Lemon_tm/iStock via Getty Images

MicroSectors Gold Miners 3X ETN Overview

Leveraged products that provide investors with exposure to gold are very popular among retail investors. These investments can produce mixed results for investors and tend to be inferior investment vehicles when used for long-term investing. However, these vehicles can work sometimes for short-term trading (days/weeks) if you time the market correctly. However, it is not uncommon for one to lose over half their investment in a manner of months.

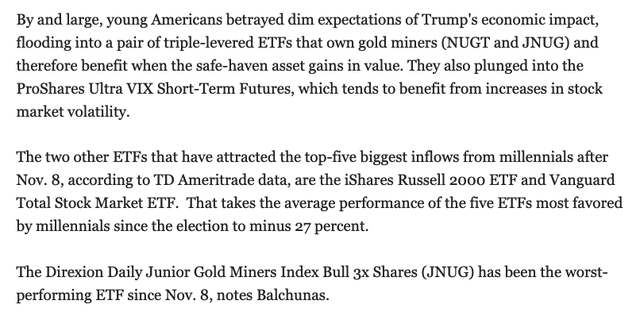

Several ETFs in the past used to provide 3x leverage, including the Direxion Daily Junior Gold Miners Bull 2x Shares ETF (JNUG), which now only provides 2x leverage. Investors piled into some of these leveraged ETFs, and they produced disappointing long-term results. These ETFs were extremely popular with retail investors following the 2016 election, and become extremely notorious afterward.

It is important not to entirely dismiss these leveraged products, but to understand that it is much safer to buy junior miners if you are a long-term gold bull looking for superior upside. Out-of-the-money call options on ETFs/large caps could also be a solid option. These leveraged products, on the other hand, are guaranteed to fail in the long term and are only short-term trading vehicles.

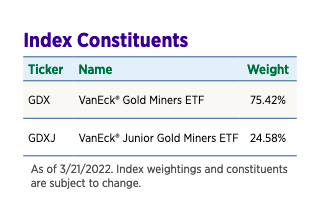

The MicroSectors Gold Miners 3X Leveraged ETN (NYSEARCA:GDXU) was launched in December 2020. It is designed to provide 3x the daily performance of the S-network MicroSectors Gold Miners Index. This index tracks the performance of the VanEck Gold Miners ETF (GDX) and the VanEck Junior Gold Miners ETF (GDXJ). It charges a 0.95% fee per annum.

Microsectors

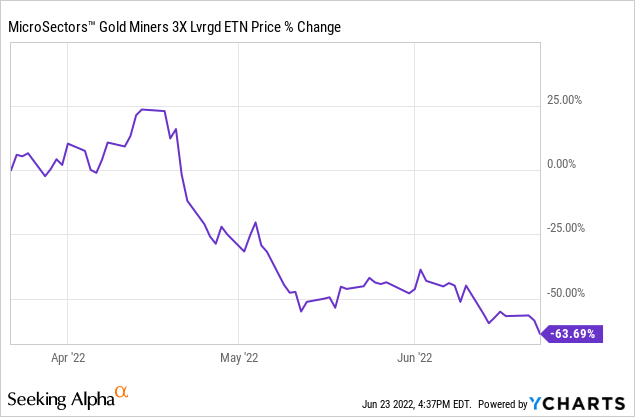

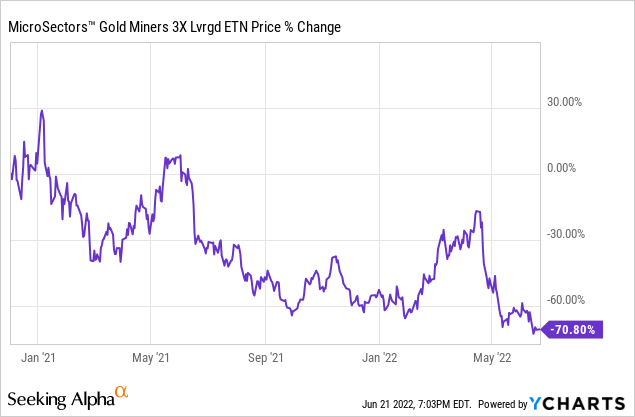

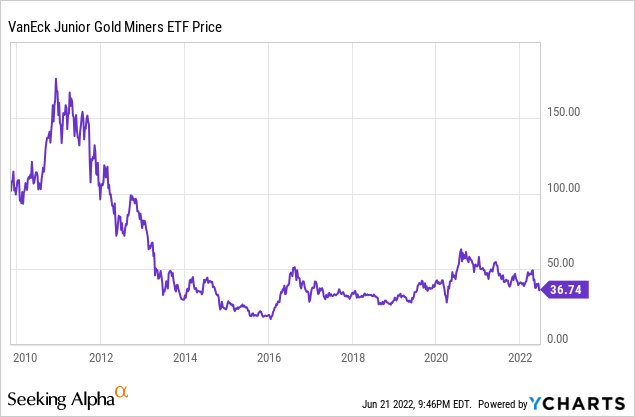

One of the most important things to note about this ETF is that it can severely underperform during bear markets/poor performing markets. If you invested in the VanEck Junior Gold Miners ETF during the same period, you would have only experienced a 17.8% gain in your investment. Leveraged products can sometimes lose more than 3x as much as the index in the long run during poor-performing time periods, as the 3x leverage is based on daily returns.

This ETN is down around 70% since its inception. Investors who want higher upside by holding gold companies or ETFs long-term should focus on junior gold miner ETFs, such as the VanEck Vectors Junior Gold Miners ETF. However, this ETN works well if you want to make a leveraged trade and hold for several days or maybe weeks. This product is especially appealing given that other leveraged products I mentioned now only provide 2x the leverage.

Short Term Gain, Long Term Pain

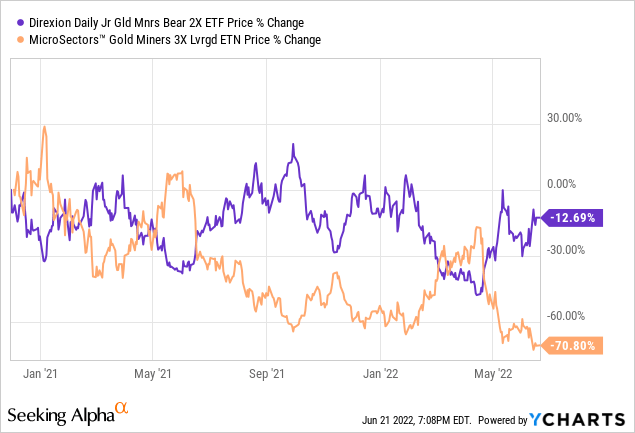

One very important thing to note is that both bullish and bearish leveraged ETF products can decline in the long run. The time decay effect pretty much ensures that both bullish/bearish leveraged products will eventually decline in a relatively similar manner on a long enough horizon.

Some investors may assume that they would have done well will a leveraged bearish gold miners ETF, if the leveraged bullish ETF declined by 70%. However, both of these bearish and bullish leveraged ETF/ETNs are down since the end of 2020. Note that the bearish ETF only provides 2x leverage, and a 3x leveraged ETF would have declined much more than 12.69%.

Not Designed for it: Leveraged products are not designed to be long-term holdings. In fact, every prospectus mentions that these vehicles are only designed for provided 2-3x the daily performance. Even holding them for weeks/months involves taking a leap of faith.

Launch Dates: Sometimes ETFs can either be launched during a time that is not strategic or ETFs can experience increased interest during the wrong time (i.e. post 2016 elections). In this case, a launch around the end of 2020, at a time when investors may want to heavily bet against the Federal Reserve/find an inflation hedge by investing in gold, may not be the best idea. Additional quantitative tightening or other poor economic data could result in a sharp sell-off of gold mining equities.

Short-term Appeals

However, this ETN can be a solid trading vehicle if you want leveraged exposure to gold over the course of weeks or maybe months. I included an example situation that compared the performance of this ETN vs. two other non-leveraged gold mining ETFs. It is crucial to note that even external market shocks driven by QT/other factors could result in massive losses over the next couple of weeks. But if you can manage to time the market, this ETN does provide around 3x the return of junior gold mining ETFs. It’s also crucial to note that this ETN is not designed to hold for months, as this is extremely risky.

|

February 1, 2022, Price |

March 1, 2022 Price |

April 1, 2022, Price |

1 Month Gain |

2 Month Gain |

|

|

MicroSectors Gold Miners 3X Leveraged ETN |

9.24 |

14.25 |

17.94 |

54.2% |

94.2% |

|

VanEck Vectors Gold Miners ETF |

30.53 |

35.86 |

39.49 |

17.5% |

29.3% |

|

VanEck Vectors Junior Gold Miners ETF |

38.88 |

45.43 |

48.20 |

16.9% |

24.0% |

MicroSectors Gold Miners 3X ETN can definitely function as intended if you buy during a low and hold during a bull run. The 1-2 month gain of this ETN was more than 3 times higher in all cases. It is easy to see why the vehicle is appealing among traders, as it can provide the opportunity to nearly double one’s money in months, while other ETFs only return 24-29%.

Of course, this is an optimistic/hypothetical case, in which one is able to buy at a relative bottom and sell at a high within a two-month period. Other investors who entered too early and hold can get wiped out with time decay. This ETF fell by nearly 67.3% from its April 14th peak by June 14th (from 20.10 to 6.57). At this point, an investor who managed to triple their investment after this would still be holding a circa 2% loss. If they only managed to double it, then they would be down by around 35%. One loss over the short term can make it nearly impossible to recover if you choose to hold. To further complicate things, gold equities do not always move in tandem with the price of gold. External market shocks can cause gold equities to sell off, even if the price of gold experiences favorable movements. In this case, buying gold as a hedge against rising political risks could actually work against the investor in the short term, even if their long term thesis was correct.

Gold in 2022

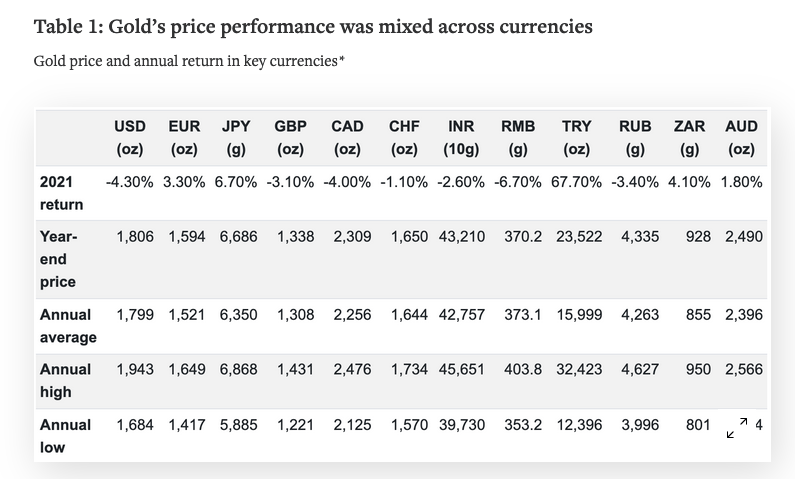

Q3-Q4 2022 will be an excellent time to accumulate gold mining stocks, and it is tempting to make a leveraged bet. However, additional rate hikes and quantitative tapering will likely result in a strong short-term pullback, which is a recipe for disaster if you are holding leveraged investment products. We are certainly at a time of heightened geopolitical risks, which makes it extremely ideal to have exposure to gold miners. However, it’s nearly impossible to make short-term calls, which means leveraged products are out of the question for more investors. It seems much more ideal to hold junior mining ETFs for the long term and to accumulate during any pullbacks. Investors in other countries may likely flock to gold as an inflation hedge, as gold appreciated against other currencies such as the Yen and Euro in 2021.

Reuters

Gold demand recently rose by 34% during Q1 2022, which was the highest level since Q4 2018. Junior mining stocks are actually uniquely positioned for long-term investors. There are still plenty of multi-bagger opportunities available on a long enough time horizon. There is no sense in risking one’s principle for a potential short-term multi-bagger opportunity when this same opportunity is guaranteed on a long-term basis if gold mining equities mean revert. The long-term gold investment thesis is much more obvious, given gold’s long-term history of preserving value. Gold has also been unloved relative to other commodities.

One doesn’t need a leveraged product if they are patient. A junior gold mining ETF could be a multi-bagger on a long enough timeline.

If you Must

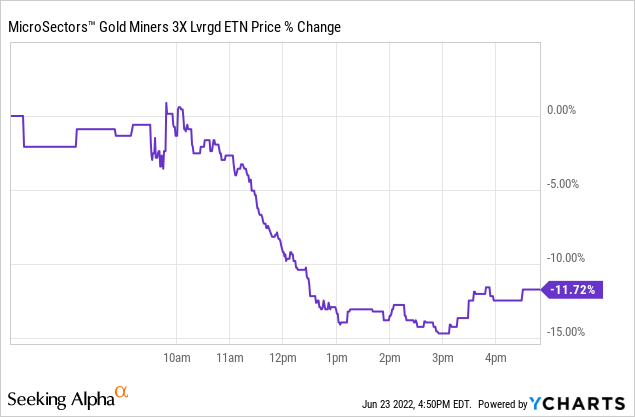

This investment could work in some cases if you have a predefined plan (i.e. betting that gold equities rebound significantly in the next month). Or it could be appealing to initiate a position on a bad day when gold mining stocks decline. For example, this ETN declined by 11.72% this Thursday. One could have bought the low on Thursday, and then sold it again several days later when it rebounds. This is probably the best way to use this ETN.

But definitely be prepared to lose a lot of money in a short amount of time if things go wrong. There is likely a reason that some of these gold mining ETFs reduced their leverage in the past (2x instead of 3x).

Be the first to comment