naisupakit

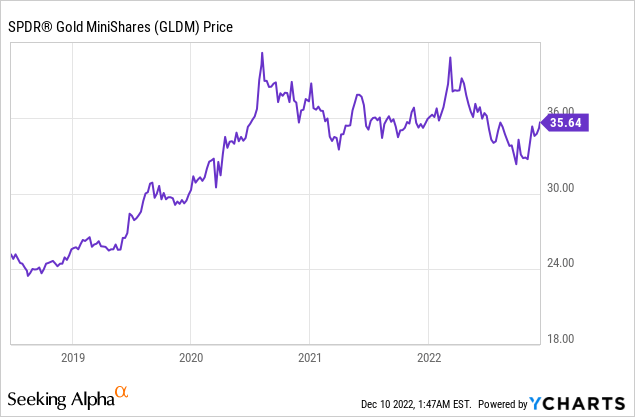

Thanks to the low expense ratios compared to typical bullion ETFs, the SPDR Gold MiniShares Trust (NYSEARCA:GLDM) is a pretty efficient way to speculate on gold prices. In the current regime, rates have not been able to topple gold off its post-breakout highs after COVID-19 first hit the scene in 2020. It’s all about risk-sentiment then, and the problem is that we think we’re at an inflection point. Sentiment is pretty low now, despite the CPI figures last month, and we think that there are a lot of things pointing to the end of this bear market. 8 months to 2 years is usually how long they last, so it’s time to take a major recovery more seriously. When stocks come out of a bear market, gold could enter one. Best to stay careful.

Risk-on Is Coming

We think there is a strong cumulative argument for why the stock bear market (in the US at least) is coming to an end. CPI figures last month show that inflation is peaking. Of course, just because the figure went lower doesn’t mean necessarily that it will stay lower or trend downwards further. But we think that major cost-push forces are coming off the pedal.

Housing figures this month showed not only declines in housing prices, but critically in rents. Rents drive the wage-price spiral almost as much as food inflation, and these coming off is a double-whammy of reduced inflationary pressure as well as reduced inflation expectations pressure. This is an essential bellwether for Fed action, and is not weighted nearly as highly as it should be by markets.

Logistics has also gone down in cost, with charter rates falling across TEUs. This is because while the US is teetering on a recession, the EU is already contracting, and we see that across our whole coverage with stocks that have substantial EU wallet.

While dislocation of energy markets is a negative hit, and a meaningful one at that, for the western bloc, we think that not all western players will share equally in the pain. The differential between US economic and corporate performance compared to EU is because the EU is getting much more affected by the war in Ukraine. The proximity to the cost pressures means that monetary policy isn’t effective there, so their currencies suffer when not keeping up with rate hiking in the US. The USD strength has been huge for the US’s public finances and the sanctity of the dollar, and this is sustained by demand for US gas and oil in Europe, products that were anti-economical to produce for a while before the invasion. Risk-off sentiment has been good for a more profitable treasury investment as well. The US is way more self-sufficient, and has a better economic portfolio to deal with the current crisis. They are winning pretty big in the current crisis.

Bottom Line

So where does this bring us as far as gold is concerned? GLDM tracks gold prices, and the story with gold prices has been that they’ve been high ever since uncertainty rose with the pandemic and then the invasion. Rates have come up a lot, and while gold tracked down a bit, it has massively outperformed the market. It’s a safe haven after all, even if treasuries create more income than a non-productive gold investment.

Rates have not been a burden on gold too much, which means what really supports gold is the risk-off sentiment. If CPI figures continue to moderate, then people will have more reason to move back into a US market that is discounted 16% YTD. European and other markets like Japan will stay low because they are more reliant on Russian supply, and have been whiplashed harder by supply dislocations in energy. The US is less influenced by the invasion as a net exporter, and US energy suppliers are still holding back. While oil is a global market and prices will remain higher than they were in the US as well, they have better access to supply than the EU which imports much more of its energy. The US has more to leverage, and likely can be a winning market at the expense of other geographies who have less resources to fill the Russian shortfall, and will have poor bargaining power when negotiating alternative supply deals with countries like Azerbaijan, the North African countries and others.

We think that there’s a building bear thesis against gold these days as the US stock market potentially becomes a much more attractive store of value. Moreover, the upside for GLDM if the status quo continues is limited. Things are not likely to become more uncertain and politics even more unmoored than they are now, and if inflation ends up being worse than we expect that will also mean higher rates which does lead some gold investors to move to income producing assets like Treasuries instead. We think even in favourable scenarios for gold, a flattening performance is likely as economies are dictated by either inflation risks and higher interest rates or rather moderation in inflation and the recovery of stock markets. A gold producer might be more attractive, and there are plenty of gold miner ETFs on the market – at least they’d provide income regardless of the market. As such, GLDM is one we’d avoid since it doesn’t play particularly well in several of the likely scenarios.

Be the first to comment