J. Michael Jones

Investment Thesis

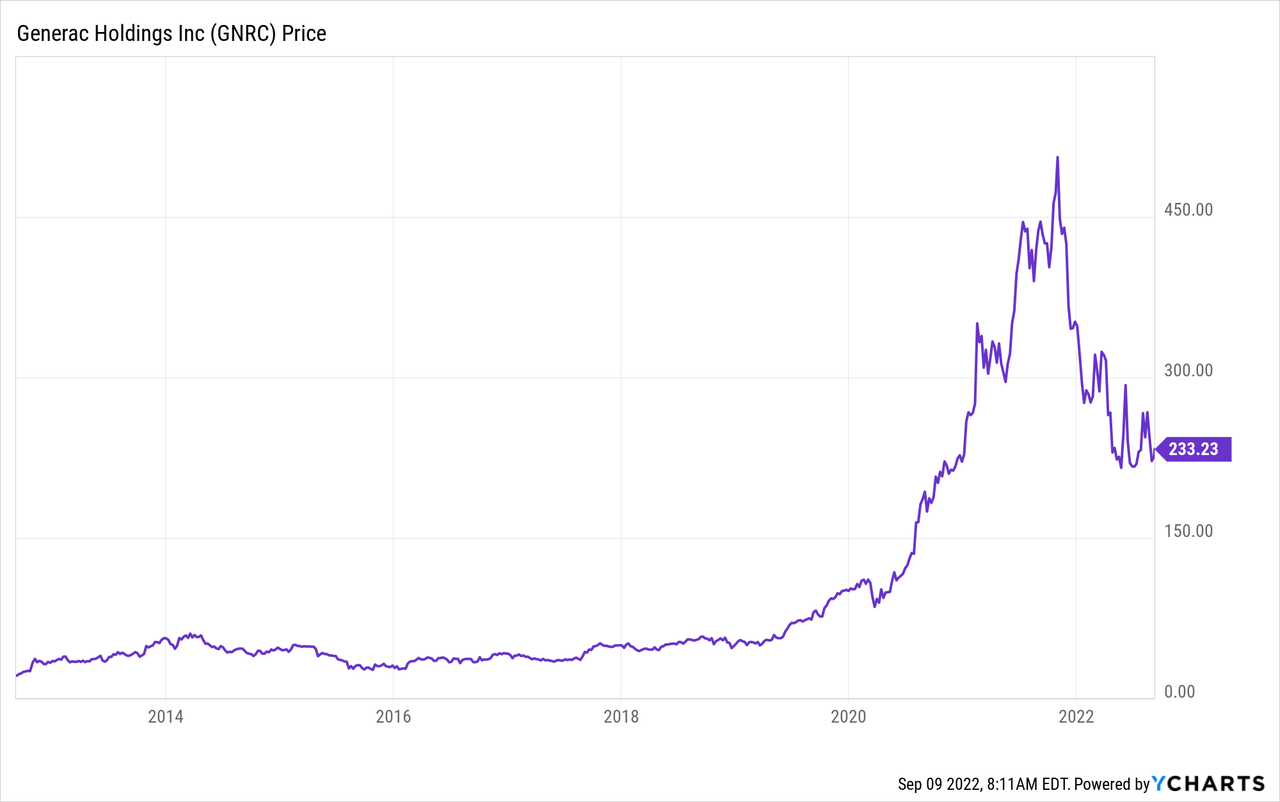

Generac (NYSE:GNRC) has been one of the best compounders in the past decade, with the share price up over 1,000% during the period. However, the company got caught in the broad market sell-off and shares are now down over 50% from the all-time high last November. After the massive drop, the current share price appears to be attractive, as valuation contracted meaningfully while revenue growth continues to be strong. The company is also benefiting from the tailwinds of clean energy transition and increasing grid service demand. I believe the growth opportunity for Generac is huge and the company is likely to outperform in the long term. Therefore I rate the company as a buy at the current price.

Overview

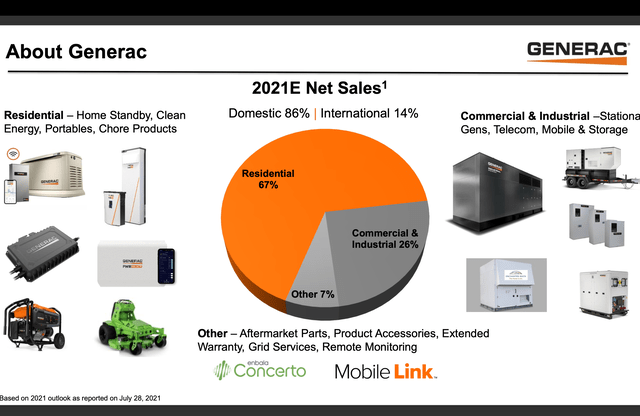

Generac is a US-based energy technology company. It is currently the leader in the backup generator and grid service space, with over 2.5 million grid edge assets and 10,000+ dealers and distributors. It offers different types of generators to both households and businesses, including backup generators, portable generators, mobile generators, industrial generators, and more. The products also come with an app, allowing users to monitor the status of the generator through their phone or computer.

In order the ride the clean energy wave, Generac has expanded into the clean energy space through multiple acquisitions. Since 2016, the company had acquired 14 companies, creating a comprehensive product portfolio for different clean energy needs. The company now has one of the broadest product portfolios in the industry, offering products like solar and battery storage systems, microinverter, power managers, and more. Generac also has a strong partnership ecosystem. It works with partners like Caterpillar (CAT), Honeywell (HON), and Cummins (CMI) to provide best-in-class grid services.

Market Opportunities

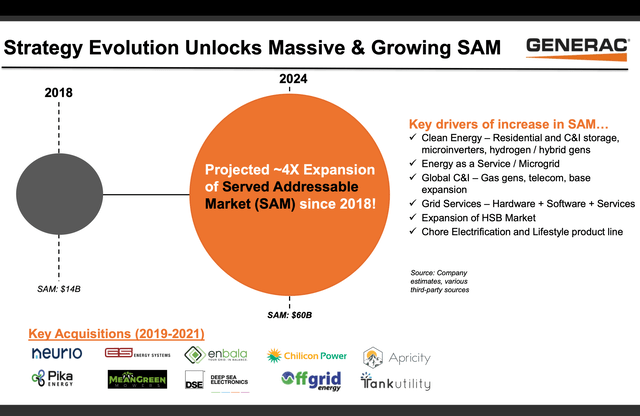

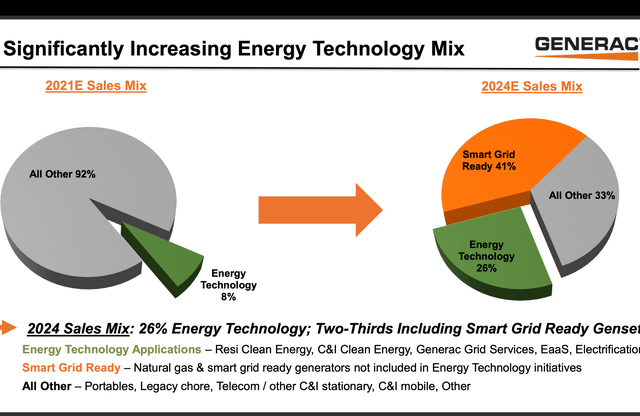

The market opportunity for Generac is huge. According to the company, the SAM (serviceable addressable market) is estimated to be $60 billion in 2024, up from $14 billion in 2018. The expansion in SAM is mostly driven by the clean energy and smart grid segment, which is forecasted to grow rapidly. According to Vantage Market Research, the solar energy industry is forecasted to grow at a CAGR of 20.8% from 2022 to 2028. Generac is just getting started with its clean energy solutions. Currently, the generator and legacy business accounts for 91% of total revenue while clean energy technology only accounts for a mere 9%. The company expects the percentage portion for the legacy segment will drop to 33% while smart grid and clean energy technology solutions will account for 41% and 26% respectively.

Generac is benefiting from multiple tailwinds. As global warming continues and the weather is getting more severe, power outages are now happening much more frequently. Earlier this week, California warned its citizens of a potential power outage, as the heat wave caused a significant increase in electricity demand. The acceleration in outages is boosting the demand for back generators, as households are seeking solutions for energy independence. Despite being the leader in the space, the company’s current penetration rate is only around 6% in the US. As demand increases, I believe the penetration rate will continue to move up nicely in the near term. Management mentioned that every 1% increase in penetration rate will bring an incremental revenue of $2.5 billion.

Besides, households’ demand for electricity has been increasing significantly in the past few years. Apart from severe weather, this is caused by wider EV adoption and electrification of HVAC, water heating, appliances, and more. This results in the need for extra energy storage and generating system, and is likely to drive up the demand for clean energy products such as microgrids and energy storage systems. I believe clean energy will continue to act as a significant catalyst moving forward. While it might not be the solution to the world’s energy crisis, it is surely a viable solution for a single household.

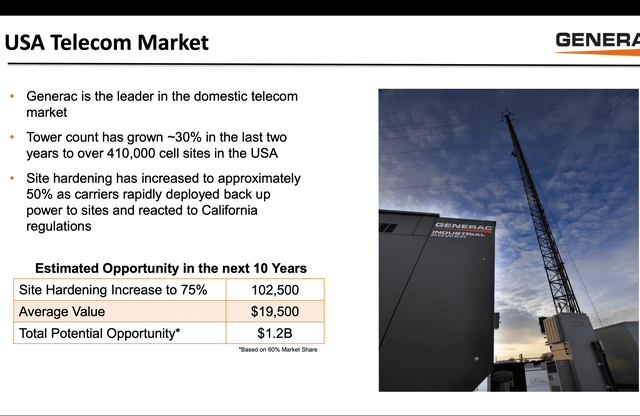

On the industrial side, 5G and telecom is a strong growth driver. According to the company, cell tower counts are forecasted to increase 30% globally in the next four years to 5.3 million. While the investment in telecom-related power systems is expected to grow at 8% CAGR over the next 6 years. Each cell tower site requires backup generators in order to maintain up-time and network reliability. The increase in cell tower sites is likely to boost the demand for industrial generators moving forward.

Aaron Jagdfeld, CEO, on telecom opportunities:

Shipments to national telecom customers increased again during the second quarter as compared to the prior year as several of our larger telecom customers further invest in hardening their existing LTE sites and begin to build out their fifth generation or 5G networks. Telecom infrastructure upgrades remain one of the key megatrends we expect to drive growth for our business in the coming years.

Financials and Valuation

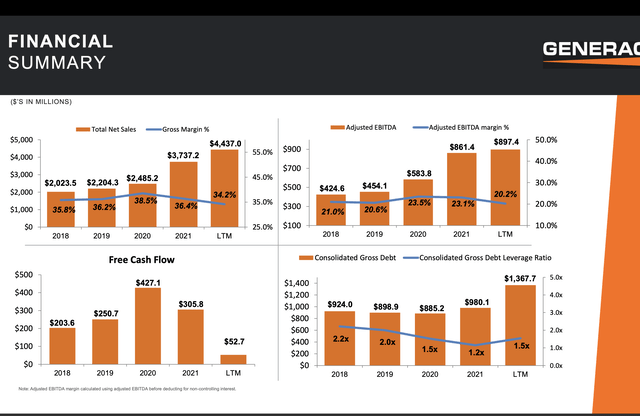

Generac reported its second-quarter earnings in August and revenue growth continues to be superb, despite facing a tough macro environment. The company reported net sales of $1.29 billion, up 40% YoY (year over year) from $920 million. Residential product sales increased 49% from $600 million to $896 million, driven by strong demand for standby generators. Commercial and industrial products increased 22% from $254 million to $309 million. While the company does not disclose the sales figure for the clean energy segment, they did mention in the earnings call that sales grew 50% YoY. The gross profit margin for the quarter was 35.4% compared to 36.9%. The slight drop in gross margins is largely due to supply chain disruption and higher logistics and labor costs.

Aaron Jagdfeld, CEO, on second-quarter results:

We continued to experience robust growth during the second quarter as ongoing capacity expansion helped drive shipments to new records. In addition to the tremendous year-over-year increase in sales, we experienced significant sequential margin improvement in the quarter, which reinforces our prior expectations that margins bottomed in the first quarter and will continue to improve throughout 2022. The mega-trends supporting this demand remain as compelling as ever, and we believe our unique suite of energy technology solutions has Generac well-positioned to lead the evolution to a more resilient, efficient and sustainable energy future

The bottom line for the quarter is decent, considering how volatile the macro environment has been. The company reported an adjusted net income of $194 million, or $2.99 per share, up 26.8% compared to $153 million, or $2.39 per share a year ago. Adjusted EBITDA was $271 million compared to $218 million, representing a 24.3% increase. Adjusted EBITDA dipped slightly from 23.7% to 21%, as operating expenses shot up 53.2%, largely attributed to acquisition-related expenses and increased employee costs.

Operating cash flow was the Achilles’ heel in the quarter, which decreased significantly from $274 million to $13.7 million. I am not too worried about the drop as the decline is largely due to the company paying off $61.3 million in deferred income tax and $54.6 million in near-term payables. Cash flow should stabilize in the coming quarters.

York Ragen, CFO, on cash flow:

We expect free cash flow conversion to return to the historical long-term average in the second half of 2022, resulting in approximately 90% conversion of adjusted net income to free cash flow.

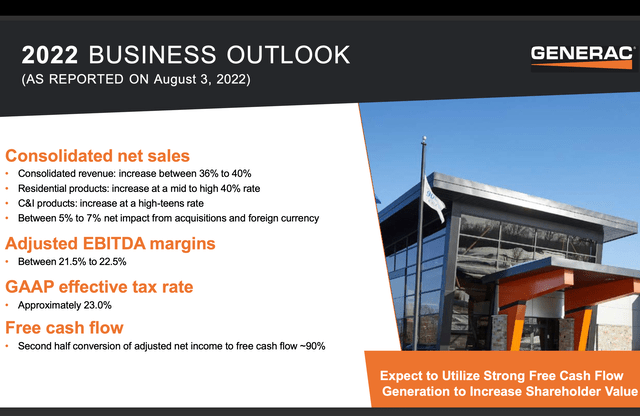

The management team expects margins to improve over the remainder of the year as they are seeing an easing of input costs. It also reaffirmed its full-year revenue growth guidance of 36%-40%, signally strong demand moving forward. The company is also continuing to reduce its share count. It repurchased $124 million of its common shares during the quarter and approved a new repurchase program of up to $500 million over the next two years.

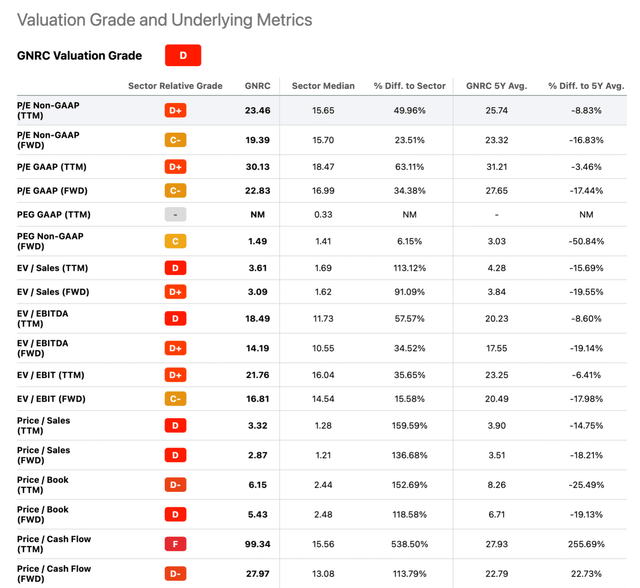

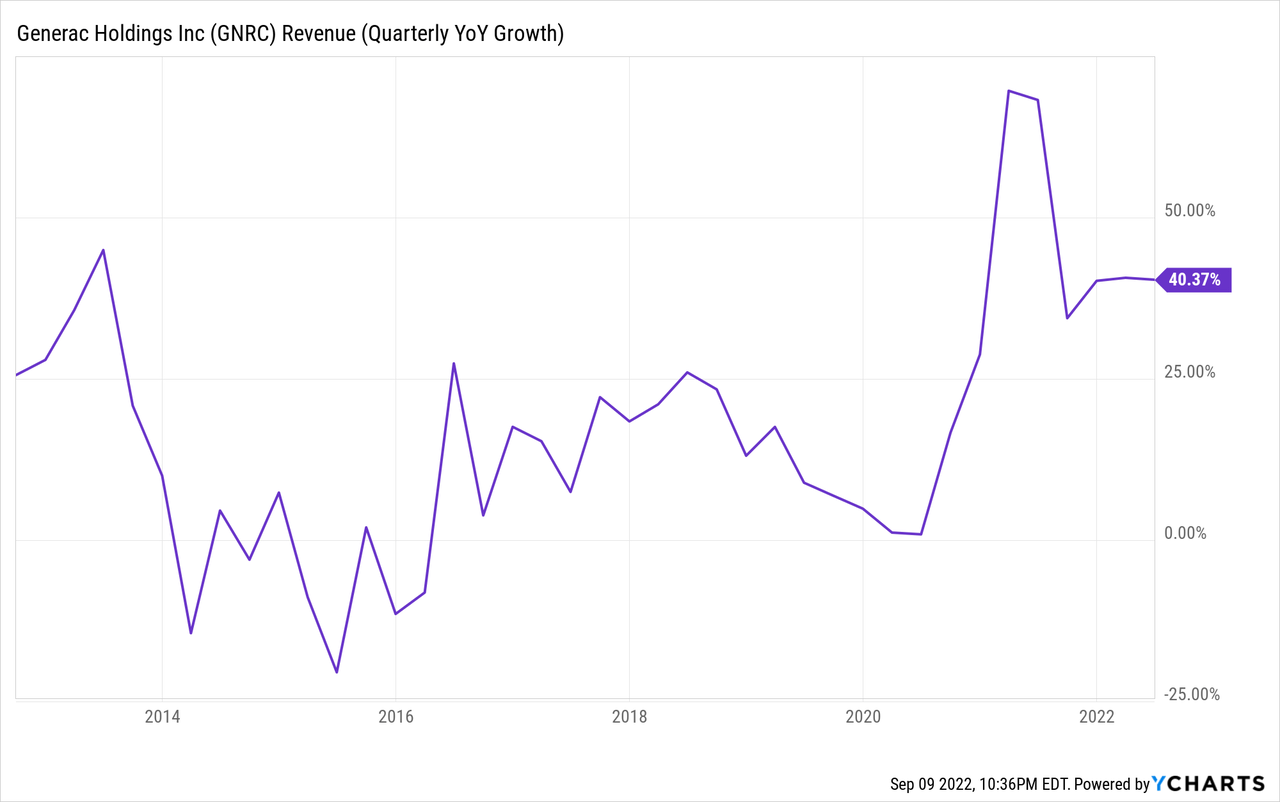

After the significant drop in share price, the company’s valuation has also come down meaningfully. It is currently trading at an FWD P/E ratio of 22.8, 17.5% below than its 5-year average P/E ratio of 27.65. On an EV/EBITDA basis, it is also trading at an 8.6% discount, as shown in the first chart below. However, despite the contraction in valuation, the company is continuing to report very strong growth. As shown in the second chart, the recent revenue growth rate of 40% is much higher compared to the past few years, which averaged 14.7%. I believe the current valuation is attractive when considering the accelerated growth rate and below-average multiples.

Seeking Alpha

Risks

While growth opportunities remain strong, the uncertainty revolving around inflation and the supply chain may pose significant risks to Generac in the near term. While the inflation rate finally dipped from 9.1% in July to 8.5%, it is still remaining at very elevated levels. Prices for commodities such as oil and natural gas continue to be very volatile as well. The uncertainty regarding China’s lockdown and the Ukraine-Russia war may post unprecedented pressure on inflation again if the situation worsens. An uptick in inflation and commodity prices will impact the company as it significantly increases operating costs and expenses, resulting in compressing margins as shown in the recent earnings. The company may also see lower-than-expected growth in the clean energy segment if the integration of its acquisitions does not proceed well.

Conclusion

In conclusion, I believe the sell-off presents a good buying opportunity for investors as Generac’s fundamental remains very strong. The legacy generator segment continues to see strong demand while the recent expansion into clean energy opened up even more opportunities. It has a large and fast-growing addressable market as the clean energy transition continues to accelerate. It also has multiple growth catalysts such as increasing frequency of power outages, higher demand for electricity, and the growth in cell tower counts. Despite facing a tough macro environment, revenue growth in recent earnings remain strong. After the sell-off, the company is now trading at a below-average valuation while posting above average growth rate. Therefore I rate Generac as a buy at the current price.

Be the first to comment