Marlon Trottmann/iStock Editorial via Getty Images

Author’s Note: A longer/more comprehensive version of this article was published on iREIT on Alpha on the 7th of April 2022.

Glencore (OTCPK:GLCNF) (OTCPK:GLNCY) isn’t a small business. In 2020, it was ranked as the 484th-largest public company in the world, and as Glencore International, it’s one of the world’s largest vertically integrated producers and marketers of commodities. It was, at one point, the largest company in Switzerland and the largest commodities trading company with a market share of 60% in Zinc, 50% in copper, and 9% in grain.

In this article, we’ll cover company operations, and see how you could and should view Glencore as an investment.

Let’s begin and start deconstructing and understanding this business.

Please be warned that I go fairly deeply into the business and how exactly this company works such as the countercyclicality of its trading-specific earnings as a market-resilient advantage. I hope this focus does not detract from the article as an interesting piece.

Understanding Glencore

Glencore has made a journey from being a pure-play commodities trader in the 1980s to one of the world’s largest diversified trader-miners today. This is in large part thanks to the Xstrata M&A in 2013, as well as a number of other accretive M&A and strategic initiatives.

Glencore is a BBB+ rated diversified minerals company with a market capitalization of £73.6B. It’s a high yielder, with a historical yield range of 4-7%.

The company’s position in the market means that Glencore has market leadership across several commodities in the world. This includes a global copper leadership at 6% of the world’s entire output, 9% of the output of Zinc, and 1.3% of the output of Coal. EV trends have also meant that its 20% global output share of cobalt is of immense importance, as is the 4% global capacity in the Nickel industry, especially with the issues in Russia.

Glencore has focused on successively increasing its mining as opposed to trading activities, but it remains a company with a majority exposure to the trading of commodities, which generate over 70% of company sales.

Glencore is active at every single stage of the commodity supply chain.

Glencore Activity (Annual Report 2019)

Specifically, when it comes to trading, Glencore offers financing, processing, storage, and logistics of its various commodities. With various commodities, I refer to the around 60 commodities that Glencore actively manages across around 150+ mining and smelting/processing sites across the world.

This results in a massively-diversified commodities base. It includes:

- Bulk metals/alloys

- Coal

- Oil

- Grain

- Sugar

- Edible oils

End users and industries are automotive, power generation, steel, food processing, etc. Glencore has no customer concentration risks. No single customer is more than 3.1% of sales, and the company’s mining and processing sites are spread around the entire world, with the largest exposure in the Americas and Oceania at 29% and 28% respectively. Glencore peers, including Rio Tinto (RIO) and Anglo American (OTCQX:AAUKF), include significant exposure to geographies, such as Africa for Anglo American, and 43% Australia for Rio Tinto.

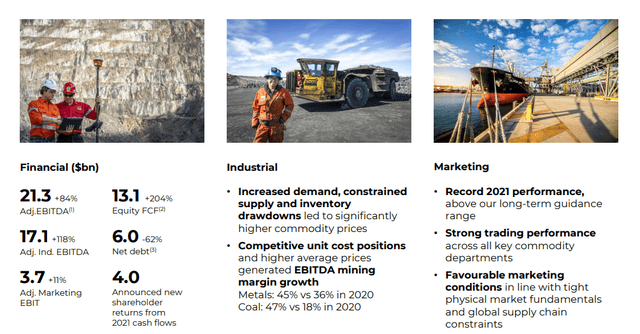

Glencore 2021 Results (Glencore IR)

Commodities trading is a high-barrier entry business. Glencore is one of the largest in the world, with players like Vitol, Cargill, and Trafigura, with hundreds of billions in annual trading revenues between these players. Ownership of various storage and logistics assets, including metal warehouses accredited by the LME and numerous oil and grain storage facilities, play a critical role in capitalizing on global arbitrage opportunities and/or demand-supply imbalances.

For instance, Glencore, in 2021, sold:

- 700M Barrels of Crude oil

- 700M Barrels of Oil products

- 70 MT of Coal

- 3.1MT of Copper

- 2.7MT of Zinc

- 8.9MT of aluminum/alumina

Glencore is the absolute exception to the previously-mentioned trading peers. All of the other companies are 100% privately held, with no public shareholding. This is in their interest given the extreme secrecy/Black-box nature of their operations. They don’t want outsiders looking in, and limited public disclosure of any data is in their own interest. This lack of comps and peers works against Glencore because few understand how the “secret sauce” is made. As a result, its share price was hammered by almost 70% in 2015 when the market seemed clueless as to how this trader-miner would service its hefty $44B debt burden. We now know it could, and it has – but this sort of understanding is crucial when looking at Glencore.

Glencore survived by divesting certain businesses, suspending the dividend, issuing equity, spending rationalization, capacity curtailments, and near-ZBB-based cost improvements. In fact, Glencore was one of the first miners to not only curtail copper/zinc capacities in order to restore market and pricing balance but also cut the dividend to conserve cash. The rest, as they say, is history.

Commodities went back up – as they always do, and on the back of a strong Chinese economy, Glencore has shot up once again.

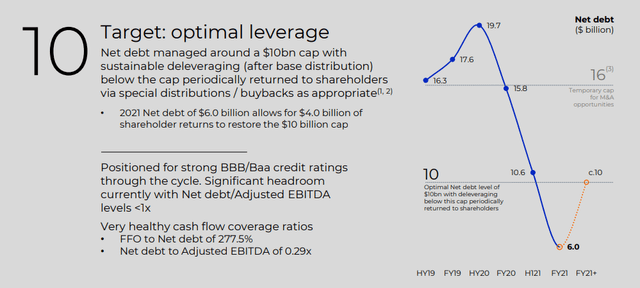

Glencore Leverage (Glencore IR)

The group has deleveraged, reinstated the dividend with plenty of cash flows cushioning it, and capacities are back online. The company has been aggressively pursuing M&As, primarily in the mining segment, like getting Rio Tinto’s Australian thermal coal assets. Qatar, through its investment authority and a JV, bought a 19.5% stake in Rosneft, the largest listed oil producer in the world, though now in a troubled position due to the trouble in Russia, leading to Glencore owning only a 0.57% stake in the company. Other assets bought by Glencore include Volcan, a Zinc mining company, Chevron’s (CVX) South African/Botswana mid/downstream business interests, copper assets in Africa, and even tried buying troubled Bunge (BG) – though nothing came of that.

So, the picture of Glencore is a company now in recovery and flying high, with an excellent balance sheet, a good dividend, and good assets. Glencore is not afraid to take on geographical risk like in Africa, so investors can expect volatility to return to the company here. COVID-19 was added to the company’s outlook and impacted things fairly heavily, with top line results being impacted across the board with the exception of the metal industry.

The company was, during COVID-19, forced to cut production outlook – but this was weighed up by the company’s exposure to what are necessary raw materials in EV production, which has offset most of any negative impact to the company here. Although we can expect restructuring in a company with $200B worth of revenues to never really be over and may lead to impairment charges, there seems to be a good possibility for this trading giant to regain much of its former market-leading position. Also, the market uncertainties unleashed by the Russia-Ukraine crisis, despite re-kindling global economic growth concerns, could be an added business opportunity.

In terms of its revenues, the company retains a high reliance on trading energy products. This part of the business generates near-on 120B worth of revenue, with Metals and Minerals both trading and mining coming barely to the $95B levels.

On a very high level, the trading activities of the business are not correlated to pricing developments in the various commodities – at least not to the major degree that mining/processing them is. While trade-funding requirements are linked to these, the impact is still lower. Trading income comes from the fee charged for handling, blending, and distributing commodities through exploiting geographical, time, and product arbitrage opportunities. Glencore does not speculate on the direction of pricing or futures but instead handles mostly hedged market volumes or pre-sold volumes to lower the pricing risk. The company’s global operational footprint means that Glencore hasn’t just been able to exploit global opportunities, but can also show some incredible market resilience to its earnings.

The company’s cash flow requirements for its trading arm are countercyclical in their nature. The division’s profits up to 2014 were ~50% of the group’s profitability, contributing over 80% in 2015 and forward. This was because mining profits struggled on account of weak commodity prices. Consistently healthy cash flows from trading, which doesn’t entail large capital spending, were one of the key reasons that helped Glencore address its lenders’ concerns back in -15 when things were at their worst.

With markets in recovery, a balance between trading and mining/industrial earnings is slowly being restored – at least until COVID-19 came. 2021 came in at absolutely exceptional levels going out of the pandemic.

Industrial profitability hit record-high levels. Record-high prices for most of the company’s crucial commodities, including copper (+51%), zinc (+32%), nickel (+34%), cobalt (+60%), and thermal coal (+125%), ensured that the impact of strengthening producer currencies, inflationary headwinds, energy headwinds, input price increases, production issues completely outweighed by the positives.

Overall, we’re looking at a mixed miner/trader that provided solid fundamentals for the industry are maintained – is likely to see continued upsides going forward. At some point, pricing will normalize, so Glencore will likely normalize/drop off a bit as well, but this is a company that’s likely to perform well going forward.

The company’s strategy includes staying out of the commodity markets that it does not trade. So it only buys mining assets of resources that it trades. Historically, when the company has done differently, it has resulted in losses, such as when they sold their platinum interests in 2015.

The biggest single shareholder in Glencore is Qatar Holding LLC at 9.16%. Then we have Ivan Glasenberg at 9%, the former CEO of the company. After that, BlackRock (BLK) owns about 5.7%.

Glencore Risks

Glencore, despite its strengths, has plenty of risks. First off, the company is never far from regulatory or legal issues given the company’s massive amounts of operating geographies. This has already happened historically, with DOJ investigations into operations like those found in Congo, Nigeria, Venezuela, and other nations. These carry the risk of fines/penalties and business disruptions.

The company also has a continued, high exposure to coal. While the current Russia situation may result in a more positive coal discussion for a few years, the company’s coal operations do color its EV metal exposures somewhat, and an unwillingness on the part of Glencore to chuck these investments may result in re-ratings from the environmental side of things.

Glencore has decent volatility and decently high cyclicality in its operations. This is probably the major risk that the company has. The balance sheet is in good shape, the credit rating is good, the yield is now well-covered at less than 50% EPS payout ratio, and currently stands at 4.1%, down from a historical 6-7% and more during undervaluation.

Overall, there’s some cyclicality and commodity risk to Glencore, but what you want to look at if you’re interested in this company is the longer-term performance of this business. I believe Glencore has found an excellent balance between mining/industry and trading, and one they’ll continue to perfect in the coming few years.

The company has generated 3-year returns of 16% CAGR or 56%, dropping below 200p for the native share back in 2020, and up more than 70% since then. While not exactly at record highs, the company is still fairly highly valued at this time.

The normalization of commodity prices is another major risk that could have an impact in the near term, and one that’s worth considering if you’re planning to buy Glencore.

Glencore’s Valuation

Glencore trades relatively high at this time – but it’s important to recall that things may indeed go higher still, as the global commodity shortage when it comes to certain things shows no sign of stopping or slowing down here. S&P Global analysts give Glencore a target ratio of 543-890p, with a current average of 719p, indicating an undervaluation to their target. Currently, 16 out of 20 analysts have either a “BUY” or “Outperform” rating on this company at this time.

When it comes to my valuation, I compare Glencore to peers such as the BHP Group (BHP), Rio Tinto, Anglo American, Boliden (OTCPK:BDNNY), and French company ERAMET (OTCPK:ERMAY). This peer group has average valuations of 11-12X in P/E, 6X EV/EBITDA, and book value multiples of near 3X.

While I do believe in an eventual normalization of trade relations, and the market does believe in this as well, it seems like the timing of this seems all but impossible to predict. Because I’m cutting these two stakes from the balance sheet, the resulting NAV/share is less than 450p, indicating actual overvaluation on the SOTP basis – but we know why this is. With these assets fully valued/included, it would be above 500p.

Now that we understand the ebb and flow of the valuations here, we can start to understand the analyst ranges that put the company at 600-700p/share.

Personally, I’m taking a more conservative stance than the average 719p of S&P Global, including the possibility of Glencore actually having to chuck their Russian investments entirely. In this scenario, I’d pay no more than 550p/share.

This still implies an upside for Glencore, but it would take a few years to materialize without almost $11B in Russian assets. Investors would certainly be excused here for taking a more conservative stance and backing off a few steps until things clarify.

However, I still consider Glencore a “BUY” with a 550p share price target.

Thesis

My investments in commodities at this point are well-known. I invest heavily in mining, fertilizer, grain, and foodstuffs – because I like investing in what people need and what the world, including our industries, need.

I believe Glencore is a high-yielding, excellent alternative here, even if it currently comes with a few caveats – the largest of which is a fairly rich valuation. I do believe that prospective investors should put Glencore on their watchlist – or invest with the target of a full valuation, currently with a near-double-digit upside to my PT of 550p per share.

The bottom line is that I believe most investors should look into the Swiss/British Commodities trader/miner, as they have a substantial global upside, a good yield, a solid balance sheet, and some attractive qualities, making them an appealing investment.

I’m a “BUY” with a PT of 550p or £5.5 here.

Be the first to comment