DNY59

Introduction

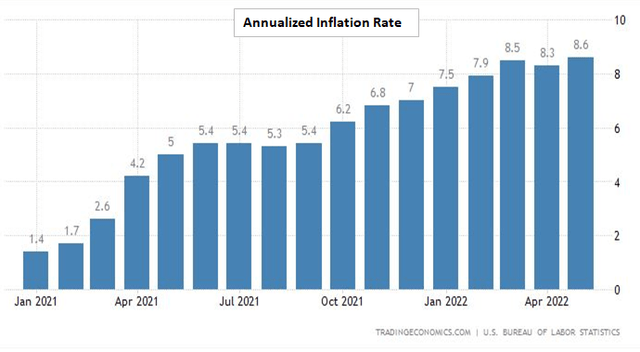

I’ve been an active self-directed investor for over 40 years and I have never seen our economy go from great to tanked in such a short period of time. What a difference 18 months has made. Excepting our chief executive, most everyone else understands that the current state of our economy and its current direction is going to be hard on a lot of families, in some cases, very hard. However, one of the truisms I’ve learned over the last 40 years is that investment opportunities can be found regardless of the state and direction of the economy. Inflation is running hot, even hotter than expectations with the June CPI estimate coming in at a scorching 9.1%. This is shaping up to be a once in a generation opportunity to pick up fixed income securities at bargain basement prices sometime in the next 6 months.

I published a similar article a few weeks ago. With the June CPI estimate coming in hot, I fully expect the Fed to raise rates a minimum of 75 basis points in July with the possibility of a full 100 basis point increase. I decided to double down and identify enough securities to develop a bond ladder and start accumulating debt securities on the near-term end of the ladder following the July FOMC meeting.

Interest Rates

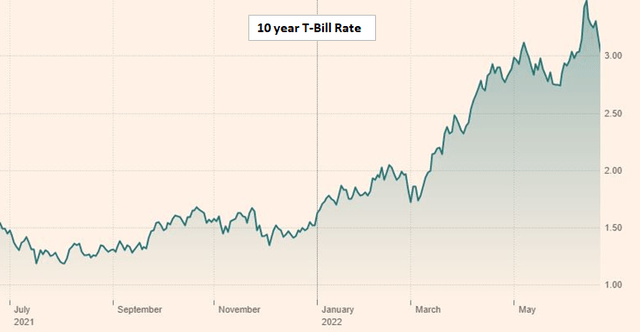

A short 18 months ago the economy was humming along with the lowest rates in roughly 50 years, falling civilian unemployment, and inflation under the 2% Federal Reserve target rate. In contrast, today companies are laying off workers or planning layoffs for the near future and inflation is currently estimated at a scorching 9.1%+, the highest in over 40 years. The charts below show the increases in the CPI and the 10 year T-Bill rate up through May, 2022.

Trading Economics Financial Times

The bull market in fixed income securities is clearly over. That is the bad news. You can, however, turn some of that into good news and maybe great news with a little patience and due diligence.

The Federal Reserve (Fed) has committed to combat inflation with both tools they have available. Raise short term interest rates and halt the buying of securities to allow them to roll-off their books as they mature (Quantitative Tightening). Both Fed actions will put upward pressure on interest rates. Given the hot June CPI estimate, the Fed will be under increasing pressure to act aggressively to get the inflation rate turned around. The bottom line is that we are going to be in a rising rate environment for the near future. I think we can expect a 75 basis point increase as a minimum coming out of the July FOMC meeting and we may see an even more aggressive 100 basis point increase. If the CPI is not showing signs of turning around by September, I believe we are likely to see another 75 basis point increase. Single and multi-family building permits are down and residential mortgage applications have fallen by about a third. With another 150 basis point rise between now and middle of September, we are likely to see more significant slowing of economic activity. It is possible we will see the Fed pause or slow the rate of increase in short term rates after September.

I’ve got cash reserves sitting on the sidelines now that I’m hoping to put to work in fixed income securities. I’ve revised my earlier planning and will likely start accumulating near term maturity debt securities after the July FOMC meeting; effectively building the near-term end of a bond ladder. To mitigate the timing uncertainty, I’m getting ready early with a list of baby bonds and preferred shares.

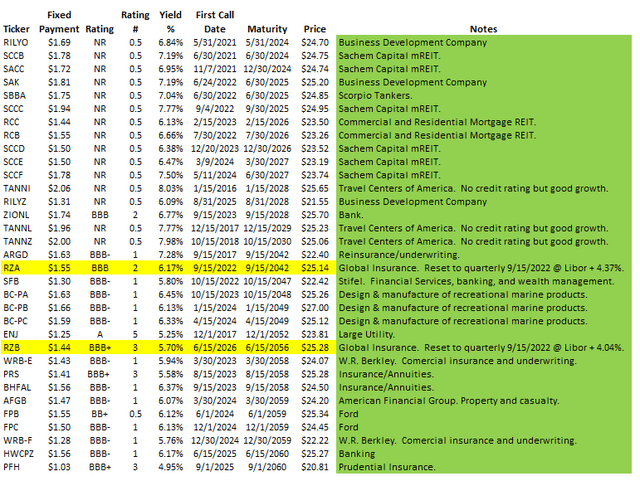

Baby Bonds List

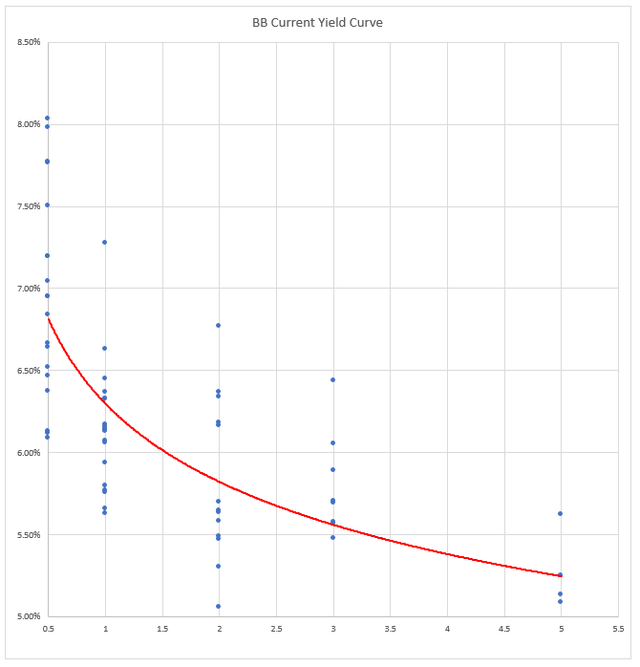

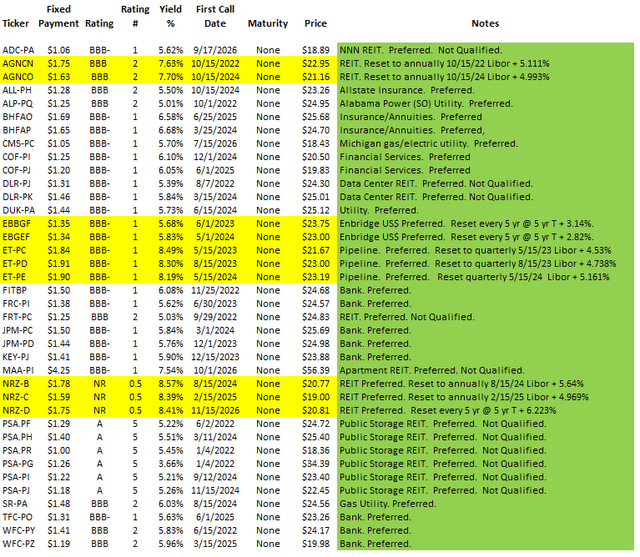

Over the last couple of months, I’ve put together a list of baby bonds for possible investment. I say “possible” because it depends on how the individual bond prices settle out after another 150 basis point increase in short term rates. The list contains about 66 issues and I expect to invest in roughly half of those 66 issues. To put some objectivity into the process of selecting the individual securities I will choose for investment, I’ve graphed the yield versus credit rating. This allows me to select those securities that are offering a higher than average yield for each credit rating category (“Not Rated” up through “A”). The list is in the form of an EXCEL spreadsheet and the column titles should be self-explanatory.

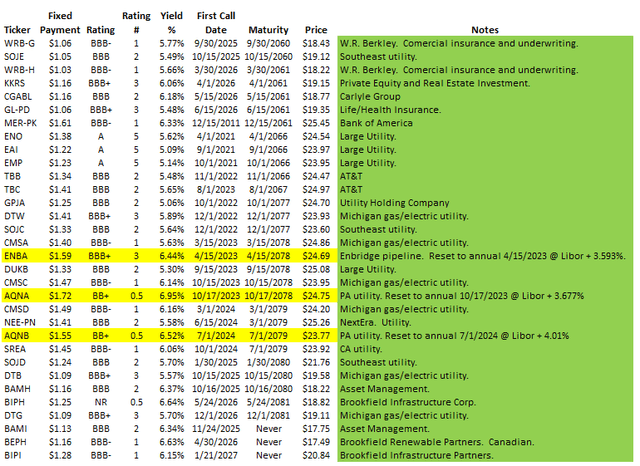

I had to split the baby bond table in half, the other half follows directly below.

I’ve sorted the baby bond list by maturity date versus by symbol as in the previous article to better facilitate the building of the near term portion of a bond ladder.

Readers should note that, because baby bonds are exchange traded debt securities, the price fluctuates intraday. Therefore, the prices listed will be different than what you will find the securities trading at this coming week. Most of the issues are trading below par ($25) with a handful still trading at or above par. After another couple rounds of Fed short term interest rate increases, I expect that all bonds in the list above will be trading below par. I generally do not invest in bonds selling above par unless there is a special circumstance that compensates for the higher than par value price.

All the baby bonds in the above lists are included in the chart below. The chart, as presented here, is simply a picture pasted into the article. In my EXCEL spreadsheet, the dots on the chart are linked to the corresponding security in the lists above. As mentioned above, I use the chart below as an aid to select those bonds that yield more than the average for their credit rating group. I may ultimately decide to invest in a security that falls below the power curve fitted line but at least I have sufficient information to make that decision.

One possible quibble readers may have is my choice to assign a value of 0.5 for the pseudo credit rating for non-rated securities. It is somewhat arbitrary and, had I assigned a value of 0 instead, the fitted power curve would have a bit less negative slope near the vertical axis (between 0 and 2). This would effectively lower the curve a bit for the 1 rated (BBB-) securities putting a few more issues above the line versus below.

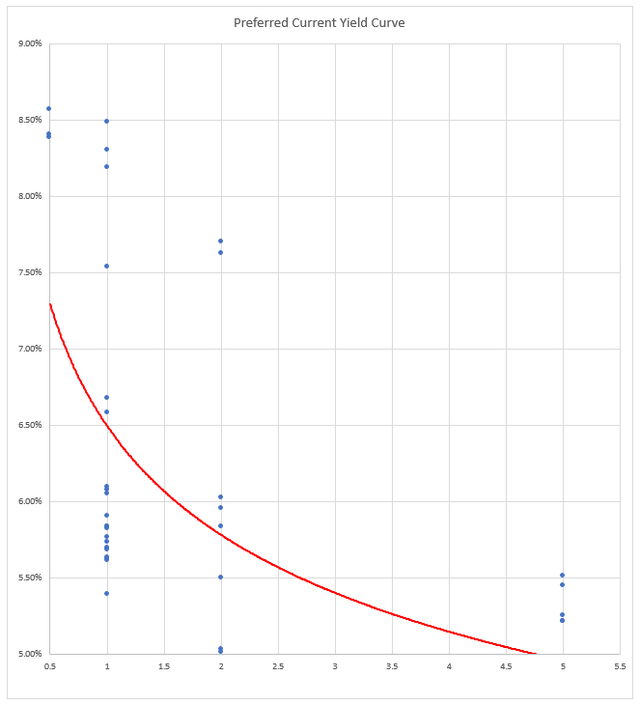

Preferred Shares

Though preferred stock issues are technically stock, because they pay a fixed dividend and most have no maturity date, preferred shares behave much more like long term bonds than they do common stock. I have fewer preferred share issues listed because I find preferred shares, for the most part, do not offer much more risk protection versus common stock. Yes, preferred shares are a notch higher in the capital stack and issues that are cumulative do have to pay out accrued dividends before common stock dividends are paid, but the board of directors can cease preferred share dividends just as easily as common stock dividends. Failure to make baby bond distributions generally leads to default on the issue and a major impact to a company’s credit rating. Baby bonds clearly have a lower risk of not returning principal and breaking your income stream. With that said, below is a list of the preferred shares I’m considering.

I probably should note here that the yellow highlights in both the baby bond list and the preferred stock list are to remind me that these issues are either fixed to floating rate or rate reset securities. This is important to understand for anyone contemplating investing in this type of security. A good website for information on exchange traded debt and preferred shares is Quantum Online. The site gives a very good summary of the terms for fixed income securities and I highly recommend reading up on any exchange traded debt or preferred share before making the decision to invest.

Similar to the baby bond list, I have a chart of current yield versus credit rating provided below.

Since I wrote and published the earlier article, I have found a number of preferred shares assigned credit ratings by either Moody’s or S&P. For those preferred shares without a credit rating, I have listed the credit rating of the issuing company. In all cases, I’ve reported the S&P rating or the Moody’s equivalent.

Conclusion

I’m planning on retiring sometime in the third quarter of this year. It will be the second time I attempted to retire; the first attempt (at 55) was derailed by boredom. This time I think I’ll stick with being retired. So, for me, the Fed’s plan to raise rates and reverse quantitative easing to combat inflation is a welcome change. I’ve got cash I need to put to work and I’ve already got a sizable stock portfolio. The opportunity to invest in fixed income at decent rates of return is a very welcome change from the historically low fixed income rates of return of just 18 months ago. With fixed income securities having dropped 10% to 27% over roughly the last year, not only will I get a decent yield, I stand to get some capital appreciation when interest rates moderate, the security is called, or the security matures.

The hot June inflation estimate makes if more likely that we will get an aggressive Fed short term rate increase at the end of July. I expect the valuations of the baby bonds and preferred shares I have selected will drop (and yields rise). I’ve never been good at predicting the exact bottom (or top) of any of the markets. However, I can’t get into too much trouble starting on the near-term end of a bond ladder and I believe yields will be more favorable after the July FOMC meeting.

Be the first to comment