Iryna Melnyk/iStock via Getty Images

REITs come in all shapes, sizes and forms. While there are some like Armada Hoffler Properties (AHH) that are diversified in different property classes, others like Simon Property Group (SPG) and Getty Realty Corp. (NYSE:GTY) are more pure-play types.

It’s been a couple of months since I last covered Getty Realty and the stock has performed admirably since then, giving a 10.4% total return, far outpacing the 1.6% rise in the S&P 500 (SPY). While GTY has gotten more expensive, I show why it’s still worth considering for high income growth investors, so let’s get started.

Why GTY?

Getty Realty is an internally-managed REIT with a $2.0 billion enterprise value, making it the largest REIT to specialize in the acquisition and development of convenience, automotive, and other single-tenant properties. At present, it holds a large portfolio of 1,021 freestanding properties that are spread across 38 U.S. states plus Washington D.C.

What sets GTY apart from many other net lease REITs is its pure-play focus primarily on automotive-related assets, many of which come with a convenience store component. This enables management to hone in on its core competency with fewer distractions.

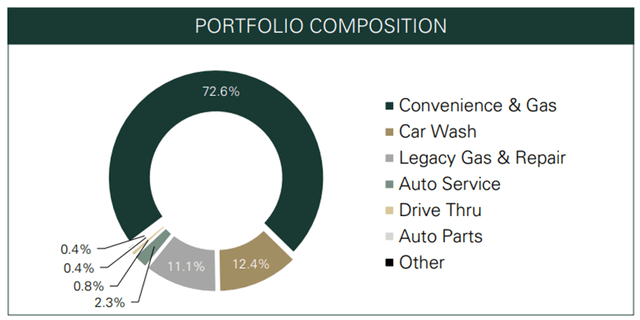

Furthermore, 71% of GTY’s properties are corner locations that garner the most traffic, and 65% of its properties are in the Top 50 MSAs in the U.S. As shown below, GTY has most of its exposure from the higher profitability Convenience & Gas segment, which comprise 73% of portfolio annual base rent versus legacy gas & repair, which now comprise 11%.

GTY Portfolio Mix (Investor Presentation)

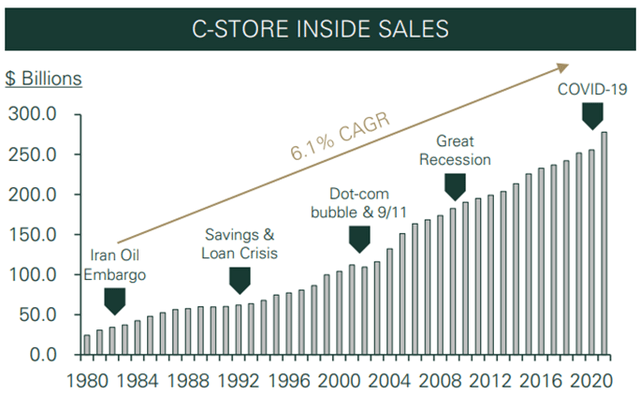

Also, if there is such a thing as a recession-resistant REIT sector, it appears that convenience stores are it. As shown below, C-Store sales have climbed steadily over the past 40 years, through a multitude of economically challenging times.

C-Store Sales (Investor Presentation)

GTY benefits from the fact that its properties are economically essential and recession resistant, considering that gas stations are a staple for most consumers much like groceries from the store. Plus the fact that GTY is net lease landlord means that it gets a steady rent check no matter the swings in gas purchases during and off peak travel times. This is reflected by the fact that GTY’s tenants have on average a healthy 2.7x rent coverage and its leases have a long weighted average term of 8.6 years.

Meanwhile, GTY continues to demonstrate strong portfolio fundamentals, with a 99.6% occupancy rate as of the end of Q3. The core property base continues to grow, with GTY acquiring 24 properties on a YTD basis for $80.5 million, including a mix of car washes and convenience stores. Moreover, GTY maintains a robust investment pipeline of over $150 million for the acquisition and development of 44 convenience stores, auto service centers, and car wash properties.

This is supported by a strong BBB- Fitch rated balance sheet, with a low 4.9x net debt to EBITDA ratio accompanied by a strong 4.0x fixed charge coverage ratio. Also encouraging, GTY’s now higher share price now supports potential for more accretive equity raises. Management noted on its attractive investment pipeline during the recent conference call:

The dedicated efforts of our team have led to a net increase in our committed investment pipeline to more than $150 million from the acquisition and development of new-to-industry convenience stores, auto service centers and car wash properties, which we expect to fund over the next year or so.

Equally important, our strong liquidity position and select capital raising activities will allow us to lock in attractive investment spreads and accretively fund these transactions. Brian will elaborate further in his remarks, but we have already raised or identified funding for approximately 75% of this transaction activity at costs meaningfully inside of prevailing market rates.

Our strategy continues to emphasize owning high-quality real estate and partnering with growing regional and national operators across the convenience and automotive retail sectors. With our relationships, underwriting expertise, and an expanding opportunity set we are confident in our ability to continue executing on our investment strategy and further diversifying our portfolio, while remaining disciplined in an environment where asset pricing is currently undergoing a significant change.

Notably, some may believe that the gas station may one day go the way of the do-do with increasing electrification. However, I believe EV growth may be overstated, considering that the past few years saw early adopters, while middle of the road adopters will be harder to convince, especially considering the environmental concerns and supply limitations around lithium, a key component of car batteries. This has led to car-marker Toyota Motor (TM) to caution against going full-electric and to maintain its line-up of gas-powered cars for the foreseeable future.

Meanwhile, GTY currently yields an attractive 5.3% and the dividend is well-covered by an AFFO payout ratio of 79.6% (based on Q3 AFFO per share of $0.54). It also comes with 8 years of consecutive growth and a respectable 5-year dividend CAGR of 7.9%, one of the highest in the net least sector.

While GTY is no longer very cheap at the current price of $32.76, it still trades lower than its net lease peers with a forward P/FFO of just 14.1. For reference, Realty Income (O) currently trades at a P/FFO of 16.2 and Agree Realty Corp. (ADC) comes with a P/FFO of 17.9. While GTY lacks the storied history of both these REITs, it does come with a comparably strong balance sheet and the pure-play focus means that management can be more laser-focused in its strategy.

Investor Takeaway

Income investors would do well to take a closer look at Getty Realty as a way to add exposure and diversification to the net lease sector. With its strong balance sheet, attractive dividend yield and solid growth prospects, GTY looks like a promising income idea for the long term.

Be the first to comment