Justin Sullivan

I’ve been writing about General Electric’s (NYSE:GE) turnaround efforts for a while now. Once the company hired Larry Culp to head the effort, I became much more interested in GE’s comeback. When Culp ran industrial conglomerate Danaher (DHR), shares ran up hundreds of percent. He has proven his chops in skilled and disciplined M&A efforts. After many years of uneven management at GE, Culp can bring both the vision and resolute decision-making needed to right the ship.

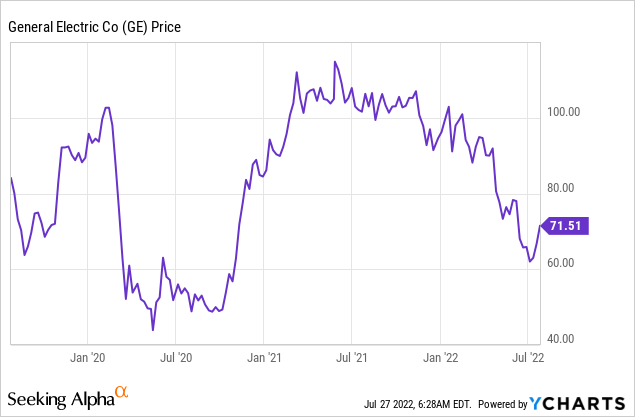

So far, however, Culp’s tenure at GE has not started off with similar success as his time at Danaher. While shares haven’t fallen back to their March 2020 lows, GE is down sharply off its 2021 highs.

While GE stock jumped following its Q2 earnings report, I’m not convinced this release will be the one that gets the stock back on track in the bigger picture. Here’s why.

This Earnings Report Wasn’t Tremendous

GE stock jumped following its earnings release Tuesday. I’d argue this came about more due to low expectations coming into the report than the actual numbers. Culp’s following quote about the numbers should sum things up:

“We continue to trend toward the low end of our 2022 outlook on all metrics except cash, which is lower due to timing of working capital and Renewable Energy-related orders.”

Trending toward the low end on nearly all metrics isn’t the sort of verbiage you see from a company firing on all cylinders.

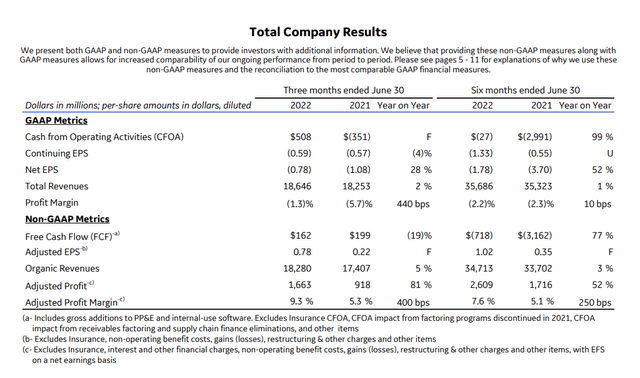

I’d also note that GE has a large number of adjustments to its earnings. While the company is reasonably profitable on an adjusted basis, it’s actually losing money outright once you add back all the excluded items:

GE earnings reconciliation (GE earnings release)

Net EPS, on a GAAP basis, improved year-over-year, but only from -$1.08 to -$0.78 per share. How’d we get from that result to a positive 78 cent per share figure for the quarter? Adjustments included mark-to-market accounting, restructuring costs, separation costs, and other expenses.

For all the excitement over the surprise positive free cash flow figure, this was hardly a rousing achievement either. Free cash flow generation year-over-year actually fell from $199 million to $162 million for this latest quarter. This is better than a loss, to be certain, but these aren’t the sort of numbers that would instantly make it clear that the transformation plan is working.

A look on a unit by unit basis shows highs and lows as well. Aerospace was particularly strong both in overall demand and the prices GE was able to charge for services. Renewables, by contrast, are really struggling. Culp said that a lack of subsidy support and higher input costs will cause that business to fail to achieve the step-up in profitability in the second half of the year that had been previously forecast.

What’s Going Right For GE

It’s disappointing that GE is still struggling to achieve profitability on a GAAP basis or generate much free cash flow. This far into its corporate restructuring and right-sizing of its business, it’s not unreasonable to hope that the company could be more consistently and strongly profitable.

That said, there are some real reasons for the soft earnings. Inflation and supply chain problems cost the company 4% of organic growth year-to-date as per the Q2 conference call. The war in Ukraine shaved another point off the company’s organic growth rate.

Even despite these obstacles, the company still managed a 3% organic growth rate, and in theory could have had an 8% organic growth rate if things were going normally. On the one hand, GE always seems to have an excuse for why their businesses aren’t delivering better results. On the other, the problems holding the company back now aren’t specific to it; almost every industrial firm is facing a slowdown due to supply chain and geopolitical problems.

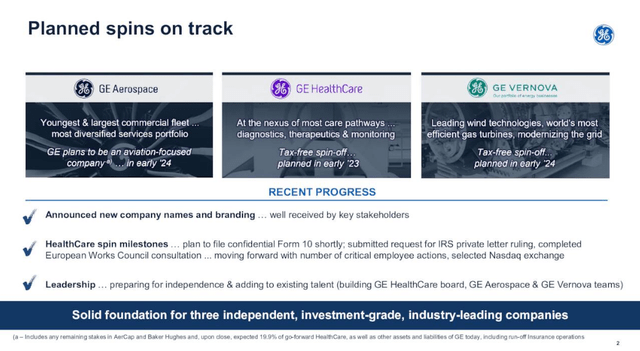

And some of the other “adjusted” earnings costs, such as separation costs related to preparing for the upcoming spin-offs, should go away soon. As per the company’s Q2 slides, all three of the new independent businesses should be up and running by early 2024:

GE spin-offs (Q2 earnings presentation)

The biggest positive out of the earnings release was the company’s margin expansion. The company saw a better than 400 basis points improvement on both a GAAP and adjusted basis. This was particularly driven in the aerospace business with the high-margin services unit leading the charge. Encouragingly, GE was able to achieve higher margins both through price increases and cost efficiencies.

As another positive, it seems the market is warming up to these sorts of strategic repositioning efforts. Notably, 3M (MMM) announced that it will be spinning off its health care division into a separate company in which it will retain 20% of the underlying business. MMM stock popped 5% Tuesday, making it one of the few big winners on an ugly day across the board for the market.

Add 3M’s move to Johnson & Johnson’s (JNJ) decision to spin off its consumer products business, and GE is not looking as lonely in its own move to split up its conglomerate structure.

Culp was enormously successful at buying and divesting various pieces of his industrial empire over at Danaher. He’s trying to navigate a challenging turnaround at GE in the midst of first the pandemic and now this complicated logistical and supply chain mess. But I believe the strategic rationale behind the spin-offs remains sound.

GE’s Bottom Line

As someone who has been upbeat on Culp’s plans to fix GE, this quarter leaves me feeling ambivalent. The Q2 results weren’t particularly bad, especially given overall macroeconomic conditions. But I’m hardly impressed with these results either. Back out the adjustments, and the overall results are pretty soft even though certain factors such as margin improvement were real positives.

Regardless, in the bigger picture, this’s still a bet on Culp’s ability to manage a tremendously complex process of selling and spinning off GE’s various assets. It’s hard to judge how well that is going until we start seeing GE’s new businesses operate independently, and that probably won’t be until early 2024.

As such, this quarterly earnings report doesn’t really move the needle. Q2 was good enough for a stock that had been near 52-week lows and facing downbeat sentiment. However, it wasn’t a blowout by any means, and management left plenty of hints in the conference call that there will be challenges in the back half of 2022.

For traders, I wouldn’t count on the positive momentum from this earnings release lasting all that long. But I remain positive on Culp’s ability to turn things around. And certain businesses, notably aerospace, are showing some signs of operational momentum. As a 2023 and 2024 story, GE stock holds considerable promise. Just don’t be surprised if the rest of 2022 is a slog, particularly if overall economic conditions further weaken.

Be the first to comment