RHJ/iStock via Getty Images

Published on the Value Lab 27/6/22

Global X Uranium ETF (NYSEARCA:URA) is a good way to play a spot exposure on uranium and in turn to bet on nuclear energy. Nuclear energy has several advantages, including strategic ones, and the time may have finally come for nuclear to be given a more broad chance to make its low carbon contribution to our electricity system. With URA giving you decent spot exposure through Cameco Corporation (CCJ) as its main holding, and also benefiting from a lower expense ratio than with physical uranium trusts, we think it’s a decent investment at this point in time.

Strategic Uranium

Electricite De France (OTCPK:ECIFF) is one of Europe’s most known producers of nuclear energy, with 70% of French energy coming from nuclear sources. Much like with our vaunted investment in Dassault Aviation (OTCPK:DUAVF) which was highly integrated in an all-France defense supply chain with Thales (OTCPK:THLEF) and Safran (OTCPK:SAFRF), the purpose of EDF’s nuclear energy focus is to assure that France has energy security, which it indeed does. This has been a major boon for French households, where the reliability of nuclear energy compared to renewable peers has allowed for France to guarantee cheaper electricity to consumers without too much economic cost to EDF. This is partially because of the economics of nuclear power plants, which essentially only have fixed costs. Variable costs related to power production are almost negligible, to the extent where input cost inflation cannot really move the needle in the profits of nuclear energy assets. Nuclear energy is on the out in some geographies like Spain, as the current energy crisis is an opportunity to shore up energy security that can be affordable for consumers. This is also by not reverting to coal and oil and eschewing the green agenda, which has been necessary due to issues in acquiring Russian supply.

The Oil Issue

Independent of the discussion of climate change, some would ask why not release the oil taps, or at least wait for OPEC to finally give the world a break and release the taps to bring down prices despite the loss of Russian supply to the western trading bloc. Another reason why it might be an opportune moment for nuclear is that there’s actually not much capacity to spare by oil producers. Saudi Arabia are the biggest holdouts of capacity for the time being, and while they substantially move the needle, many countries are already at full capacity like Nigeria, and due to their assets falling into disrepair, those assets will actually start becoming unusable. Saudi Arabian capacity if fully released could increase oil on the market by about 3.5% sustainably, leaving only another 3.5% incoming from other OPEC countries, well 5% if you include Iran whose capacity is not necessarily ready for large export. While supply on the margins has a large impact on the price of oil, we are talking about small margins here, and this is all because of years of underinvestment in oil due to low prices but also in part due to the green agenda creating stranded asset risk.

If the decision is between engaging subsea companies and getting offshore installations going, or similarly incurring large costs to develop nuclear assets, the rational choice would be nuclear. It is low carbon, has manageable risks and also excellent capacity factors, blowing other renewable energy sources out of the water. Additionally, it allows for energy security as explained above, and its economics are favorable in an environment where input cost sensitivity is such a problem for many utility businesses.

The URA Bet

Betting on URA means betting on holdings that benefit with the price of uranium. Nuclear assets aren’t sensitive to the price of uranium, so as opposed to other commodities, elasticity is lessened, also due to the difficulty in transporting and storing uranium, as well as the value add required in its processing. But if you are a bull on nuclear, you can still expect the price of uranium to rise were it to become a more important input for energy production.

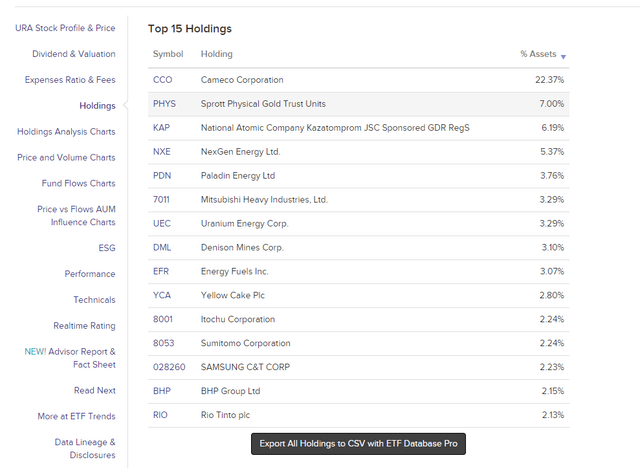

URA owns Cameco and then some other uranium miners.

It also owns some physical trusts. Down the list, all it has is some general commodity exposures and even total chemical and other industry conglomerates. But the needle here is moved by companies that have explicit spot price exposure to uranium. Despite the spot price exposure, investors benefit from a lower expense ratio of 0.69%, which while higher than most ETFs is much lower than the 1% paid for Sprott’s Physical Uranium Trust (OTCPK:SRUUF). Finally, URA offers a bit of a yield of 0.43%, which isn’t fantastic, but is because of exposure to some smaller cap companies that aren’t paying out dividends due to needing the cash for their own mine developments.

While there are obvious threats to the uranium thesis, most of which political but also freak incidents where there might be radiation accidents that could create more political antipathy, the downside should be fairly limited for this peculiar commodity. There is the risk of availability, however, that investors should consider, which is that 50% of uranium comes from Kazakhstan, which is very much within the Russian sphere of influence. The balance comes mostly from west-friendly nations, but still not all. Nonetheless, nuclear asset economics would not be effected much by the price due to all the costs being upfront for nuclear assets. So, the possibility that eastern supply becomes unavailable to the western bloc would only mean good things as far as uranium spot prices go. With low expense ratios, we think URA offers a good way to get that uranium exposure.

Be the first to comment