Editor’s note: Seeking Alpha is proud to welcome Diamond Hands Equity Research as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

George Frey/Getty Images News

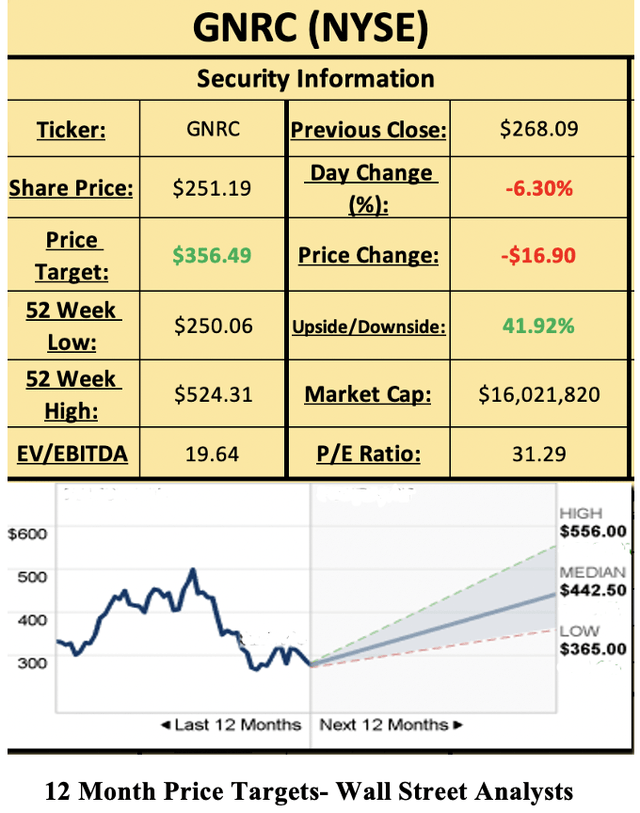

I give Generac (GNRC), the pre-eminent supplier of generators with 75% market share in the United States, a buy rating due to robust underlying demand, supply-chain improvement, and a significant increase in their manufacturing capacity. While supply-chain issues have hindered their ability to meet demand in FY21, Generac still experienced 50% revenue growth. A combination of supply chain issues and high demand have led to record backlogs for the company, leading management to optimistically suggest 32%-36% top-line growth and adjusted EBITDA margins of 22%-23% for FY22.

To meet the insatiable demand, GNRC has doubled its production with a large expansion of their manufacturing, assembly, and distribution facility located in Trent, South Carolina. Operations at the new facility began in July 2021 and the addition is expected to double the company’s production by 2Q22. Generac has also invested in existing facilities for further expansion of their manufacturing capacity. With a significant increase in production capacity and supply-chain problems beginning to subside, I believe Generac is a good long-term buy that should see significant top-line growth given their record backlogs.

Security Information for Generac (My Model via Excel)

High Demand Leading To Record Backlogs

High demand illustrated by their record backlogs suggest that high top-line growth should continue for Generac into the foreseeable future. According to 3Q21 Earnings, the company had over $1 Billion in backlogs for their Home Standby Generators (HSB). Luckily for Generac, Supply Chain issues are beginning to subside with lead times for their HSB decreasing from 32 weeks to 27-28 weeks. Despite ramping up their manufacturing capacity, their backlog for the HSB continues to grow. Management is forecasting a significant amount of backlog by YE22, which they previously believed would normalize. This suggests that robust demand for Generac’s HSB will continue to drive this type of strong top-line growth well into FY23.

Supply Chain Improvements With Minimal Capital Expenditure

For Generac, Demand is obviously not the issue. Supply Chain and Manufacturing Capacity problems are holding the company back from further top-line growth. Routine channel checks performed by analysts around Wall Street suggest that these issues are beginning to subside. Depleted inventories are being fulfilled more often and that is a good sign for shareholders of GNRC. To solve their backlog issue, Generac made a necessary addition to their distribution, manufacturing, assembly, and distribution facility in South Carolina. This addition added 200,000 square feet to the facility and is expected to double production by 2Q22 (compared to the beginning of 2021).

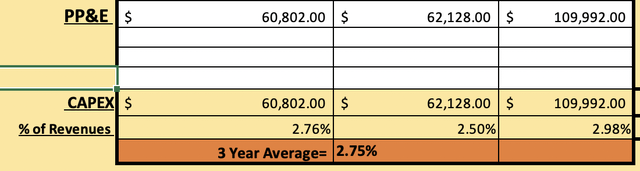

The investment in the new South Carolina facility investment led to an increase in capital expenditure by 77%, which was still only 3% of total revenue. In fact, Generac’s growth since their IPO has been very organic with capital expenditure averaging 2.5%-3.5% of sales annually. Organic growth means more cash flow. Generac’s combination of strong top-line growth, wide EBITDA margins, and minimized capital expenditure will generate significant cash flow. This cash flow will be used to reward shareholders in one way or another (i.e. stock buybacks). It also gives Generac ample liquidity to invest in future cash-flow generating opportunities through research & development or synergistic Mergers & Acquisitions with above WAAC returns.

Generac’s CAPEX- Past 3 Years (My Model via Excel)

Track Record Of Growth

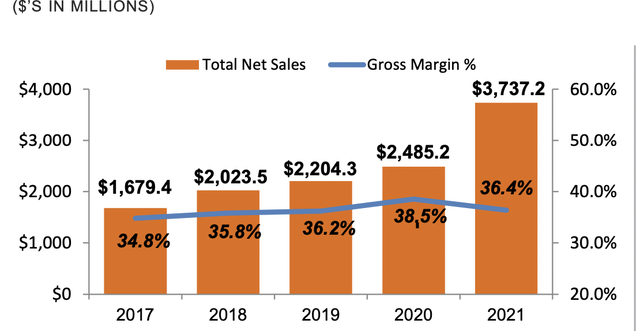

Net Sales and Gross Profit- 5 Year Historical (Generac Investor Presentation- FYE21) Adj EBITDA & EBITDA Margins- 5 Year Historical (Generac Investor Presentation- FYE21)

Generac has a demonstrated track record of growth. Since the firm’s IPO in 2010, Generac has experienced a 19% compound annual growth rate in revenue. Pictured above is Generac’s net sales, gross profit margins, adjusted EBITDA, and Adj. EBITDA margins over the past 5 years. They have consistently grown their net sales, adjusted EBITDA, and adjusted EBITDA margins. GNRC estimates that FY22 revenue will fall between $4.93B and $5.08B, which was above the consensus analyst estimate of $4.70B. This strong boost in sales is expected to be accompanied by a 22%-23% EBITDA margin and a healthy profit margin of 36.64%. Additionally, earnings for Generac have grown by 28.45% over the past 5 years (see below). Generac has a strong history of topping earnings estimates, having only missed earnings estimates twice since 2Q15 (see below).

Earnings History- GNRC (Bloomberg Terminal- ERN Function)

Discounted Cash Flow Analysis

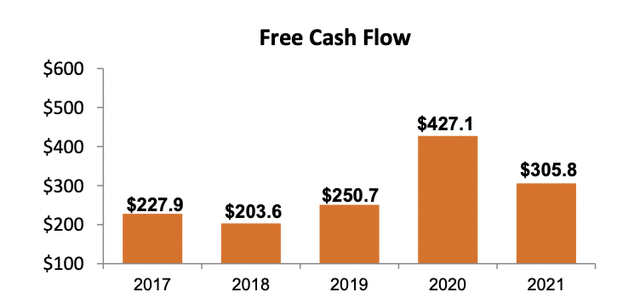

Generac Free Cash Flow- 5 Year Historical (Generac Investor Presentation- February 2022)

In the image above, you can see that Generac generates a steady amount of free cash flow over the past 5 years. After making assumptions using a combination of management guidance for 2022 and historical averages, my discounted free cash flow analysis arrived at an intrinsic value of $356 per share (42% upside from current price of $251). For this analysis, I made assumptions of 32% revenue growth in FY22 and CAGR of 13% for FY23 through FY25 (which I believe is very conservative given that management has forecasted a significant amount of backlog by YE22).

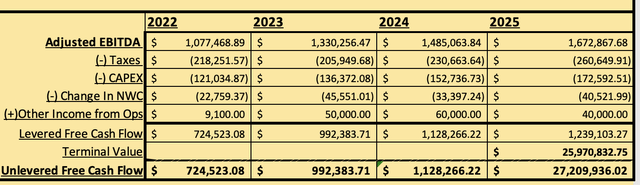

Additionally, I used 3-year historical averages as a % of sales. Over the past three years, Generac’s average cost of revenues were 62.76% of sales. Their 3-year average of operating expenses were 18% of sales. Non-operating expenses were 1.28% of sales. Capital expenditures were 2.75% of sales. And finally, changes in net working capital were 4.25% of sales. Regarding terminal value, I used the 10 Yr Treasury Note as the perpetuity growth rate. After placing these assumptions into my DCF model, I arrived at the following cash flows for FY22 through FY25:

Forecasted FCF with my assumptions (My Model via Excel)

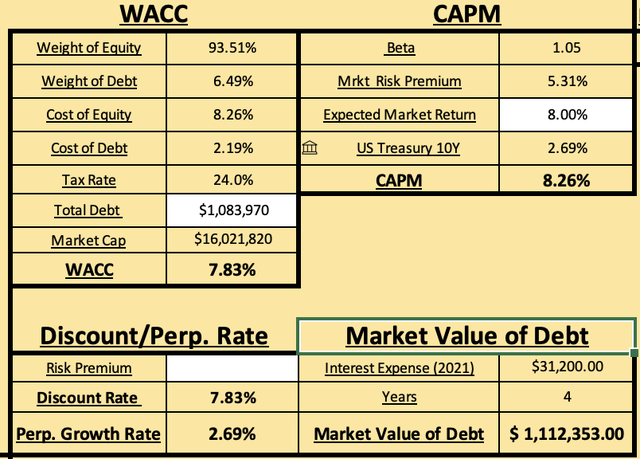

For my discount rate, I calculated Generac’s WACC to be 7.83% using their current market capitalization and current market value of debt (illustrated below). To calculate Generac’s Cost of Equity, I arrived at market risk premium of 5.31% for their cost of equity by taking the difference between an expected market return of 8% and risk-free rate of 2.69% (US Treasury 10Y). To calculate the market value of debt, I used the interest expense from 2021, total debt (book value) from YE21, and a period of 4 years.

WAAC Calculation (My Model via Excel)

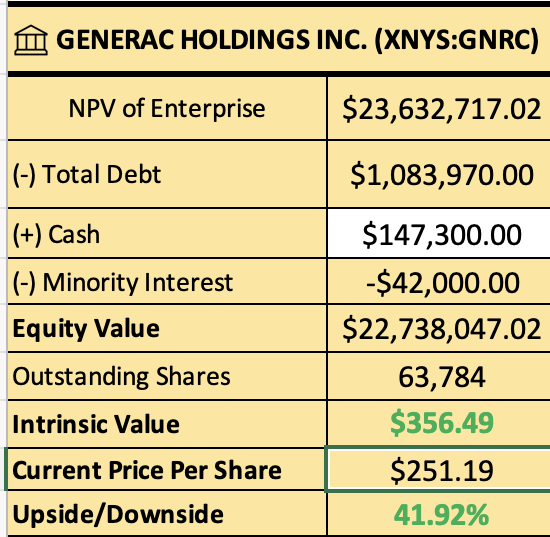

After applying a discount rate of 7.83% to my forecasted future cash flows, I arrived at an intrinsic value of $356 per share (pictured below). Given my conservative top-line revenue forecasts, I expected my intrinsic value to be on the low-end in comparison to Wall Street’s price targets. Wall Street is very bullish on Generac with price targets ranging from $365 to $556 per share.

Generac’s Intrinsic Enterprise Value and Price Per Share (My Model via Excel)

Investment Risks

There are a number of risks that could keep Generac from achieving their full potential as a company. One risk that could stagnate growth is consumer’s perception of Generators as non-essential, especially if power outages prove to be elusive. Additionally, as our economy becomes more uncertain with high inflation, war, and high oil prices, consumers may avoid non-essential items, especially a $7000 generator. Growing uncertainty may cause consumers to hold onto cash with the growing probability of recession.

A second risk that Generac faces is the correlation of generator demand with grid reliability and weather patterns. Demand for Generac’s HSB thrives in an environment of frequent and extended power outages. If consumers don’t experience power outages due to severe weather, demand for Generac’s HSB could decrease. Additionally, continued improvement in grid reliability could negatively impact Generac. As we continue advancing in technology into the future, grid reliability could improve drastically and cause a significant reduction in demand for HSB.

A third risk for shareholders of Generac is the highly inflationary environment in which we find ourselves. The annual inflation rate for the United States was 8.5% at the end of March, the highest since 1981. While financials and energy generally perform better during times of high inflation, industrials such as Generac don’t because of their reliance on debt capital. The fed has been hawkish and could hike rates up to 5 more times this year. High interest rates will deter industrial companies from taking on debt to fund new capital projects in order to maximize shareholder value and strategic M&A. This is not a good sign for industrials lacking liquidity.

A fourth risk for Generac is the opportunity cost of losing consumers due to their extensive backlog. It has been a difficult environment for supply-chains all over the globe, especially Generac. Because lead times are still 27-28 weeks, frustrated consumers may cancel their orders, causing Generac to miss out on potential revenue growth. These lead times may lead consumers to Generac’s biggest competitor in the power generation space, Kohler.

Closing Remarks

As a caveat, there is a theory that consumers buy generators during times of war. Even if this theory is false, Generac is about to experience significant top-line growth in FY22 due to increased manufacturing capacity to appease their record backlogs. Cash flow generated from these backlogs should put Generac in a position to fuel growth in future initiatives (such as green energy) in addition to rewarding shareholders via stock buybacks. Most Wall Street analysts are bullish, and Goldman Sachs recently upgraded Generac to overweight, citing Generac’s broad product portfolio and supply-chain improvement as catalysts for growth.

I bought this stock 4 months ago and I believe it’s trading at a hefty discount. Be patient. Generac investors will reap capital gains given the insatiable demand for generators, EBITDA margin growth, and increased manufacturing capacity that will aid in strong earnings reports for the foreseeable future. Additionally, there is a significant opportunity for Generac to continue to gain market share with the lack of market penetration within their industry. I do own Generac and will continue to hold. I would buy more, but I am currently lacking liquidity. Long Generac.

Be the first to comment