jetcityimage

File this one under the “trust but verify” category. I came across a thoughtful article in Barron’s detailing the breakup value of General Electric Company (NYSE:GE). It was an interesting concept, but I wanted to do my own homework to at least validate the findings of the article. This analysis takes an independent look at the sum of GE’s parts to see if it warrants an investment.

Last year, the company announced a plan to form three separate, publicly traded companies – the Healthcare business to be named GE Healthcare, the Energy businesses to be named GE Vernova and the Aviation business to be named GE Aerospace. GE Vernova will combine the company’s existing Renewable Energy, Power, Digital and Energy Financial Services lines. The tax-free spin-offs of the Healthcare business and the Energy businesses will be completed in early 2023 and early 2024, respectively, leaving GE Aerospace as the third and remaining piece of the puzzle.

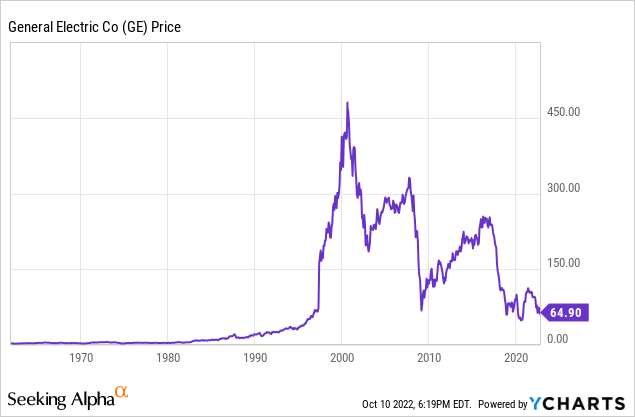

But first, how did GE get here? In 2000, GE became the most valuable company in the world, with a market cap of over $600 billion, which today would be close to $1 trillion. That year, the bulk of the company’s profitability came from what was then GE Capital, which was the 7th largest financial institution. Half of the company’s revenue came from this unit as well. Fast forward to the financial crisis in 2008, and GE was hanging on by a thread. With all forms of credit collapsing, the government determined GE to be a “systemically important financial institution” and the company subsequently received government support to avoid a potential catastrophe. Management basically spent the next decade winding down the finance business and selling off other non-core, commodity-type businesses, such as Appliances and Light Bulbs.

Today, GE is a shell of its former self. Revenues in 2021 were $74 billion, down from a peak of $182 billion in 2008 at the onset of the financial crisis. With a market cap of about $70 billion, the company is comprised of the three primary businesses which are about to broken up. The company has been paying off debt like crazy, probably looking behind old filing cabinets for nickels and quarters to help. Well, it might not be like that. But they have jettisoned businesses and restructured deals to reduce debt from $336 billion in 2009 to $31 billion at the end of last year – a remarkable 91% reduction.

Something had to be done. The company could no longer operate as a conglomerate, with businesses as diverse as lightbulbs, credit cards and jet engines. Capital really cannot be allocated properly inside a company like that. CEO Larry Culp, who seems to be the only one of GE’s recent CEOs who actually has the ability to look to the future, has made the difficult decision to break up the company. Any shareholder who bought into GE stock since the late 1990s and has held it (as if anyone would have) has had one disastrous long-term investment. Maybe if you bought it in 1970 you are in the money!

The stock is basically where it was in the mid-1990s. Management has finally reached a point where the balance sheet is probably the cleanest it will ever be and believes that the sum of the parts is potentially worth more than the current whole. The remaining businesses are all leaders in their respective industries, and upon first glance, should continue to lead their industries forward.

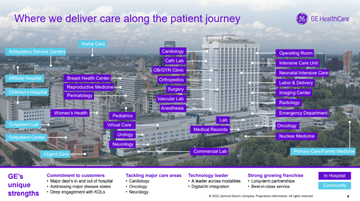

So, let’s look at what remains of GE. The first piece is the Healthcare business. Healthcare develops and produces critical healthcare technology, with particular expertise in medical imaging, digital, monitoring and diagnostics, drug discovery and other solutions that support precision health. Products and services are sold to hospitals and medical facilities around the world.

GE Healthcare – Morgan Stanley Healthcare Conference Sept 2022

This market has competitors from a variety of US and non-US manufacturers and service providers. One thing that management points out in their 2021 MD&A is the fact that new technologies could make their products obsolete “unless we continue to develop new and improved offerings.” One problem with the conglomerate structure is the strong internal competition for resources among the company’s businesses. Does management allocate to the business that needs help, the business that is growing fast, or the business that is the cash flow king? It is a classic management problem, one which does not have an easy (or correct) answer all of the time. On its own, GE Healthcare will live or die by their own ability to properly allocate resources across its portfolio of products and services, providing a better result for shareholders. Or at least that is the idea.

Healthcare is the second largest operating segment within the company today, reporting revenues of $17.7 billion in 2021. Lately, it has been the most profitable segment, with operating income of $3.0 billion in 2021. Revenue growth has been somewhat lackluster, although revenue from services has outpaced equipment revenue over the past few years. Some of the decline in equipment revenue is due to the decrease of COVID-19 related product sales in 2020. Backlog, or as the company calls it Remaining Performance Obligation (RPO), has seen some growth of late. Part of that growth is the recent acquisition of BK Medical, which is a leader in surgical ultrasound imaging. Management is expecting order demand to remain solid through the rest of the year, with mid-single digit growth expected. Profits, though, will remain under pressure because of ongoing inflation.

So far in 2022, the company is seeing strong demand from the US, Europe and the Middle East and Africa. China remains challenging due to the ongoing COVID 19 impacts there. Also, inflationary pressures are not helping, with supply chain and pricing issues hindering its ability to convert RPO and increase margins.

| GE Healthcare (billions) | 2019 | 2020 | 2021 | 2022 est |

| Sales | $19.9 | $18.0 | $17.7 | $18.6 |

| Sales growth % | -10% | -2% | 5% | |

| Operating income | $3.7 | $3.1 | $3.0 | $3.0 |

| Operating margin | 18.7% | 17.0% | 16.7% | 16.1% |

Two comparable companies to GE Healthcare are Siemens Healthineers (OTCPK:SEMHF) (OTCPK:SMMNY) and Philips (PHG). Siemens Healthineers is a German company with a portfolio of products, services and solutions for clinical decision-making and treatment. The company provides medical imaging, lab diagnostics, testing, IT and other services. The company has had decent revenue growth over the past couple of years, with 2021 revenues increasing 24% and expected 2022 revenues to be about 6% higher. Operating margins are around 13-14%, which is pretty solid. Recently, the company was valued at about 48 billion euros, or 2.6x current year estimated sales and 18x current year estimated operating income.

Philips is another German company that trades in the US under ticker symbol PHG. Philips is a diverse health technology company, with products ranging from breathing and respiratory care, to computed tomography machines (CT) to cardiographs and stress systems and magnetic resonance (MRI) systems. Last year, the company saw slightly lower revenues, however, the expectation is for revenues to grow a robust 11% in 2022. Operating margins have been volatile, ranging from 7% in 2020 to just 0.4% in the first half of 2022. With a value of about 15 billion euros, the company is trading at 0.8x current year sales and 15x current year estimated operating income.

With estimated 2022 sales of about $18.6 billion, GE Healthcare would be valued between $32 billion and $49 billion based on the comparable multiplier methods. That is a fairly wide range, but I will take a simple average of the two, which is about $41 billion. For a company with a worldwide brand name and the highest margins of the peer group, it seems reasonable that the company would have a value in between the other 2 peers.

GE is targeting the first week of January 2023 for the spinoff of GE Healthcare. An investor day will be held on December 8, 2022. Investors will have to decide soon whether they would like to be part of this.

In early 2024, GE will spinoff the Energy businesses, including Renewables, Power, Digital and Energy Financial Services into company with the name of GE Vernova. These businesses have struggled the most with flat to declining revenues and low-single digit margins at Power and losses at Renewable Energy. However, if you think about where the world is going with their energy needs, these businesses could also have huge potential as the market for renewable and alternative energy sources continues to expand. The Renewable Energy business produces onshore and offshore wind, blade manufacturing, grid solutions, hydro solutions and hybrid solutions. The business has installed more than 400 gigawatts of clean renewable energy equipment. Also, the business has equipped more than 90% of transmission utilities with the company’s grid solutions across the world.

Management is expecting long-term growth in US onshore wind. However, the expiration of certain tax credits continues to provide much uncertainty about the timing and validity of particular investments. Nevertheless, the company maintains a market leading position and has the ability to take advantage of market growth. For the offshore wind sector, the company sees continued growth across Europe, North America and Asia. Customers are looking to shift to larger, more efficient units to continue to reduce costs to compete with other generation options. The Grid and Hydro businesses are working through turnaround plans to help them continue to grow and take advantage of the demand for the company’s services. Management notes that inflationary pressures, supply chain bottle necks and permitting issues present continued challenges across the offshore and onshore wind segments.

As mentioned previously, sales growth has been challenging of late. So far in 2022, revenues have decreased due to fewer wind turbine deliveries for Onshore Wind as well as the impact from a stronger dollar. If, big if, they can pick up the revenue pace in the back half of this year, I think it will be in a good position going into 2023 and the spinoff in the following year.

Profits, however, are a different story. In fact, those profits are actually losses, for 3 straight years! Margins in the first half of 2022 have been abysmal, with no real chance of making a profit this year. But it is a growing industry with a great deal of uncertainty surrounding subsidies, costs, permitting and acceptance. I think the trend is definitely in favor of renewable and alternative energy sources, and GE is well-positioned to benefit as the market continues to mature.

| GE Renewable Energy (billions) | 2019 | 2020 | 2021 | 2022 est |

| Sales | $15.3 | $15.7 | $15.7 | $15.2 |

| Sales growth % | 2% | 0% | -3% | |

| Operating income (loss) | ($0.8) | ($0.7) | ($0.8) | ($1.7) |

| Operating margin | (5.2%) | (4.6%) | (5.1%) | (11.2%) |

The comparable companies for GE Renewable Energy are Siemens Gamesa Renewable Energy (OTCPK:GCTAF) (OTCPK:GCTAY) and Vestas Wind Systems (OTCPK:VWDRY) (OTCPK:VWSYF). Vestas is probably the best performer of the group, with revenues similar to GE, but operating margins in the low single digits. The Siemens company has seen some struggles of late with top-line growth as well as elusive profits. Vestas is currently valued at about 19 billion euros, or 1.2x estimated 2022 sales. Siemens Gamesa RE has a recent value of about 12 billion euros, or 1.3x estimated 2022 sales. Assuming GE Renewable Energy can eke out very slight growth over the next couple of years, I estimated that the business has a value of about $20 billion. There is a lot of uncertainty here, but given the peer companies, it does not seem that $20 billion is unreasonable.

GE Power is a quintessential GE business, producing gas turbines for utilities and other power producers and industrial uses, steam turbines, mainly for the nuclear and fossil fuel power plants and power conversion and nuclear technologies. While it seems that Power would be in competition with Renewable Energy, the reality is that “all of the above” energy will likely prevail over the long term in various parts of the world. These businesses complement each other well and it makes sense to combine them into a single company.

The company continues to increase megawatt hours, but looking ahead, management expects overcapacity to be an issue as well as price pressures from the competition. The business had an RPO of over $67 billion at the end of the second quarter, which represents about 4 years of sales. Sales are down this year, as seems to be the case across all of GE’s businesses. Management indicated that Gas Power saw increases through the first half of the year, while Steam Power was down somewhat. Profit was favorable because of higher Gas deliveries and other one-time items. For the full year 2022, management is expecting low single-digit growth and slight margin expansion.

| GE Power (billions) | 2019 | 2020 | 2021 | 2022 est |

| Sales | $18.6 | $17.6 | $16.9 | $17.1 |

| Sales growth % | -6% | -4% | 1% | |

| Operating income (loss) | $0.3 | $0.3 | $0.7 | $0.8 |

| Operating margin | 1.6% | 1.6% | 4.3% | 4.5% |

Comparable companies include Siemens Energy (OTCPK:SMEGF) (OTCPK:SMNEY) and Mitsubishi Heavy Industries (OTCPK:MHVYF). Siemens is the largest of the bunch with a market capitalization of about 8 billion euros. Revenue growth has been sluggish and operating margins have been negative the past two years, but turned positive in the first half of 2022. Mitsubishi has a market cap of about $12 billion (converted from Yen).

Assuming GE Power can eke out low single-digit growth, I estimate the company to have a value of about $6 billion. That seems low for a company with revenues of about $17 billion, but both of the peer companies are valued at well less than 1x sales. So, on that basis, it seems reasonable.

Combined, GE Vernova should be valued at approximately $26 billion, with revenues about $32 billion. I think when the company can get the profitability on a stable track, there could potentially be a lot of upside in this company. But a lot can happen between now and early 2024.

After the two spinoffs, the remaining GE will consist of today’s Aviation business, which will be renamed GE Aerospace. The primary purpose of this business is to design and produce commercial and military aircraft engines, components, electric power and aircraft systems. The business is also a provider of aftermarket products and services. In the commercial engine sector, the company produces engines for all types of commercial aircraft – regional, widebody and narrowbody. Interestingly, the company has joint ventures with Safran Group of France (OTCPK:SAFRF) (OTCPK:SAFRY) and Pratt & Whitney (part of Raytheon Technologies (RTX)). The military sector manufactures jet engines for military aircraft – fighters, bombers, tankers, helicopters and surveillance aircraft. Finally, the company also competes in avionics, power systems, transmission components and other related products and services.

A key driver of revenues in Aviation is global commercial air traffic, which is driven by economic activity and the desire for personal and business travel. Covid has obviously wreaked havoc on the travel sector, but 2021 saw some signs of a return to normalcy. I think it will be a gradual return to pre-pandemic levels, but maybe even below. There is a large segment of business travel that has proven to no longer be necessary. Folks who do not need to travel will likely travel much less than before. So, while I think it will continue to improve from the dark days of the 2020 shutdowns, it will be some time before we get back to 2019 levels.

On the military side, demand for military aircraft remains strong from the US and our allies. Supply chain issues could impact the ability for the company to meet that demand, as well as lingering COVID related disruptions.

In 2021, GE Aviation reported revenues of $21 billion, which were down from $33 billion before the pandemic. To provide an idea of the pandemic’s impact on sales, the company sold 1,487 commercial engines in 2021, compared to 3,048 in 2019. Margins came in at 13.5% in 2021, compared to 20.7% in 2019.

However, things are looking better so far in 2022, despite the economic headwinds around the world. In the first six months of this year, revenues increased 19%, with most of the growth coming from the commercial engine segment. Additionally, profit margins came in at 17.5%, compared to 8.3% in the first half of last year. Management maintains their guidance of about 20% topline growth with expanding margins.

| GE Aerospace (billions) | 2019 | 2020 | 2021 | 2022 est |

| Sales | $32.9 | $22.0 | $21.3 | $25.6 |

| Sales growth % | -33% | -3% | 20% | |

| Operating income (loss) | $6.8 | $1.2 | $2.9 | $4.0 |

| Operating margin | 20.7% | 5.6% | 13.5% | 15.6% |

Key competitors include Raytheon Technologies, which through its Pratt & Whitney division is a formidable manufacturer of aircraft engines, Safran and Rolls-Royce (OTCPK:RYCEY) (OTCPK:RYCEF). Raytheon is a key competitor but is also a major defense contractor, so the comparison is not quite accurate. Safran is roughly the same size as GE Aviation, but with lower margins. Finally, Rolls-Royce is the smallest of the group, with the lowest margins.

Raytheon is valued at about $124 billion, or 1.8x sales and 23x operating income. Safran is valued at 40 billion euros, or 2.2x sales and 16.9x operating income. Finally, Rolls-Royce is worth about 7 billion pounds, or 0.6x sales and 17.5x operating income. Assuming the company can continue to see revenue returning close to pre-pandemic levels and margins remain at least as strong as they are his year, GE Aviation could be worth $58 billion based on sales and $92 billion based on operating income multiples. Let’s use an average and call it $76 billion. That’s reasonable for a company with double digit growth, leading brand name and highest margins in the business.

Put it all together, subtract out some net debt, a couple billion for separation and half a billion for incremental costs and the sum of the parts is about $129 billion, compared to a value of $71 billion today.

| Segment | Est. Value |

| GE Healthcare | $41 billion |

| GE Vernova | $26 billion |

| GE Aerospace | $76 billion |

| Less: | |

| Net debt | ($13 billion) |

| Separation costs | ($2 billion) |

| Incremental transaction costs | ($0.5 billion) |

| Total estimated value of parts | $129 billion |

| Current value of GE | $71 billion |

Now, a ton can happen between now and early 2024 when the transaction will be complete. GE Healthcare goes in the first week of 2023, with GE Vernova a year later. Multiples could collapse, the market for this type of transaction could dry up, the long-term liabilities could raise their ugly head again or who knows what else might happen. The point is, this is not without risk. But it certainly is enticing. I am excited at the potential for multiple GEs becoming the trusted and respected brand that it once was. For some investors, this may be a good idea. I think I have verified the premise of the original article and I am definitely going to take a good look at this.

Be the first to comment