gorodenkoff/iStock via Getty Images

A Quick Take On Genelux Corporation

Genelux Corporation (GNLX) has filed to raise $30 million in an IPO of its common stock, according to an S-1 registration statement.

The firm is a clinical-stage biopharma developing treatments for various types of cancers.

When we learn more about management’s proposed valuation and pricing assumptions for the IPO, I’ll provide a final opinion.

Genelux Overview

Westlake Village, California-based Genelux was founded to develop treatments for various aggressive or difficult-to-treat solid tumor cancers.

Management is headed by president and CEO Thomas Zindrick, J.D., who has been with the firm since May 2014 and was previously CEO of Amitech Therapeutics Solutions and held the position of Vice President Associate General Counsel at Amgen.

The firm’s lead candidate is Olvi-Vec, which is in Phase 3 planning phase for the treatment of platinum-resistant/refractory ovarian cancer [PRROC] and which has already met a preliminary endpoint for its Phase 2 trial for that disease.

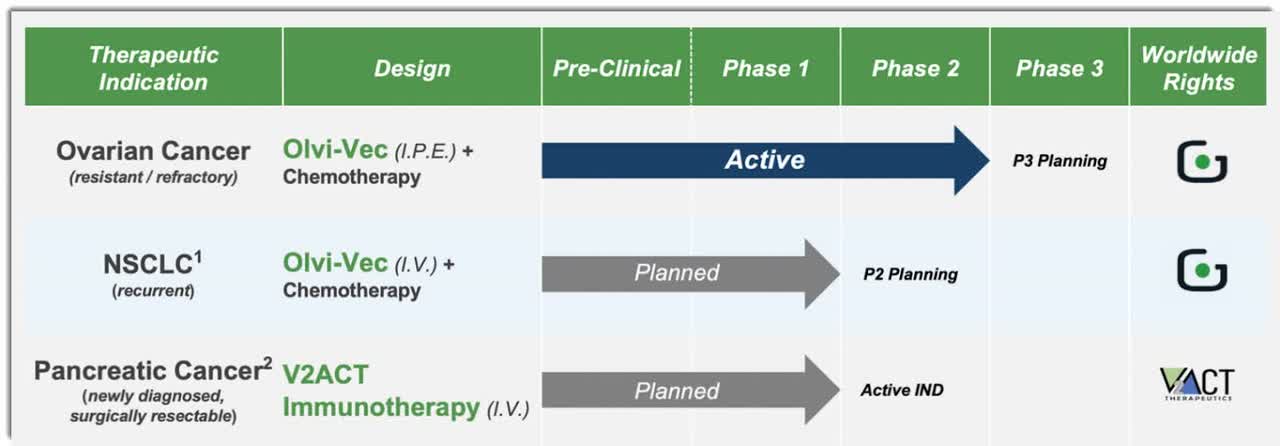

Below is the current status of the company’s drug development pipeline:

Company Pipeline (Company Website)

Genelux has booked fair market value investment of $169.4 million in equity and convertible debt as of March 31, 2022 from investors.

Genelux’ Market & Competition

According to a 2018 market research report by BCC Research, the global market for ovarian cancer therapeutics was an estimated $2.1 billion in 2017 and is forecast to reach $2.9 billion by 2022.

This represents a forecast CAGR (Compound Annual Growth Rate) of 7.1% from 2017 to 2022.

Key elements driving this expected growth are a growing incidence of cancers as global populations age and immune system performance is reduced.

Also, new drug classes are expected to be approved, with five new drugs expected to be approved by 2028.

However, the growth in use of biosimilar products and generics will likely act as a drag on growth of the market’s total dollar value over time.

Notably, the GlobalData estimate for the ovarian cancer market has a much higher estimate, with the market forecast to reach $6.7 billion by 2028.

Major competitive vendors that provide or are developing related treatments include:

-

Amgen (AMGN)

-

AstraZeneca (AZN)

-

Boehringer Ingelheim

-

CG Oncology

-

Candel Therapeutics (CADL)

-

Daiichi Sankyo (OTCPK:DSKYF) (OTCPK:DSNKY)

-

DNAtrix

-

Johnson & Johnson (JNJ)

-

Merck (MRK)

-

Oncolytics Biotech (ONCY)

-

Oncorus (ONCR)

-

Replimmune

-

SillaJen

-

Targovax USA

-

Transgene SA (OTCPK:TRGNF)

-

Others

Genelux Corporation Financial Status

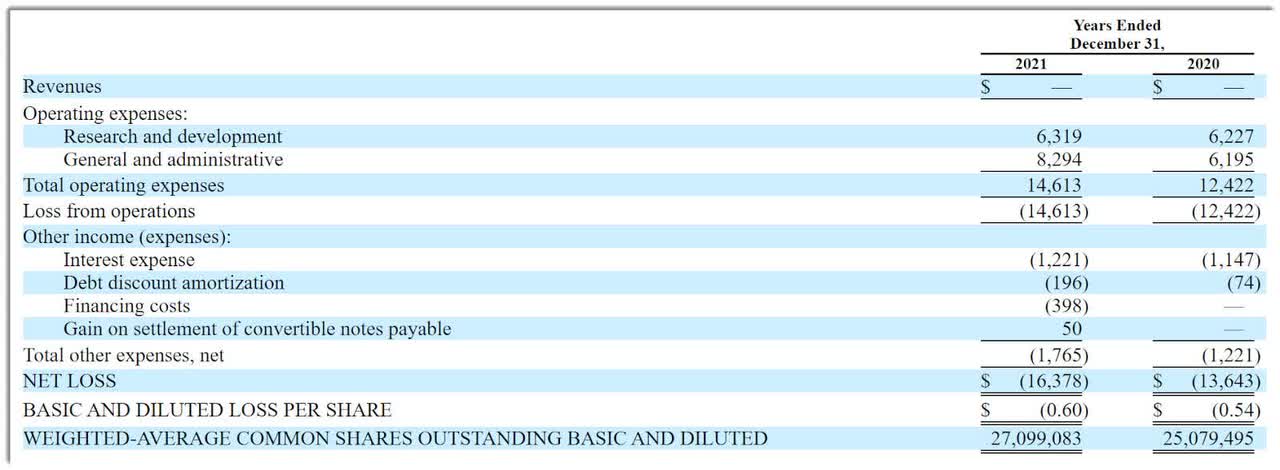

The firm’s recent financial results are typical of a clinical-stage biopharma in that they feature no revenue and significant R&D and G&A expenses associated with advancing its pipeline.

Below are the company’s financial results for the past two calendar years:

Statement of Operations (SEC)

As of March 31, 2022, the company had $7.2 million in cash and $46.7 million in total liabilities.

Genelux Corporation IPO Details

Genelux intends to raise $30 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest to purchase shares at the IPO price, although this element may become a feature of the IPO if disclosed in a future filing.

Management says it will use the net proceeds from the IPO as follows:

to fund the clinical development of our lead product candidate, Olvi-Vec in PRROC and [related] manufacturing activities;

to pay outstanding accounts payable; and

any remaining proceeds for working capital and general corporate purposes.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is not currently a party or received notice of any material legal proceedings against it.

Listed bookrunners of the IPO are The Benchmark Company, Brookline Capital Markets and Valuable Capital Limited.

Commentary About Genelux’ IPO

GNLX is seeking U.S. public capital market investment to fund further advancement of its pipeline of treatments through mid- and late-stage trials.

The firm’s lead candidate, Olvi-Vec, which is in Phase 3 planning phase for the treatment of platinum-resistant/refractory ovarian cancer [PRROC] and which has already met a preliminary endpoint for its Phase 2 trial for that disease.

The market opportunity for ovarian cancer treatments is reasonably large and expected to grow at a moderate rate of growth over the coming years.

Management hasn’t disclosed any major pharma firm collaboration relationship.

The company’s investor syndicate does not include any widely known institutional life science investors or strategic investors.

The Benchmark Company is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of approximately 91% since their IPO. This is a top-tier performance for all major underwriters during the period.

Genelux has achieved a milestone that many biopharma firms at IPO have not, that of achieving a Phase 2 efficacy endpoint, so in that regard, the IPO is somewhat unusual, in a good way.

When we learn more about management’s proposed valuation and pricing assumptions for the IPO, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Be the first to comment