Denis_Vermenko/iStock via Getty Images

Market downturns can be an investor’s best friend or their worst enemy, depending on how their portfolio is positioned. For those who are heavily tilted towards non-dividend paying growth stocks, unrealized losses are no fun to look at, and some may even forgo reviewing their brokerage accounts in hopes of better days ahead.

On the contrary, stock price declines present an opportunity for income investors to buy their favorite stocks on the cheap, while their yields are elevated. This brings me to Gladstone Capital (NASDAQ:GLAD), whose share price weakness now presents an opportunity for income investors to layer in at an attractive yield. This article highlights what makes GLAD a good buy at present, so let’s get started.

Why GLAD?

Gladstone Capital is a BDC that’s externally-managed by Gladstone Management Corp., with its namesake David Gladstone serving as Chairman of the company. It belongs to the Gladstone family of companies, including REITs Gladstone Land (LAND), Gladstone Commercial (GOOD), and BDC peer, Gladstone Investment (GAIN).

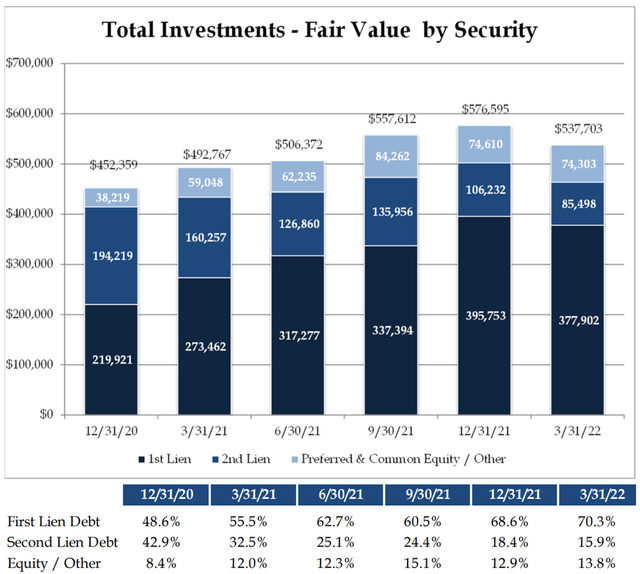

What sets GLAD apart from its sister BDC, GAIN, is that it has lower exposure to equity investments, and higher exposure to secured debt. This makes GLAD more like a traditional BDC with a more assured recurring income stream. As shown below, 86% of GLAD’s investment portfolio is comprised of secured debt (70% first lien, 16% second lien), with the remaining 14% comprised of equity for a faster potential upside to its NAV per share.

GLAD Portfolio Composition (Investor Presentation)

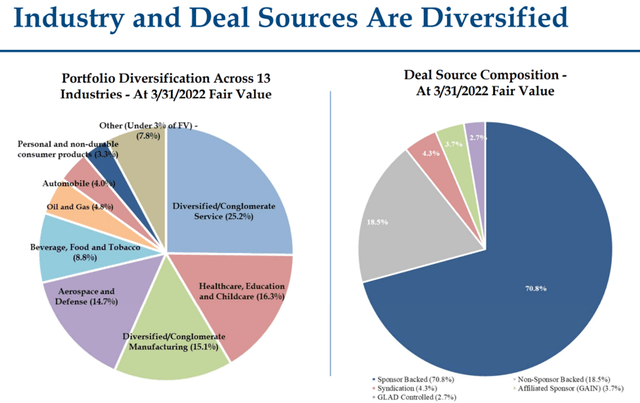

GLAD’s current portfolio is valued at $538 million, and is diversified across 45 companies in 13 different industries. The portfolio primarily consists of economically essential sectors including services, childcare, and manufacturing. It also targets lower middle market companies, whose market is fragmented with little access to traditional sources of funding. This results in attractive investment spreads for GLAD, as reflected by its current weighted average portfolio yield of 10.2%.

Moreover, the majority of GLAD’s portfolio is backed by private equity sponsors. This is beneficial to the portfolio company in that it has an automatic source of institutional governance, strategic sector insight and guidance from the PE firm. As shown below, 74.5% of GLAD’s portfolio is sponsor backed, with an additional 3% being GLAD controlled.

GLAD Portfolio Mix (Investor Presentation)

Notably, GLAD’s NAV per share increased by $0.24 on a sequential QoQ basis, but net investment income per share declined by 5.1% over the same period, to $0.25. This is primarily attributed to lower net originations during its second fiscal quarter (ended March 31) given the soft market conditions. Importantly, however, the dividend (paid monthly) remains well-covered by an 81% payout ratio.

Risks to GLAD include a more pronounced than expected economic recession, which may suppress deal activity and harm its portfolio companies. This is offset by potential benefits due to higher interest rates, as 90% of GLAD’s debt investments are floating rate, while 90% of GLAD’s borrowings are fixed rate. As such, a rise in interest rates would result in bigger investment spreads for GLAD.

Additionally, GLAD maintains plenty of balance sheet flexibility to make add-on investments, as it has carries a low debt to EBITDA ratio of 68.5%, sitting well below the 200% regulatory limit. This ability to fund its pipeline was highlighted by management during the recent conference call:

The company is on a good strong run right now and continues to invest in growth oriented middle market businesses with good management, and many of these investments are supported by mid-sized private equity funds that are always looking for an experienced partner to support the acquisition and growth of the business they are investing in. This gives us the opportunity to make attractive investments and these investments are interest paying loans, and they support their ongoing commitment to pay cash distributions to our shareholders.

Meanwhile, I see value in GLAD after the recent share price dip, from a high of $12.78 achieved recently in April to just $9.78 at present, pushing the dividend yield to 8.3%. This translates to a price to book value of just 1.03x, sitting well below the ~1.25x range it traded at for much of the past 12 months. Sell side analysts have an average price target of $11, implying a potential one-year 21% total return including dividends.

GLAD Price to Book (Seeking Alpha)

Investor Takeaway

Income investors seeking exposure to the well-run BDCs may want to consider GLAD for its high and well-covered dividend yield, as well as its potential upside from a rising interest rate environment. While risks include a more prolonged economic downturn, I believe these are more than offset by GLAD’s attractive valuation and the aforementioned benefits from rising rates. As such, GLAD’s current share price appears to present a good opportunity for high income.

Be the first to comment