Justin Sullivan/Getty Images News

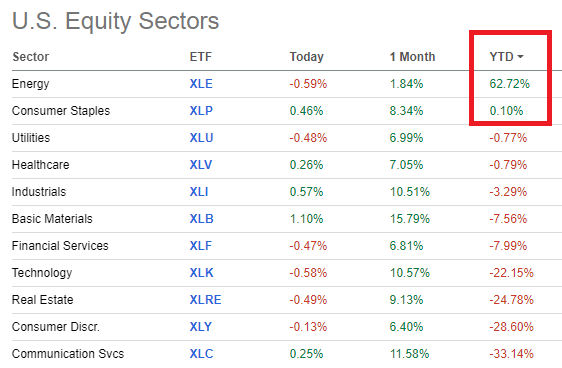

Investors in consumer staples have a reason to rejoice as the sector is so far the second best in terms of performance for 2022. Although 0.1% year to date return might sound disappointing during a period marked by double digit inflation rate, on a relative basis the sector performed very well.

Seeking Alpha

Of course, Energy remains as the best performing industry for 2022, but the investment thesis for the sector is vastly different from that for consumer staples.

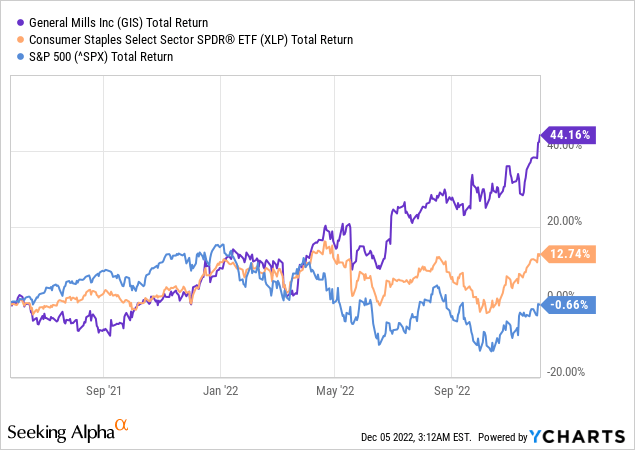

Finding the highest quality companies within the consumer staples space, however, has been far more rewarding than holding large and diversified sector ETFs, such as the Consumer Staples Select Sector SPDR ETF (XLP).

General Mills (NYSE:GIS), for example, has been one of my favorites in the Packed Food space. The reason for that has been the company’s strong standing both from a financial point of view and a competitive positioning.

I outlined my investment thesis in more detail back in May of 2021, when the company was hardly a popular pick among most retail investors, who were largely ecstatic about the latest gimmicks in the tech space.

Seeking Alpha

Fast forward a year and a half and GIS has returned a total of 44%, when the S&P 500 remained flat and the XLP had a total return of less than 13%.

At present, my long-term investment thesis for the company remains intact. For anyone interested in further detail, I highly recommend the thought piece called ‘General Mills: Capital Allocation Matters‘, which goes into all the details.

Having said that, however, recent sector rotations into lower risk assets and investors’ sentiment around General Mills accelerating growth have significantly reduced the expected return on the stock for the coming year.

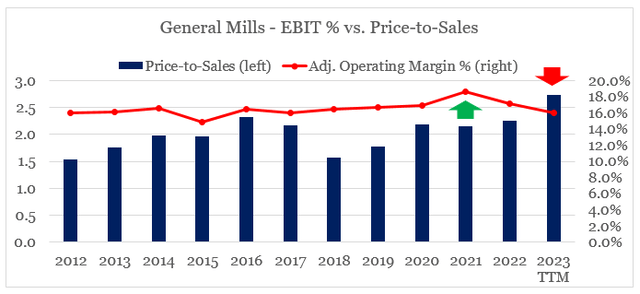

Stretched Multiples

As General Mills share price skyrocketed, it caused a significant multiple repricing. For example, the price-to-sales multiple, which is not impacted by one-off items to the extent that the price-to-earnings multiple is, has reached its highest levels for the past decade and is flirting with the all-time highs of the early 2000s.

prepared by the author, using data from SEC Filings

While this is partly justified due to the company’s better positioning than many of its peers, margins remain under pressure. The reason why this is important is that over long periods of time, the dynamic between the P/S multiple and adjusted operating margin is indicative of short to medium term discrepancies.

One of the major reasons for the margin compression in the past year, has been the unprecedented increase in most of the company’s raw materials. These include a number of grains, dairy products, sugar etc.

The principal raw materials that we use are grains (wheat, oats, and corn), dairy products, sugar, fruits, vegetable oils, meats, nuts, vegetables, and other agricultural products.

Source: General Mills 2022 10-K SEC Filing

Although GIS strong brand portfolio allows for pricing actions, the recent jump in raw material costs has been too violent.

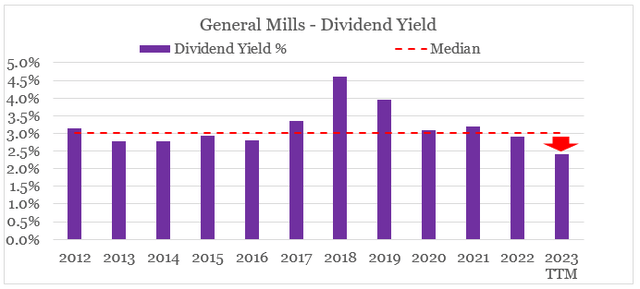

In terms of dividends, GIS management has recently increased the quarterly payments. This has given investors strong indications that the company’s strategy is working even during these unprecedented times. Nevertheless, the share price has run ahead a bit too fast and GIS now trades at one of its lowest dividend yields.

prepared by the author, using data from SEC Filings

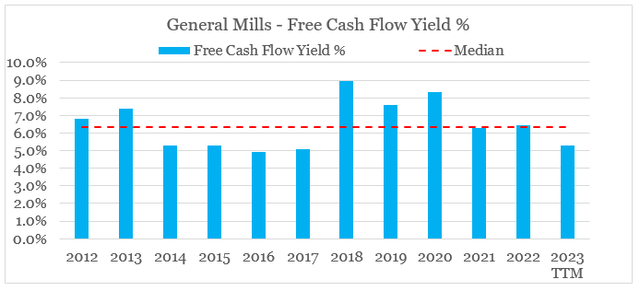

The same is true for the company’s free cash flow yield, which has declined from as high as 9% in 2018 to a bit more than 5% during the past 12-month period.

prepared by the author, using data from SEC Filings

Higher Growth Means Higher Expenditure

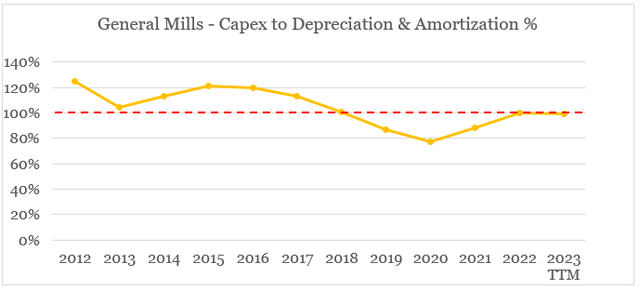

One key development that we need to take into account when analyzing GIS free cash flow is the company’s depreciation & amortization expense relative to capital expenditure, which is indicative of the level of reinvestment back into the business.

In that regards, GIS Capex to D&A Expense ratio has been consistently near at or below 100% for the past 5 years.

prepared by the author, using data from SEC Filings

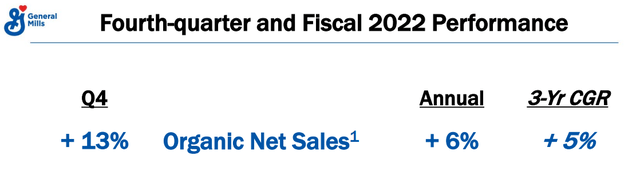

This dynamic should change in the coming years as the company experiences accelerating topline growth. For example during the past fiscal year, revenue increased by 6%, which is higher than the annual rate of the previous 3-year period.

General Mills Q4 2022 Earnings Presentation

Forward guidance was also increased back in September of this year and management now expects topline to increase to 6-7% in 2023.

General Mills Earnings Release Q1 2023

In addition to higher capacity investments, GIS management would also need to dial-up its brand investment activities as its portfolio expands, especially in the pet food segment.

Relative to its initial full-year expectations, the company now expects lower volume elasticities and better volume performance, increased input cost inflation to 14 to 15 percent of total cost of goods sold, and increased investment in brand building and other growth-driving activities.

Source: General Mills Q1 2023 Earnings Release

All that is good news for long-term holders of GIS, however, in the coming year it will likely weigh further on the company’s free cash flow and put further pressure on multiples.

Investor Takeaway

General Mills’ strong competitive positioning, best-in-class capital allocation and accelerating topline growth are all good news for long-term shareholders. The company also seems to be making the right decisions in terms of expanding into adjacent product categories, where it has strong competitive advantages.

Having said all that, however, in the short-term GIS share price has run ahead of its fundamentals which significantly reduces expected returns. Although, trying to time the market is not worth the effort, now is not a good time to accumulate more shares.

Be the first to comment