PeopleImages

Thesis

The Gabelli Global Small and Mid-Cap Value Trust (NYSE:GGZ) is a closed-end diversified management investment company focused on midcap equities. The fund has capital growth as its main objective. As per the fund literature:

Under normal market conditions, the Fund will invest at least 80% of its total assets in equity securities (such as common stock and preferred stock) of companies with small or medium sized market capitalizations. The Fund currently defines “small cap companies” as those with a market capitalization generally less than $3 billion at the time of investment and “mid cap companies” as those with a market capitalization between $3 billion and $12 billion at the time of investment. At least 40% of its total assets will be invested in the equity securities of companies located outside the United States and in at least three countries.

The fund is on the small side with an AUM of approximately $100 million and an expense ratio of 1.8%. The fund has a poor Sharpe ratio of 0.2 on a 5-year range and underperformed significantly the two main midcap indices, the S&P Mid-Cap 400 Index (SP400) and the Russell index as reflected in the iShares Russell Mid-Cap ETF (IWR). The fund has a total return in the past 5-years that is only 7% and its high leverage has been responsible for a massive drawdown during the Covid crisis. We feel we are currently in the midst of a bear market rally and not done with equities selling, therefore there is further weakness to come for GGZ. However, more importantly, long term we do not see the necessary alpha generation capabilities that would have us go long GGZ versus a plain vanilla ETF in the midcap space.

We feel this fund is running a leverage ratio that is too high and has a stock selection which has failed to impress during the last up-leg in the market. Leverage can be destructive when the underlying equities do not outperform the index, and this is what we are seeing in this case. It is ultimately about total returns, and GGZ is lagging. The vehicle is trading at a -13.2% discount to NAV and has seen discounts as wide as -20%. There is nothing in the metrics of this fund or its historical performance that would have us go long GGZ versus a plain vanilla index ETF in the space. We feel this is an example of a CEF using too much leverage that has not translated into returns.

Analytics

AUM: $0.1 billion.

Sharpe Ratio: 0.2 (5Y).

St Deviation: 22 (5Y).

Yield: 5.78%.

Expense Ratio: 1.8%.

Premium/Discount to NAV: -13.2%.

Z-Stat: -0.9.

Leverage Ratio: 38%.

* the fund runs leverage through a preferred share offering rather than a traditional TRS line with an investment bank

* the CEF has 4.00% Series B Cumulative Preferred (GGZ.PRB) shares outstanding with an aggregate notional of $40 million

Holdings

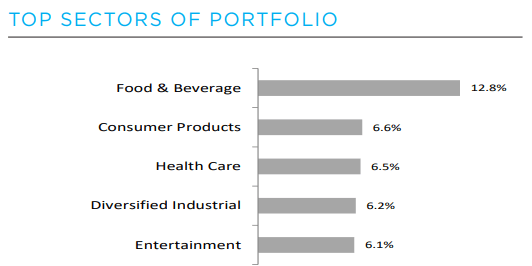

The fund counts Food & Beverage as its top sector:

Top Sectors (Fund Fact Sheet)

The top holdings are as follows, but being in the midcap space the companies are not resounding names:

Top Ten Holdings (Fund Fact Sheet)

Herc Holdings (HRI) is for example an equipment rental company with a history of over 60 years. The company has a 2.75 billion market cap that has almost doubled in the past two years. The fund has an annual asset turnover of 23%, meaning that the holdings change fairly frequently.

Performance

The fund is down almost -30% year to date:

YTD Performance (Seeking Alpha)

The vehicle is down almost -30% year to date versus -20% for the benchmark indices. The reason behind this deeply negative performance is the high amount of leverage for the fund, which clocks in at 38%. As a reminder, leverage magnifies returns both on the upside as well on the downside. 2022 has proven itself to be the year when the downside is magnified.

More worryingly though, the fund did not beat the indices during the rally up in the markets either:

5-Year Performance (Seeking Alpha)

We do not like to see this type of graph – a highly leveraged CEF with a good stock selection should be able to beat the index when the market is static or rallying. Otherwise, it is symptomatic of poor securities selection and that translates into a CEF that should not be bought. We can see from the above graph that GGZ did not beat the index from 2017 to 2020, experienced a massive drawdown that impaired some of the holdings during Covid and never subsequently overperformed. There is not much to like here where a 5-year period total return is zero. Why hold an investment if it does not produce any returns when the benchmark index does?

Premium/Discount

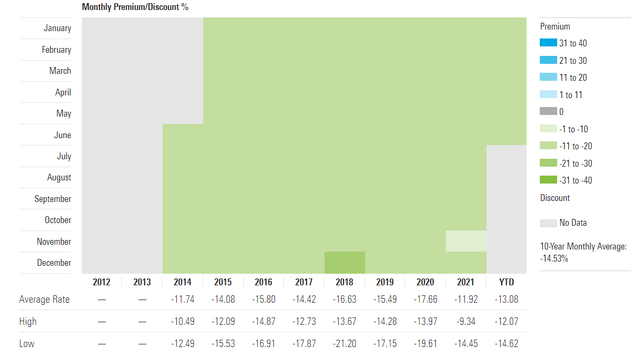

The fund is currently trading at a -13.2% discount to NAV. To put it into historical context:

Premium/Discount (Morningstar)

The current discount to net asset value is trending towards the wide side, but the fund has always traded at a discount to NAV. We can see that during 2018 that discount hit a wide of -21.2%.

Conclusion

GGZ is a closed end fund focused on U.S. midcap equities. The fund has a fairly mediocre track record, underperforming no leverage ETFs in the space. GGZ runs a very high leverage ratio of 38% which has been responsible for its deep negative performance of close to -30% year to date. The vehicle has seen the destructive force of leverage during the Covid crisis as well when it experienced a very deep drawdown. With poor risk/reward analytics we feel GGZ is a good example of a CEF running very high leverage while failing to produce matching results. We do not see any reason for going long GGZ versus a plain vanilla ETF with no leverage in the midcap space.

Be the first to comment