courtneyk/E+ via Getty Images

Editor’s note: Seeking Alpha is proud to welcome Stocks Telegraph as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Gevo, Inc. (NASDAQ:GEVO) is a stock that should be avoided given its clear red flags and mounting uncertainties. As a result, investors are warned to not fall into the present buying spree. Its financial fundamentals and insider transactions along with the uncertain nature of projects point to a high opportunity cost for investing in the stock.

What is GEVO and What Does its Recent Trajectory Tell Us?

Gevo is a company operating within the renewable fuels sector and is supported by a business model that commercializes diesel and jet fuel, along with gasoline. The company’s broader vision aims at the reduction of greenhouse gas emissions while launching suitable renewable alternatives to the markets it serves. The stock has seen highs and lows in recent years, trading as high as $23 per share in 2018, and down to penny stock levels of $0.49 per share in 2020. Early 2021 was when GEVO experienced its recovery phase, shooting up above to over $14. At present, the stock is oscillating beneath the $5 mark, which falls 50% below its 52-week high price.

GEVO’s Revenue Keeps Sliding

On Feb. 24, 2022, GEVO released its earnings report, which is one trigger that brought the stock under the spotlight. In its fourth quarter of 2021, the company reported a revenue of nearly $100,000, a significant slump from the fourth quarter of 2020 which delivered half a million in revenue. This fall is a clear red flag for investors in GEVO, which understandably raises concerns about future growth prospects. This slump in quarterly revenue presumably is attributed to the sale of hydrocarbons, which amounted to nothing. In the previous year’s comparable quarter, this head of revenue stood at $400,000. Moreover, sales from its Luverne-based production facility in Minnesota remained insignificant, for over a year due to COVID-related circumstances.

Gross profit in the fourth quarter also took a heavy hit, because, in addition to the diminished revenue figure, the cost of sales also rose drastically from $0.9 million to $2.8 million, in the fourth quarter of 2020 and 2021 respectively. GEVO attributed this to producing isobutanol in-house, rather than purchasing it from an external supplier. The company maintains that with the refining of its production processes, efficiencies will be realized, and costs will be pushed down.

To make matters worse, the company’s cost of operations swelled substantially within a year, from $7.6 million to a whopping $16.5 million. With this surging cost of operations and a resultantly diminished revenue, it is evident that the company is unable to translate its spending into value for shareholders, which goes on to justify this skepticism.

Despite these deteriorating financials for the fourth quarter, GEVO managed to report a reduced net loss per share of -$0.08 from the previous year’s -$0.15. Analysts, however, have rightfully pointed out that this reduction had been in large part due to the share dilution in 2020. The number of floating shares rose from 120 million in 2020, by over almost 70% to 202 million in the prior year. As a result, the net loss, rather than being diminished through positive performance, was simply spread out to a larger number of shares, minimizing the magnitude of its impact on each GEVO stockholder.

Typically, share dilution is met with resistance by its shareholders, as it holds the prospects of divided ownership, and hence a divided right to earnings. However, in the case of a company such as GEVO, the move has potentially divided losses to a bearable level across a larger pool of investors. When adjusting this loss according to Non-GAAP standards, there is an increase in net loss per share across the year from -$0.07 to -$0.08 per share.

Is GEVO’s Growth Potential Worth the Costs?

From within GEVO’s total value package for its investors, a fundamental component is the high-volume sales deals the company has reported. These include a sustainable fuel agreement with Delta Air, a sales deal with Oneworld Alliance Members, as well as an eight-year supply agreement with Kolmar Americas Inc, worth $2.8 billion, amongst many others. Each of these deals, worth in the billions, would theoretically boost the company’s potential for value creation to a significant degree. Moreover, the company boasted that deals worth an accumulative $30 billion are currently in the pipeline, which supposedly enhances GEVO’s probability of becoming a clean energy leader, to a substantial degree. However, there is far more at play than this surface-level information.

Given the volume of these sales deals, which surpasses $30 billion, the market’s valuation of Gevo at approximately $1 billion raises eyebrows. For one, its financials do not add up to this flowery picture these deals paint. Considering its revenue figure of a measly $100,000 in the fourth quarter, it is evident that the deals are yet to translate into value realization for its shareholders.

Concerns regarding these figures are reasonably justified, especially given that the GEVO management has expressed that these deals are subject to several assumptions. These include prevalent fuel prices, as well as other macroeconomic factors, which raises a question mark if this $30 billion figure will see an execution. Broader assumptions are an uncertain anchor to rely upon, as recent years have shown. From the global industrial paralysis that was caused by the COVID-19 phenomenon and its subsequent recession to the Russian invasion of Ukraine, and the supply chain breakdown across the globe. Markets are repulsed by uncertainty, and this is clearly why GEVO’s deal figures have not impacted its market capitalization as of yet.

GEVO’s Short-Term and Long-Term Tradeoff Between Risk and Return

Gevo is a company, by the very nature of its industry, that takes long-term strategic aims. The renewable fuels industry is defined by initially heavy infrastructure costs and investments, which will eventually pay off with growing demand, and optimizing external conditions. For instance, the U.S. government’s passing of the $1.2 trillion infrastructure bill, with as much as $550 billion being considered for allocation in the clean energy sector, indicates a significant shift in market dynamics. However, the degree to which Gevo is positioned to capture this opportunity, in an increasingly competitive industry, is yet to be determined. The uncertainty further exacerbates when considering the long payoff period that a GEVO investment would entail.

One example of this time uncertainty that is inherent to GEVO is its upcoming Net-Zero project, which is anticipated to operationalize in 2025. The company states the project will generate an EBITDA of up to $200 million, on an annual basis. However, this outlook too is based on several assumptions, with little substance that bulls in the market can latch on to for three years.

The present value of this growth potential is substantial, however, is not reflected in the company’s current market capitalization. This is perhaps due to the significant opportunity cost for the growth spurt that will come a full three years later, as well as the skepticism regarding this expectation, which is based on several assumptions.

When Will GEVO Transition to a Cash-Maker?

Looking at Gevo’s financial position, it is evident that the company has been enhancing its liquidity position. Although this improves the company’s ability to work on its profit-generating initiatives, as well as market growth. However, what is concerning is that this cash generation is achieved through equity financing, as indicated below:

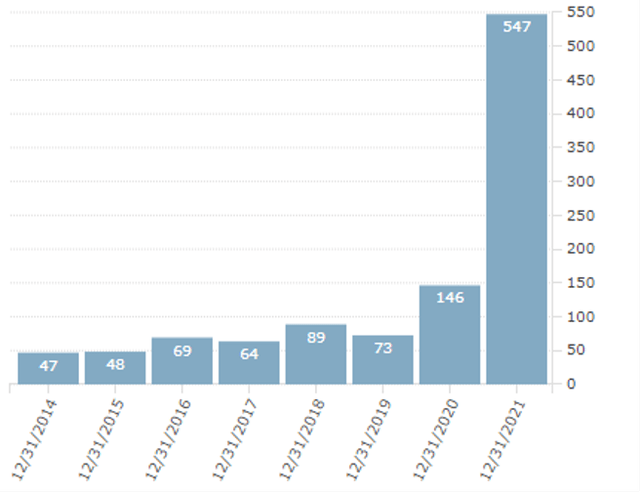

GEVO’s Equity History (Finviz)

As can be seen, total equity jumped up to $547 million in 2021, indicating a financing boost for the company of substantial proportions. Share dilution to such a degree, although helpful in dividing the burden of loss, comes with its costs. The present value of future growth potential, which is all the stock is presently standing on, ends up getting severely diluted, as a result. The approach is unsustainable as a means for cash generation, and the company will eventually need to begin generating revenue to support its growth and pay off obligations.

However, for a company as heavily shorted as GEVO, creditworthiness may remain low, which makes equity financing a far more suitable option to generate funds.

Can Insider Transactions Tell Us What the Market Doesn’t?

In our attempts to get to the bottom of GEVO stock, some recent SEC filings may potentially shed light on whether or not GEVO is worth betting on. On March 24, 2022, Gary Mize, who has been a director at the company for the last 11 years, sold $453,469 worth of his share in Gevo. The same day, director William H. Baum sold a hefty amount of his direct stock worth $396,234. Like Gary Mize, Baum too is a long-time executive in the company, who has been a board member for the last 6 years.

The news raises red flags, given the information advantage such high-profile insiders have over the wider market. Where on one hand, the management optimistically puts forward its growth prospects, and its deal worth billions, insider trading depicts an entirely different picture.

How Pessimistic is the Market Regarding GEVO?

A major sign of distress for the stock is its short float, which is reported as 19.84% as of the 5th of April, 2022. This proportion is extraordinarily high, with close to a fifth of shareholding in the company reflecting bets on it eventually falling. The short float is a useful metric to assess, as it is essentially an indicator of sentiment. In the case of the wider market, pessimism towards GEVO runs fairly high, based on the information available to the public.

Coupling this with what insiders of the company lean toward, it is evident that there is little that gives market participants a reason to take long positions on the stock. Furthermore, GEVO’s institutional ownership of 43% remains relatively low compared to the wider market, where most ownership of stocks is attributed to various institutions. Given the promise that is widely associated with the renewable fuels sector, institutional ownership of between 70% and 80% is typical. Taking into account the rigorous risk assessment models that such institutions apply, as well as the long-term horizons that are considered, this low percentage adds to the concerns of the wider market.

Could the Crisis in Ukraine Turn the Tables for GEVO?

Several broader factors however deliver a fresh wave of optimism to those looking to take long positions in clean energy companies such as Gevo – particularly the crisis between Ukraine and Russia, which acts as the perfect macroeconomic jolt that is needed to adjust the status quo, towards transitions away from the norm. With economic sanctions imposed on Russia, which is one of the largest fuel exporters in the world, countries are increasingly looking toward severing this vulnerable reliance on fossil fuels. The immediate call to attention is clean energy alternatives, which offer a sustainable way forward, that addresses state-level reliance on countries. With the large uncertainty in the GEVO assumptions, a key variable to factor in will be the transitory phase major global economies will be under, with a heavy incentive to work towards sustainable alternatives to fossil fuels. However, the number of uncertainties factored into this growth path makes this a risky bet to latch onto.

Moreover, the global shocks from the Russian invasion of Ukraine also raise severe obstacles to the growth of the industry as a whole. Both Ukraine and Russia are primary global exporters of precious metals, which are crucial to solar panels, wind turbines, and the components used in electric vehicles. Currently, there is little to show that GEVO’s long-term prospects could take a favorable turn, which is why market participants are staying put.

Conclusion

GEVO, in many respects, is an interesting stock. It anticipates sales deals worth tens of billions of dollars, yet holds a relatively low market capitalization and even lower revenue. Its decreasing financial performance is a strong indicator that its mammoth deals are not translating into real value addition for its shareholders. This raises serious concerns for investors, given that the company is unable to generate value despite so many large-scale deals being communicated. GEVO is a high-risk stock with no signs of making a turnaround as yet. Moreover, despite the promises of management, the market is not pricing the stock based on the present value of its growth potential. This reinforces the lack of prospects that appeal to investors.

Bottom line? GEVO stock is not a buy right now.

Be the first to comment