vlada_maestro/iStock via Getty Images

Genesco (GCO) is a Nashville-based specialty retailer selling footwear, clothing and accessories in more than 1,455 retail stores through the U.S., Canada, the United Kingdom and Ireland. Store names at your local mall include Journeys, Journeys Kidz, Schuh, Schuh Kids, Little Burgundy, and Johnston & Murphy. The company also has a major online retail presence. In addition to marketing popular shoe brand names, Genesco sells wholesale footwear under its Johnston & Murphy brand, plus the licensed Levi’s, Bass and Dockers brands, among others. Customer focus revolves around the teenage and young adult population.

GCO 2021 Annual Report

My bullish investment thesis is built around incredible free cash flow numbers in 2021, likely continuing in 2022 if the U.S. economy avoids a consumer spending recession (which is far from guaranteed as the Federal Reserve is forced to dramatically raise interest rates to match skyrocketing inflation). Honestly, on trailing metrics Genesco is the cheapest shoe retailer, and may be one of the least expensive choices in all of U.S. retail, using basic financial ratio analysis.

Reinforcing my bullish take on the firm, stock performance over the last 52 weeks has been terrific, and momentum trends still point to further gains in 2022. Let me explain some of the bargain basement data points and Genesco’s positive stock chart setup.

It’s All About The Valuation

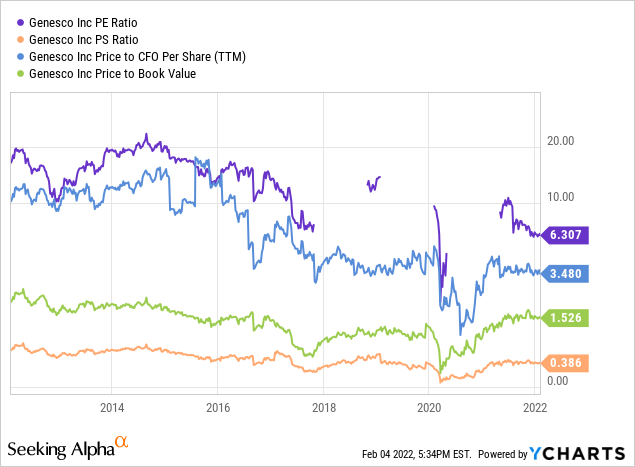

Genesco remains an inexpensive stock despite a superb run after the 2020 pandemic retail shutdown linked sell-off. The reason is operating results have jumped faster than the share quote. Below you can see on trailing valuation metrics like price to earnings, sales, cash flow and book value, the company has only been cheaper for a few months in 2017 and 2020 over the last decade of trading.

YCharts

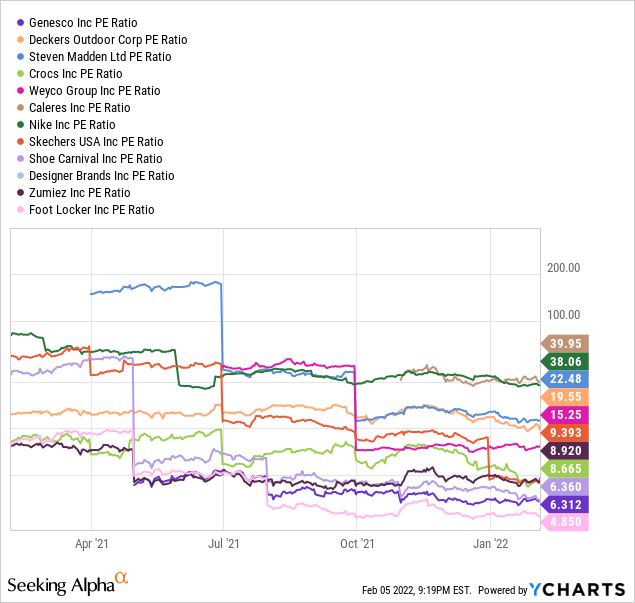

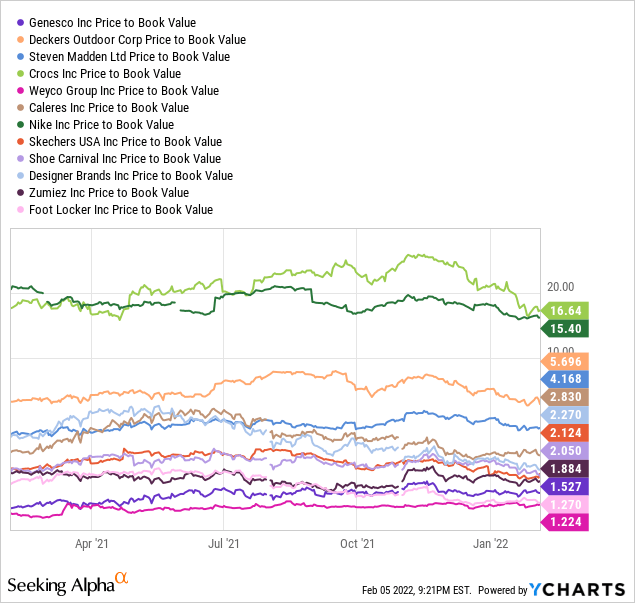

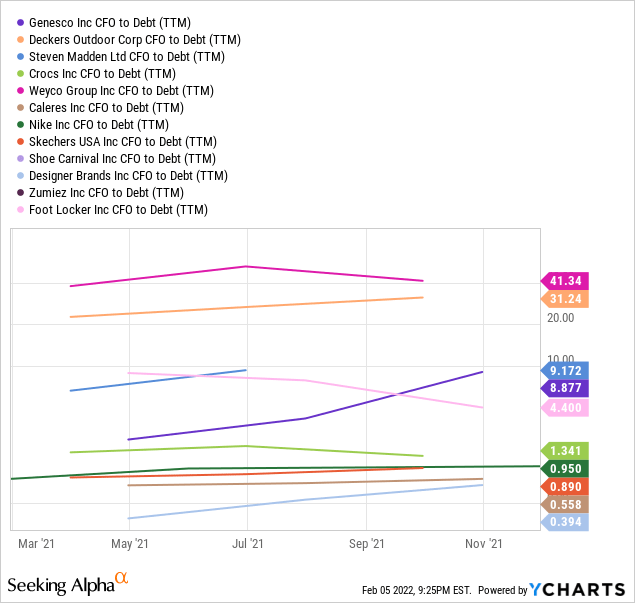

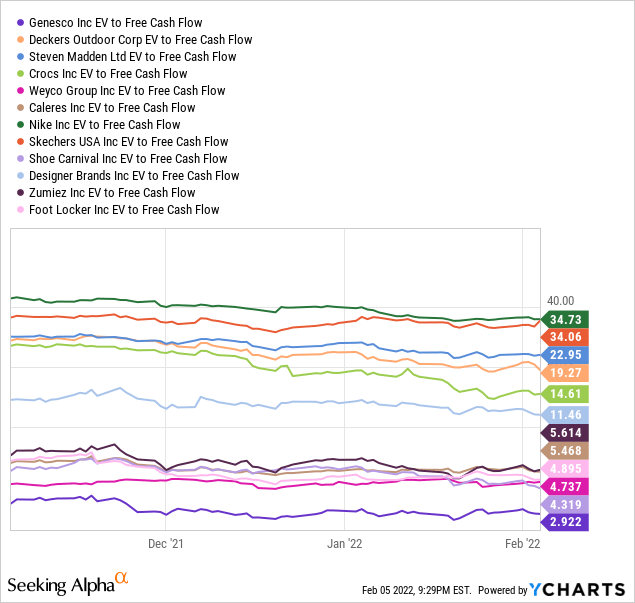

Measured against peers in the shoe retailing world, Genesco is the standout valuation choice. Below I am comparing the company to Deckers Outdoor (DECK), Steven Madden (SHOO), Crocs (CROX), Weyco (WEYS), Caleres (CAL), Nike (NKE), Skechers (SKX), Shoe Carnival (SCVL), Designer Brands (DBI), Zumiez (ZUMZ), and Foot Locker (FL). The whole group has enjoyed above average stock gains from U.S. government stimulus checks and extra unemployment benefits sent to hundreds of millions of consumers during 2020-21. Today’s Genesco equity valuation on trailing 12-month income generation is pictured below vs. peers and competitors.

YCharts

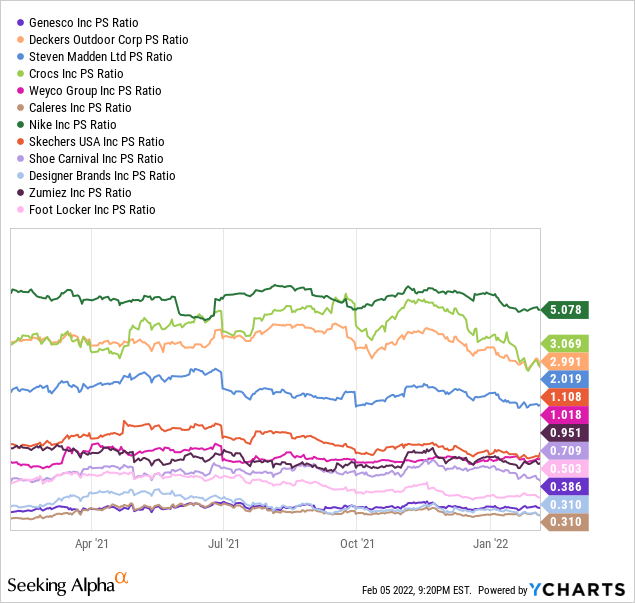

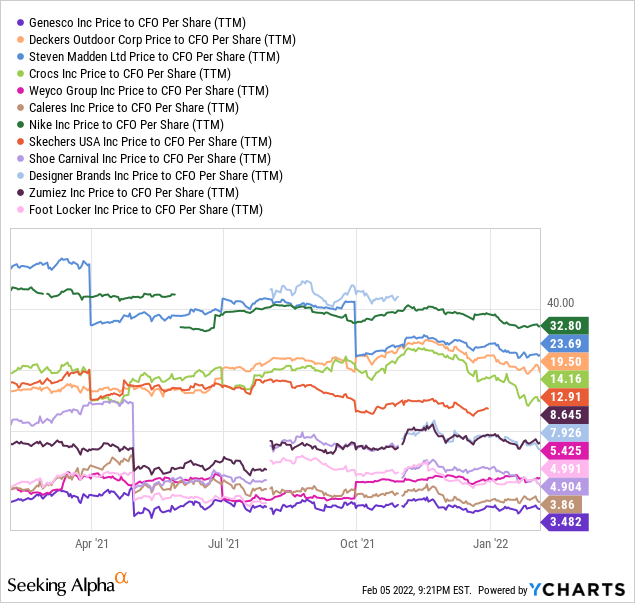

Price to sales, cash flow, and book value show an equally low upfront price for Genesco if operating results just stay steady in 2022.

YCharts YCharts YCharts

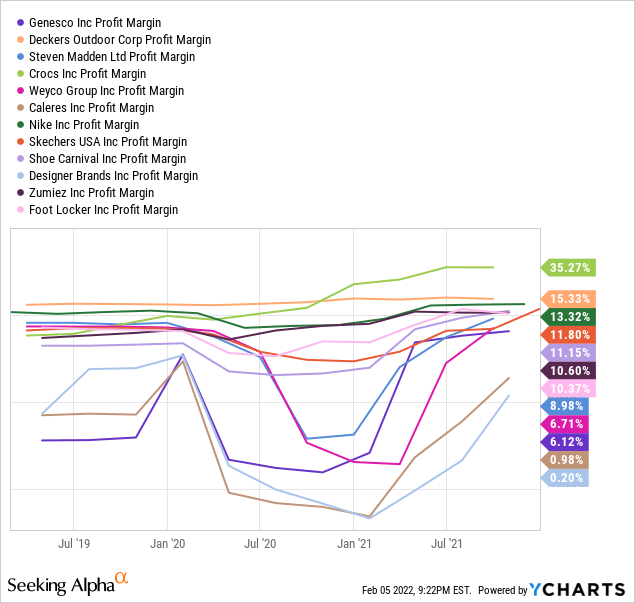

Investor logic for the valuation disconnect is Genesco’s business model acts only as a middleman retailer, with a final profit margin lower than competitors with hands in different pots.

YCharts

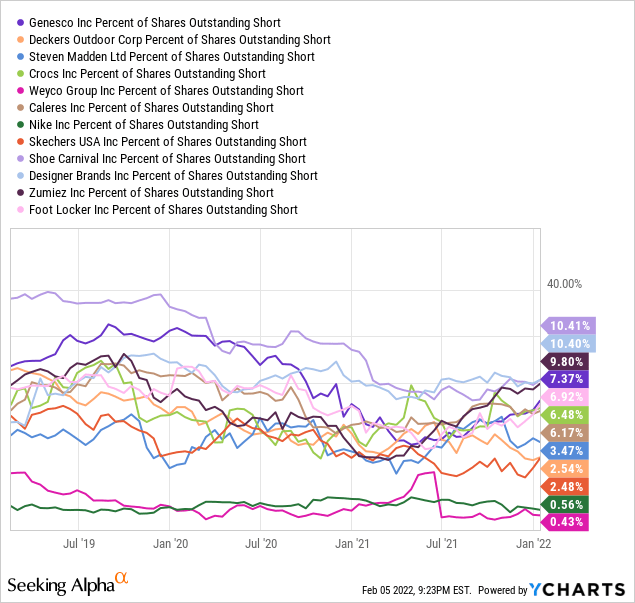

Bearish short interest bets in the stock have been higher than the peer group for many years, mainly because retailing only is a tough and fickle business with swings hard to predict.

YCharts

I get it to a degree. Yet, the valuation is so much lower than the peer group, I question if Wall Street has created a fair balance with Genesco’s business future.

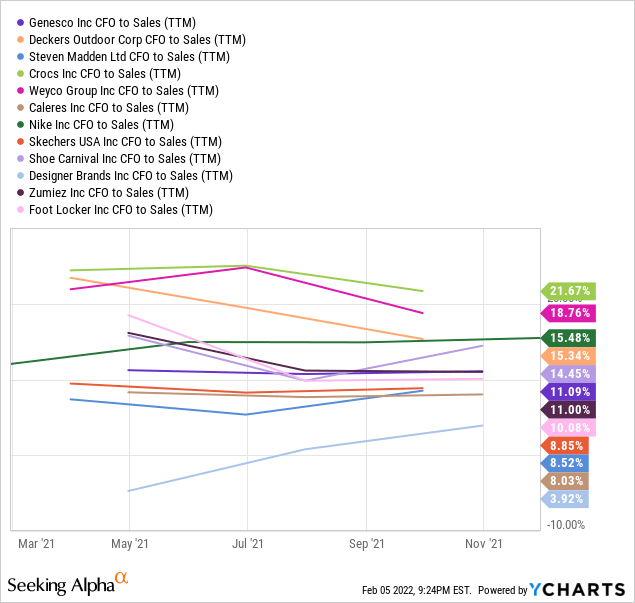

Cash flow on sales and debt are average to above average with a strong/conservative balance sheet using almost no financial leverage.

YCharts YCharts

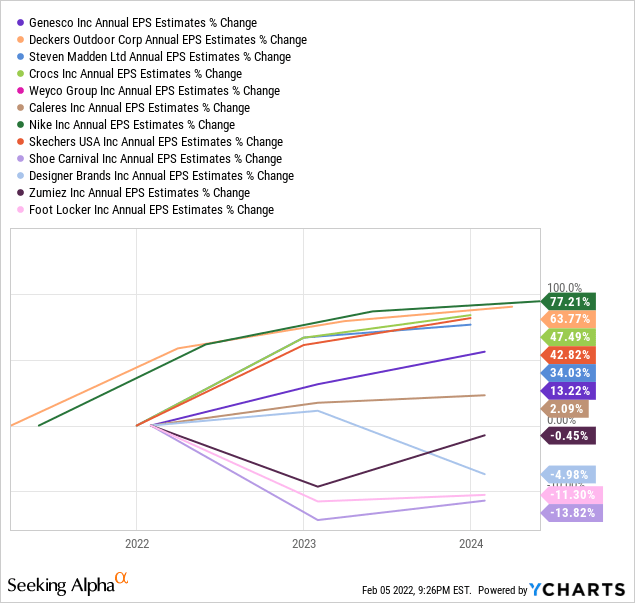

On top of respectable returns beyond the final profit margin, EPS growth is projected by Wall Street analysts to climb at an industry average clip, pictured below.

YCharts

Free Cash Flow Story

My primary argument for ownership is free cash flow has exploded with higher margin online sales and reduced staff expenses at store locations. Rising product prices are also part of the better income equation. Consumers flush with spending cash, stimulated by government checks, have cared less about goods pricing.

Yet, everyone expects retail business sales and pricing power to tail off in 2022 with the end of government help for most Americans. In anticipation of this slowdown (which may not occur), shoe retail stocks have not risen much the past 6-9 months, while underlying results continue to improve rapidly.

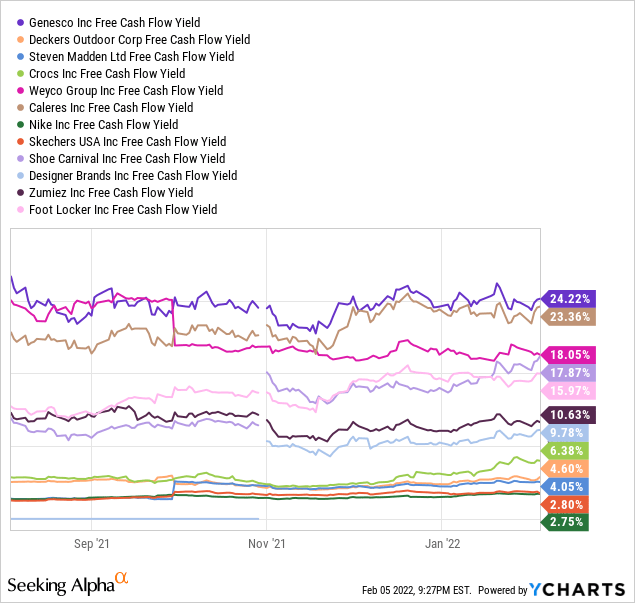

For Genesco in particular, today’s 24% trailing free cash flow yield looks way out of whack with reality. If business sales just remain flat in 2022, and cash flow numbers remain elevated, the stock quote should jump significantly. In comparison, the equivalent S&P 500 free cash low yield is closer to 4% today.

YCharts

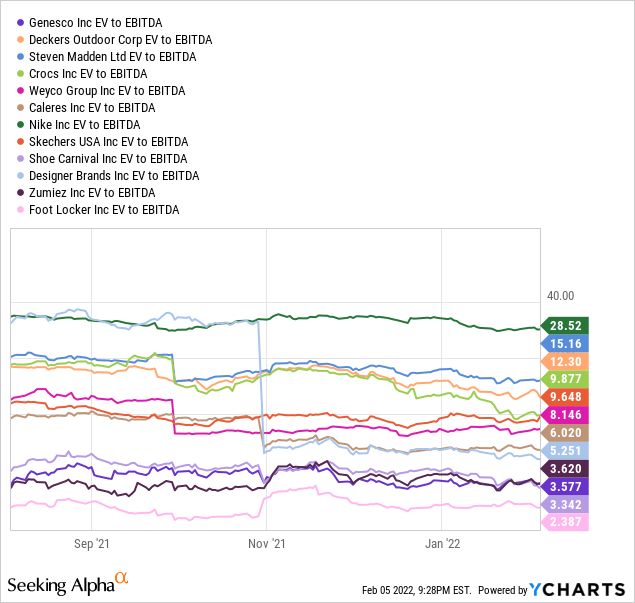

When we add debt and equity capitalizations together (then subtract cash on the balance sheet), GCO enterprise valuations move even deeper into bargain territory. The EV ratio to earnings before interest, taxes, depreciation and amortization is very appealing for new investment at just 3.6x.

YCharts

On free cash flow numbers, the enterprise valuation is extremely low at 2.9x. Theoretically, if free cash flow generation continues at the current pace, a single owner buying out the company at $61 a share could get his/her initial investment capital back and pay off all company debt over less than three years! Then, whatever operating performance exists after three years is free and clear to be pocketed in the future.

YCharts

Technical Momentum

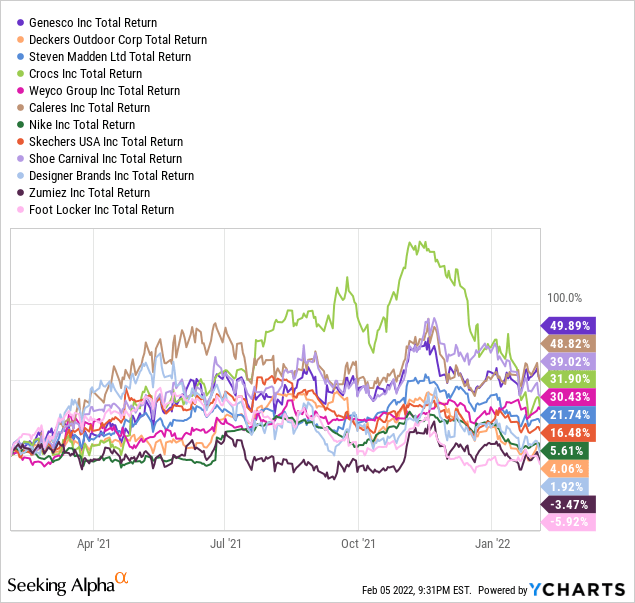

Investors have slowly figured out the disconnect between the stock price and still growing operating results at Genesco. It has been the leading total return gainer in the group over the past 52 weeks.

YCharts

Plus, another bump higher in price could be approaching. I have drawn a 12-month chart of daily price and volume activity below. With today’s quote trading under June’s high, the low valuation setup has actually improved markedly as income and cash flow keep piling up in company coffers.

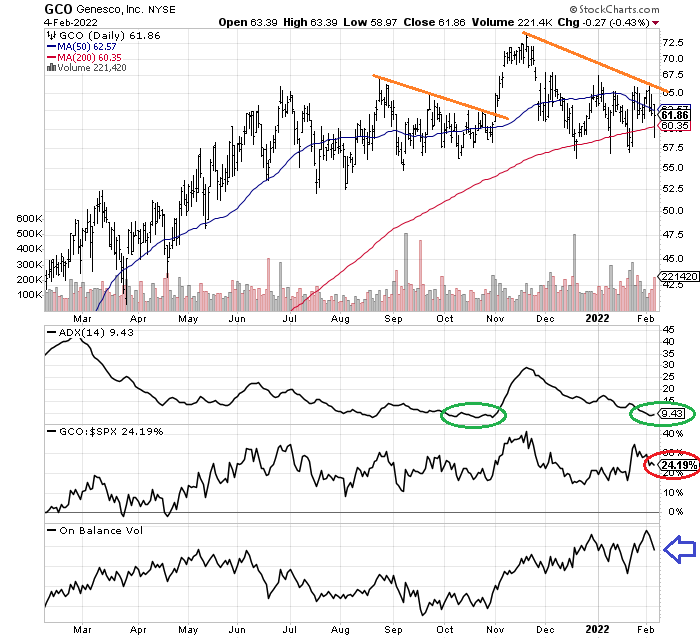

I have penciled in some orange trendlines through falling price highs to illustrate how an upmove above $66 in February could kick off another round of investor buying interest and rising price. The low Average Directional Index scores circled in green often mark bottoms in price, as a standoff in buying and selling pressure exists for a spell. In many respects, today’s chart setup is similar to late October.

The stock quote has gained +24% faster than the S&P 500 index typical advance over the last year, circled in red. So, price momentum vs. its peer group and the market overall remains relatively strong.

Lastly, On Balance Volume has been very positive since October, next to the blue arrow. You wouldn’t know it from the languishing quote over the last five months, but money is flowing into the stock at very high rates on up days vs. limited selling on down days.

StockCharts.com

Final Thoughts

An investment in Genesco essentially comes down to your outlook for economic growth and consumer spending in the U.S. economy. If COVID-19 issues fade quickly and Russia plays nice regarding Ukraine, the outlook for spending on shoes is quite favorable in the first half of 2022. After summertime, we’ll see how much damage to reserves of wealth in stocks/bonds and real estate becomes reality from the Fed’s rising interest rate cycle and other monetary tightening measures.

If you believe in a healthy consumer economy during 2022, I would rate Genesco as a must own today in your portfolio. (Management reported +18% sales growth for 2021 vs. +9% in the pandemic-plagued 2020 period.) If you think a recession is likely by the end of the year, avoiding this name is probably not a bad idea. I am in the middle, thinking a small ownership stake makes sense to capture its ultra-low valuation vs. a still overvalued equity market in America, especially in large-capitalization corporations.

In terms of potential downside risk for Genesco, a stock market crash and recession could pull the stock back to $40 a share in a worst-case scenario (book value). I am modeling a 20-25% bear market and slower economy could drop price back to $50.

Nevertheless, upside is easily $80-90 a share in 12-18 months, given solidly positive economic trends and better consumer confidence vs. today. Remember, decent EPS growth is estimated by Wall Street brokerages into 2022-23 for Genesco. $7 EPS and a multiple of 12x makes logical sense, assuming 5% CPI inflation and a P/E ratio of 20x for the S&P 500 market norm.

Management’s biggest “problem” is what to do with all the cash flow coming in the door. I feel the smartest decision is to start a 3% or 4% annual dividend payout on the low-$60s price today. With little debt, share buybacks (40% of its float has been repurchased over the last decade) and minor expansion plans are also reasonable. I am hoping a material merger deal or robust expansion plans are not being contemplated.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment