion

Globant is one of the Latin America technology service providers that is likely to outperform in the near term. This is due to the fact that the company is operating in a fast growing industry segment that has several industry tailwinds which will continue to persist even after the covid-19 pandemic.

Furthermore, I think that the company is executing a great growth strategy and we will likely see more new large customers and also over time, see evidence of the company’s ability to cross-sell and upsell. There is also the aspect of its strategic acquisitions which in my view complements and strengthens the current portfolio of offerings Globant has.

Lastly, Globant has a large customer base and strong relationships with these customers, evident from the growing spend of the company’s top clients. As such, I initiate Globant with a “Buy” rating and my target price for Globant is $287, implying a 55% upside from current levels.

Be the first to comment