Roman Barkov

Investment thesis: With the latest news of Russia-EU gas pipelines blowing up, there is no longer any doubt about the fact that Europe is going on a severe energy diet for the foreseeable future. The big question now is how the necessary demand destruction will play out. Germany’s 200 billion euro plan to shield its own consumers from high energy prices in effect helps to shift some of the energy demand destruction that will occur in the EU to the consumers of other nations, especially the ones that are fiscally weaker. Other nations that have a strong fiscal situation to rely on, such as the Netherlands, Austria, or Luxembourg, will most likely do the same, while EU members in the South and in the Eastern part of the EU will be forced to stand by and watch as their households and their industries are priced out of the market. Germany’s move is meant to deal with a tough situation, especially in the aftermath of the destruction of the Nord Stream pipelines, which now leaves it mostly dependent on LNG. The socio-economic pressures and frictions that this situation is likely to create have the potential to demolish the entire EU project.

Starting this winter and beyond, the EU will find itself in constant extreme crisis mode, with no end in sight to the ongoing economic destruction, which has the potential to change the calculus of individual nations in regards to how they view their benefit/liability analysis in regards to continuing to be part of the EU. From an investment perspective, we have to keep in mind that a socio-economic implosion of the EU has the potential to throw the entire world into a severe financial and economic crisis. Even as the recent market selloff may signal an investment environment that is starting to look attractive in terms of investors finding more and more bargains, if an EU implosion will take place, the downside risks to investment portfolios are severe and broad-based.

The energy situation in Europe is dire and it is one cold winter in the Northern hemisphere away from becoming catastrophic.

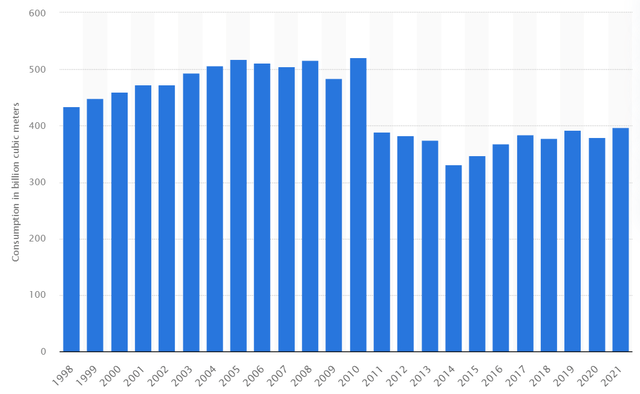

In order to understand the circumstances that led Germany to announce a 200 billion euro energy consumption subsidy plan, equivalent to about 5% of its GDP, we have to take stock of the dire situation that the EU finds itself in. As of right now, there is barely any flow of Russian natural gas headed to the EU. Last year, it consumed 155 Bcm of Russian natural gas, out of the total demand of 397 Bcm.

EU natural gas demand (Statista)

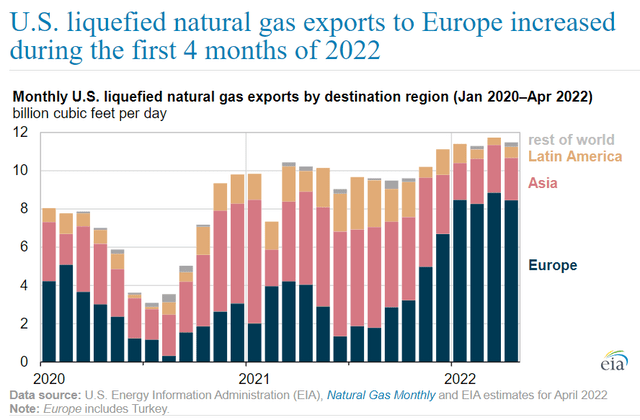

As things stand right now, the EU is looking at having to replace most of that 155 Bcm gas volume, mostly with LNG imports, with demand destruction having to take care of the rest. In 2021, the EU was already importing about 80 Bcm of LNG, or about 57 million tonnes of LNG, out of 380 million tonnes available on the global market. Most of the rest was going to Asia Replacing the full 155 Bcm that now seems to be lost due to the Russia situation would take another 110 million tonnes. In other words, the EU would have to import almost half of the world’s LNG supplies.

While great strides have been made in supplying extra LNG to the EU, we should make note of the fact that American LNG in particular is what made it happen.

This is an important detail because the U.S. is faced with the same Northern Hemisphere seasonality of natural gas demand issue as Europe. In other words, in the event that the U.S. faces a harsh winter, it will at some point be left with no choice but to cut LNG exports, which at this point are set to amount to about 100 Bcm/year for the European market.

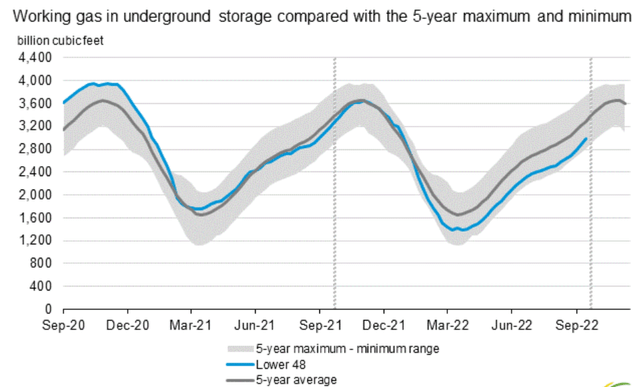

US natural gas storage levels (EIA)

As we can see, the ramping up of U.S. LNG exports to the EU coincided with a widening gap between the 5-year average U.S. gas in storage and current levels that are down by almost 10% compared with that average.

Summing up the overall situation, the EU has to trigger demand destruction by pricing out consumers, imposing gas use limits, or outright asking industrial entities to shut in production. A 15% cut between summer of this year and spring of next year was considered to be the bare minimum needed, which was estimated to be about 45 Bcm in consumption cuts. In a worst-case scenario where winter will be colder than usual in Europe as well as in the U.S. the need for demand destruction can widen significantly to perhaps about 30% or more.

The German plan to subsidize its residential, as well as its industrial consumers with 200 billion euros, answers at least in part the question of which nations will be obliged to contribute most to whatever level of demand destruction that is needed, and which will contribute the least. The very obvious answer is that all countries which will be able to proportionally match Germany’s subsidy plan will see less demand destruction, while countries that cannot match it, will see the most demand destruction occur.

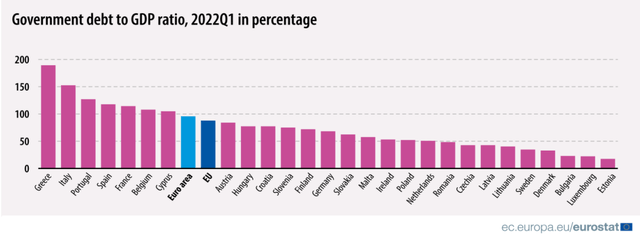

How national subsidy measures will affect the EU energy market and EU consumers overall, comparatively speaking, depends on the national economic and financial situation

In order to illustrate the huge disparity in the ability of various governments to subsidize the consumption of energy in the economy, the best indicator, although not the only factor, is the debt/GDP situation of various nations.

In order to match Germany’s plan proportionally speaking, a country like Italy, for instance, would have to come up with about 100 billion euros. Italy does not have any hope of approaching the market even for half of that amount in new debt, especially with the ECB being forced into monetary tightening mode by a falling euro and surging inflation.

There are other factors that will affect the level of demand destruction that we will see across the EU, such as huge disparities in buying power. For instance, with net incomes in Romania being only about a quarter of wages in Germany, Romanian households are more likely to respond to the exorbitant rise in utility bills by cutting back on heating their homes and hot water use. Such disparities will only serve to exacerbate the disparities in terms of the pain that will be inflicted on EU economies. A country like Romania will also find itself more constrained in its ability to subsidize its consumers for the simple fact that a similar subsidy package of about 5% of GDP will only amount to about a quarter on a per/capita basis in nominal terms, given that Romania’s GDP/capita is only about a quarter of Germany’s.

The inevitable end result of all these limiting factors that will prevent certain governments from helping out their own consumers to a similar degree that Germany just announced, will be a massive disparity in the level of pain that this crisis will inflict on the EU’s individual member states. Eastern and Southern EU members will be more likely to suffer a disproportionate impact at household as well as at industrial levels, while the wealthier countries in the EU economic core, namely Germany, Austria, the Netherlands and perhaps France will experience a lesser impact. France in particular is set to benefit from its heavy reliance on nuclear power, which shields it from this crisis to some extent.

The socioeconomic and probable political fallout

In the face of disproportionate pain that EU nations that are already economically weaker will see inflicted on them, there will be inevitable political fallout. It will not take long to realize that industrial activities in certain countries will be less affected, with fewer people losing their jobs, and also realize that households in certain countries are suffering far less than they will and already do suffer more in some of the poorer states. The next obvious public reaction will be to demand tangible solutions.

There are signs that there are already fears within certain governments that the German plan will create such disparities. Italy’s outgoing technocrat Prime Minister Mario Draghi remarked the following on the subject:

“Faced with the common threats of our times, we cannot divide ourselves according to the amount of room in our national budgets.”

Italy’s most likely incoming Prime Minister after the recent elections, Giorgia Meloni, is also critical of Germany’s plan. Some disapproval has been voiced within EU institutions as well.

The energy shortage situation that the EU finds itself in and the resulting demands made on EU households and businesses to conserve energy will lead to very unfamiliar living conditions for most citizens of the EU. There are some notable exceptions, namely in EU member Romania, where one can already find many voices of disbelief, especially among those who are 40 years old or older and still have unfond memories of life in 1980s Romania. The communist dictatorship of that time demanded similar sacrifices from its citizens, including imposed household energy-saving measures. I will never forget the public mood of joy and relief that day when the execution of the Ceausescu couple took place, as well as the reasons why the execution of two people brought so many people so much happiness and hope for a better future. It was not so much the authoritarian regime, but rather the poor living conditions imposed on people, with no end in sight. It led to desperation and rage, which could no longer be contained, even by acts of brutality, such as opening fire on protesting crowds.

Perhaps, as long as enough people in the EU can be convinced that there is a light at the end of the tunnel, they may endure through the coming winter, without their rage and desperation spilling over. I do not see it lasting beyond that, at which point leaders of the most affected countries will be left with no choice but to face the rage of their electorate or channel it in other directions. Channeling it towards Russia will most likely not suffice. That approach is already starting to wear thin with more and more people as far as I can tell, which is also increasingly evidenced in electoral results in certain places this year. I am not certain how things might play out beyond that point, but I do believe that it will leave the EU paralyzed, dysfunctional, and perhaps on its way to institutional demolition, or perhaps with some member states headed for the exit door.

Investment implications

Given the stock market selloff that we saw much of this year, it is increasingly tempting to start looking for bargains. It is hard to ignore that Advanced Micro Devices, Inc. (AMD) is trading at under $65/share, given that not long ago it was trading at almost $170/share. Even its rival Intel Corporation (INTC), which was trading at a 2022 high of $68/share, now looks increasingly attractive at under $26/share, especially since it is also paying a generous dividend per share of over 5.5% currently. Suncor Energy Inc. (SU) has been trading at a roughly 30% discount from this year’s highs. These are just some of the examples where I either built a position in their stock recently or I added to my already existing position.

Even though I am looking at some of these discounted stocks that I consider to be trading at a price that offers a good entry point for the long term, I should specify that I am acting very cautiously. At this point, I am still keeping the cash portion of my portfolio well above 30%, as I have been mentioning in recent articles. It is in part because I see a very high probability of a significant global economic downturn, perhaps starting at the end of the current year and going into the next year.

The German move to shield its own energy consumers, using its fiscal power relative to its EU peers as an advantage leads me to believe that we need to become even more cautious in regard to investing. Deepening disparities between the richer countries and the poorer countries in the EU can only lead to its destabilization. While I have no way of predicting how such a crisis will play out, I know that it cannot lead to a good outcome. In a worst-case scenario, it can lead to the outright collapse of the EU, which would be a calamitous event for the entire global economy, especially if it will happen in a disorderly manner. Personally, even as I continue to look for opportunities to invest, given the pullback in markets this year, I also intend to remain cautious and keep a very close eye on the EU situation for signs of destabilization or even implosion as it continues to deal with the grim economic situation caused by its energy crisis. The situation dramatically changes the overall investment risk-reward calculus in my view and not for the better.

Be the first to comment