Sundry Photography/iStock Editorial via Getty Images

Investment Thesis

ASML Holding N.V. (NASDAQ:ASML) stock was buffeted by the recent tech bear market. As a result, the EUV lithography systems maker saw its stock lose almost 38% of its value from its September highs before recovering last week. Moreover, we also discussed its solid FQ4 card in January, coupled with robust guidance. It demonstrated that ASML has benefited from its EUV systems monopoly and its leadership in the ArF Immersion (ArFi) market. Furthermore, we also highlighted that ASML has clear revenue visibility with its current EUV tech until 2025.

The recent steep bear market in ASML stock has undoubtedly helped its premium valuation revert to more attractive levels. Furthermore, we believe that the global semiconductors arms race will further intensify moving forward. The global chip shortages, exacerbated by the Russia-Ukraine conflict, have motivated the resolution in spending plans to diversify and localize supply chains. Most notably is the focus on the leading-edge process, of which ASML is well-positioned to benefit tremendously.

Therefore, ASML investors don’t have to worry about whether the US, Europe, China, or South Korea would win the race for leading-edge chips production and packaging. We believe that the global semiconductor arms race will continue to boost ASML’s revenue runway and profitability over the next decade.

ASML Stock Key Metrics

ASML stock consensus price targets Vs. stock performance (TIKR) ASML stock NTM EBIT multiples & NTM FCF yield % (TIKR)

ASML stock is currently trading below its most conservative price targets (PTs). Notably, it has supported the floor in ASML stock’s price action over the past five years. Therefore, investors have been given another fantastic opportunity to consider adding exposure after its steep decline over the last six months.

Furthermore, ASML stock’s valuation has also reverted broadly to its 3Y mean. It’s trading at an NTM EBIT multiple of 30.8x (3Y mean: 30.9x). Its NTM FCF yield also read 2.4%, just below its 3Y mean of 2.8%.

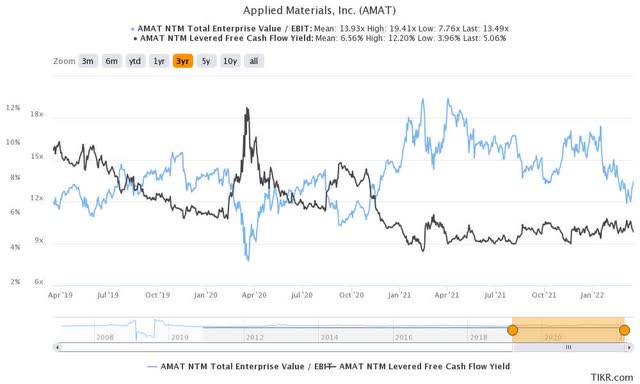

AMAT stock NTM EBIT multiple & FCF yield % (TIKR)

Nevertheless, it’s still trading at a significant premium against its peer Applied Materials (AMAT) stock. As a result, investors can glean the discount applied to AMAT stock, with an NTM EBIT multiple of 13.5x and an FCF yield of 5.1%. Notably, AMAT stock has also traded at a marked discount against ASML stock over the last three years. Therefore, investors who invest in ASML must have a firm conviction over its strategy and execution, given its premium valuation. In addition, AMAT stock has also lost 29% of its value (to the recent March lows) from its January highs. Therefore, ASML stock investors should be prepared for a more volatile ride as the market parses its premium valuation.

Where Is ASML Stock Heading In 2022?

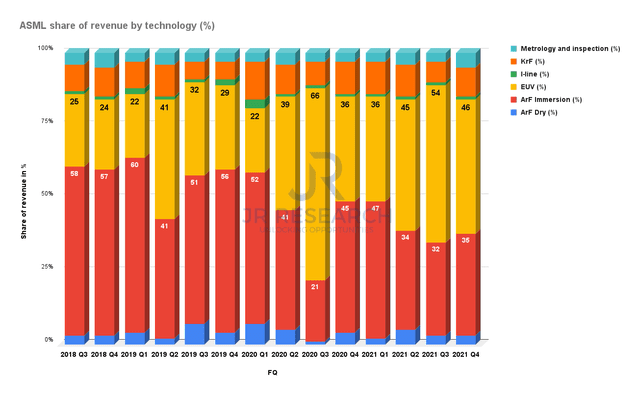

ASML share of revenue by technology % (Company filings)

We are firm believers in ASML’s business model and technology dominance. We have discussed the company’s EUV monopoly in our previous articles. New investors to ASML are invited to parse our previous articles. Furthermore, the company expects to continue its EUV monopoly through its 2025 roadmap and also dominate the ArFi market (90%). Investors can refer to the critical contribution from both technologies to its topline. ArFi and EUV collectively accounted for 81% of its revenue in FQ4. Similar trends have also been observed over the past two years.

Furthermore, we believe that the global semiconductor arms race will only intensify further. Intel (INTC) is “desperate” to retrieve its foundry leadership that it lost to Taiwan Semiconductor (TSM) and Samsung (OTC:SSNLF). It has expanded its CapEx investments from Arizona to Ohio and, recently, Europe. It telegraphed a massive 80B euros investment over the next decade, including its leading-edge investment in Magdeburg, Germany worth almost 19B euros. It’s also part of its aggressive 33B euros initial investment in Europe to build up its semiconductor supply chain. Of course, Intel may also receive generous subsidies from the German government, reportedly amounting to more than 5B euros. In addition, the South Korean government has also dedicated $450B over the next decade to turn the country into a global semiconductor powerhouse.

Therefore, we believe that the US and European governments are keen to ensure that they invest aggressively to improve the resilience of their domestic supply chains. TSMC has consistently accounted for more than 50% of the global foundry market share. As the leading-edge foundry market leader, we think there’s no close second.

But Intel and Samsung are keen to challenge that status quo, supported by their respective governments’ efforts. Furthermore, the geopolitical risk emanating from the Russia-Ukraine conflict has further emphasized the importance of supply chain resilience. In addition, the west is also concerned with the threat posed to Taiwan by China. Therefore, it has further intensified their impetus to accelerate their supply chain development.

Therefore, we remain highly convinced that ASML will continue to be the prime beneficiary of the global semiconductor arms race. Its EUV systems are critical to the actualization of their ambitions. Nonetheless, there is reasonable skepticism over whether these countries can succeed in localizing the majority of their supply chain. However, ASML should continue to ride on these tailwinds. Furthermore, ASML expects its 0.55 High-NA EUV system to be used in high-volume manufacturing by 2025. Therefore, the leap into the sub-3nm process can only be achieved through ASML’s High-NA machines.

Consequently, we believe that its revenue runway is long and highly lucrative. It would further entrench ASML’s technology in the global arms race.

Is ASML Stock A Buy, Sell, Or Hold?

We discussed earlier that ASML stock’s valuation looks attractive now. It’s also within our fair value zone (+/-10%). Therefore, investors are encouraged to capitalize on its recent weakness and add exposure to one of the most important semiconductor stocks over the next decade.

Consequently, we reiterate our Buy rating on ASML stock.

Be the first to comment