PeopleImages/iStock via Getty Images

Investment summary

Medical technology (“medtech”) stocks have caught a bid in H2 FY22 and have lent investors strategic and tactical alpha on the allocation side. However, we stress that profitability, resiliency, strong balance sheet and other quality metrics are integral for names to flourish within the medtech space.

Alas, we are neutral on Glaukos Corporation (NYSE:GKOS) shares given the lack of alternative equity premia available to harvest in the name. Whilst the company continues on steadily with its operations, as a consideration for the equity risk budget, we believe there are better names out there at present. We value the stock at $52 and look forward to further coverage.

Exhibit 1. GKOS 6-month price action and net volume

Data: Refinitiv Eikon

Q2 earnings: sequential downturns continue

Second-quarter sales came in above consensus with a 500bps YoY decline to $72.7 million. This was up ~900bps sequentially, however. Gross margin also contracted ~200bps YoY to 75%, although GKOS booked a non-GAAP gross margin of 83% (down 100bps YoY). The company also saw a 1,000bps headwind at the SG&A line with expenses increasing to ~$50 million, whereas it expensed ~$32 million in R&D, up 31% YoY. It also incurred a $10 million in-process R&D charge tied to an upfront licensing payment with iVeena Delivery Systems, Inc. Segmentally, the US glaucoma business grew 13% QoQ. Meanwhile, international glaucoma sales printed a record quarter in revenue.

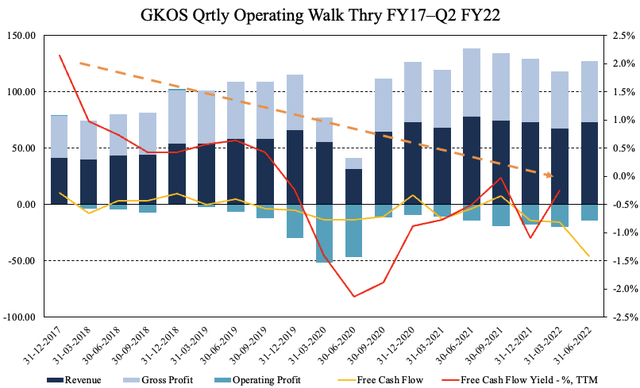

Moving down the P&L, loss from operations came in at $36.8 million, well behind the operating loss of $14.2 million in Q2 FY21. This carried down to a net loss of $45 million of -$0.96 per share for the quarter. It also ended the quarter with $400 million in cash and equivalent. As seen in Exhibit 2, operating losses have been lumpy for the company on a sequential basis since FY18. It has printed a loss on FCF each quarter with trends worsening over time, as seen below. Investors currently realize a -1.8% FCFF yield. Moreover, top-line growth trends have tightened in recent quarters as well off a high in Q3 FY21.

Exhibit 2. The asymmetry in operating metrics looks to be widening on a sequential basis

Image: HB Insights, GKOS SEC Filings

Data: HB Insights, GKOS SEC Filings

Despite the pullback in top-bottom growth, results were better than originally forecast. As such, management revised FY22 guidance upwards. It now expects net sales of $275–280 million, up from $270-275 million previously. It expects modest early contributions from new launches of iAccess, iPrime, and iStent infinite for the rest of FY22 (discussed below).

New product launches could inflect positively

GKOS continued the pace of new product launches and commercializations last quarter. It launched the iAccess device and began the commercial launch of activities for its iPrime device. iAccess is designed to deliver outflow through the trabecular meshwork into Schlemm’s canal. It purportedly offers more of an opening to the canal while “preserving up to 95% more anatomical tissue”. More importantly in our estimation, is that GKOS also received 510(k) clearance for its iSTent infinite system, announced on the earnings call. This is a key milestone that investors should consider as a key inflection point for the company. The system is a 3-stent injectable that is indicated to provide round the clock intraocular pressure (“IOP”) control for patients with glaucoma.

This is a key differential for GKOS as it is an implantable device that is designed as a standalone therapy, and therefore doesn’t necessarily compete with the current standard of care. Instead, it has its own class. Data has held up well to date. The key USP in our view is that it offers treating surgeons an alternative route of treatment as a standalone treatment.

Moreover, submissions for the iDose TR are underway and the company is projecting to read topline data from the phase 3 trial later this year. Data has held up well here on safety and efficacy. In earlier readouts, GKOS confirmed that 70% of patients saw similar results 36 months post treatment with lower IOP versus patients on medication. There was statistically meaningful difference between the groups with a range of 8.3-8.5mm/mg of pressure reduction on average across the iDose cohort.

Just like iStent, iDose offers surgeons an alternative route of treatment and this is validated by the fact the glaucoma market always has a demand for sustained release medication. Primarily this stems due to non-compliance of medication protocols, and hence, sustained release regimes tend to overcome this hurdle.

With respect to reimbursement, GKOS has applied to category 3 codes with AMA CPT Committee. Management is confident it will receive the code. Reimbursement has been a contentious issue this year. In the glaucoma/ophthalmologic domain, codes have shifted from stent-based treatments to now a proposal for canal-based offerings. Noteworthy is that combination cataract procedures move into a category 1 procedural code. With respect to iDose reimbursement, per CEO Tom Burns:

“That code then, right now it’s under current exclusion, so it doesn’t be corrupted by people that would put data in that category in the hospital. And so what we’ll do is we’ll open it up with CMS just prior to commercial launch.”

Valuation

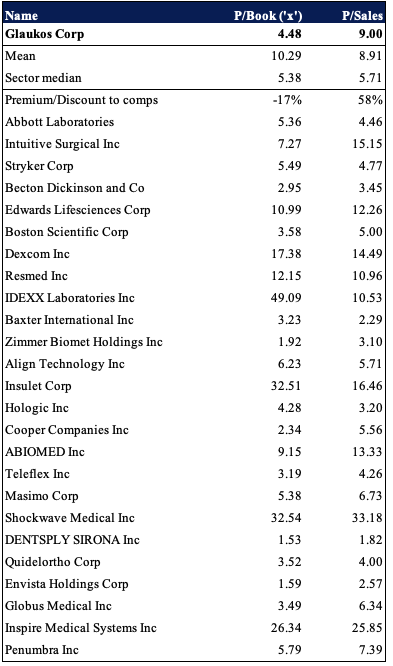

Shares are priced at ~4.5x book value and roughly 9x sales as seen on the chart below. This represents a 17% discount and 58% premium to the GICS Industry peer median, respectively. Trading at a discount to peers on the equity value level might be an attractive proposition; if the calculus works out, we are in fact getting the stock at a discount.

Exhibit 2. Multiples and comps

Data: HB Insights

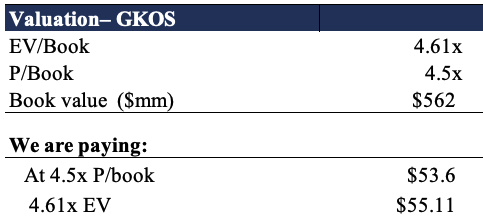

On closer examination, it appears the stock is not trading at a respective discount to book value and in fact looks to be marginally overpriced, by around 3%. Hence, we price GKOS at $52.

Exhibit 3. Valuations are unsupportive and GKOS looks to be marginally overpriced at the equity level

Data & Image: HB Insights Estimates

In short

We rate GKOS a hold citing the reasons outlined in this report. Operating performance continues to tighten on a sequential basis, particularly below the operating line. We notice an ongoing asymmetry in operating metrics from the top to bottom lines. Offsetting this is the numerous product launches completed last quarter that should see some early revenue late in the year. However, there is execution risk tied to this, and we aren’t sure exactly on the final product economics yet either.

Valuations are also unsupportive and we feel the stock is marginally overpriced trading 4.48x book value of equity, especially given its lack of profitability and declining gross margins on sequential bases. On the culmination of these factors, we value GKOS at $52 per share.

Be the first to comment