xavierarnau/E+ via Getty Images

Investment Thesis

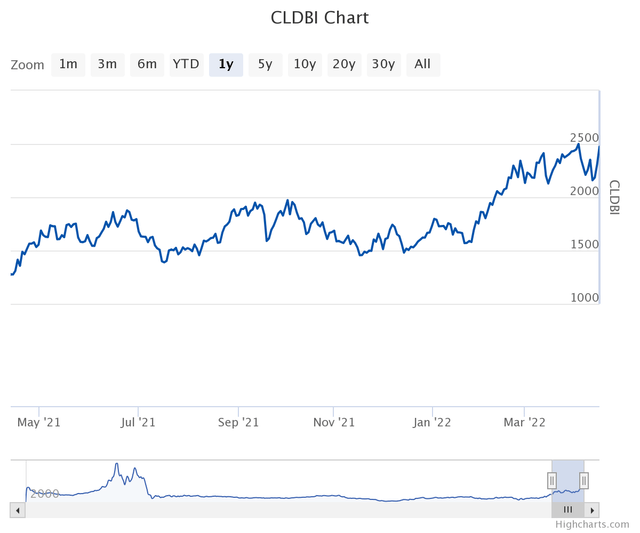

Genco Shipping & Trading Limited (NYSE:GNK) operates in the maritime industry, which experienced a meteoritic rate rise in 2021, inflating the revenues of the whole industry, including the Capital Link Drybulk Index (CLDBI) that contains Genco.

GNK stock has risen by almost 110% in the previous 52-week period, significantly lower than CLDBI’s 163.79% gain. However, upon a closer look, the only companies outpacing GNK inside the index are the microcaps; for instance, the previously covered EuroDry (EDRY) showed phenomenal price returns of 274%, whereas the company’s closest peers all lag GNK in price returns.

Additionally, the company boasts a healthy annualized dividend of 10.88% with a payout ratio of 22.88%, meaning that it has sufficient leftover resources to reinvest into its future growth while simultaneously rewarding its shareholders. The company sports a solid balance sheet, healthy revenue growth, high dividend yield, and attractive valuation metrics.

At its core, strong fundamentals, healthy shareholder returns, and great valuation metrics make this stock a solid buy.

Maritime Market Update

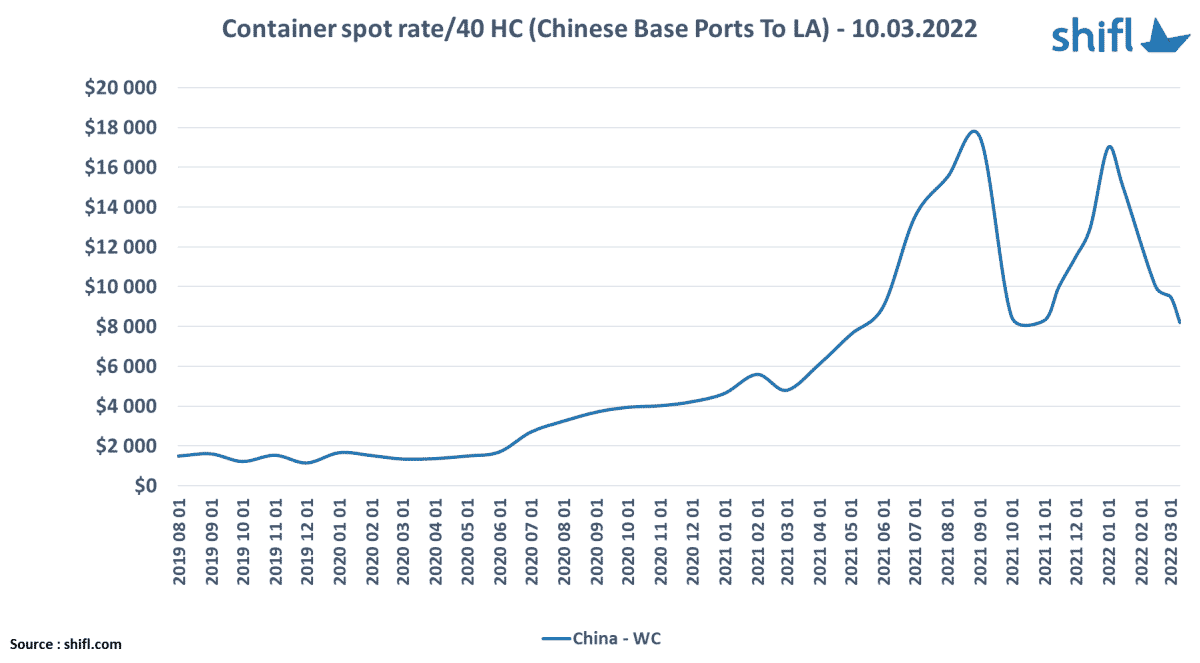

In 2021, the shipping rates rapidly surged due to pandemic-related constraints and set a new high. Pertinent to constrained shipping and clogged docks, the limited supply and demand spread inflated the freight rates. Since January 2022, shipping spot rates have declined by over 50% on the east and west coasts.

According to the CEO and Founder of Shifl, a technology platform helping shippers plan and manage their supply chain,

“We have seen a sharp decline in freight rates in the last three months due to a decrease in sales and full inventories as we enter the traditional post-Chinese New Year lean season.”

shifl.com

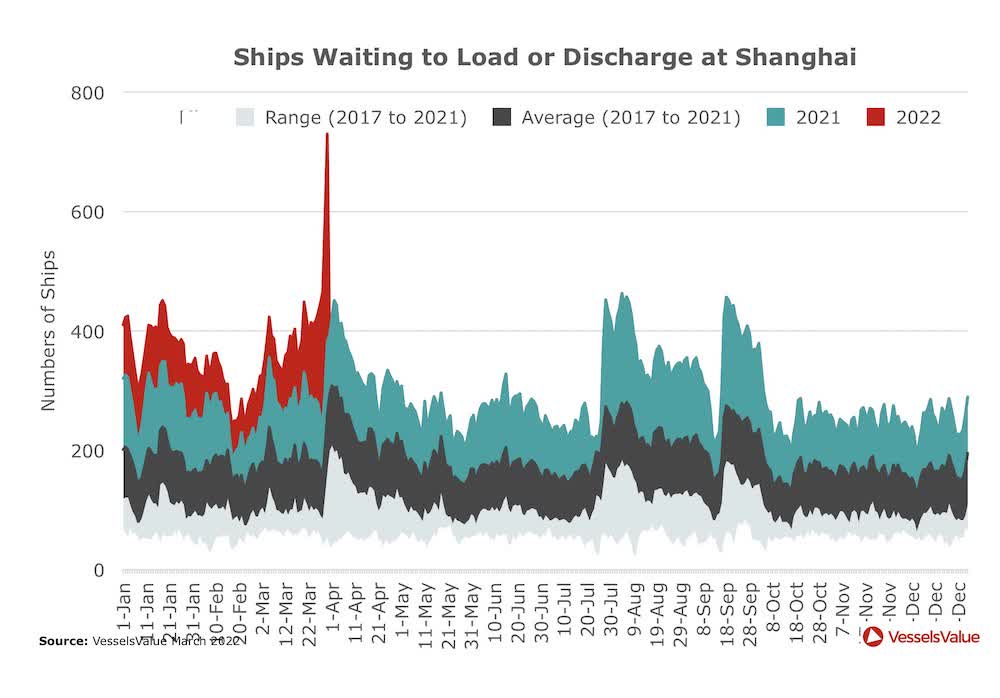

Shifl further states that the ongoing pandemic-related Chinese lockdowns also significantly contribute to this decline. Even though the Chinese officials and media have declined the backlog at Chinese ports, Lloyd’s Intelligence data reports that 140 containership carriers waited outside ports of Shanghai and nearby Ningbo as of April 4. Similarly, ports like Yangshan are operating at half of their capacity.

Splash247

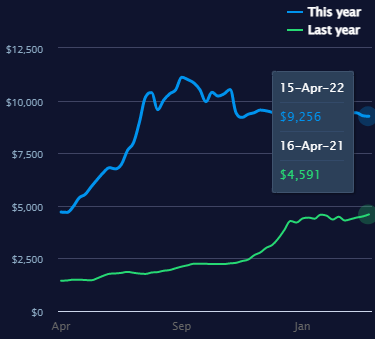

The rates are still considerably higher than pre-pandemic levels, and even if they decline further to settle down at the “new normal,” they will most likely still stay above the pre-pandemic levels. A measure of the average global shipping price of a 40-foot freight container, the Freightos Baltic Index, of $9,232 is presently 6.6 times higher than the March 2020 level of $1,400. While it’s down from the September 2021 highs of over $11,000, it’s still double the rates 52-weeks ago.

Frieghtos

This is in line with my previous maritime industry analysis,

“One of the possible downsides of this (historically high shipping rates) is that the industry may drive this surge into an oversupply, leading to deflations in shipping rates and, thereby, higher idle times and depressed revenues… Accordingly, UNCTAD has predicted a Compound Annual Growth Rate (CAGR) of 2.4% for the maritime industry by 2026, down from 2.9% in the last 2 decades.”

In light of all this, the rates are expected to continue this downward trend until the traditional peak shipping season later this year (Q3) and when the supply clog in China clears up, rebound at a slower rate than in 2021.

Company Overview

Genco is the largest U.S based drybulk owner that transports iron ore, coal, grains, steel products, and other drybulk cargoes globally. Its fleet of 44 vessels contains 17 Capesize, 15 Ultramax, and 12 Supramax drybulk carriers with an aggregate carrying capacity of 4.64 million deadweight tons ((dwt)), most of them engaged under time charters and spot market voyage charters.

More than half of Genco’s carried commodities are iron ore, so an increase in Chinese steel production because of easing emission targets in lieu of the country’s GDP growth will be significantly advantageous to the company. However, if the iron ore industry falters during the year, GNK’s topline growth will be substantially squeezed.

Financial Performance

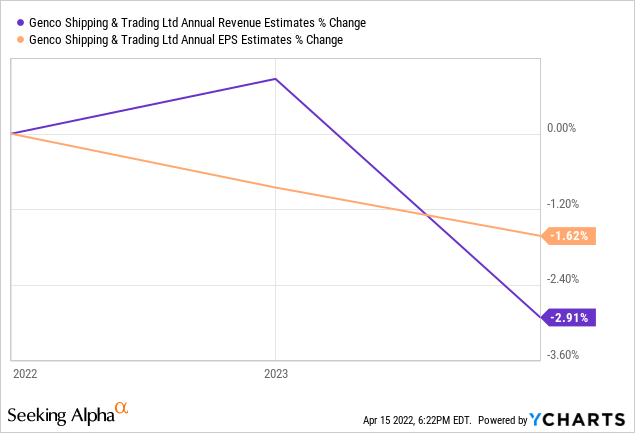

The company’s total YoY revenue growth of almost 154% in 2021 exceeded the 139% YoY annual average daily fleet rate increase, signifying that the company’s revenue growth was not completely attributable to the rising market rates, meaning that even though the company is likely to feel the pressure of the declining spot rates, its growth will not be entirely halted by them.

In fact, the consensus annual revenue estimate for 2022 is a mere 2.9% drop from the 2021 revenue, and the consensus EPS drop is even lower at 1.6%, from $4.26 to $4.19.

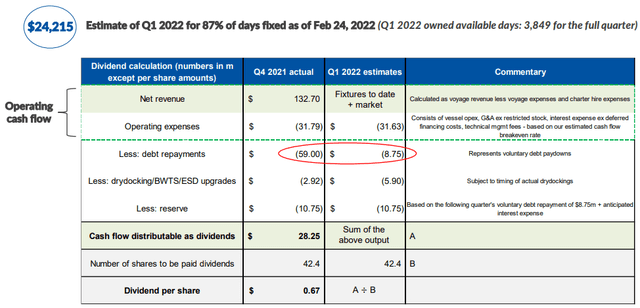

The inflated rates will highly influence the first-quarter revenue growth as its daily charter rate for Q1 2022 has been fixed at $24,215, marginally lower than 2021’s $24,402 but significantly lower than Q4 2021’s $35,200. Subsequently, despite the decline in rates, Q2 to Q4 of 2022 will benefit from rising cargo volumes and lifted steel production, especially from China.

Dividends

The growing revenues will be significantly aided by lower voluntary debt repayment of $8.75 million, representing an almost 85% decline from Q4 2021, to generate a healthy amount of cash flow to be distributed as dividends.

If the company’s revenue declined by almost 32% (decline in daily average charter rate) in Q1 2022 from Q4 levels, it would generate about $126.08 million. This will generate cash flow distributable as dividends of $69.05 million or $1.63 per share, informing a sustainable dividend payout and leaving substantial room for dividend growth.

Genco Shipping & Trading Limited

The company has recently declared a quarterly dividend of $0.67, a substantial increase of about 350% from the previous quarter. This brings the annualized dividend yield to about 11%, making it one of the highest dividend-yielding maritime stocks in the market.

The 22% payout ratio also ensures that the company has enough cash on hand to reinvest, securing future growth and sustainability. With the new value strategy in place, reducing leverage, and increasing cash flows, the dividend will likely experience meaningful growth in the coming quarters.

Leverage

During the previous 2 years, the company has substantially reduced its debt obligations by paying $203 million in 2021 and bringing the total debt to under $239 million. With total debt to equity of around 26%, net loan-to-value (LTV) of 15%, and interest coverage of almost 13x, the company’s leverage is well under control.

The company has no mandatory debt payments until 2026. Still, it voluntarily makes debt payments under its de-leveraging strategy to reach net-zero debt in the medium term, freeing up extra resources to amplify shareholder returns.

Valuation

Genco is currently trading at a forward and TTM-based PE multiple of 5.8, undercutting the industry median by around 70%. Similarly, the PB and PCF metrics are also lower than Genco’s peer group at 1.13 and 4.5, respectively. The company’s forward PS ratio exceeds the industry median by almost double at 2.64x, which might be a point of concern to value investors, but based on the average price targets of forward and TTM-based PE, PB, PS, and PCF; the intrinsic value comes out to be $54, which is 46% higher than analyst estimates of $37 at the high point.

This might seem unrealistic, but it speaks to the quality of value held inside the stock, facilitated by its earnings prospects, book value, and the ability to generate cash.

Conclusion

Genco has had a successful year with substantial market gains. This momentum is expected to continue, pushed by its strong fundamentals and positive investor sentiments guided by the attractive dividend distributions. The stock seems an all-rounder, desirable from a value, income, and growth perspective.

With the new value strategy being actively implemented, the de-leveraging, dividend distributions, and revenue growth are taking place, bolstering the company’s financial position and escalating the expected shareholder returns.

Even if the freight shipping rates remain at Q1 levels for the whole year, the company is adequately suited to continue its strategic progress and adhere to its plans. This makes me confident in the company’s performance in the short, medium, and long-term, rating the stock as a strong buy.

Be the first to comment