Justin Sullivan/Getty Images News

Oftentimes, the best investment opportunities tend to be those that involve companies that are, conceptually speaking, boring. Buying into exciting, high-growth enterprises may offer strong returns from time to time. But it always comes with a risk that you are overpaying for that growth. In the ‘boring’ category, however, you have the chance to acquire shares in a company that is often under-followed and, as a result, undervalued. Within the space, one such prospect is food giant General Mills (NYSE:GIS). After reporting strong financial performance for the third quarter of its 2022 fiscal year and raising guidance for the year as a whole, shares of the company appreciated nicely. Moving forward, the company does still have some progress that it should work on. But on the whole, the firm makes for a sensible long-term prospect for value-oriented investors.

Things are changing at General Mills

In recent years, the management team at General Mills has worked hard to reinvent the business. Earlier this year, management gave an update on the company’s efforts. The firm has been reshaping its operations by reorganizing certain functions within it. Examples include combining segments so there is less complexity and more streamlined decision making, and Engaging in transactions that help to refresh the company’s value proposition as a whole. In this latter vein, management announced that, since the 2018 fiscal year, the company has successfully turned over about 15% of its net sales base and has increased its enterprise net sales growth exposure by about one percentage point. Though this may not seem like significant progress in the time frame covered, it’s important to keep in mind the size and complexity of the organization and what refreshing the business really entails.

Some of the conglomerate’s efforts really paid off in the latest quarter. Although the company missed sales guidance by $10 million, the fact of the matter is that the company is now forecasting stronger growth for the year as a whole. Previously, management had been anticipating organic sales growth of between 4% and 5% for the year. That figure has now been revised up to a solid 5%. Overall sales growth, of course, will be a bit lower because of the combined divestitures and acquisitions impacting the company’s top line in a negative way to the tune of 1%. As for the latest quarter, the site shortfall for the business came from a reduction in organic volume growth that was more than offset by attractive net price realization and product mix. This resulted in overall sales growth for the quarter coming in at 0.4%.

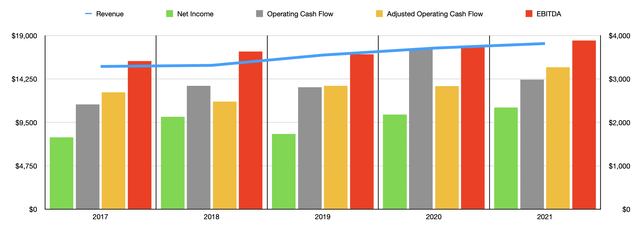

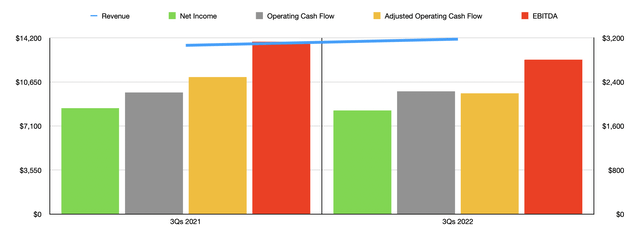

At first glance, some investors may worry about the disconnect between the slow growth experienced in the latest quarter and management’s forecast for the year as a whole. But the fact of the matter is that management has, historically speaking, done well to grow the firm’s sales. Revenue has increased every year for at least the past five years, climbing from $15.62 billion in 2017 to $18.13 billion in 2021. This implies an annualized growth rate of 3.8%, with growth between 2020 and 2021 totaling 2.8%. From 2020 to 2021, organic sales were even higher, coming in at 4%. This is solidly higher than the 2% to 3% range management is aiming for long-term. As for this year, growth remains robust, with overall revenue in the first nine months of the year totaling $14.10 billion. That is 3.7% higher than the $13.60 billion generated the same time one year earlier.

Outside of revenue, there are other metrics that investors should be paying attention to. Profitability is one example. With the exception of one year, the company’s net profits have increased every year from 2017 through 2021. Net income expanded from $1.66 billion to $2.34 billion over this timeframe, marking an annualized increase of 9%. Growth has remained strong in recent years, with profits expanding by 7.3% from 2020 to 2021 alone. So far in the 2022 fiscal year, profits for the company have taken a slight step back, with net income dropping by 2% from $1.92 billion to $1.89 billion. In the latest quarter, margins for the company were impacted by higher input costs, as well as it declined in volume. Though this was somewhat offset by higher pricing and a favorable product mix in what was sold. And for the full nine months reported so far for the 2022 fiscal year, these same issues remained in play.

Naturally, higher costs and lower volume would hit other profitability metrics as well. Although operating cash flow for the company in the first nine months of its 2022 fiscal year grew from $2.21 billion to $2.23 billion, the adjusted version of this where we remove changes in working capital actually declined from $2.49 billion to $2.20 billion. And EBITDA for the company shrank from $3.13 billion to $2.81 billion. This is not the first time that operating cash flow for the company declined. In fact, this metric has been rather lumpy from year-to-year. From 2020 to 2021, for instance, cash flow shrank from $3.68 billion to $2.98 billion. Even when we adjust for changes in working capital, the metric has been lumpy over at least the past five years. The same can be said, admittedly to a lesser extent, about EBITDA.

Despite these near-term issues, management remains hopeful about the future. For the entire year as a whole, earnings per share are expected to come in at between negative 2% and positive 1%, but with the constant currency earnings per share ranging from a 0% change to a 2% increase. Taking the earnings per share midpoint guidance provided by management, this implies net profits of $2.32 billion for the year. Similar year-over-year changes for the other profitability metrics would imply adjusted operating cash flow of $3.24 billion and EBITDA of $3.85 billion.

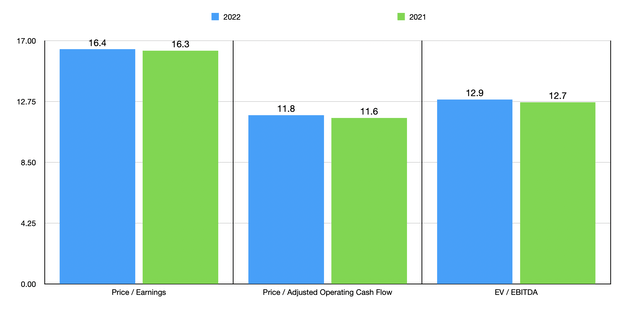

Taking these figures, we can effectively price the company. Using the company’s 2021 results, shares are trading at a price to earnings multiple of 16.3. Even with the decline anticipated for 2022, the earnings per share multiple for this year should be 16.4. The price to adjusted operating cash flow multiple should rise from 11.6 to 11.8. And the EV to EBITDA multiple should grow from 12.7 to 12.9. To put this pricing into perspective, I decided to compare the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 8.5 to a high of 47.1. Two of the five companies were cheaper than our prospect. Using the price to operating cash flow approach, the range was from 8.1 to 23.3. And using the EV to EBITDA approach, the range was from 5.8 to 21.2. In both of these scenarios, two of the five companies were cheaper than General Mills.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| General Mills | 16.3 | 11.6 | 12.7 |

| The Hershey Company (HSY) | 29.7 | 19.8 | 21.2 |

| Tyson Foods (TSN) | 8.5 | 8.1 | 5.8 |

| Kraft Heinz (KHC) | 47.1 | 8.9 | 14.0 |

| Hormel Foods (HRL) | 29.8 | 23.3 | 20.5 |

| Kellogg Company (K) | 14.3 | 12.5 | 10.7 |

Takeaway

What this data suggests is that General Mills is, relative to its peers, more or less fairly valued. But on the whole, such low multiples for such a high-quality operation should make it at least modestly underpriced. Don’t get me wrong. This business is not one that will make you fantastically wealthy. But for investors who want a quality operation at an attractive price, a prospect that you will likely lose very little sleep over in the event of a major economic downturn, this could make for an excellent play. On top of the pricing and quality concerns, it’s also worth noting that management is focused on trying to return as much value to investors as possible. Long term, the company aims to return between 80% and 90% of its free cash flow to shareholders through a combination of dividends and share buybacks. And the objective on free cash flow is to convert at least 95% of adjusted net earnings into it. And so far this year, management has done well to deliver on its promise to return value to investors. In the first nine months of its 2022 fiscal year, for instance, the business bought back 8.8 million shares for $550 million. Add in all of the aforementioned factors I already detailed, and it’s hard to understand why somebody wouldn’t appreciate this prospect.

Be the first to comment