Pixelimage/E+ via Getty Images GBT

I constantly see people rise in life who are not the smartest, sometimes not even the most diligent, but they are learning machines. They go to bed every night a little wiser than they were when they got up and boy does that help, particularly when you have a long run ahead of you. – Charlie Munger

In biotech investing, it’s important that you stick to an innovator that is enjoying great success. Even when a bear market causes the stock to tumble, I still considered it a success. You can imagine that Warren Buffett would, too. After all, such a great stock would most likely rebound in the next bull market cycle.

Hence, a bearish cycle is a golden opportunity for you to average down on such fundamental stocks. As a gentle reminder, don’t just hold your shares. Make sure you keep tabs on the underlying growth story. Know why you own your stocks and what to expect from them.

That being said, I’d like to revisit the powerful growth story of Global Blood Therapeutics, Inc. (NASDAQ:GBT). Contrary to conventional market wisdom, GBT successfully gained approval for Oxbryta and is enjoying substantial sales growth. Nevertheless, there are several powerful catalysts that could leap growth to the next level. In this research, I’ll feature a fundamental analysis of GBT and share with you my projection of this intriguing growth equity.

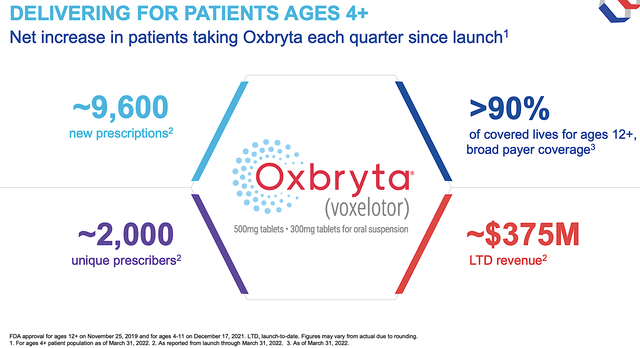

Figure 1: GBT chart

About The Company

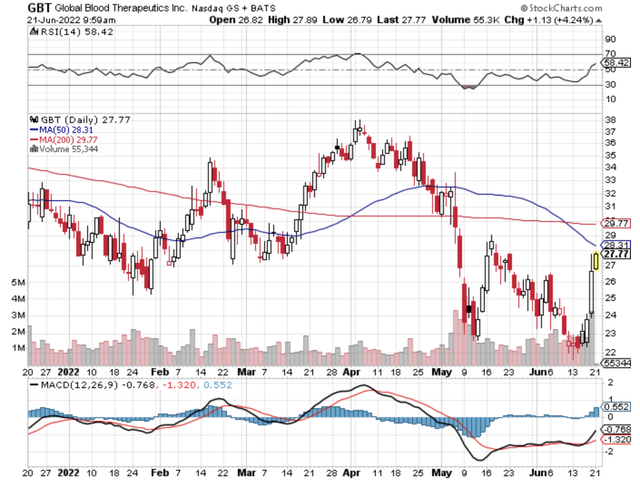

As usual, I’ll deliver a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. Operating out of San Francisco, California, GBT is focused on the development and commercialization of novel medicines to serve the unmet needs of the debilitating blood disorder coined sickle cell disease (“SCD”). Notably, GBT already launched Oxbryta in the U.S. for adults and kids (age 4-11) suffering from SCD. In February 2022, GBT also received Oxbryta’s marketing authorization in the European Union (i.e., EU) for kids in the same age group.

Figure 2: Therapeutic pipeline

Oxbryta Commercialization Progress

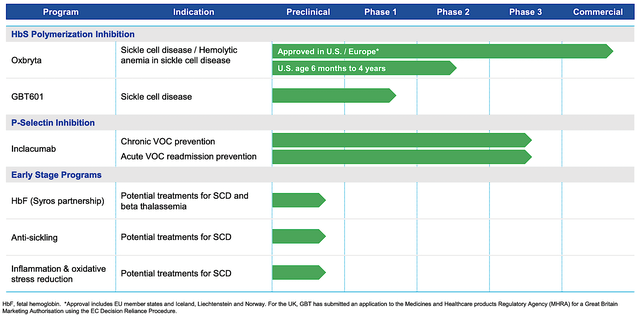

Shifting gears, let us check into the specific progress to see if the GBT’s investment thesis is playing out as it should. In its launch to date (i.e., LTD), you can see that GBT procured $375M in Oxbryta revenue. Powering that figure is the 9.6K new prescriptions and 2K of unique prescribers with over 90% insurance coverage. As you can appreciate, that sales figure is quite significant for a small company like GBT “going at it alone” in commercialization.

Figure 3: Oxbryta launch success

Asides from the sales result, you should analyze Oxbryta’s quarterly revenue growth. After all, it would give you an idea of the sales trajectory going forward. Accordingly, the 1Q2022 earnings report has GBT posted $55.2M in Oxbryta sales, which represents a remarkable 41% year-over-year (YOY) growth rate. The President and CEO (Dr. Ted Love) commented in the earnings call:

The first quarter was a notable start to the year for GBT, highlighted by strong sequential growth in new prescriptions of Oxbryta, including a promising start to our launch in patient ages 4 to 11. The early feedback and metrics on the pediatric launch have been encouraging. For example, we’ve already secured coverage with many important payers for this expanded indication. In patient ages 12 and older, we had our best result for new prescriptions in several quarters. We are optimistic that this momentum will continue if our key growth drivers increased overall awareness and interest in Oxbryta as we expect.

Now, the sequential growth from the previous quarter (i.e., 4Q2021) experienced a small decline of 2%. Don’t be alarmed by this because the reduction is due to an issue on the distributor’s end. That is to say, they had reduced inventory. As you can imagine, this is due to the COVID-related supply chain which should abate as the pandemic subsides. Keep in mind that with the pandemic easing, it would still take a few quarters for supply chain constraints to be alleviated. Most people are also used to working at home due to COVID. Therefore, it would take time to get them back into the company.

Regardless of what is seemingly a small obstacle, the solid proof in the pudding that Oxbryta is a great drug is that it enjoyed strong market traction. Putting it another way, the patient demand is increasing. The total number of patients taking the drug in Q1 compared to the previous quarter and since launch has been a steady increase. In Q1, GBT garnered more than 1.2K new prescriptions, reflective of the strong launch for kids (i.e., age 4 to 11). As you saw from the figure above, there are now over 2K prescriptions (i.e., the equivalent number to the number of patients taking the drug).

More Oxbryta Growth

As you know, Oxbryta is already launched for both adults/kids in the U.S. Though Oxbryta is approved for adults in the EU a while back, it recently gained the EU marketing authorization for kids (ages 4-11) back in February this year. With GBT anticipated to commercialize Oxbryta for kids in the EU by mid-May, you can expect the sales to ramp up faster. Of note, I projected that the sales traction for kids would be greater than for adults because of higher compliance. Simply put, people are also much more inclined to see their kids getting treatment.

Asides from the newly launched initiatives for kids in Europe, GBT is hitting new grounds with the adult campaigns outside of the USA. Specifically, the company recently pushed Oxbryta in the Arab Emirates (i.e., UAE). Later this year, GBT is poised to launch Oxbryta in Germany, France, and England, as well as other countries in Europe.

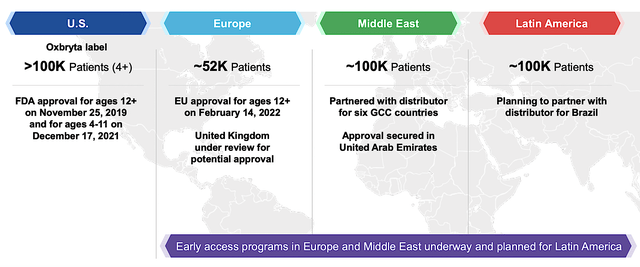

From the figure below, the total number of patients that you can expect Oxbryta to reach all the aforesaid countries in the near term is roughly 350K. For most drugs, you don’t expect the Middle East to generate substantial sales. Notwithstanding, there is a high incidence of SCD over there, thus allowing Oxbryta to reach roughly 100K patients. Latin America also contributed roughly 100K patients, along with about 50K patients in Europe. Taken all together, there is a sizable market with strong demand for a highly efficacious and safe drug like Oxbryta.

Figure 4: Near-term catalysts to reach beyond 350K patients

Oxbryta for Babies

Not satisfied with its strong growth, GBT is also maximizing the value of Oxbryta by studying it in the Phase 1/2 trials for babies (6 months to 3 years old). I believe that this is a prudent move because it would nearly definitely unlock more value for GBT.

If you could allow me to clarify, the “fetal hemoglobin” (i.e., HbF) would be depleted for babies when they reached 6 months old. At that age and beyond, their underlying SCD would start to manifest. By studying Oxbryta in this age group, GBT can reap more revenue from this avenue. Though it’s still in early clinical development, I’m also optimistic about this label expansion. In the longer horizon, it would deliver more sales growth for Oxbryta.

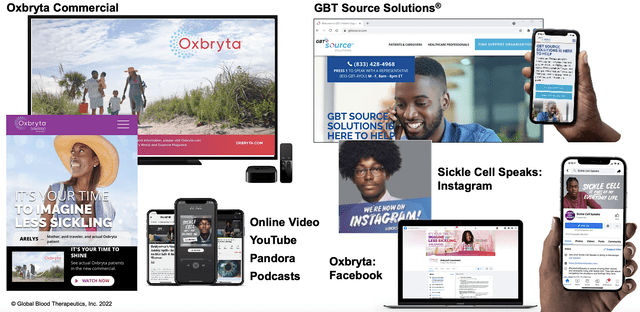

Marketing Campaigns

As you can appreciate, GBT is leveraging the digital wave of innovation to bring Oxbryta to many patients. Instead of employing the traditional shoes/leather approach to marketing, GBT is also focusing on digital campaigns through various social media like Facebook, Instagram, YouTube, Pandora Podcasts, and its own websites. Nowadays, you can see that nearly everyone has a Facebook. By engaging patients through the digital platforms, GBT can spark strong interest from the patients to deliver continuous Oxbryta sales growth.

Figure 5: Oxbryta digital campaigns

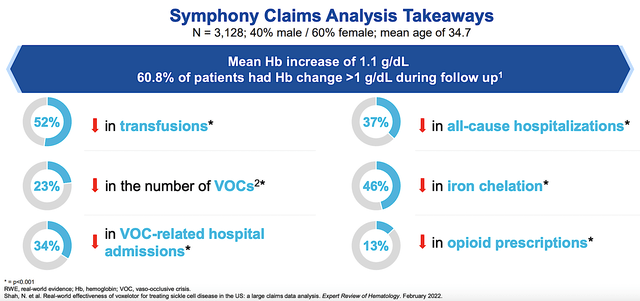

Real-World Experience Supports Efficacy

As you know, robust marketing does not equate to strong sales unless the drug has therapeutic merits. Putting it another way, you’d need a drug to demonstrate strong efficacy and excellent safety to garner sales traction. On this front, GBT conducted an additional analysis based on Real World Experience (RWE) and found the phenomenal benefits as shown below. Specifically, patients on Oxbryta showed a 52% reduction in the need for a blood transfusion and a 37% lowering in all-cause hospitalizations. As you expected, all of these data further support the HOPE trial data that garnered the Oxbryta approval in the first place.

Figure 6: Strong Oxbryta efficacy

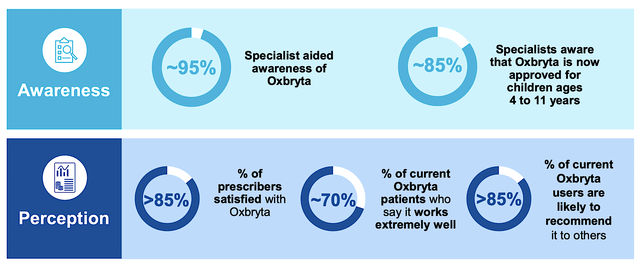

Here is more supporting evidence for Oxbryta’s utility. As you can see, surveys showed that 85% of specialists are now aware of Oxbryta being approved for kids. Interestingly, 95% of those prescribers helped support the increasing awareness. Moreover, the number of satisfied clinicians and patients is over 8% and 70%, respectively. As shown below, a majority of the patients (i.e., 85%) would recommend Oxbryta to others.

Figure 7: Excellent awareness and perception of Oxbryta

Other Growth Catalysts

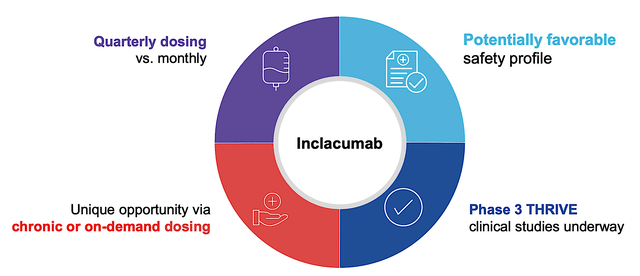

As a hallmark of a great growth company, GBT is planting additional growth seeds with GBT601 and Inclacumab. As the next-generation oxygen binding affinity modulator, GBT601 is restarted in the Phase 1 (GBT021601) study this May. Going forward, the company employs a higher dosage (i.e., 150mg) instead of the 100mg dose. All patients who participated in the trial back in 2021 also expressed an interest in getting the higher dosage. That aside, GBT would launch another Phase 2/3 trial for GBT601 by mid-year.

As to inclacumab, the company is enrolling patients in two Phase 3 (TRIVE) studies. As the ongoing global, randomized, placebo-controlled trials, THRIVE is pivotal to inclacumab’s upcoming success. If THRIVE can demonstrate positive results (and there is a very good chance they will be), the P-selectin inhibitor (inclacumab) would be instrumental to the alleviation of VOC and VOC-related hospital admissions for patients. From the investment viewpoint, inclacumab would highly likely become a blockbuster.

Figure 8: Inclacumab therapeutic profile

Competitor Landscape

Regarding competition, Oxbryta faces traditional medicines like hydroxyureas (i.e., Droxia, Hydrea, Siklos) and supportive care. No doubt about it, hydroxyureas are efficacious treatments. Nevertheless, their utility is hampered by significant side effects. I noted in the prior article,

The FDA also recently approved L-glutamine oral powder (Endari) which reduces the number of VOCs. There is also crizanlizumab (Adakveo) to lower complications. That aside, there are novel treatment modalities like gene therapies in development. Despite the competition, Oxbryta is a novel and highly efficacious drug. As such, it should trump competition to take the most dominant shares over time.

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check up on the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 1Q2022 earnings report for the period that concluded on March 31.

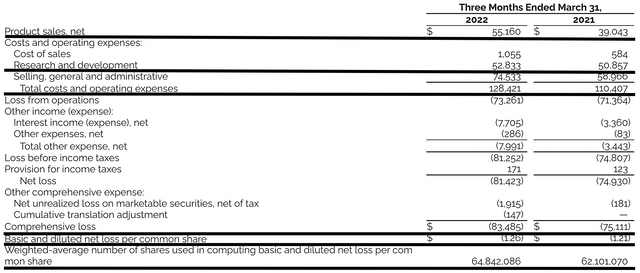

As you know, GBT procured $55.1M in revenues compared to $39.0M for the same period a year prior. That aside, the research and development (R&D) for the respective periods registered at $52.8M and $50.8M. I viewed the 3.9% R&D increase positively became the money invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $83.4M ($1.26 per share) net losses compared to $75.1M ($1.21 per share) decline for the same comparison. On a per-share basis, the bottom line depreciation widened by 4.1%. With the increasing R&D and launch expenses, you can see why the bottom line depreciation widens. As GBT grows in size, I anticipated that the company would bank net profits due to the economy of scale.

Figure 9: Key financial metrics

About the balance sheet, there were $662.1M in cash, equivalents, and investments. On top of the $52.8M quarterly revenue and against the $128.4M quarterly OpEx, I believe there is adequate capital to fund operations into 2Q2024. Simply put, the cash position is robust relative to the burn rate and top-line revenue.

While on the balance sheet, you should check to see if GBT is a “serial diluter.” After all, a company that is serially diluted will render your investment essentially worthless. Given that the shares outstanding increased from 62.1M to 64.8M, my math reveals a 4.3% annual dilution. At this rate, GBT easily cleared my 30% cut-off for a profitable investment.

Valuation Analysis

It’s important that you appraise GBT to determine how much your shares are truly worth. Before running our figure, I liked to share with you the following:

Wall Street analysts typically employ a valuation method coined Discount Cash Flows (i.e., DCF). This valuation model follows a simple plug-and-chug approach. That aside, there are other valuation techniques such as price/sales and price/earnings. Now, there is no such thing as a right or wrong approach. The most important thing is to make sure you use the right technique for the appropriate type of stocks.

Given that developmental-stage biotech has yet to generate any revenues, I steer away from using DCF because it is most applicable for blue-chip equities. For developmental biotech, I leverage a combination of both qualitative and quantitative variables. That is to say, I take into account the quality of the drug, comparative market analysis, chances of clinical trial success, and potential market penetration. Qualitatively, I rely heavily on my intuition and forecasting experience over the years.

|

Molecules and franchises |

Market potential and penetration |

Net earnings based on a 25% margin |

PT based on 64.4M shares outstanding and 10 P/E |

“PT of the part” after appropriate discount |

|

Oxbryta for SCD |

$1.5B (estimated based on the $5.5B SCD market, growing at a 14.3% CAGR) |

$375M | $58.22 | $52.39 (only 10% discount because it’s gaining strong sales traction) |

| GBT601 for SCD | $1B (estimated based on the $5.5B SCD market, growing at 14.3% CAGR) | $250M | $38.81 | $19.40 (50% discount because it’s still in early stage). |

|

Inclacumab for SCD |

$1B (estimated based on the $5.5B SCD market, growing at 14.3% CAGR) | $250M | $38.81 | $19.40 (50% discount because it’s still in early stage). |

| Younger pipeline assets | Will appraise with more development in the future | NA | NA | NA |

|

The Sum of The Parts |

$91.19 |

Figure 10: Valuation analysis

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the most important concern for GBT is if Oxbryta sales growth can be increased sequentially. Despite the prescription ramp-up, there was a 2% sequential decline, of which GBT attributed to supply distribution issue. You want to monitor the next quarter to see if that is resolved or if the company would give you an excuse. From my experience of running my startups, I like it when the executives just deliver rather than giving me a reason why things did not work. To be fair to GBT, the company is going at it alone in commercialization, and they’re doing an excellent job.

The other risk is if the other pipeline assets (i.e., GBT601 and inclacumab) can generate positive results. If they do, you’re looking at what is most likely an investment bonanza. Else, GBT would still continue to grow, but it won’t be as robust. As an aggressive young grower, GBT might overexert itself and thereby run into a potential cash flow constraint.

Conclusion

In all, I maintain my buy recommendation on Global Blood Therapeutics with the 5/5 stars (i.e., raised from 4.8) rating. Global Blood therapeutics is a highly promising company that already successfully transitioned into a powerful commercialization-stage operator. Riding the therapeutic prowess of Oxbryta, GBT is enjoying that aggressive 41% YOY growth rate.

Despite temporarily slowing down on a sequential basis, I believe that the supply distribution issue would soon be abated. With the recent launch of Oxbryta for kids in the EU, you can expect much stronger sales growth to come. On top of the rest of the world’s expansion, Oxbryta is poised to enjoy a leaping growth rate. In the longer horizon, GBT would gain the Oxbryta approval for babies. Moreover, the younger pipeline assets (GBT601 and inclacumab) would come into prominence in the coming year to deliver more powerful growth.

As usual, I’d like to remind investors that the choice to buy, sell, or hold is always yours to make. In my view, you should either hold GBT or accumulate more shares during this bear market.

Be the first to comment