Claudiad/E+ via Getty Images

It is commonly said that a rising tide lifts all boats. Since the end of the Great Recession that has been true for REITs. After bottoming in early 2009, REITs have performed exceptionally well. Simply investing in the index would have provided investors with handsome returns of over 500% over the last 13 years. With the possible exception of Class B malls, it did not matter what sector or REIT an investor chose they would have done very well. REITs benefitted from a growing economy, limited new supply in part due to post financial crisis lending regulations, and most importantly, low interest rates.

Warren Buffett famously stated: “Only when the tide goes out do you discover who’s been swimming naked.” As the interest rate environment that REITs have enjoyed for the last decade begins to change, I think investors will find that most REIT management teams, scarred by the 2008 crisis, locked in low rates for the foreseeable future. (There may be other nasty surprises for investors due to changes in the patterns of how and where Americans live and work, but I will save that for another article.) It appears one notable exception to this conservative approach to the right side of the balance sheet is Gladstone Commercial (NASDAQ:GOOD). It should not surprise long-time REIT investors that GOOD seems to be using inexpensive partial hedges to protect against rising rates or that it has dark space that is becoming a problem for its business model. GOOD is one of the few remaining externally managed REITs.

Most externally managed REITs were chased out of the industry in the 1990’s due to the potential divergence of interests between management and shareholders. External managers, including GOOD’s, based on my reading of the Management Agreement, are paid a Management Fee based on assets or equity and an Incentive Fee based on exceeding an FFO hurdle. Good’s Management Agreement pays a Base Management based on Gross Tangible Real Estate. This means as Real Estates Assets grow the Base Management Fee grows. The bigger issue for investors is the Incentive Fee. Based on my reading of the Management Agreement, the Manager is paid 15% of the amount FFO exceeds Equity times 2.0% quarterly. Based on my understanding if FFO goes up due to higher leverage, the use of floating rate debt or acquiring higher cap rate assets with more risk the Incentive Fee will rise as well. I surmise that sell-side research has largely ignored GOOD’s issues and continues to analyze the stock as though it was any other REIT. Their models seem to indicate that they believe GOOD’s exposure to floating rate debt is entirely hedged and increasing LIBOR rates will not impact their interest expense. Additionally, it appears the sell-side models have failed to capture the nature of GOOD’s near-term debt maturities or its upcoming lease expirations. In my opinion all of these issues will come to the fore for GOOD in the coming months and significantly impact its FFO/share in 2023.

Variable Rate Debt: The Difference Between a Cap and Swap

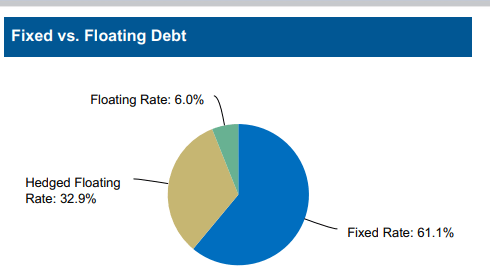

GOOD’s investor presentation shows its exposure to variable rate debt as only 6%.

Source:GOOD Investor Presentation – May 17, 2022

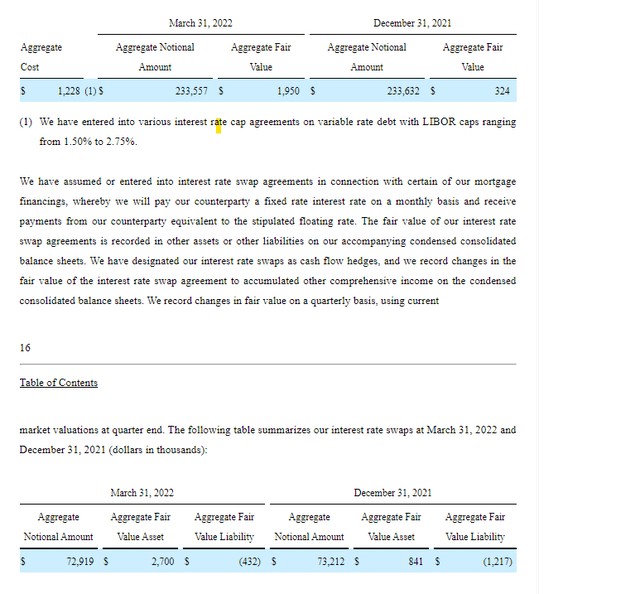

It appears to me that most sell-side analysts have used this 6% exposure in their financial models and their comp analysis. The reality is most of 32.9% that is shown as Hedged Floating Rate Debt is simply debt with a LIBOR Cap. This is clearly explained in their most recent 10Q. A cap means that as opposed to LIBOR being swapped to a fixed rate, it is limited to not going above a prespecified level. While a swap protects a borrower from any interest rate increase, a cap simply limits a borrower’s exposure after LIBOR reaches a prespecified level. Of course, caps, which offer less protection, are cheaper than swaps. It is telling that GOOD only started using swaps in 1Q22 as rates started going up. Nonetheless, they still have over $233 million of debt subject to LIBOR caps ranging from 1.5% to 2.75%.

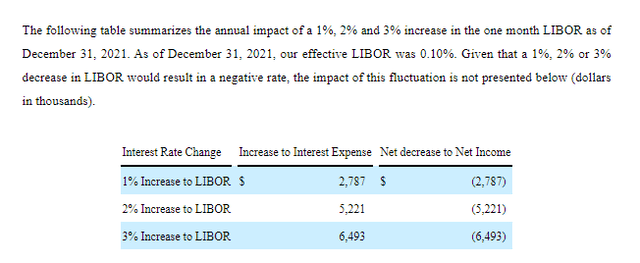

GOOD’s immediate vulnerability to LIBOR increasing is described in their 10-K. As the chart below shows if one-month LIBOR goes up by 2.0% from its December 31st, 2021, level, GOOD’s interest expense would go up by $5.02 million or $0.13/share annually. As of December 31, 2021, LIBOR was at 0.10%. One Month LIBOR is already at 1.63% (Global Rates). With the Federal Reserve poised to continue increasing rates over the balance of the year, most market forecasters, including The Financial Forecast Center, expect One-Month LIBOR will soon exceed 2.0% and stay above that level into 2023. I think analysts’ models do not show GOOD’s interest expense rising or FFO falling by enough to capture the exposure to floating rate debt that is detailed in GOOD’s own 10-K.

Maturing Debt

As of May 4th, the date of GOOD’s 1Q22 conference call, they had $79 million of debt maturities for the balance of 2022. Based on GOOD’s current disclosure, I believe it is hard for investors to tell exactly which properties serve as collateral for the debt that is coming due. However, by working with GOOD’s disclosure from past 10-K’s we can piece together their largest remaining 2022 maturities and the underlying collateral.

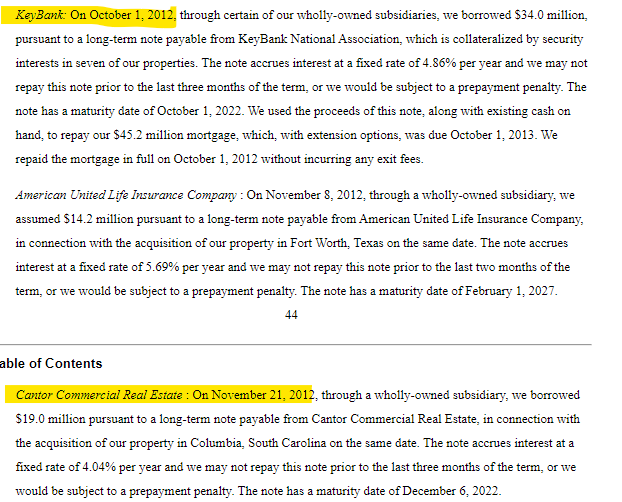

GOOD 10-K 2012 p. 44-45

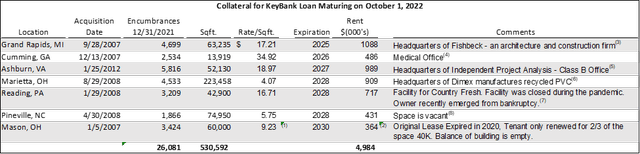

In October of 2012 GOOD borrowed $34 million from KeyBank. The loan had a 10-year term and a 25-year amortization schedule. This means that just over $25 million would be due on October 1st of this year. A review of Gladstone’s Schedule III from their most recent 10-K shows that GOOD still owns all of the original collateral for this loan and based on the amount of encumbrance shown it is almost certain that these assets still serve as collateral for the loan. The below chart shows the lease expiration date for the properties as well as some commentary. It is hard for me to imagine GOOD getting any meaningful leverage on these assets, given that over 20% of the rental income comes from leases expiring within 3 years and over 50% of the rental income comes from leases expiring within 5 years. I think the quality of the properties, in particularly the offices, will give lenders pause as well.

Exhibits filed by GOOD with SEC on October 3, 2012 and Item 2 Properties in GOOD’s 10-K 2012

Notes:

- Quest, the original tenant extended their lease 10 years to 2030. The tenant gave up 1/3 of the space in the building in 2020. (GOOD press release 12/11/2019.) The remaining space is still vacant and is being marketed by Cushman. The rate per sq. ft. is the rate on the initial lease as Gladstone did not disclose the rate on the new lease.

- Rent shown equals the rate on the initial lease multiplied by the 39,417 sq. ft. currently occupied by Quest.

- Fishbeck Headquarters

- Medical Office for Outpatient Surgery

- Property listed as Class B space by Commercial Café. It is currently headquarters for IPA, a risk management firm.

- Headquarters for Dimex, a manufacturer of recycled flexible PVC and TPE.

- Facility issued a Worker Adjustment and Retraining Notice in August of 2020 indicating it was closing. Division that owns the plant has been purchased out of bankruptcy.

- Space is being marketed on Property Shark as available immediately.

It is interesting to note that despite GOOD’s recent focus on industrial acquisitions as discussed on it most recent conference call, its largest near-term refinancing, as shown in the chart above, is in part dependent on whether an architectural firm in Grand Rapids, MI renews its office lease.

GOOD is also facing a debt maturity that comes due on December 6th which is secured by an office property in Elgin (Columbia), SC. Based on my review of GOOD’s filings, the Note on this property was never filed as an exhibit and there is limited disclosure on the loan. Nonetheless, GOOD’s 2012 10-K (p.45) discloses this $19 million loan was originated by Cantor Commercial Real Estate, a CMBS lender, so it is likely it has a 25-year amortization schedule. Assuming GOOD made the minimum payments on this loan, my amortization schedule which assumes an initial balance of $19 million, an interest rate of 4.04% (see above disclosure) and 10 years of payments indicates a $14.5 million balloon payment is coming due in December. The office building, a former call center, is being marketed by JLL as the tenant has moved out and the original 10-year lease expires in December. Once again it is impossible for me to imagine a lender providing a loan secured by this asset.

Given the short-term nature of the leases on the KeyBank Note’s collateral and the current state of the debt markets, it is possible GOOD will not be able to refinance any of these properties. In my mind, in a best-case scenario they would likely struggle to refinance the debt for half of its original amount or $17 million. This implies GOOD would need to come up with somewhere between $8 million and $25 million of equity to pay off the outstanding balance. Whatever the eventual amount that is needed for the KeyBank Note, I believe GOOD will also require $14.5 million for the property in Elgin which likely cannot be refinanced without a new tenant. (See analysis in prior paragraph.) In total GOOD could be looking at raising almost $40 million in equity before the end of the year. GOOD pays out 95% of its FFO in dividends based on its current dividend and consensus FFO. The 5% that it retains is more than spoken for by its capex. According to my calculations, there will be no excess cash flow from operations to pay down these balloon payments and GOOD will need to issue equity. My analysis indicates this will be a highly dilutive raise. (See Below)

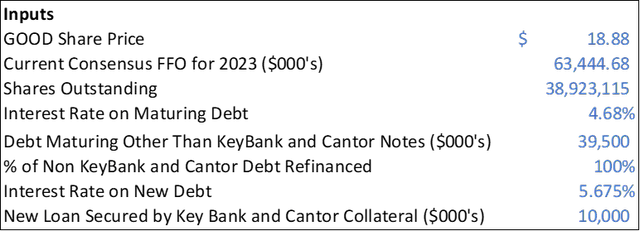

Not only will GOOD’s earnings be pressured by the equity required to pay off its balloon maturities, but I think it is also likely to face higher rates on the debt that it refinances. GOOD’s most recent refinancing in 1Q22 took place at a 2.5% spread over the base rate. (GOOD 1Q22 10Q p. 26.) If we assume they will be looking to refinance their debt with a five-year term and use the Five-Year Treasury (currently 3.175%) as the base rate and apply the 2.5% spread this equates to a rate of 5.675%.

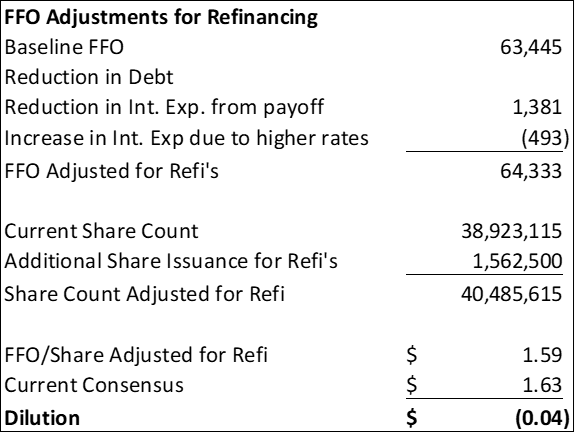

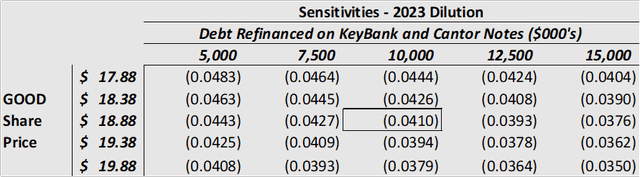

Below is a high-level model of the dilution from GOOD’s required refinancing activity sensitized for the level of equity GOOD will need to raise and GOOD’s share price. The inputs are consensus FFO, the diluted share count from p. 17 of the May 17 Investor Presentation, the average cost of their debt maturing in 2022 from p. 28 of the Investor Presentation, the $79 million of 2022 debt maturities mentioned on the earnings call, the cost of their new debt at 5.675% and GOOD’s share price. As illustrated below refinancing its maturing debt could easily cost GOOD $0.04 of FFO/share in 2023.

Old Timer Calculations Old Timer Calculations Old Timer Calculations

2022 Lease Expirations

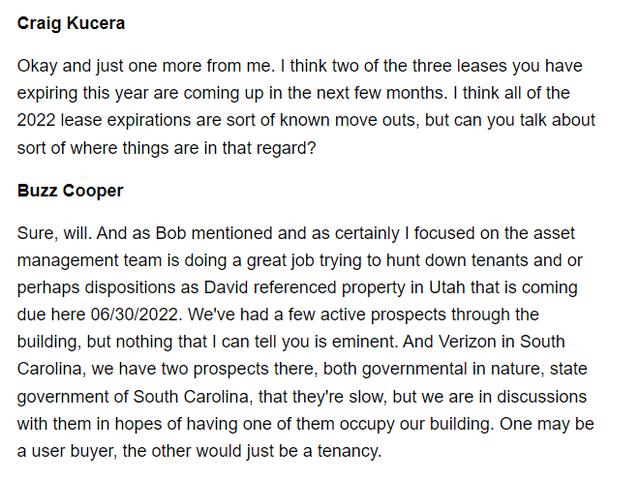

While it looks to me like the sell-side analysts who are currently covering GOOD are not digging through old 10-Ks to truly understand GOOD’s exposure to variable rate debt and debt maturities, they are aware of GOOD’s 2022 lease expirations as they are hard to ignore. Below is an analyst’s exchange with the company from the last earnings call.

I would be surprised if the company’s answer inspired confidence from investors. Nothing seems to point to a scenario where these move out will quickly be replaced with new tenants. I believe the total lost revenue equates to more than the $5.2 million in rents or $0.13/share shown in the 1Q22 Financial Supplement on page 19. GOOD will also need to assume the cost of taxes, insurance and maintenance as tenants stop paying these expenses once they leave the properties.

Risks to Shorting GOOD

It is important for readers to understand that despite the problems I believe GOOD faces in 2023, numbers for 2Q22 will not reflect the stress. LIBOR only started moving up rapidly in June and; the KeyBank and Cantor Notes will not mature until the 4th quarter. GOOD will likely continue to pay its dividend until its lenders tell it they need to stop. Not only does the dividend represent a cost to a short seller, I believe the dividend will put a floor on the stock price for some time as there will always be investors who are seeking yield. My assumption is that lenders will wait until the last possible moment to ask GOOD to reduce its dividend. In the interim they will simply pressure GOOD to raise more equity to help their position in the capital stack. In other words, I believe someone shorting GOOD needs to have the patience and capital to wait until the market has a clear and informed view of GOOD’s projected 2023 FFO/share.

Additionally, short-sellers need to be prepared for the possibility that if GOOD successfully leases some of their vacant space in Austin at attractive rates the stock could move upward.

Conclusion

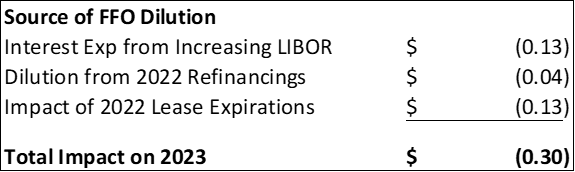

I believe that as investors begin to seriously focus on GOOD’s 2023 numbers, the idea that Net Lease REITs always produce stable results will be tested. Based on my math, if one adds up the likely hits to GOOD’s FFO from higher interest expense from variable rate debt, dilution from refinancing the remaining 2022 debt maturities and the expiration of tenant leases GOOD could be a looking at $0.30 hit to FFO/share.

Best I can tell, the sell-side analysts who cover GOOD do not appear to be fully capturing GOOD’s variable rate exposure in their models and their optimistic assumptions about refinancing 2022 debt maturities and releasing GOOD’s upcoming lease expirations do not reflect the current debt markets or office leasing environment. Based on my analysis it is hard for me to see how anything else can explain how consensus numbers show GOOD’s 2023 FFO per share going up as opposed to down.

For those who are currently long GOOD and enjoying the dividend, it is a question of when it will be too late to sell as the challenges of 2023 come into focus for investors and analysts. Short sellers need to think about the appropriate timing for going short. While 2Q22 numbers may come in in-line with consensus estimates, the challenges for 2023 will become clearer in the second half of 2022. In my opinion the opportunity to short the stock profitably will only exist before the sell-side analysts adjust their numbers.

Be the first to comment