Deagreez

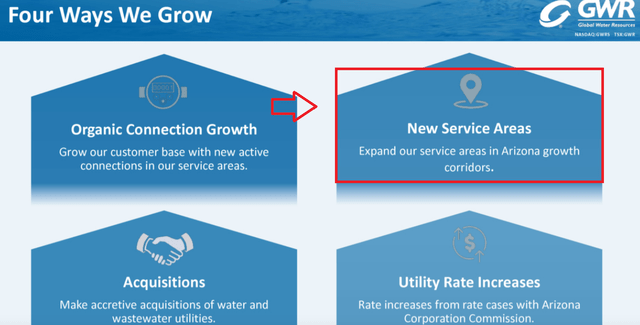

Global Water Resources (NASDAQ:GWRS) (TSX:GWR:CA), which offers water-related services, recently announced its expansion into the growth corridors of metropolitan Phoenix, Arizona, which will likely bring FCF margin increases. Considering the company’s access to collected data about the level of consumption and tanks available, in my view, efficiency could trend up in the coming years. Even considering risks from regulators and access to chemical supplies, I believe that there is an upside potential in the stock price.

Global Water Resources

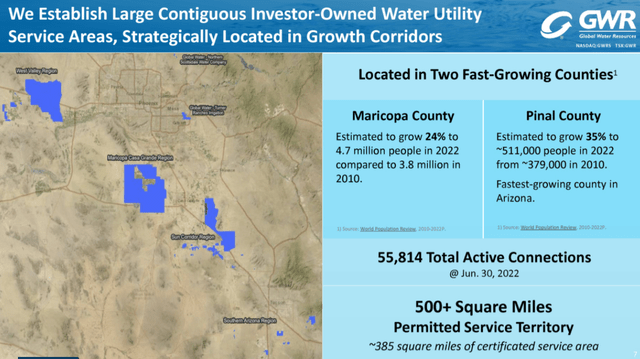

Founded in 2003, Global Water Resources has been part of the capital market since 2015. As of December 2020, the company already had more than 40k active installations in and around the city of Phoenix. These facilities have been growing year after year, currently positioning itself as the leading company in the water-related services market in the region.

Currently, Global Water Resources has 25 water and wastewater systems installed at strategic points in the city of Phoenix, serving more than 75,000 people in an area of 375 square miles. The amount of capex and property and equipment reported by Global Water Resources is significant.

Source: Investor Presentation

The company’s job is to cover the entire water cycle, mainly for homes and communities in the suburbs. Global Water Resources notes that growth corridors like Maricopa County and Pinal County could deliver double-digit growth in the coming years.

This work involves the circulation, purification, recycling, and channeling of residual water in a specific environment. For this, in general, it is necessary to carry out new pipe networks, involving large-scale and high-cost works.

Although they also work with installations for private homes, they commonly operate by being hired by a small community. This implies the elaboration of agreements and financing programs with different government entities such as mayors and communes. In my view, the accumulated know-how in negotiations with small communities is what will help the company enter new regions.

The company’s ethical program is considered one of the fundamental pillars of its work, which is why it offers information and training courses to the people included in its projects. This does not only involve the employees and the general population, but also reaches suppliers and partners as well as regulators and technical workers.

In this way, the company managed to combine, under the same name, two large service areas available to the company: advice and provision of drinking water services in small communities and the development and implementation of infrastructure projects.

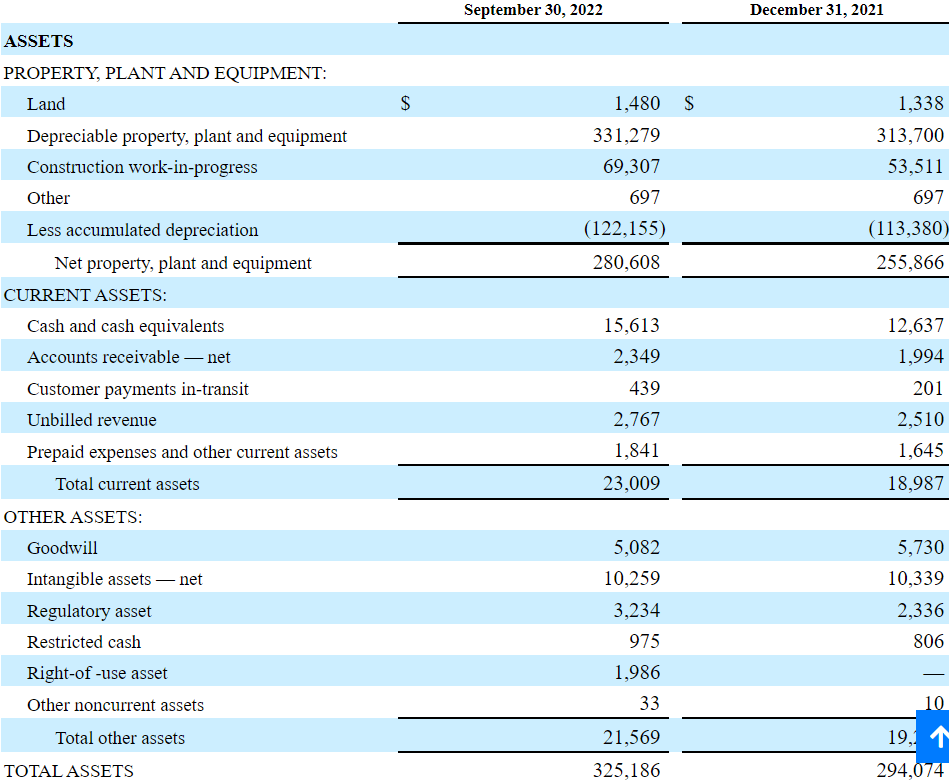

Balance Sheet: Property And Equipment Is The Company’s Most Valuable Asset

Most of the company’s assets are represented by fixed assets. As of September 30, 2022, Global Water Resources reports depreciable property of $331.279 million, with construction work in progress worth $69.307 million, and total net property of $280.608 million. Management also reported cash of $15.613 million and an unbilled revenue of $2.767 million with the total current assets of $23.009 million.

Other assets include a goodwill of $5.082 million along with intangible assets of $10.259 million, suggesting that management has expertise in the M&A markets. Finally, total assets stand at $325.186 million, close to 1x the total amount of liabilities. In sum, I believe that the balance sheet appears in good shape.

Source: 10-Q

Regarding the liabilities, accounts payable stand at $4 million with accrued expenses of $9.5 million, current term debt of $3.833 million, and total current liabilities of $19.756 million. With total current assets close to $23 million, I don’t see a liquidity issue.

The long-term debt was $106.851 million, which I don’t consider a small amount. Considering forward EBITDA close to $33 million, the net debt/ EBITDA does not appear small. I believe that we have to take into account the property and equipment to understand the total amount of debt.

Other liabilities include deferred revenue of $20.870 million, advances in construction aid worth $91.745 million, total non-current liabilities of $260.396 million, and total liabilities of $280.152 million.

Source: 10-Q

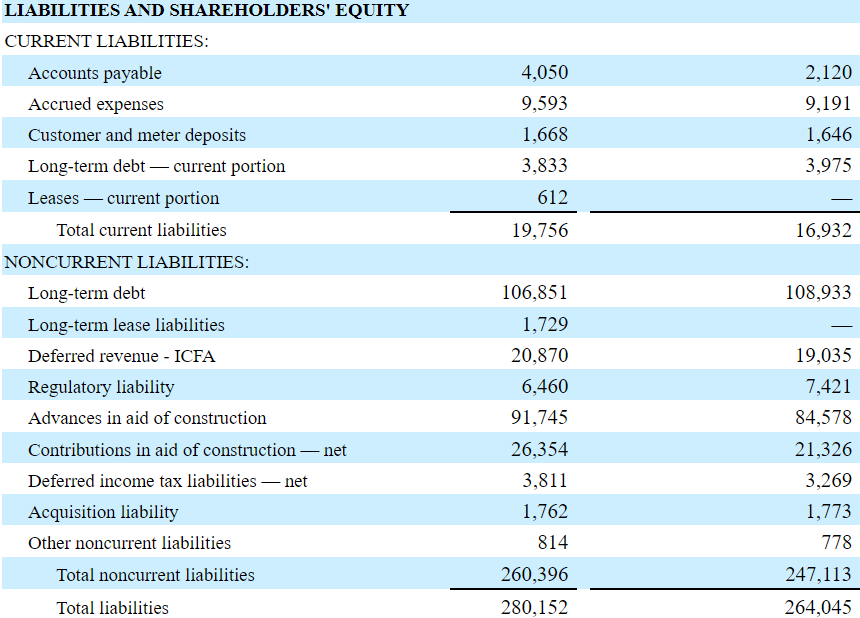

Expectations From Analysts

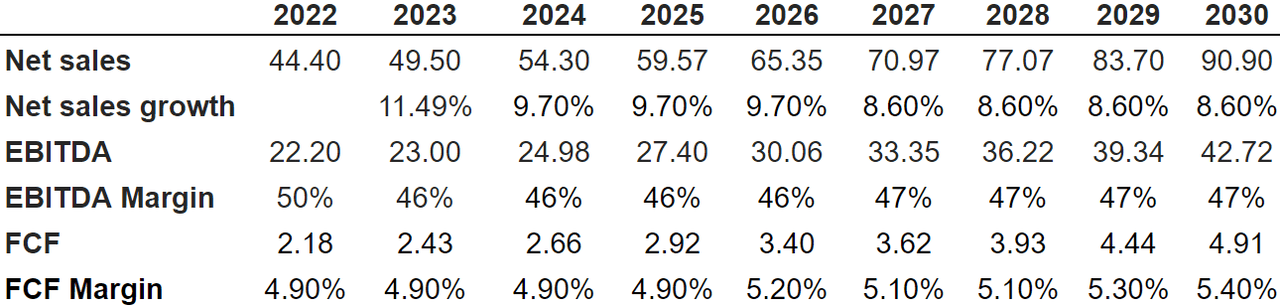

I believe that the expectations from other analysts are quite beneficial. The expectations include 2032 net sales of $49.5 million, and net sales growth of 11.49%.

Estimates also include an EBITDA of $23 million and an EBITDA margin of 46.46%. Forecasts include an operating profit of $9.88 million, an operating margin of 20%, and a net income of $5.9 million.

Let’s note that average figures include average net sales growth of 8.6%, average operating profit of 46%, and operating margin of 18%. I used some of these figures in my base case scenario, so I believe that my numbers are close to the reality.

Source: Marketscreener.com

Base Case Scenario: Total Water Management, And Extensive Use Of Data Could Mean A Fair Value Of Close To $15.99

Global Water Resources defines its services as Total Water Management since they are present in all phases of circulation. As we said before, channeling, supply, recycling, purification, and reuse are the elementary keys in the company’s service. In my view, control of all phases means that management can supervise all steps, which would likely improve quality, and may enhance FCF margins. If Global Water Resources does not work with many third parties, I would assume that the company would be a bit more profitable. With this in mind, I assumed that the free cash flow would grow over time.

The company’s premise is that water, even though it is a clearly limited resource, can be managed correctly through accurate planning, which is made up of previously collected data. Some of these are the level of consumption of the population, the tanks available for its reservoir, the extension and distance between the supply sources and the homes, and, of course, the number of homes and people to whom the service is planned.

In my view, a large amount of data will likely help the company compete with peers and remain profitable. Under this case scenario, I assumed that data will help Global Water Resources enhance sales growth and EBITDA.

Currently, in addition to being positioned in Phoenix, it is expanding its services to new areas. In my view, Global Water Resources may see certain revenue growth thanks to new target markets in fast-growing counties.

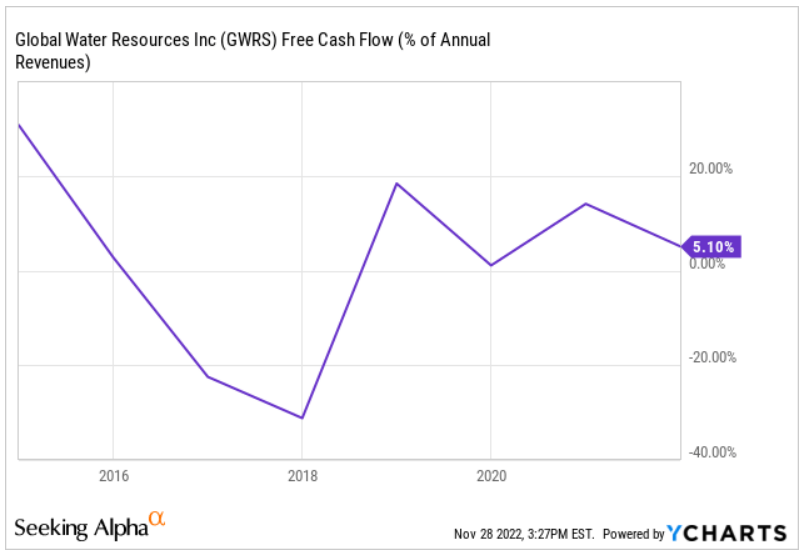

Under my base case, I took into account the previous FCF margin reported by Global Water Resources. The free cash flow for global water resources was -30% for 2018, while for 2020, it was 0%. It is currently close to 5.10%, so I used some figure close to this mark in my DCF model.

Source: YCharts

I included 2030 net sales of $90.90 million with a net sales growth of 8.60%. I also expect 2030 EBITDA to be $42.72 million and EBITDA margin of 47%. FCF would be $4.91 million with FCF margin of 5.40%.

Source: Author’s Compilations

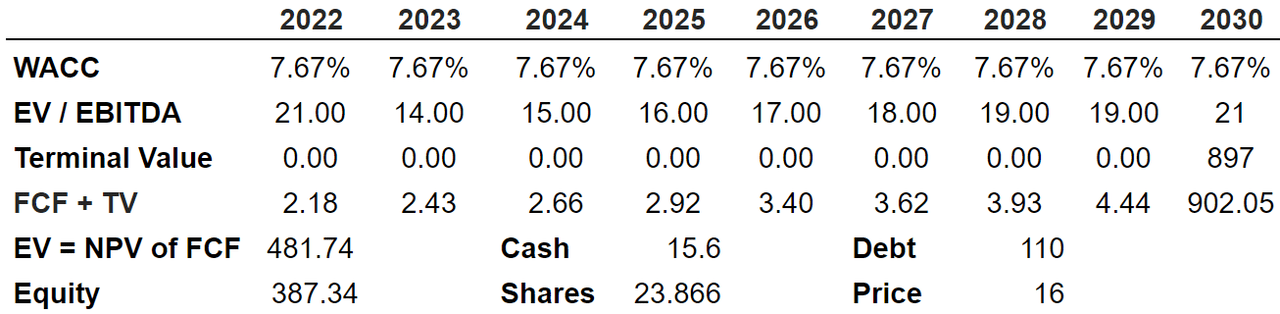

With WACC of 7.67% together with an EV/EBITDA of 21x, I estimated an enterprise value of $902.05 million. Equity would stand at $387.34 million, and with a share count of $23.866 million, the implied price would be $16 per share.

Source: Author’s Compilations

Bearish Case Scenario

Global Water Resources must comply with the regulations established by the Arizona Corporation Commission and other regulatory bodies. Any merger, capital expenditures, and long-term financing programs have to be approved by some public authorities. In my bearish case scenario, management wouldn’t be able to make meaningful investments in new areas, which may lower future sales growth.

The Arizona Corporation Commission is the regulatory authority with jurisdiction over water and wastewater utilities. The ACC has exclusive authority to approve rates, mandate accounting treatments, authorize long-term financing programs, evaluate significant capital expenditures and plant additions, examine and regulate transactions between a regulated subsidiary and its affiliated entities, and approve or disapprove reorganizations, mergers, and acquisitions prior to their completion. Source: 10-k

Global Water Resources may also have to comply with environmental regulations related to drinking water quality or waste disposal and raw groundwater abstraction limits. If agencies decide to restrict the company’s activities or regulations change, opex may increase. As a result, I believe that the company’s free cash flow would decline over time.

In Arizona, water and wastewater utilities are subject to regulation by water, environmental, public utility, and health and safety regulators, and we are required to obtain environmental permits from governmental agencies in order to operate our facilities. Regulations relate to, among other things, standards and criteria for drinking water quality and for wastewater discharges, customer service and service delivery standards, waste disposal and raw groundwater abstraction limits, and rates and charges for our regulated services. Source: 10-k

Supplies of chemicals, electricity, and other inputs may see price increases. If management can’t increase prices of its services, the company’s EBITDA margins would decline. As a result, I believe that Global Water’s valuation could suffer significantly.

In addition, we require bulk supplies of chemicals for water and wastewater treatment, and if we were to suffer an interruption of supply that we cannot replace quickly, we might not be able to perform these functions adequately. Supply chain constraints may result in increased costs of supplies, products and materials that are critical to or used in the Company’s business operations. Also, some chemicals are available from a single source or a limited number of sources. Source: 10-k

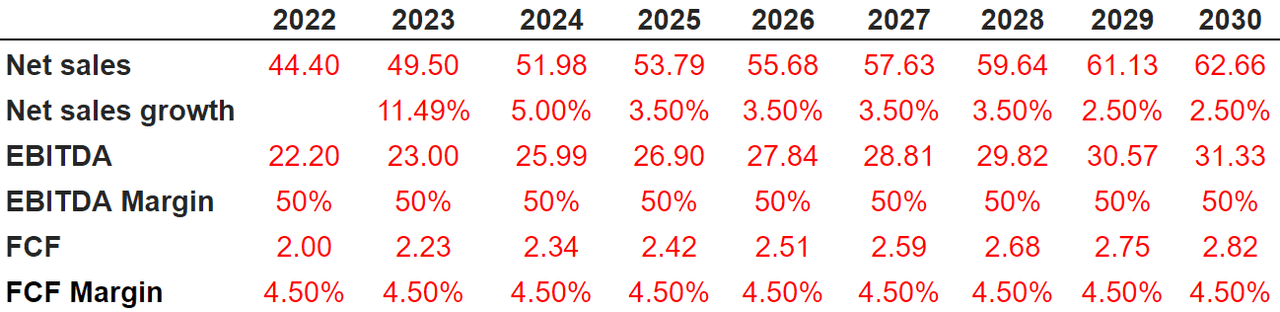

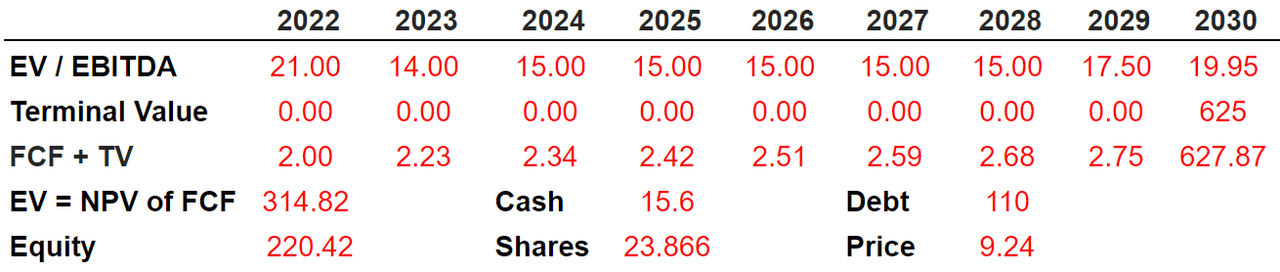

Under this case scenario, I included 2030 net sales of $62.66 million, a net sales growth of 2.50%, and the EBITDA of $31.33 million with an EBITDA margin of 50%. I also expect the FCF to be $2.82 million with the FCF margin of 4.50%.

Source: Author’s Work

If we use an EV/EBITDA multiple of 19.95x, the enterprise value would stand at close to $315 million. The equity valuation would stand at $220.42 million along with a fair price of $9.24 per share. With that, let’s note that reaching this valuation, in my view, would most likely be very unlikely. We are talking about an established business model. Everything can’t go wrong.

Source: Author’s Work

Conclusion

Global Water Resources reports a significant amount of net property and cash in hand. The free cash flow is expected to trend north. Considering the incoming expansion, and analysis of collected data about the level of consumption and tanks available, Global Water will likely see revenue growth. With conservative assumptions, I believe that future free cash flow could justify a valuation of more than $15.97 per share. Even considering risks from regulators, in my view, it’s likely that Global Water’s stock price goes up.

Be the first to comment