xavierarnau/E+ via Getty Images

Machinery, whether it’s an automobile or some piece of industrial equipment, requires regular upkeep and replacement parts. Otherwise, the machinery in question will eventually fail. One company that’s dedicated to providing replacement parts for both the automotive and industrial markets is Genuine Parts Company (NYSE:GPC). In recent months, the company has performed exceptionally well. This comes as management is forecasting a rather strong 2022 fiscal year. Despite the company’s stock rising in recent months, I do believe that the business offers investors additional upside potential moving forward. While this upside may not be as material as it was previously, it is definitely worth a close look for investors who are searching for a high-quality operator in this market.

The company just keeps growing

Back in September of last year, I wrote an article that had a bullish take on Genuine Parts Company. At that time, I saw the company as a quality player in its space. This was based on the company’s historical track record, including its return to growth following the worst days of the COVID-19 pandemic. I said that the firm would likely continue to grow in the years to come, but I also said that it was far from being a value play. All the same, I did think that the company would offer investors attractive prospects. So as a result, I ended up rating it a ‘buy’ to reflect my belief that its returns, for the foreseeable future, should outpace the broader market. Truth be told, the business has done far better than even I anticipated. While the S&P 500 is down by 15.5% over this time frame, shares of Genuine Parts Company have generated a return for investors of 12.5% as of this writing.

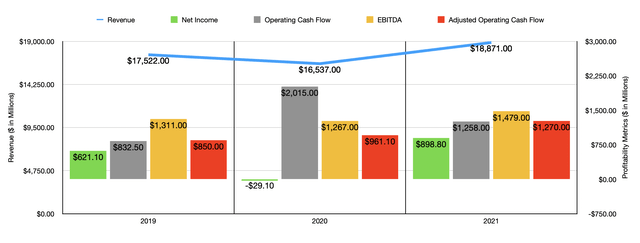

Author – SEC EDGAR Data

This strong upside at a time when the market was down significantly was not without cause. To see what I mean, we need only look at how the company finished off its 2021 fiscal year. For the year as a whole, revenue came in at $18.87 billion. That represents an increase of 14.1% over the $16.54 billion reported for its 2020 fiscal year. Although the company benefited from organic growth, there is no denying that a significant contributor to its upside in 2021 was its strategy for expanding inorganically. During that year, the company made multiple acquisitions totaling $281.9 million net of cash received. This followed acquisitions of only $86.4 million during the company’s 2020 fiscal year but we’re still lower than the $732.1 million spent in 2019. Had the company had these acquisitions at the start of its 2021 fiscal year, revenue actually would have been $19.92 billion.

When it comes to the bottom line, things also were quite impressive. Net income of $898.8 million beat out the $29.1 million loss achieved in 2020 and topped the $621.1 million in profits the company reported for 2019. Operating cash flow did manage to decline, dropping from $2 billion to $1.26 billion. But if we adjust for changes in working capital, it would have risen from $961.1 million to $1.27 billion. Meanwhile, EBITDA for the company also improved, climbing from $1.27 billion to $1.48 billion.

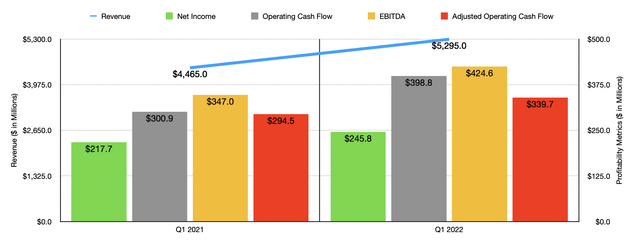

Author – SEC EDGAR Data

For the 2022 fiscal year, growth for the company continued to improve. Revenue in the first quarter of the year totaled just under $5.30 billion. That’s 18.6% higher than the $4.47 billion reported for the first quarter of 2021. Once again, acquisitions did play some part in this. In early 2022, the company completed its purchase of Kaman Distribution Group in a deal that cost it $1.3 billion in cash. It’s likely that the business will continue to make purchases throughout this year.

On the bottom line, things also are coming in strong. Net income in the latest quarter was $245.8 million. That’s 12.9% higher than the $217.7 million reported just one year earlier. Operating cash flow for the company expanded from $300.9 million to $398.8 million, while the adjusted operating cash flow for the firm grew from $294.5 million to $339.7 million. Meanwhile, EBITDA increased from $347 million to $424.6 million.

Management has some pretty high hopes for the current fiscal year. Revenue is expected to climb by between 10% and 12%. This will be led by a 21% to 23% increase associated with the company’s industrial operations. By comparison, its automotive revenue will likely only increase by between 5% and 7%. At the midpoint, this would translate to revenue of $20.95 billion for the year. From a profitability perspective, management expects earnings per share of between $7.56 and $7.71. At the midpoint, that would translate to net income of $1.08 billion for a year-over-year improvement of 20.3%. Clearly, the company is proving successful and transferring it’s increased costs associated with inflation and supply chain issues onto its customers. Operating cash flow, meanwhile, should be between $1.5 billion and $1.7 billion. No guidance was given when it came to EBITDA, but if we take the midpoint expectation for operating cash flow and assume that the year-over-year growth for EBITDA will match that, then investors should anticipate EBITDA of around $1.86 billion.

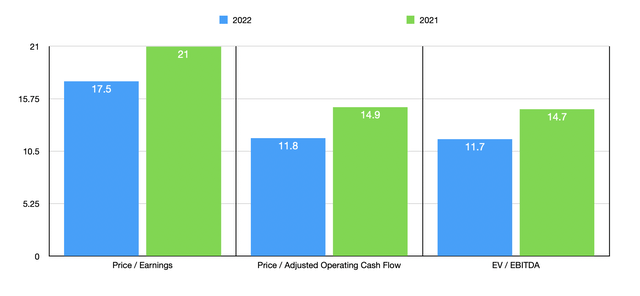

Author – SEC EDGAR Data

Using this data, shares of Genuine Parts Company don’t look all that pricey. On a forward basis, the company is trading at a price-to-earnings multiple of 17.5. This compares to the 21 reading that we get if we use 2021 figures. the price to adjusted operating cash flow multiple should be 11.8. That stacks up against the 2021 calculation of 14.9. And the EV to EBITDA multiple should drop from 14.7 to 11.7. As part of my analysis, I decided to compare Genuine Parts Company to five similar companies, largely focused around the automotive parts space. On a price-to-earnings basis, these companies ranged from a low of 13.3 to a high of 20.6. Using the EV to EBITDA approach, the range was from 9.4 to 14.1. In both of these cases, Genuine Parts Company was the most expensive of the group if we were to rely on its 2021 figures. Meanwhile, using the price to operating cash flow approach, the range was from 11.6 to 24.3. In this scenario, three of the five companies were cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Genuine Parts Company | 21.0 | 14.9 | 14.7 |

| AutoZone (AZO) | 19.2 | 14.0 | 13.1 |

| LKQ Corporation (LKQ) | 13.3 | 11.6 | 9.4 |

| Advance Auto Parts (AAP) | 19.3 | 15.1 | 11.0 |

| O’Reilly Automotive (ORLY) | 20.4 | 14.5 | 14.1 |

| W.W. Grainger (GWW) | 20.6 | 24.3 | 13.3 |

Takeaway

From the data I see, Genuine Parts Company continues to prove itself as a high-quality operator in its market. Due in part to acquisitions, the firm continues to expand and I don’t see that stopping anytime soon. What’s more, shares of the business do look quite cheap on a forward basis and they don’t look all that bad if we use the 2021 figures for the business. Having said that, the stock is rather pricey compared to similar firms. But given the growth trajectory of the firm, I still do think that some upside potential exists. It certainly is not a tremendous amount relative to the market like it was before. But I do think it’s enough to warrant the ‘buy’ rating I assigned the company to remain in place for now.

Be the first to comment